Fact Sheet - Waterberg - Transnet Capital Projects

advertisement

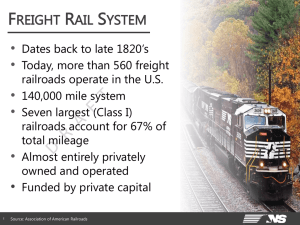

Project Fact sheet Stream 2 Waterberg Project Scope The scope of the project is to construct the infrastructure in stages as highlighted below: Stage 2 Thabazimbi (200 wagons) Bleskop – Norite (5km) Oonderspoort – Dam (7km) Stage 3 Ferrogate, Arthersview, Paul, Phokeng, Rooiheuwel, Pyramid South Stage 4 Lengthen Matlabas loop for 200 wagon trains. Lengthen Northam Additional loop at Thabazimbi Additional loop at Pyramid South Stage 5 Lephalale to Thabazimbi electrification The infrastructure is defined in the following context: Perway and Rail infrastructure Electrical infrastructure Signalling infrastructure Structural infrastructure Possible property / land acquisition Additional Wagons infrastructure Background The Waterberg complex is regarded as a strategic growth node for various activities within the Mining and Industrial sectors. Adequate rail infrastructure capacity is deemed critical to unlock the potential of this economic hub which necessitates a review of the required capacity to support the forecast growth of various commodities, of which coal potentially is dominant. The Waterberg region – outlined below – represents an in-situ coal resource in excess of 75.7 billion tons, and is expected to experience significant growth in Coal and Mineral production over the next 20 years. Transnet has in recent years received numerous requests from industry for an assessment and subsequent supply of long term rail network capacity from the Waterberg area to Richards Bay and Maputo (for export) and to various inland destinations (for the domestic market). The Waterberg complex is regarded as a strategic growth node for various activities within the Mining and Industrial sectors. Adequate rail infrastructure capacity is deemed critical to unlock the potential of this region which necessitates a review of the available and required capacity to support the forecast growth of various commodities, of which coal potentially is dominant. Demand scenarios generated from customers and public domain sources range from 80Mtpa to some 135Mtpa. Leads from major players including Anglo Coal, Exxaro, Aquila, ESKOM, Sekoko coal, Resource Generation, Firestone Coal, CIC Energy and Sasol indicate a long term potential of the order of 110 million tons per annum (Mtpa) on rail but demand is speculative and realisation will depend on the economics of the day. Demand scenarios generated from customers and public domain sources range from a low in the region of 50Mtpa to a high of some 135Mtpa. Status of Project FEL 1 investigation was undertaken accordingly and a signed off report delivered in June 2011. In 2012 October 2013 a final simulation report was handed over to Transnet. TCP was appointed to conduct FEL 2 & 3 following the successful completion of the simulation. There are two tenders currently on the market (until end March 14) for Geotech and Survey. We need to develop Business Case for Stage 2 by end of April 2014. Benefits of Project The main benefit of the project will to increase the coal volumes from Lephalale for domestic and export. Cost The project is being estimated to be R 5 billion for Perway and Rail infrastructure Electrical infrastructure Signalling infrastructure Structural infrastructure Possible property / land acquisition Additional Wagons infrastructure Project Management Project Management Transnet Capital Projects EPCM TCP has been appoint to develop FEL 2 & 3 for the Waterberg project. We will plan for the FEL 4 / execution of the project during the FEL 3 development. Client The client for this project is TFR Contractor Phase There will be three phase project implementation for Waterberg Stages 2 – 5. TFR requested that TCP to develop a Business Cases for: Stage 2, Stage 3, and Stage 4&5