Syllabus - Department of Economics

advertisement

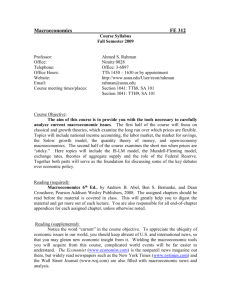

Iowa State University Department of Economics Spring 2016 Tuesdays and Thursdays, 12:40 – 2 pm East 119 Prof. Rajesh Singh Office: 281 Heady E-mail: rsingh@iastate.edu Office hours: Tuesdays, 10 am – 11 am Thursdays, 10 – 11 am International Finance COURSE OBJECTIVES This course will focus on studying macro-economic problems in interdependent economies. The key macroeconomic variables to be studied are exchange rates and international capital flows, both under free markets and under policy controls (as currently practiced in a large part of the world). A part of the course will focus on understanding exchange rate unions, particularly in the context of Euro. Along the way, we will consider the decision problems faced by countries (its individuals and policymakers) in an increasingly interconnected world and analyze how they interact to determine international allocation of resources and determination of exchange and interest rates. TEXTBOOK The required textbook is International Economics (or Macroeconomics), by Robert C. Feenstra and Alan M. Taylor, third edition. (Used second edition will work fine too.) CLASS MATERIAL ONLINE Lecture slides used in class meetings will be available on the class website (http://www2.econ.iastate.edu/classes/econ457/rksingh) in advance. Since one of the main objectives of the course is to cultivate the ability to think analytically about international capital markets and institutions, students are strongly encouraged to become familiar with current international economic issues, for example, current trends in US-China, US-Europe exchange rates, ongoing economic recession in Europe and uncertainty about the future of the Euro, policy responses of central banks in US and Europe, and the Chinese exchange rate policy. The Economist (a weekly) provides an excellent coverage and discussion of current economic and financial events. Some of the articles published weekly in the Economist are freely available at the Economist's home page (http://www.economist.com). Daily coverage can be found in Financial Times and the Wall Street Journal. On the course website I will post a list of newspaper/magazine articles relevant to the class. I will regularly recommend articles for you to read as a motivation for upcoming or past course topics. Each exam will have bonus question/s on star-marked readings. PROBLEM SETS/QUIZZES During the term, 4 problem sets will be handed out. These problem sets will help you learn the material presented in the class and in the text, and help you practice for the exams. Problem sets will be worth 10% or your grades. The problem sets will be graded on a ‘good (G)’, ‘satisfactory (S)’, and ‘unsatisfactory’ (U) basis, which will be worth 2, 1, and 0 points, respectively. Non-submission will automatically earn a 0. The solutions to these problems will be posted on the class website after their due date. OFFICE HOURS Office hours are on Tuesdays and Thursdays 10 am – 11 am, or by appointment. Please also feel free to e-mail me with questions and/or comments. I strongly encourage students to take advantage of office hours. EXAMS/GRADING There will be three (each one hour-long) midterm exams (no make-ups) during the semester, plus a final exam. The midterms will cover lectures, all the reading material, and problem sets (see course outline). The final exam will be comprehensive. The final grade will be based upon the following Three midterms (best 2 out of 3): 27.5 percent each Comprehensive final: 35 percent The letter grades will be based on the individuals’ mastery of the course material, as displayed by each student’s overall course score, and not on a curve. The exact cut-offs for letter grades will be announced after the second midterm. OUTLINE OF COURSE TOPICS A tentative topic-wise calendar of lectures is as follows Date Topic Chapters Part I: Introduction; Understanding Exchange Rates 1/12 Why study International Finance? Ch. 1 1/14 – 1/21 Exchange Rates and the Foreign Exchange Market Ch. 2 1/26 – 2/2 Understanding exchange rates in the Long Run Ch. 3 2/4 – 2/9 Understanding Exchange rates in the Short Run Ch. 4 2/11 HOUR EXAM I – Chs. 1 - 3 Part II: Balance of Payments; Intertemporal approach to current account determination 2/16– 2/23 Understanding Exchange rates in the Short Run Ch. 4 2/25– 3/1 National Income accounting Ch. 5 3/3-3/8 The Gains from Financial Globalization Ch. 6 3/10 Hour Exam II -- Chs. 4, 5, and a part of 6 (covered in class up to March 5) Part III: International Macroeconomic Policy 3/22 – 4/5 Output, Exchange rates and Macroeconomic policies in the short run Ch. 4/7 Hour Exam III -- Chs. 6 - 7 Ch. 7 4/12 – 4/14 International Monetary Experience Ch. 8 4/14 – 4/19 Exchange Rate Crises Ch. 9 4/21– 4/28 Optimum Currency Area (Euro) Ch. 10 Final Exam: Thursday, May 5, 12-2pm (East 119)