estimate

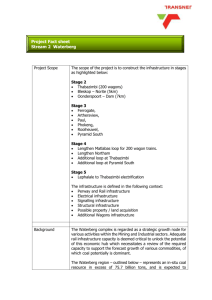

advertisement

PRESENTATION TO THE PORTFOLIO COMMITTEE ON PUBLIC ENTERPRISES 19 September 2007 AGENDA • OPENING REVIEW BY CHAIRMAN FRED PHASWANA • OVERVIEW OF PERFORMANCE OF TRANSNET MARIA RAMOS • REVIEW OF FINANCIAL PERFORMANCE CHRIS WELLS • HUMAN RESOURCES STRATEGY AND PROGRESS PRADEEP MAHARAJ • OPERATING DIVISIONS REVIEW CHIEF EXECUTIVE OFFICERS • CONCLUSION AND WAY FORWARD MARIA RAMOS 2 OPENING REVIEW: CHAIRMAN OF TRANSNET The compact with the Shareholder sets out: • Transnet’s mandate • The strategic objectives to be attained by Transnet • The Key Performance Areas and Indicators to measure Transnet’s performance during a certain period 3 SHAREHOLDERS COMPACT: MANDATE “The mandate for Transnet remains as determined by the company’s founding documents, by prevailing legislation and by this Compact” Transnet’s key role is to assist in lowering the cost of doing business in South Africa and enabling economic growth through providing appropriate ports, rail and pipeline infrastructure and operations in a cost effective and efficient manner and within acceptable benchmark standards 4 SHAREHOLDERS COMPACT: STRATEGIC OBJECTIVES 4 KEY AREAS 1. Capital and financial efficiency 2. Operating efficiency & effectiveness 3. Infrastructure Investments 4. Development - Strong balance sheet - Appropriate gearing - Cost effective funding - Volume growth (especially GFB) - Operating margin improvement - Business re-engineering - Exit non-core businesses - Competitively priced services - Correlation between budget and actual capital spending - Implement maintenance plan - Investment program (ASGISA); logistics cost reduction - Skills development - BEE 5 SHAREHOLDERS COMPACT: FINANCIAL KPI’s Performance Area Capital/financial efficiency Key performance indicator (KPI)/measure EBITDA margin(%) Cash interest cover (times) Gearing ratio(%) CFROI(%) Infrastructure investment % of actual capital expenditure compared to budget expenditure % of total maintenance spent compared to budget 2007 Target 34.8 5,3 47.9 5.8 > 90% > 90% 6 CONCLUSION: TRANSNET PERFORMANCE 2006/07 • Pleasing progress made in implementing Transnet’s Strategy • Significant investment in human and physical capital • Strong governance and risk processes • Achieved all the financial objectives – strong balance sheet • Now focussed on core Businesses – major non-core assets disposed off • Platform created for future growth and service delivery 7 MARIA RAMOS OVERVIEW OF PERFORMANCE OF TRANSNET TRANSNET’S VISION AND MISSION Transnet is a focused freight transport company delivering: • Integrated, efficient, safe, reliable and cost effective services which help promote economic growth in South Africa INCREASED Market share IMPROVED PROVIDING Productivity and profitability Capacity for customers ahead of demand 9 TRANSNET VALUES TRANSNET’S CUSTOMERS PREFER US BECAUSE: We are: • • • • Reliable Trustworthy Responsive Safe service provider OUR EMPLOYEES ARE: • Ethical • Committed • Safety conscious • Accountable • Thinking • Disciplined • Results orientated 10 4-POINT TURNAROUND STRATEGY Strategic Intent 4-point Turnaround Strategy Focused freight transport company Redirecting & re-engineering the Business • Improving efficiencies & effectiveness of core divisions • Realising port-rail synergies • Customer focus • Infrastructure and maintenance Delivering efficient & Competitive services Ensure Corporate Governance & Risk Management Strategic Balance Sheet Management • Dispose all non-core • • • • activities and focus on core business units Appropriate rate of return on invested capital (>WACC) Post retirement funding Optimise cash flow and cash management Strategic asset/liability management Enabling economic growth • Highest standards of • corporate governance Improvement in risk management, especially safety in all operations Develop Human capital • Revitalising HR by transforming culture & behaviour of staff. • Be a preferred and sustainable employer. • Focusing on: - Talent management - Leadership - Transformation - Performance and reward management 11 RATIONALE FOR REBRANDING • We chose the monolithic route to mirror the new corporate strategy and structure of the Company • To communicate the integrated and customer-centric approach of the new Company • Enforcement of the consistent application of the new Transnet identity throughout the organization • To present a consistent face to customers as a platform to build and sustain momentum as Transnet gears itself for sustainable growth • To consolidate employee energies, and maximise economies of scale and brand assets in building Transnet and its unique offerings, and • To create a singular platform to leverage and reinforce the “One Company, One Vision” philosophy 12 FINDINGS AND RECOMMENDATIONS • The current name, Transnet, should be retained • Transnet should refresh its brand image to reflect: - Customer centeredness - Reliability - Cost-efficiency - Transparency - Competitiveness - Flexibility - OD alignment - Improved communication • Preference for a monolithic or endorsed brand architecture, particularly amongst customers. In particular, customers, preferred one dominating name for Transnet with reference to its ODs to emphasize unity but distinguish between the core businesses 13 NEW TRANSNET BRAND ARCHITECTURE Discontinued Businesses Supporting businesses: Transnet Properties and Transnet Projects 14 THE WAY FORWARD: BRANDING Use the brand to: • Underpin the growth strategy • Drive integration • Support Transnet’s new culture • Establish Transnet as a leading corporate in South Africa • Enabling growth by optimising the efficiency and competitiveness of the country’s freight transport and logistics • Act as a catalyst for the growth of the economy 15 STRUCTURE TO SUPPORT STRATEGY TRANSNET COMPANY Operational divisions (continued businesses) Discontinued Businesses •Discontinued SA Express businesses RAIL Freight Rail Rail Engineering PORTS National Ports Authority Port Terminals • Transtel Telecoms PIPELINE • Viamax • Autopax Pipelines • freightdynamics • Housing Lending Book Supporting businesses: Transnet Property and Transnet Projects • Shosholoza Meyl • Arivia.kom 16 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Investment On target with 2007 (R11,7 bn) roll out of five-year investment plan • Replacement of assets (R8,2 billion) • Expansion investments (R3,5 billion) Major projects commenced and spending next five years per Corporate Plan • New Multi Product Pipeline (NMPP) from Durban to Johannesburg (R9,3 billion; latest estimate R11.2bn) • Widening and deepening of the entrance channel at the Port of Durban (R2,6 billion) • New container terminal at Durban Pier 1 (R1,3 billion) 17 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Investment continued Major projects commenced and spending next five years per Corporate Plan • Durban container terminal re-engineering (R1,4 billion) • Cape Town container terminal expansion (R4,2 billion) • Ngqura Container terminal (capacity from 2010 onwards) (R6,1 billion) • Coal line capacity expansion to 86 mtpa (R3,3 billion) • Ore line expansion to 47 mtpa (R3,8 billion) • Acquisition of 404 new locomotives (R4,9 billion) Project management: Establishment of Transnet Projects • Focus on: Co-ordination, implementation, skills, planning and delivery 18 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Disposal of non-core assets Businesses disposed Buyer Price South African Airways (Pty) Ltd (100%) Department of Public Enterprises R2 billion (no cash flow – transaction effected by share buy-back) V&A Waterfront Holdings (Pty) Ltd (26%) London & Regional Consortium R1.8 billion Transtel Telecom FSN Metro assets Neotel (Pty) Ltd (formerly the Second Network Operator) Equity Aviation Services (Pty) Ltd (49%) Equity Aviation Services (Pty) Ltd (and employee share scheme) R250 million (funded by issue of equity of 15% in Neotel (Pty) Ltd via Transpoint Properties (Pty) Ltd) R70 million VAE Perway (Pty) Ltd (35%) VAE SA (Pty) Ltd R30 million Transnet Pension Fund Administrators (100% administration and investment services) Metropolitan Life (including Kagiso Trust Investments) and Fifth Quadrant respectively R20 million and R3 million, respectively 19 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Disposal of non-core assets – Subsequent events Businesses Buyer Price “C” Preference share Newshelf 664 (Pty) Ltd R5,7 billion – Cash received Viamax Pty Ltd (100%) Bidvest Ltd Approximate R1,0 billion − Cash to be received shortly Transnet Housing Loan Book FirstRand Bank Ltd Fair value of R1,4 billion – Subject to Competition Commission approval Total proceeds of disposals approximately R10bn 20 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Human capital development Focus on: Achievements: • Skills demand planning Skills mapping completed • Capacity building and skills development Leadership development plans • Talent management Prioritising skills and succession planning • Performance management SPO’s defined for all managers and performance assessed • Attract critical skills HR processes in place to become employer of choice • Organisational culture Change management programmes in place • HR Enablement New HR policies, standardised supporting procedures Additional capacity building 175 additional engineering bursaries 173 students at institutions of technology (to be increased to 300) 1 261 additional apprentices in different trades 20 Thuthuka bursaries through SA Institute of Chartered Accountants 21 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Re-engineering the business: Vulindlela projects Second year of implementation • • • • • • Improve productivity levels and operational efficiencies Orientate businesses towards customers Address safety Culture of planned maintenance Increase in market share – volume growth (especially GFB in Spoornet) Savings of more than R2 billion have been achieved since inception Success/achievements in 2007 • Improved GFB freight flows (3 mt) – current tempo - First year for a decade where volumes did not decrease • Capacity created on Iron Ore and Coal Line that exceeds current demand from clients • Increase in monthly port handling capacity at DCT (TEU’s 186 000 vs 158 000) • Procurement savings of R500 million p.a. and reduction in safety incidents (R200 million) 22 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Efficiency improvement: Transnet Business Intelligence projects (TBI) • Implementation of TBI projects - Effective use of technology, world class systems and processes - Financial management and reporting - Improving processes and systems that enable information management • Identified KPI’s across businesses to measure key value drivers • Benchmarking against international companies to ensure world class performance • Implemented Key Performance Indicator project to measure: - Key volume drivers - KPI performance weekly/monthly - Performance vs benchmarks – all areas of business 23 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Transnet Second Defined Benefit Fund (TSDBF) • Active management and leadership from Transnet • Currently in surplus of R1,7 billion as opposed to being in deficit in 2006 of R1,6 billion (aided by the sale of MTN shares-M Cell and V&A Waterfront) • Rule amendments approved by the Minister - Generally to enable bonus amounts to be paid to pensioners to exceed 2% pension increase (subject to affordability) • Transnet paid ex-gratia bonuses of R125 million to pensioners - All received an additional 1% - Previously disadvantaged widows and members with >15 years service who receive low pensions and/or also over 65 years old received additional amounts 24 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Transnet Pension Fund • Act changes have received presidential approval to enable non-Transnet employees of businesses transferred to Government to remain members • Rule amendments approved by Minister • Fund will become multi-employer with new employers guaranteeing the obligations of its employees and pensioners • Fund now in substantial surplus (R 2.4 billion of which R 1.1 billion relates to the Transnet sub-fund) Transnet Retirement Fund • Act changes have received presidential approval to enable non-Transnet employees of businesses transferred to Government to remain members • Rule amendments approved by Minister 25 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Economic Regulation National Ports Act • Act in place from November 2006 • Places responsibility on NPA to ensure safe, efficient and effective functioning of ports system • Independent Regulator oversees NPA’s functions, approves tariffs, hears complaints and appeals from port users • Transnet is investing in systems and capacities to perform additional functions prescribed by legislation • Interacting with shareholder in certain aspects of Act 26 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Economic Regulation continued Pipelines • NERSA (energy regulator), declined Petronet’s application for 5,6% increase • Regulations for, amongst other issues, determining tariff increases not yet finalised • Transnet engaging with relevant authorities; important that tariff methodology enables Transnet to earn a fair return on invested capital (> WACC) Have formed a regulation policy unit to lead Transnet’s strategy and interactions with the Regulator 27 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Risk Management Operational Risk • Established a Risk Committee of the Board and appointed a Chief Risk Officer that serves on EXCO • Appointed GE Human Resources and HR Sub-Committee dealing with human capital in sustaining the turnaround • Improved safety measures and roll out safety awareness and training programmes • Reviewed safety procedures and strengthened capacity in problematic areas • Improved controls and campaign against fraud 28 STRATEGY IMPLEMENTATION: ACHIEVEMENTS TO DATE Risk Management Financial Risk • Financial Risk Framework in place covering all risks (interest, currency, market) • Asset and Liability Committee ensures that financial risks are effectively managed • Stringent financial objectives are set to ensure that targeted financial ratios are achieved/maintained • Improved internal financial and system controls 29 CAPEX SPENDING FIVE-YEAR PLAN: R78 billion (continuing businesses) RAIL Freight Rail R34,8 bn • Coal Line – R4,9 bn • Ore Line – R3,8 bn • General Freight – R15,3 bn • Maintenance Capitalisation – R10,8 bn PIPELINE Pipelines R10 bn * • Multi-product pipeline – R9,3 bn • Gas line upgrading – R0,2 bn Pipelines 13% Port Terminals 12% Freight Rail 45% 24% 5% RAIL Rail Engineering R4,1 bn • Equipment - R2 bn • Upgrade of facilities – R1,1 bn * Latest estimate R11.2bn Rail Engineering NPA PORTS Port Terminals R9,5 bn • Durban – R0,9 bn • Richards Bay – R0,7 bn • Ngqura – R1,5 bn • Cape Town – R0,4 bn • Saldanha – R2,9 bn PORTS NPA R18,5 bn • Richards Bay – R0,8 bn • Ngqura – R4,7 bn • Cape Town – R3,8 bn • Durban – R7,6 bn • Floating craft – R0,7 bn 30 CAPEX FIVE-YEAR PLAN: R78 billion* Annual spending over five years Cumulative R78 bn R21.5 bn R17.5 bn R16.9 bn R12.7 bn R9.4 bn 2008 2009 2010 Pipeline and other 2011 Ports 2012 Five-year plan Rail * Continuing businesses 31 SHAREHOLDER’S COMPACT Performance area Key performance indicator (KPI)/measure Capital/financial efficiency** EBITDA margin(%) # Benchmark Cash interest cover (times)# Gearing ratio(%) -2007 -2007 % of actual capital expenditure compared to budget expenditure -2007 40.7 Achieved >5*** 5,4* 5.4 Achieved 40 - 50*** 47.9 39 Achieved 59.0 47 Achieved 5.8 6.8 Achieved 4.1 5.8 Achieved R11 847 million R11 674 million >6*** >90% of target -2006 % of total maintenance spent compared to budget # Performance 34.8 -2006 Infrastructure investment 2007 Actual > 35*** -2006 CFROI(%) 2007 Target 99% Achieved 100% Achieved >90% of target R3 890 million R5 495 million 141% Achieved * Including sale of shares ** Discontinued business -SAA, freightdynamics,Viamax and Autopax *** These benchmarks are the target of performance in the medium term (next three years) # Key performance indicators not applicable in prior year 32 BROAD-BASED BLACK ECONOMIC EMPOWERMENT Policy: • Transnet fully endorses and supports the Government’s Broad-based Black Economic Empowerment Programme and has aligned its policies with the DTI’s Codes of Good Practice which were gazetted on 9 February 2007. (Some alignments need to take place between the DTI Codes and the DoT’s new draft Rail Transport Charter) • Transnet encourages join ventures with- and sub-contracting to BBBEE companies Achievements: • During the 2006/07 financial year, Transnet’s operating divisions spent R10.6 billion externally with suppliers, of which R3.9 billion went to broad based BEE companies, up R600 million from 2006 33 BROAD-BASED BLACK ECONOMIC EMPOWERMENT Strategy – BBBEE going Forward: • Transnet will participate in the Rail Transport Charter workgroup to ensure alignment between the DTI- and DoT scorecards • Transnet has had most of its high-value suppliers accredited against the DTI scorecard and will continue to encourage all its tenderers / suppliers to do so • Having had itself accredited, Transnet scored 56.8 on BBBEE, equating to a “Level 5”, recognition level of 80%. A BBBEE Task team has subsequently been created at Transnet Corporate office to improve this score by driving strategy and coordinating all elements of the DTI Scorecard • Over and above Transnet’s BBBEE and Supplier Development strategies, we will implement a plan for Competitive Supplier Development (“CSDP”) in alignment with our support of AsgiSA. This plan will consider opportunities to develop globally competitive local suppliers (especially from the BBBEE ranks) through various strategic initiatives 34 SUBSTANTIAL IMPROVEMENTS IN FINANCIAL PERFORMANCE DEMONSTRATED Transnet Performance Highlights: Three-Year View Measures 2004 Actual 2007 Actual Operating profit R4 750m R8 470m EBITDA (%) 17% 40,7% Cash interest cover 3,5 times 5,4 times 54% Cash flow return on investment (CFROI in real returns) 4,0% 6,8% 70% Gearing 83% 39% 53% Capex (excl. Aviation) R3,8 bn R11,7 bn 208% Shareholders equity R9,9 bn R37,4 bn 278% Four-point turnaround plan starting point Improvement vs 2004 78% 139% All measurements exceeded Shareholder Compact requirements 35 CHRIS WELLS FINANCIAL OVERVIEW 2006/07 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement for the year ended 31 March Revenue 2007 R million 2006 R million 28 214 26 034 Revenue contribution for 2007 Fin Yr 8% 4% 15% 51% • Revenue growth of 8,4% • Strong volume growth from all divisions except Freight Rail 22% Freight Rail National Port Authority Port Terminals Piplines Other 37 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement for the year ended 31 March Revenue Net operating expenses • Operating expenses increase by 6,3% • Operating expenses contain certain onceoff costs, notably • R125 million bonus payout to TSDBF members • R100 million additional contribution to TPF • R165 million in respect of provisions • Adjusting for the above costs, operating expenses would have increased by only 3,8%, well below the inflation rate 2007 R million 2006 R million 28 214 26 034 (16 726) (15 733) 22% 2% 2% 52% 7% 15% Personnel and benefits Energy Operating Leases Material costs Maintenance costs Other 38 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement for the year ended 31 March Revenue Net operating expenses EBITDA 2007 R million 2006 R million 28 214 26 034 (16 726) (15 733) 11 488 10 301 EBITDA increased by 12%, margin increased to 40,7% (2006: 39,6%) SAA 953 8,000 6 489 7 333 10 301 11 488 10,000 4,000 8 269 28 214 6,000 26 034 15,000 10,000 25 260 20,000 27 298 25,000 SAA 17 342 30,000 23 936 35,000 SAA 16 339 12,000 45,000 40,000 EBITDA (R million) SAA 768 Revenue (R million) 2003 2004 2005 2006 2007 2,000 5,000 0 0 2003 2004 2005 2006 2007 39 GROUP FINANCIAL RESULTS: 2006/07 Five-year EBITDA Margin Growth 50 86% growth 40 30 % 40 41 29 2006 2007 17 10 22 20 0 2003 2004 2005 40 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement 2007 R million 2006 R million 28 214 26 034 (16 726) (15 733) EBITDA 11 488 10 301 Depreciation & amortisation (3 018) (2 163) for the year ended 31 March Revenue Net operating expenses • Depreciation and amortisation for the year increased by 39,5%. • Acceleration of the capital expenditure programme and depreciation on capitalised maintenance in terms of IFRS 41 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement 2007 R million 2006 R million 28 214 26 034 (16 726) (15 733) EBITDA 11 488 10 301 Depreciation and amortisation (3 018) (2 163) 2 189 1 105 for the year ended 31 March Revenue Net operating expenses Profit on sale of interest in businesses, impairment of assets, dividends received and fair value adjustments The fair value adjustments: - “C” class preference share - Increase in the carrying value of investment properties 42 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement 2007 R million 2006 R million 28 214 26 034 (16 726) (15 733) EBITDA 11 488 10 301 Depreciation and amortisation (3 018) (2 163) 2 189 1 105 Profit from operations before net finance costs 10 659 9 243 Net finance costs (2 437) (2 406) for the year ended 31 March Revenue Net operating expenses Profit on sale of interest in businesses, impairment of assets, dividends received and fair value adjustments Interest cover (times) 3.5 1 2.6 2 3.4 • The Group’s WACD of 11,9% is high due to legacy debt 3 2.1 • Finance costs remain at similar levels to the prior year and interest cover increased to 3,5 times (2006: 3,4 times) 4 2.5 • Profit from operations before finance costs increased by 15% to R10,7 billion 2006 2007 0 2003 2004 2005 43 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement 2007 R million 2006 R million 28 214 26 034 (16 726) (15 733) EBITDA 11 488 10 301 Depreciation and amortisation (3 018) (2 163) 2 189 1 105 Profit from operations before net finance costs 10 659 9 243 Net finance costs (2 437) (2 406) Taxation (1 902) (2 042) for the year ended 31 March Revenue Net operating expenses Profit on sale of interest in businesses, impairment of assets, dividends received and fair value adjustments • Current taxation charge of R0,9 billion and deferred taxation charge of R1,0 billion 44 GROUP FINANCIAL RESULTS: 2006/07 Consolidated income statement 2007 R million 2006 R million 28 214 26 034 (16 726) (15 733) EBITDA 11 488 10 301 Depreciation and amortisation (3 018) (2 163) 2 189 1 105 Profit from operations before net finance costs 10 659 9 243 Net finance costs (2 437) (2 406) Taxation (1 902) (2 042) 2 33 Profit for the year from continuing operations 6 322 4 828 Profit for the year from discontinued operations 1 082 102 Profit for year 7 404 4 930 40,7% 39,6% for the year ended 31 March Revenue Net operating expenses Profit on sale of interest in businesses, impairment of assets, dividends received and fair value adjustments Income from associates EBITDA margin (%) 45 GROUP FINANCIAL RESULTS: 2006/07 Consolidated balance sheet 2007 R million 2006 R million Capital and Reserves 37 433 29 526 Non-current liabilities 22 832 22 189 Borrowings and provisions 18 703 17 789 for the year ended 31 March EQUITY AND LIABILITIES Capital and Reserves (R billion) Gearing (%) 40 90 35 80 30 70 60 25 20 39 46 61 30 10 5 40 65 37 30 18 10 22 15 83 50 20 10 0 0 2003 2004 2005 2006 2007 2003 2004 2005 2006 2007 46 GROUP FINANCIAL RESULTS: 2006/07 2007 R million 2006 R million Capital and Reserves 37 433 29 526 Non-current liabilities 22 832 22 189 Borrowings and provisions 18 703 17 789 2 422 4 348 Consolidated balance sheet for the year ended 31 March EQUITY AND LIABILITIES Post-retirement benefit obligation Transnet Pension Fund (a) (fully funded) – – Transnet Second Defined Benefit Fund (a) (fully funded) – 1 628 1 369 1 607 Transnet employees 717 765 Other (a) Restructuring and funding plan in progress (b) Funding monthly including Transnet subsidy 336 348 Post-retirement Medical Benefits (b) SATS Pensioners 47 GROUP FINANCIAL RESULTS: 2006/07 Consolidated balance sheet 2007 R million 2006 R million Capital and Reserves 37 433 29 526 Non-current liabilities 22 832 22 189 Borrowings and provisions 18 703 17 789 Post-retirement benefit obligation 2 422 4 348 Deferred taxation 1 707 52 for the year ended 31 March EQUITY AND LIABILITIES • The deferred taxation liability increase in the year is due to increased temporary differences as a result of: • Capital expenditure programme • Post retirement benefit obligation • Taxation on increased carrying value of PPE recorded at fair values • Depreciation changes announced in budget speech by the Minister of Finance to reduce the taxation deprecation periods: • New rolling stock from 14 years to 5 years, • New quay wall and other port facilities to qualify for deductions over 20 years rather than nondepreciation for taxation purposes 48 GROUP FINANCIAL RESULTS: 2006/07 Consolidated balance sheet 2007 R million 2006 R million Capital and Reserves 37 433 29 526 Non-current liabilities 22 832 22 189 Borrowings and provisions 18 703 17 789 Post-retirement benefit obligation 2 422 4 348 Deferred taxation 1 707 52 Current liabilities 16 989 26 631 Payables and other 16 559 13 699 430 12 932 77 254 78 346 for the year ended 31 March EQUITY AND LIABILITIES Liabilities classified as held-for-sale TOTAL EQUITY AND LIABILITIES 49 GROUP FINANCIAL RESULTS: 2006/07 2007 R million 2006 R million Non-current assets 57 843 50 144 PPE and other 57 720 48 125 123 2 019 19 411 28 202 Inventory, receivable assets and cash 9 841 7 588 Derivative financial assets 5 658 3 874 Assets classified as held-for-sale 3 912 16 740 77 254 78 346 Consolidated balance sheet for the year ended 31 March ASSETS Long term loans and advances CURRENT ASSETS TOTAL ASSETS 12 Return on average total assets (%) 10 7 4 7 9 10 6 2004 2005 11 8 2 50 0 2003 2006 2007 GROUP FINANCIAL RESULTS: 2006/07 Abridged consolidated cash flow statement 2007 R million 2006 R million 8 851 5 865 Cash generated from operations 13 488 11 244 Other (4 637) (5 379) for the year ended 31 March Cash flow from operating activities • Cash generated from operations before working capital changes increased by 20% to R13,5 billion • Net cash generated from operating activities increased by 51% to R8,9 billion Cash generated from operations (R million) Cash interest cover (times) 14,000 6 12,000 5 10,000 4 8,000 3,5 4,8 4,5 5,4 2 4,3 13 488 11 244 10 089 7 040 4,000 7 178 3 6,000 2003 2004 2005 2006 2007 1 2,000 0 0 2003 2004 2005 2006 2007 51 FUNDING REQUIREMENTS: NEXT 5 YEARS 2007 R million 2008-2012 R million 8 851 69 805 (11 674) (78 014) Cash shortfall (1 904) (5 122) Loan redemptions (1 860) (10 085) Funding requirements (3 764) (15 207)* 39% 40% – 45% Cash flows from operating activities Gross capital expenditure * Funding requirements over 3 years approximately R25 billion Gearing • ECA umbrella facility • DMTN program – 30 billion facility rated by Moody’s • Raise cost effective borrowings at the appropriate tenors 52 KEY FEATURES OF FUNDING PROGRAM Key funding objectives: • Minimize funding costs – Reduce weighted average cost of debt (WACD) • Financing directly in Rand preferred • Reduce reliance on government guarantee • Diversify Transnet’s debt portfolio and lengthen debt maturity profile • Improve the liquidity position • Access diverse financing sources for specific projects: - Asset backed finance incorporated in ECA facility ECA financing – ECA umbrella facility Development funding Project financing DMTN program for local funding 53 FINANCIAL STRATEGY – FORTHCOMING YEARS Focus will be on: Strong control environment • Reliable, timely and relevant information Improved operational efficiency • Managing key performance drivers • Margins improvement Capital investment roll out • Returns exceeding WACC Funding plan • Adequately address borrowing requirements • Reduce the cost of debt 54 HR STRATEGY PRADEEP MAHARAJ 2007/08 PRIORITIES Capacity and skills HR Enablement Performance and Reward Talent Management and Leadership Development Culture Change 56 ACHIEVEMENTS AND AGENDA HR Enablement 2006: • Audit and review policies • Standard HR Processes • Improve quality of HR management Performance and Reward information 2007: • Implementation of policies across Transnet • Alignment of procedures • New supporting Processes • Standard application of SAP HR modules • Clean-up of employee data 57 ACHIEVEMENTS AND AGENDA Capacity and skills development 2006: • Skills demand planning • Implement Engineering and Technicians bursary programme • Training centre review 2007: Culture • Development of a competency based career ladder • Optimize training delivery through academy management 58 ACHIEVEMENTS AND AGENDA Talent and Leadership Development Leadership Philosophy: Leadership for Transformation to enable leaders to achieve particular outcomes to contribute to Transnet’s successful turnaround and performance excellence 2006: • Develop Talent Management Framework • Roll-out of Navigator Leadership Development Programme • 2000 leaders identified for training Culture 2007: • Increase talent management capacity • Launch Innovator Leadership Development Programme 59 ACHIEVEMENTS AND AGENDA 2006: • Short term incentives • Contract conversions • New reward philosophy • Introduce performance management system 2007: Critical skills retention Performance and Reward • Technicians • Specialists • Artisans • Train drivers Incentive scheme for train movement Enhance organisational and individual performance Standardise remuneration practices 60 EXECUTIVE REMUNERATION •Transnet is currently reviewing the executive reward philosophy • Benchmark remuneration information for the Executive Management of Transnet is sourced and will encompass: - Detailed market data schedules per position reflecting all elements of guaranteed and variable pay as well as job size - Awarded and anticipated market pay adjustments - Detailed analysis of short and long term incentive practices • For this purpose, the services of a leading management consulting firm in South Africa providing local and international employers with remuneration consulting advice have been appointed • It is planned that a detailed report including factors such as impact of the economy; nature of competition; complexity of industry and strategic freedom to act, will be presented to the Transnet Board of Directors during October 2007 61 2007/8 PRIORITIES Purpose: The main purpose is the development of a consolidated Transnet Group Culture and Behaviours which will facilitate the success of the turnaround strategy 2006: Culture charter wheel Leadership behaviours charter Leadership alignment with strategy 2007: Rebranding Transnet Culture Charter Employee survey-bottom up approach Change management process to implement Culture Change 62 NUMBER OF EMPLOYEES Operating Division Transnet Freight Rail Nonbargaining Bargaining Number Fixed terms Total Employees 1,765 23,046 661 25,472 Transnet Rail Engineering 719 13,010 1,217 14,946 Transnet Port Terminals 292 4,757 310 5,359 Transnet national Port Authority 908 2,343 148 3,399 Transnet Projects 254 433 6,215 6,902 Transnet Pipelines 94 389 46 529 239 32 29 300 4,271 44,010 8,626 56,907 Transnet H/O Totals 63 PROFILE TRANSNET EMPLOYEES 2007 Profile of Transnet Permanent Employees 2007 (48,281 ) White 29% Coloured 9% Indian 4% African 58% Female 16% Male 84% 64 RACE PROFILE 2001 to 2007 1.4% 100% 0.4% 8.6% 10.5% 90% 0.5% 9.7% 33.2% 80% 43.1% 38.6% 43.6% 45.2% 50.2% 54.8% 70% 63.1% 3.2% 60% 8.6% 7.5% 15.7% 3.4% 50% 13.0% 6.3% 9.0% 40% 8.2% 7.4% 10.4% 8.5% 89.7% 79.4% 9.3% 7.4% 8.9% 30% 55.0% 8.1% 20% 43.3% 43.1% 36.7% 35.0% 33.0% 25.9% 21.4% 10% 0% 2001 - Top & Sen Mngt 2007 - Top & 2001 2007 2001 - Skilled 2007 - Skilled Sen Mngt Professionals Professionals Technical Technical African Coloured Indian 2001 - Semi Skilled 2007 - Semi Skilled 2001 Unskilled 2007 Unskilled White 65 GENDER PROFILE 2001 to 2007 100% 90% 80% 70% 60% 78.8% 79.8% 79.3% 75.9% 83.5% 80.1% 84.1% 90.6% 50% 97.5% 97.3% 2.5% 2.7% 2001 Unskilled 2007 Unskilled 40% 30% 20% 10% 21.2% 20.2% 20.7% 24.1% 16.5% 19.9% 15.9% 9.4% 0% 2001 - Top & Sen Mngt 2001 - Skilled 2007 - Skilled 2007 2001 2007 - Top & Technical Technical Professionals Professionals Sen Mngt Female 2001 - Semi Skilled 2007 - Semi Skilled Male 66 EE TARGETS 2007 to 2012 Occupational level Status quo representation Proposed 2010 representation Black Female Black Female Management (101-106) 58% 24% 65% 30% Professional (108-109) 54% 24% 60% 30% Skilled technical (610) 51% 18% 60% 25% Semi-skilled 65% 23% 70% 30% Unskilled 90% 8% 90% 15% 67 CAPACITY BUILDING OVERVIEW Transnet’s skills forecast process through detailed workforce planning led to the following skills targets for the period 2007-2012 : Transnet Targets for Skills per annum Skills required 2007 2008 2009 2010 2011 2012 Total Engineer Degree 100 100 100 100 100 100 600 Technician Diploma 300 300 300 300 300 300 1 800 Artisan 800 800 800 800 800 800 4 800 Managers 20 20 20 20 20 20 120 Specialist 143 100 100 100 100 100 643 45 20 20 20 20 20 145 Operations 1 878 1 610 1 563 1 561 1 412 1 000 8 024 Grand Total 3 286 2 950 2 903 2 901 2 752 2 340 17 132 First-line Management 68 PROGRESS TO DATE Capacity building continues to be integrally involved in the delivery of skills required by Transnet and progress thus far is :- Entry Levels • R20 million spend from a CSI perspective in regard to education and development, • Forged a relationship with Denel and have put 50 youth on a Youth Foundation and Schools outreach programme for enhancing the math and science output. • Currently unpacking our approach for the adoption of 10 Dinaledi Schools to further increase the math and science pool of prospective, future learners for Transnet skills programmes • Transnet awarded an additional 98 bursars in 2007 to give us a total of 176 engineering bursars. We will continue awarding 100 bursars p.a. over the next five years to ensure that we have a steady outflow and absorption in terms of engineering skills required by the organisation • Recruitment and development of these bursars has been consolidated to central office to ensure that we promote standardised, qualitative approaches in terms of skills transfer, remunerations, Engineers allowances, and the general management and administration of the feeder channels. • Transnet GPM and the OD’s are currently busy with a recruitment drive in terms of the 100 Engineers and 300 Technicians p.a. that Transnet requires. The focus of the drive will be on exploiting our present relationships with Universities and Universities of Technology to obtain the “best” candidates available in the market. We will also adopt a rigorous assessment process for the candidates. 69 PROGRESS TO DATE • At present we have 200 Technicians who are on a bursar programme or serving Technicians internship within the organization. Transnet has a history of absorbing more than 95% of these candidates into full time employment with the organization • Progress has also been made in terms of consolidating this area of capacity building under central office. • The recruitment drive will facilitate progress in achieving the annual intake of 300 • We have 1261 Artisans in our apprenticeship schools. This is approximately a 40% Artisans increase in our year on year intakes. The candidates are predominantly from FET’s with N2 qualifications. The target is approximately 800 apprentices pa. until 2012. • The on-the-job training framework has been adopted and being piloted • Transnet has instituted a Graduate in Training programme that targets commercial Specialist graduates. The graduates are taken through a structured two-year programme and absorbed by our OD’s in line with their expertise. Transnet will be employing 25 candidates p.a into this programme until 2012. • Currently concluding the intake of 12 GIT’s for Supply Chain and HR • In addition Transnet sponsors 20 TOPP students – program to develop mainly black charter accountants • First line managers and Managers will be internally allocated through the Talent Managers and First Line Supervisors management process and be developed through the Leadership Development programmes • We have launched our leadership programmes which targets approximately 1800 management employees for 2007. 70 PROGRESS TO DATE • Currently there is a 62% achievement in terms of priority skills (Movement, Control and Operations – Rail Yards) target for 2007. • Delegation of candidates from Train Movement and Infrastructure maintenance will also attend training in Australia and India. The key objective is to build organizational operational and technical competence in the train driving, create a pipeline of critical skills in the operational and technical arena; learning from international best practice and forging partnerships. • The Marine pilot training is currently done in partnership with STC. A process is Operations Maritime underway to ensure that the training will be delivered locally (Port Academy) as from 2008. • A sufficient number of delegates have been indentured into the Tugmaster and Marine Engineering Officer (CMEO) skills pipelines • Currently there is a 71% achievement in terms of priority skills (OLE’s, Cargo Coordinators and AV Drivers) target for 2007. Operations – Port Operations 71 TRANSNET FREIGHT RAIL SIYABONGA GAMA FREIGHT RAIL OPERATES IN 14 CORRIDORS IN 3 REGIONS Northcor Capecor Southcor Natalcor R.Baycor N.WestcorEastcor (Maputo) N.Eastcor Sishen-Saldanha Sentracor South East Cor Westcor Freestate Namibia Central Beit Bridge Messina East Louis Trichardt Ellisras West Soekmekaar Thabazimbi Pietersbu rg Drummondlea Vaalwater Chroomvallei Zebediela Naboomspruit Middelwit Nylstroom Northam Rustenburg Mafikeng Lichtenburg Coligny Welverdiend Vermaas Potchestroom Ottosdal Klerksdo Orkney rp Schweizer-Reneke Vierfontein Hotazel Erts Ancona Sishe n Manganore Naroegas Upington Warrenton Palingpan Postmasburg Kimberley Kakamas Belmont Bloemfontein Sannaspos Koffiefontein Standerton Charlestown Vrede Newcastle Utrecht Arlington Warden Bethlehem WinburgMarquard Douglas Prieska Wolwehoek Glen H Whites Virginia Bultfontein Theunisen Harrismith Bergville Golela Hlobane Vryheid Glencoe Ladysmith Nkwalini Kranskop Eshowe Moorleigh Ladybrand Maseru Howick Greytown Stanger Hilton Copperton Springfontein Bethulie De Aar Aliwal North Sakrivier Bitterfontein Dreunberg Jamestown Noupoort Kootjieskolk Calvinia Hutchinson Rosmead Beaufort West Klawer Somerset East Cookhouse Klipplaat Porterville Prins Alfred Hamlet Touwsrivier Ladysmith Calitzdorp Worcester Oudtshoorn George Avontuur Franschhoek Riversdale Stellenbosch Knysna Mosselbaai Protem Strand Atlantis Source: Spoornet NOC Cape Town Simonstad Umtata Queenstown Qamata Tarkastad Saldanha Underberg Donnybrook Richmond Mid Ilovo Durban Mandonela Matatiele Franklin Kelso Kokstad HardingSimuma Port Shepstone Barkley East Maclear Schoombee Hofmeyer Bredasdorp Seymour Amabele Blaney Fort Beaufort Kirkwood Uitenhage Patensie Alexandria Port Alfred Port Elizabeth Komatipoort Welgedag B/plaas Hawerklip Breyten Bethal Lothair J’burg WestleighKroonst ad Graskop Plaston Belfast Machadodorp Baberton Rayton Witbank Sentrarand Ogies Makwassie Pudimoe Nako p Krugersdorp Steelpoort Marble Hall Roossenekal Cullinan Pretoria O/fontein Phalaborwa Hoedspruit East London Empangeni Richards Bay BUSINESS OVERVIEW Rail freight Transportation of Iron ore People Total = 25 270 Employees transferred to Rail engineering Coal line General Freight Facilities 22 277 km rail network 1500km heavy haul lines Connectivity to all ports Revenue R 14 574m Discontinued Shosoloza Meyl Blue Train EBITDA R 3 737m 74 We have taken successful actions to stabilise the business and have structured and sequenced the path to world class Re-engineer and transform Stabilise and analyse Defined corporate strategy Divestment of non-core business New leadership and organisational structure 2005: Inefficient, shrinking, and unprofitable Safety-first mindset Operating loss of R21 million Perform and grow Skill and capability improvements Volume and market share growth Investment of capital for sustainability Strategic investment for better performance 2012: Scheduled, efficient, and profitable Operating profit of R5.7 billion Motivated, valueadding employees Improved operational performance New operating principles 2005 2007 2008 2009 75 2012 WE CRAFTED OUR CURRENT BUSINESS PLAN AROUND FIVE KEY OBJECTIVES, SUPPORTED BY A NUMBER OF STRATEGIC INITIATIVES “The what” “The how” Customer Service Delivery •Retain the desired customer base and improve service delivery Leadership & Employee Capability •Optimise human capital deployment and development The people project and governance initiatives • Enterprise Performance • Enabling Programme Safety •Transform Freight Rail into a safe railway ‘Safety first’ programme Freight Rail Strategic Objectives Drive high yield general freight growth • Key account plans for strategic accounts • Yield management • Collaboration projects Scheduled Freight Railway •Implement efficiency improvements Corridor optimisation rollout programme Creating Capacity •Invest to maintain, replace and increase capacity Capital investment and optimisation programme 76 CORE OPERATING DIVISION PERFORMANCE Operating divisions Freight Rail Revenue (R million) EBITDA (R million) 2006 %▲ 2007 2006 %▲ 2007 14 055 4% 14 574 2 910 28% 3 737 Freight Rail contribution to Group EBITDA 33% • 4% increase in revenue. • Total volumes 176,6 mt (2006:178,1 mt) - GFB 79,6 (2006: 79.8) - Iron ore 30,0 (2006: 29,6) - Coal 67,0 (2006: 68,7) 33% • Volumes negatively impacted by - Customer’s production constraints, - Capacity constraints - Derailments • 3% decrease in operating cost compared to prior year – improvements from the re-engineering programme 67% • Capital expenditure R7,4 billion 77 CORE OPERATING DIVISION PERFORMANCE Freight Rail Maintenance Total expenditure Maintenance per income statement COPEX* • Rolling stock • Infrastructure • Coaches • Ballast cleaning • Property maintenance interventions (R million) (R million) 2006 %▲ 2007 2 073 165% 5 495 1 225 82% 2 230 848 285% 3 265 2 453 633 16 100 63 * Capitalised operating expenditure 78 KPI’s – FREIGHT RAIL 2006 Actual 2007 Target 2007 Performance Actual Revenue (Rmillion) 14 055 16 478 14 574 Not achieved* EBITDA (Rmillion) 2 910 3 715 3 737 Achieved 3 809 7 253 7 387 Achieved Volume – iron ore (mt) 29.6 32.8 30.0 Not achieved* Volume – coal (mt) 68.7 74.0 67.0 Not achieved* Volume – general freight (mt) 79.8 81.0 79.6 Not achieved Financial Infrastructure Capital expenditure (Rmillion) Efficiency * Non-achievement primarily due to lack of iron ore and coal to rail 79 TRANSNET FREIGHT RAIL: ACTION PLANS TO CREATE CAPACITY AND IMPROVE SERVICE DELIVERY Capacity creation 5 Year Investment Plan - 404 locomotives • General Freight (262) • Coal (110) • Ore-line (32) Efficiency improvement - Vulindlela initiatives – 1.5mV improvement in General Freight Volumes - Transnet Rail Engineering -Improved availability and reliability of all wagon and loco fleets Sufficient capacity to meet demand from Iron ore and Coal exports Improved service delivery - Stabilised the operational platform - General Freight tempo to date is at a level + 82mV per annum - strong growth compared to previous year - Improved service delivery to identified key account customers 80 TRANSNET RAIL ENGINEERING RICHARD VALLIHU BUSINESS OVERVIEW Product focused businesses specializing in Maintenance Locomotives Running Maintenance Upgrading Refurbishment Wagons Running Maintenance Upgrading Conversions New Build Coaches Running Maintenance Shosholoza Meyl Upgrading Other Rail Rolling Stock People Total = 13 729 Increase by 114% due to 6 253 Maintenance Integration Facilities 7 Centres 150 sites Revenue R 7 317m EBITDA R1 088m Refurbishment of rail rolling stock related Components (wheels, traction motors etc.) 82 BUSINESS OVERVIEW CUSTOMER MANAGEMENT Customers Transnet Freight Rail Main Locomotives Business Wagons Business Wagon Build African Markets Freight Rail Mainline Services SARCC Metrorail Internal Support • Wheels • Rotating Machines Coach Business • Rolling Stock Equip • Tarpaulins 83 RAILWAY ENGINEERING STARTED VARIOUS INITIATIVES TO SUPPORT THE GROWTH STRATEGY FROM FREIGHT RAIL Customer Service Delivery Strategic focus on: Transnet Rail freight objectives • Maintenance of assets servicing high yield commodities • Technology and capacity upgrades of assets • Development of new rolling stock products and services for enhanced service Transnet Rail engineering support Leadership & Employee Capability Building a lean taskforce with a strong focus on leadership capabilities and core competencies Scheduled Freight Railway How to support Freight Rail Safety Improvement in reliability of rolling stock through: • Application of world class maintenance practices • Technology upgrades (E.g. Fitment of roller bearings and air brakes). • Application of standard operating procedures (e.g. PPE) • Geographic alignment of maintenance facilities with corridor strategy. • Mobile maintenance crews. • Adherence to Scheduled Maintenance Creating Capacity • • • • • • Optimization of maintenance processes Faster turn-around time in maintenance facilities Implement preparation depots Capacity increase through upgrading and modernisation of rolling stock. Build A-shed depots in yards Improved feeding and de-feeding in depots and yards 84 CORE OPERATING DIVISIONS PERFORMANCE Operating divisions Revenue (R million) 2006 Rail Engineering 3 845 EBITDA (R million) %▲ 2007 2006 %▲ 2007 90% 7 317 738 47% 1 088 • Revenue increase mainly due to integration of Spoornet maintenance operation. Rail Engineering contribution to Group EBITDA 9%* 9% • Locomotive reliability and availability exceeded targets • Annual number of wagon maintenance lifting increased from 12 000 to 20 000 • • Record production of 1 022 new iron ore and coal wagons • Capital expenditure R623 million 91% * Mainly internal and eliminated on consolidation 85 KPI’s – RAIL ENGINEERING 2007 Target 2007 Actual Performance Financial Revenue (Rmillion) 5 241 7 317 Achieved EBITDA (Rmillion) 1 118 1 088 Not achieved* 375 623 Achieved Infrastructure Capital expenditure (Rmillion) Efficiency Locomotive reliability General freight 43 43 Achieved (faults per million km) Coal 61 54 Achieved Iron ore 30 41 Not achieved General freight 82 85 Achieved Coal 88 85 Not achieved Iron ore 81 86 Achieved Locomotive availability (%) *Internal profit mainly – focus is primarily on productivity 86 TRANSNET RAIL ENGINEERING : ACTION PLANS TO CREATE CAPACITY AND IMPROVE SERVICE DELIVERY Capacity creation Investment 5 year plan Replacement /expansion of equipment/infrastructure to create capacity - Machinery and equipment (R1.7bn) - Rotable components (R0.8bn) - Buildings/structures for expanding operations (R0.9bn) - Efficiency improvements in all areas of operations Improved service delivery Wagon liftings increased from 12 000 to 20 000 in 2006/07 (18 000 liftings planned for 2007/08) Locomotive availability for coal improved from 85.2% in 2006/07 to 86% currently Locomotive reliability remains a challenge and numerous action plans are being implemented to improve reliability e.g. mobile teams (average locomotive fleet age is 29 years) 87 TRANSNET NATIONAL PORT AUTHORITY KHOMOTSO PHIHLELA BUSINESS OVERVIEW Transnet National Ports Authority is responsible for the safe, efficient and effective economic functioning of the national ports system which it manages, controls and administers on behalf of the South African Government OPERATIONAL STRUCTURE Transnet National Ports Authority provides services within a Infrastructure and Maritime environment; • Infrastructure: – Own, manage, control and administer ports; – Plan, provide, maintain and improve port infrastructure; – Port tariff authority that determines and charges fees for • Cargo segments: – – – – – Containers Automotive Bulk Dry bulk Liquid bulk provision of infrastructure and port services; – Controller of operations/services within the port. • Maritime: – Marine Operations – Provide Tug Services, Pilotage, Berthing Services; – Lighthouse Services – Provide, maintain and operate lighthouses and other aids to navigation around the coast of Richards Bay South Africa; – Ship Repair Facilities – Provision of repair facilities for ships calling at ports; Durban Saldanha – Dredging Services – Maintenance dredging and hydrographic surveys; – Harbour Master – Port Control and Vessel Traffic Services. East London Cape Town Port Elizabeth Ngqura Mossel Bay 90 PORTS AUTHORITY: STRATEGIC OBJECTIVES 2005 - 2006 Ports Authority • South Africa a regional leader in port management and operational expertise • Imports and exports are the key driver of volume growth • Medium to long term growth prospects remain favourable • SA ports under threat as new port developments in the region capture market share • Transshipment opportunities • Complementary ports that offer specialised services to natural hinterlands • Marine services competency • Ability to invest and create port infrastructure capacity • The Ports Act and a new regulatory environment 2007/2008 Strategic Objectives 1 Improve vessel and cargo turnaround 2 Provision of Port Infrastructure ahead of demand 3 Improve productive use of assets Develop human capital and 6 skills to achieve objectives Enterprise-wide Risk 5 Management 2009 - 2012 Safe, efficient and effective functioning of the port system • Sustained infrastructure capacity provision, ahead of growth demands • Integrated planning for port infrastructure • Safe and secure worldclass port system, preserving the environment • Competitive and efficient port system that drives volume growth • Growing, productive and committed workforce Increase the Market 4 Planning to lead growth A Port system leading growth demands 91 GROWTH STRATEGY 1 Infrastructure capacity 2 Efficiency : port management and port operations 3 Enhancing ports’ position as gateways for trade Aimed at leading and growing trade through the SA ports The guiding principles of our Growth Strategy are : Efficiency : Improving efficiency of port services to best meet demand Competitiveness : To support and enhance competitiveness of the port authority’s port and related service offers Partnership : Working with stakeholders in the logistics chain to ensure delivery of world-class port services Rebalancing our revenue by increasing real estate income 92 CORE OPERATING DIVISION PERFORMANCE Operating divisions NPA Revenue (R million) %▲ 2006 5 438 12% EBITDA (R million) %▲ 2006 2007 6 107 4 242 9% 2007 4 627 NPA contribution to Group EBITDA 40% 40% • Increase in revenue mainly due to volume increases - Containers 13% in TEU’s - Vehicles 18% in units • Capital expenditure R1 026 million 60% • Berth occupancy 66% (2006: 58,9%) 93 KPI’s - NPA 2007 Target 2007 Actual Performance Financial Revenue (Rmillion) 5 915 6 107 Achieved EBITDA (Rmillion) 4 383 4 627 Achieved 1 964 1 026 Not Achieved 58.9 66 Infrastructure Capital expenditure (Rmillion) Efficiency Berth Occupancy (%) Achieved 94 TRANSNET NPA: ACTION PLANS TO CREATE CAPACITY AND IMPROVE SERVICE DELIVERY • Capacity creation at the Ports ahead of time: Investment 5 year plan: • Durban: Widening and deepening of entrance channel (R3bn) to enable future growth Pier 1 resurfacing and berth deepening (R1bn) to create capacity Remodelling of Maydon Wharf (R3.5bn) Car terminal to increase capacity from 10 000 parking bays to 14 000 parking bays total cost of project is R0.66bn of which R0.18bn relates to NPA Cape Town container terminal expansion to increase capacity from 700 000 teu’s to 1 400 000 teu’s. Total cost of project R4.2bn of which R2.7bn relates to NPA Ngqura: - New container terminal with capacity of 800 000 teu’s. Total costs of project R7.9bn of which R3.8bn relates to NPA 4 Berths for bulk/ore Sufficient capacity to support future growth in imports/exports 95 TRANSNET PORTS TERMINALS TAU MORWE BUSINESS OVERVIEW •Transnet Port Terminals manages 15 cargo terminal operations situated across 6 South African ports with a staff compliment of 5,049 • Operations are divided into four cargo sectors - Containers Dry Bulk Break Bulk Automotive • Transnet Port Terminals provides an efficient and reliable service to a wide spectrum of customers including shipping lines and cargo owners 97 TRANSNET PORT TERMINALS STRATEGIC OBJECTIVES “The what” “The how” Create a performance management culture and skills base that enables the execution of SAPO business plan Enter into strategic partnerships to exploit new business opportunities that grow our revenue base Talent management, skills recruitment and selection Maintain our market dominance by ensuring we are recognized as an efficient and cost competitive operator Productivity improvement and initiatives to increase capacity and grow revenue Joint ventures and partnerships to gain skills and processes and to retain and grow the revenue Port Terminals Strategic Objectives Contain operating costs per unit of volume to an increase of less than CPIX cost increases Cost maps to understand costs per unit per commodity Business Process reengineering Understand customer requirements, translate these into consistent and personalised service offerings that exceed their expectations Corridor approach Port –rail service packages Create capacity ahead of demand Strategic investments that inform and support growth initiatives 98 WE HAVE TAKEN SUCCESSFUL ACTIONS TO STABILISE THE BUSINESS AND HAVE STRUCTURED AND SEQUENCED THE PATH TO WORLD CLASS Stabilise and privatise Defined corporate strategy Re-engineer and transform New leadership and organisational structure Operational improvement and efficiencies Customer focus and stakeholder management Volume and market share growth Strategic investment for better performance 2012: Double capacity and Revenue base to R8.9bn Corridor performance Motivated, valueadding employees Financial results: R1,3bn Financial results: R50m loss 2000 Injected Skills and developing existing people Investment of capital for sustainability Business Turnaround and prepare to sell 2000 – concession and close shop Perform and grow 2004 2007 2009 99 2012 3 CORE OPERATING DIVISION PERFORMANCE Operating division Port Terminals Revenue (R million) %▲ 2006 3 585 14% EBITDA (R million) %▲ 2006 2007 4 098 1 193 31% 2007 1 561 Port Terminals contribution to Group EBITDA 14% 14% • Revenue increase 14% vs 2006 - Containers (13% in TEU’s) - Automotive (18% in Units) - Bulk (2% in tons) • Capital expenditure R1 740 million 86% 100 KPI’s – PORT TERMINALS 2007 Target 2007 Actual Performance Financial Revenue (Rmillion) 4 052 4 098 Achieved EBITDA (Rmillion) 1 543* 1 561 Achieved 1 415 1 740 Achieved Durban container terminal 20 17 Not achieved Cape town container terminal 20 21 Achieved Durban container terminal 32 33 Achieved Cape town container terminal 33 33 Achieved 4 349 3 951 Infrastructure Capital expenditure (Rmillion) Efficiency Moves per crane hour Moves per ship hour Tons loaded per hour Iron ore terminal Not achieved** *Adjusted to be consistent with bonus costs ** As a result of ship loader failure and lack of iron ore for export 101 TRANSNET PORT TERMINALS: ACTION PLANS TO CREATE CAPACITY AND IMPROVE SERVICE DELIVERY • Capacity creation: Investment 5 year plan - New container terminal at Pier 1 (Durban) to create additional capacity of 720 000 teu’s (R1.8bn) - Durban container expansion and replacement (R1,4bn) to create additional 600 000 teu’s - Ngqura container terminal (additional 800 000 teu’s) - Cape Town container terminal (additional 700 000 teu’s) • Improved service delivery - DCT: Improved teu’s handled from 158 000 to 186 000 per month in 2006/07. Currently for the past 5 months DCT averaged 180 000 teu’s per month. The moves per ship working hour increased from an average of 33 to 38 peaking at 80 moves per ship working hour 102 PIPELINES CHARL MOLLER BUSINESS OVERVIEW • Transnet Pipelines (Pipelines) can best be described as an energy carrier. We transport a range of petroleum products and gas though 3000km of strategic underground pipelines traversing five provinces. The pipeline network consists of 4 main lines: a Multi-product line, the Crude oil pipeline, Gas pipeline and Jet-fuel pipeline plus a network of pipelines mainly in the Gauteng area of South Africa • Pipelines plays an important role in ensuring the secure supply of petroleum products in South Africa. It currently transports approx 17bn litres of petroleum products and 14m gigajoules of gas annually. Products currently transported by Pipelines include methane rich gas, crude oil, aviation turbine fuel, diesel and various grades of petrol (ULP and LRP) • Clients consist of major oil companies operational in SA: BP, Chevron, Engen, Sasol Oil, Sasol Gas, Shell and Total 104 TRANSNET PIPELINES’ STRATEGY FOR GROWTH Transnet pipelines will grow into a totally new business over the next five years. We are presently in the period of transition as depicted below NEW TRANSNET PIPELINES PETRONET WE KNEW FULL REGULATION 2011 ONWARDS CHARACTERISTICS 1. 2. 3. 4. 5. 6. 7. 8. Cash flush 500 Employees Limited Capacity available Informal Regulation (DME) Volumes transported: 17bl/a Interruptible production process Total Net Assets : R5,4 billion Annual turnover : R1,2 billion 1. 2. 3. 4. 5. Cash Constrained 500 650 Employees Capacity constrained Developing formal Regulation Volumes transported :Maximum 18 bl/a 6. Interruptible production process 7. Total Net Assets : Changing 8. Annual turnover : Increasing 1. 2. 3. 4. 5. Cash transition 700 Employees Capacity in abundance Formal Regulation (NERSA) Volumes transported upwards of 22 bl/a 6. Uninterrupted production process (Trunkline and Terminals) 7. Total Net Assets : R20 billion 105 8. Annual turnover : R2,4 billion TRANSNET PIPELINES’ STRATEGY FOR GROWTH Our strategic Objectives are now focused on moving towards the bigger Transnet Pipelines business beyond 2011 - from a small, constrained division to a bigger and growing division of Transnet Limited Develop new business portfolio Full alignment: Regulation • Expanding terminals • Run depots for clients • Optimisation of facilities Ensuring Sustainable Business Support Systems Fit for purpose SAP and Telecontrol features Finalise rules Obtain all licences Embed sound relationship Pipelines’ Strategic Objectives Optimally manage Capacity • Bridging Plan until 2010 (DRA’s & DIC) • Complete and Commission NMPP by Q3 2010 Effective and Efficient Employee Capabilities • New look skill-set for Pipelines beyond 2010 • New Operations and Terminals • Huge Pipeline and Equipment Ensuring highest quality of maintenance Ensuring a sustainable and legally compliant set of older assets and getting to grips with challenges of NMPP 106 MAP OF TRANSNET PIPELINES’ NETWORK (ALSO INDICATING THE ROUTE AND POSITION OF THE NEW MULTI-PRODUCTS (NMPP) GAUTENG Ø219,1 (8”) WALTLOO PRETORIA WEST ø323,8 (12”) RUSTENBURG Ø219,1 (8”) LANGLAAGTE KLERKSDORP SASOLBURG ø323,8 (12”) JAMESON PARK ø323,8 (12”) Ø219,1 (8”) LESOTHO ø502 (20”) ALRODE MEYERTON SOUTH AFRICA MPUMALANGA Ø168,3 (6”) ø323,8 (12”) SECUND A WITBANK KENDAL AIRPORT TARLTON NORTH - WEST GAUTENG ELARDUS PARK ø457,2 (18”) Ø406,4 COALBROOK (16”) CAPE TOWN SECUNDA STANDERTON Ø457,2 (18”) ø457,2 (18") ø457,2 (18”) WILGE AFRICA VOLKSRUST FREE STATE MAGDALA KROONSTAD VREDE “T” QUAGGA Ø406,4 (16”) INGOGO ø457,2 (18”) Ø457,2 (18”) NEWCASTLE BETHLEHEM FORT MISTAKE BHT KWAZULU / NATAL VAN REENEN CRUDE OIL GAS VRYHEID SCHEEPERSNEK ø406,4 (16”) ø323,8 (12”) REFINED PRODUCTS RICHARDS BAY DURBAN N MAHLABATINI LADYSMITH AVTUR EMPANGENI NOT IN USE FUTURE NMPP PIPELINES FUTURE PUMPSTATIONS Ø LESOTHO RICHARDS BAY ø323,8 (12”) MOOIRIVER ø406,4 (16”) Ø457,2 (18”) FUTURE TERMINALS DOUBLE PUMP STATION HOWICK INDIAN OCEAN DUZI PUMP STATIONS DELIVERY STATIONS / METERS INTAKE STATIONS HILLCREST MNGENI Page 107 FYNNLAND DURBAN 107 CORE OPERATING DIVISIONS PERFORMANCE Operating division Revenue (R million) %▲ 2006 Pipelines 1 060 15% 2007 1 218 EBITDA (R million) %▲ 2006 2007 860 931 8% Pipelines contribution to Group EBITDA 8% 8% • 15% increase in revenue vs 2006 - Petroleum volumes (8,1%) - Gas (14,6%) - Tariff increase 2,5% • Capital expenditure R310 million • Board approval to commence with the Multi Product Pipeline subject to certain governance issues being resolved 92% 108 KPI’s - PIPELINES 2007 Target 2007 Actual Performance Financial Revenue (Rmillion) EBITDA (Rmillion) 1 154 1 218 Achieved 860 931 Achieved 226 310 Achieved 43.5 38.6 Achieved Infrastructure Capital expenditure (Rmillion) Efficiency Total operating costs per Ml km of product conveyed (R) 109 TRANSNET PIPELINES: ACTION PLANS TO CREATE CAPACITY AND IMPROVE SERVICE DELIVERY • Capacity creation: Investment 5 year plan - • New pipeline (NMPP) to increase capacity to meet future demand (2010 onwards) at an estimated cost of R11.2bn Improved throughput on existing lines (DRA and DIC initiatives) to create additional capacity until NMPP completed Sufficient capacity will be created up to 2030 with a yoy growth volume of 5% 110 MARIA RAMOS - CONCLUSION THE FOUR-POINT TURNAROUND PLAN WAS DEVELOPED TO STABALISE TRANSNET Transnet situation in 2004/05 • Lack of clear strategic direction Growing a focused freight transport company Strategic intent Delivering efficient & competitive services Enabling economic growth • Weak financial performance and controls 1 2 3 4 • Unfocussed and inefficient business structure – significant non-core investments Four- • Low morale: Lack of Turn- investment in Human Capital • Poor risk management point around Strategy Redirecting Strategic and Reengi- Balance neering Sheet the Business Management Ensure Corporate Governance & Risk Develop Human Capital Management and governance • Lack of capital investment 112 FROM FOUR-POINT TURNAROUND TO FOUR-POINT GROWTH STRATEGY Growth through: Reengineering – integration, productivity and efficiency • Priority corridors • Integrated commercial management • Cross-divisional operational integration Capital optimisation and financial management operations, and financial customer planning • Focused investment for growth • Capital portfolio • Planned • Strategic • Cost effective • Funding strategy maintenance in all divisions Human capital execution • Integrated capital, • Delivery on safety • Accelerate • Efficient asset utilisation Safety, risk and effective governance optimisation asset/liability management performance • Complying to the highest standards of corporate governance • Enterprise risk management • Enterprise performance management (EPM) implementation of HC strategy • Talent management including critical skills • Remuneration based on performance against strategic outcomes • Value and culture procurement • Shared services 113 SUMMARY OF STRATEGY • Drive cross-divisional capital projects and capacity planning • Focus Vulindlela on integrated cross-functional corridor rollout • Implement integrated commercial management • Implement focused management reporting and EPM • Efficient asset utilisation • Enhance safety, risk and governance • Accelerate HC strategy implementation 114 THE SHAREHOLDER MANDATE IS ADDRESSED WITHIN THE NEXT HORIZON OF THE TRANSFORMATION PROCESS Transformation horizons for a networked organisation ‘Expand competitive advantage’ Current position ‘Optimise and extend growth’ ‘Stabilise the core’ • Accelerate HC strategy implementation • Implement integrated commercial ‘Stop the bleeding’ • Financial restructuring • New freight strategy and disposal of non-core assets management capacity management and supply chain integration products) • Strategic organisational initiatives • Develop and implement long term network improvement concepts • Implement critical infrastructure • Long-term capacity planning • Launch Vulindlela to stabilise key • Focus Vulindlela on integrated, cross • Achieve world-class performance projects operational functions and capture productivity • Implement critical capability building • Restructure corporate centre • Complete disposals • Create HC strategy • Shareholder Compact • Risk and governance • Develop customer services (e,g,. functional corridor rollout (using ‘standardised” improvements) • Improve cross-divisional capital projects and financial planning • Implement focussed management levels • Build long term stakeholder relationships • Explore international expansion reporting, KPI analysis and Enterprise Performance Management (EPM) • Best practice CAPEX • Funding strategy 115 THERE ARE SEVEN MAJOR LEVERS FOR GROWTH Major levers Key drivers for success •1 Increase in investment to create • Roll out of Capex plan: Optimal •2 Productivity/efficiency improvement • Vulindlela re-engineering initiatives •3 Customer focus and orientation • Integrated commercial management •4 Sustainable service delivery • Integrated commercial management •5 Financial strength and sustainability • Volume growth and optimal asset capacity integration and allocation across divisions utilisation Key enablers •6 Safety • Embedding safety culture in •7 Human capital • Navigator and Group HC programmes organisation (ERM) 116 THE END 117