Introduction to STINMOD and Microsimulation Modelling in Australia

advertisement

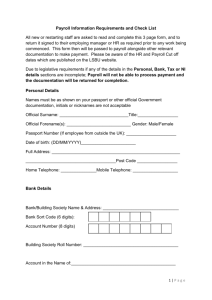

Introduction to STINMOD and Microsimulation Modelling in Australia Ben Phillips: Principal Research Fellow, NATSEM, 21 Feb 2015 What are microsimulation models? ● Tools to simulate government programs, demographic and economic change, current or alternative situation ● Based on microdata ● Records of individual people or households ● Usually large – thousands of records ● Sample surveys or administrative data ● Allow detailed assessment of impact of change ● On individuals, or groups of individuals ● On whole population ● On government budgets 2 What are microsimulation models? ● Used widely in USA, UK, Europe in policy development ● Started in Australia in mid-1980s ● Types of microsimulation models ● Static – day after impacts (STINMOD) ● Behavioral – incorporates modelled behaviour change (MITTS) ● Dynamic – the future (DYNAMOD, APPSIM) ● Spatial – small areas (SpatialMSM) 3 Why microsimulation models? ● Every year, government introduces various changes to tax and transfer payment system ● Goods and services tax (2000) ● Welfare to work package (2006) ● Major cuts in income tax (2007, 2008, 2010) ● Increases in pension (2009) ● Carbon Price, lower personal income tax and higher benefits (2012) ● Budget 2014-15 (examples) ● Question: How do we ensure that the tax and transfer payment system is fair, or achieve the intended targets? ● The impact of these policies can be assessed by using microsimulation models on cost/revenue/distributional outcomes. 4 Overview of STINMOD ● STINMOD (Static Income Model) is a static microsimulation model of Australian income tax and social security systems ● First release STINMOD 94; updated and released every year in 3 versions (source code, outyears, and Interface) ● Shows impact of policy changes ● Fiscal (revenue and expenditure) ● Distributional (winners and losers) ● Effective marginal tax rates 5 Reduce tax for low income, Increase tax for high income ● First rate reduced from 19% to 15% and top rate up from 45% to 50% 6 Who wins and loses? 7 STINMOD basefile ● Created from ABS microdata (Survey of Income and Housing – SIH and ABS Census sample file) ● Contains demographic and income information for members of the family ● Age, sex, marital status, study status, employment status, housing status ● Family type, number of children ● Income from private sources and the government 8 STINMOD basefile How do we make survey data representative of the population we want to model? ● Income uprating ● All monetary variables need to be uprated ● Ageing / reweighting ● Adjust weights to take account of changes in the population ● Adjust weights to reflect number of people receiving various social security payments ● STINMOD 14 outyears: covers 2013-14 to 2017-18 ● Capable of modelling out to 2084 9 STINMOD parameters datasets ● Parameter datasets ● Centrelink: pension rates, allowances, rent assistance, family assistance ● DVA: pension rates and rent assistance ● Medicare parameters ● Tax parameters: tax scale, tax offset, HECs repayments ● Childcare parameters: child care benefit, childcare tax rebate ● Parameters for future years are projected based on projected CPI, AWE (Average Weekly Earnings) 10 STINMOD program modules ● Social security payments ● Age Pension ● Disability Support Pension ● Carer Payment ● Wife Pension ● Parenting Payment Single ● Pensioner Education Supplement ● Pharmaceutical Allowance ● Rent Assistance ● Widow Allowance 11 STINMOD program modules ● Social security payments (continued) ● Newstart Allowance ● Mature Age Allowance ● Youth Allowance ● Parenting Payment Partnered ● Partner Allowance ● Sickness Allowance ● Special Benefit ● Telephone and utilities allowance 12 STINMOD program modules ● Family payments ● Family Tax Benefit Parts A and B ● Maternity Payment ● Child Care Benefit and Childcare Rebate ● Veterans’ payments ● Service pension (age and invalidity) ● DVA disability pension ● War widow(er)’s pension ● Income support supplement ● DVA rent assistance 13 STINMOD program modules ● Taxation ● Income tax ● Medicare levy ● More common tax offsets - low income, Senior Australian, pensioner/beneficiary, dependent spouse ● Imputation credits ● Child care tax rebate (hypothetical only) ● HECS repayments (hypothetical only) ● Education tax refund ● Now also included carbon tax, GST, production taxes, in-kind benefits (modelled) 14 STINMOD Output: base and new ● Simulation output include all original variables in the basefiles and many new variables related to: ● Entitlement to: Allowances; Pensions; Family assistance; Child Care Benefit (hypothetical only) ● Liability for: Income tax; Medicare levy; HECS repayments (hypothetical only) ● From simulation output, various tables can be produced ● Gains or losses from policy changes between base and new simulation can be calculated 15 Examples of uses of STINMOD ● Used by Federal Government departments for formulating budget policy ● Federal Treasury (Capita model – developed from STINMOD) ● Department of Social Services ● Department of Employment and Education ● Recent use example: Introducing Carbon Price package in Australia, Budget 2014-15. ● http://www.cleanenergyfuture.gov.au/wpcontent/uploads/2012/06/CleanEnergyPlan-201206283.pdf ● Page 37 to 51 – who wins, who loses. ● STINMOD/microsim modelling is best when designing a ‘package’ of reform. 16 Budget 2014-15 – distributional impact 17 Hypothetical Example 18 ● Introduction of GST in 2000 ● Carbon Pricing in 2012 ● Welfare to work reforms 2006 ● Works best for costing programs where there are ‘new’ recipients or a package of policy changes are being made. ● Adding behavioural element is complicated but useful for describing relativities in magnitude and direction of policy outcomes. 19 20 21 2% increase in mortgage rates – SA3 Summary ● STINMOD is complex model of Australia’s tax and transfer system. ● Heavily used by major government departments for policy modelling and policy costing. ● Most valuable for analysis of ‘distributional outcomes’ of policy and considering impacts of a ‘package’ of reform. ● These types of models became popular as more individual survey and administration data became available in 80s and computing power increased. ● Valuable tool for policy modelling – indispensible in Australia now. 23 www.natsem.canberra.edu.au