John McDougall, PhillipsMcDougall

advertisement

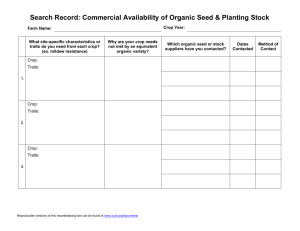

Industry Presentation The development of the Agrochemical Market in Europe Phillips McDougall Vineyard Business Centre Saughland Pathhead Midlothian EH37 5XP Tel : 01875 320611 john@phillipsmcdougall.com March 2015 1 © PhillipsMcDougall Industry Presentation 2014 March 2015 2 © PhillipsMcDougall Industry Presentation Market Performance 2014 (Ex-manufacturer level – average exchange rates - Nominal US$) Year 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Preliminary 2014 / 2013 % Crop Protection ($m) 32204 32814 32508 35885 43187 40147 41291 46539 49549 54208 56145 Non-Crop Agrocemicals ($m) 4675 4905 5150 5365 5655 5860 5880 6290 6372 6481 6557 GM Seed ($m) 4476 5095 5855 7062 9150 10570 12870 15685 18495 20100 21054 Conventional Seed ($m) 14524 14657 14485 14648 16870 17185 17950 18810 19065 19325 19497 3.6% 1.2% 4.7% 0.9% Agrochemicals = $62,702 +3.3% March 2015 3 Seed= $40,551 +2.9% © PhillipsMcDougall Industry Presentation Crop Protection Market Outlook 2014 NAFTA: Lower crop prices Maize area -3.9% Soybean area +10.9% Canada wheat area -7.4% Continuing dryness in south and west USA Modest decline in glyphosate prices Hard winter affects citrus and autumn planted crops US Registration review Latin America: Increased soybean and wheat area in Brazil and Argentina, but decline for maize Dryness in Brazil in early 2014 Weaker Real affects Brazil crop exports Increased GM uptake in Region High inflation in Argentina High interest rates in Brazil Rising sugar and cotton price Economic improvement drives developing markets World Rising demand for crop commodities Static to declining glyphosate prices Crop prices weakening Farm economies strong, after good 2013 Lower maize and soybean prices Asia: Japan: modest improvement Further GM uptake in China and India Drive for grain production in China Quest for rice self sufficiency in Malaysia and Indonesia Lower palm oil and rice prices Increasing food demand Dry weather affects East Australia Weak 2014 monsoon Tax rise on agrochemicals in Japan Africa / Middle East: Modestly developing markets Speciality crops for export Improved political stability benefits North Africa Political and infrastructure problems Water availability Growth Markets March 2015 Europe: Wheat price remains high EU wheat area +3.2% Oilseed area increased marginally Re-registration under revised criteria Mild winter promotes Autumn crop survival Potential for high disease pressure Good start to 2014 season Wet summer in Central Europe Static to Slow Growth 4 Static to Decline © PhillipsMcDougall Industry Presentation Regional Crop Protection Market Development $m 18000 16000 14000 12000 10000 8000 6000 4000 2000 0 Latin America Asia Europe NAFTA 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Africa / Middle East March 2015 5 © PhillipsMcDougall Industry Presentation Crop Protection Market 2014 Analysis Region NAFTA LAM EUROPE ASIA World March 2015 Nominal $ Growth 2014/2013 (%) -4.4 13.1 1.8 1.6 3.6 6 Real Growth 2014/2013 (%) -4.5 16.1 1.7 1.9 4.5 Constant Dollar Growth 2014/2013 (%) -2.9 26.8 4.8 5.4 7.2 © PhillipsMcDougall Industry Presentation Growth of European Crop Protection Market €m 11000 10000 9000 8000 7000 6000 CAP Reform Introduction of Single Farm Payments 5000 4000 3000 CAP Reform Introduction of set-aside 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2000 March 2015 7 © PhillipsMcDougall Industry Presentation Compound Annual Growth Rate of the European Crop Protection Market (% p.a.) € Terms 2014/2009 2014/2004 2.6 3.1 5.8 8.0 6.8 9.6 EU15 New EU13 Other March 2015 8 © PhillipsMcDougall Industry Presentation Top Twenty European Country Markets Sales Growth in € Terms 2014/2009 (% p.a.) Romania Bulgaria Russia Ukraine Poland Hungary UK Spain Switzerland Italy Portugal Germany Czech Croatia Denmark Greece Slovakia Austria France Netherlands Belgium -5 March 2015 0 5 10 9 15 20 25 © PhillipsMcDougall 30 Industry Presentation Agrochemical Market Split by Product Category (2013) Other, 3.0% Other, 3.4% Fungicide, 25.8% Herbicide, 43.7% Insecticide, 27.5% Herbicide, 46.3% Insecticide, 13.5% Europe World March 2015 Fungicide, 36.8% 10 © PhillipsMcDougall Industry Presentation Agrochemical Market Split by Crop (2013) 35 World % ofTotal Value 30 24.2% 25 20 16.7% 14.2% 15 11.7% 9.5% 10 8.8% 5.1% 4% 5 1.4% 1.3% 3.1% 0 35 34.6% Europe 29.2% % ofTotal Value 30 25 20 15 11.6% 9.5% 10 0.8% 1.1% 0 March 2015 11 4.9% 4.2% 3.7% 5 0.4% 0 © PhillipsMcDougall Industry Presentation European Agrochemical Market 2013 Key Crop Product Sectors 1800 4.1% 1600 4.2% 1400 Red values are CAGR in % from 2009 -2013 Sales (Euro m.) 1200 6.6% 1000 800 2.4% 600 7.1% 7.4% 400 15.1% 11.1% 3.6% 5.5% 200 0 March 2015 12 © PhillipsMcDougall Industry Presentation Crop Commodity Prices March 2015 13 © PhillipsMcDougall Industry Presentation Indicative Global Trade Commodity Prices 1998-2014 $/Tonne Annual Average 600 Soybean 500 Rice 400 300 Wheat Maize 200 100 Cottton (cents/lb) 0 1998 1999 March 2015 2000 2001 2002 2003 2004 2005 14 2006 2007 2008 2009 2010 2011 2012 2013 2014 © PhillipsMcDougall Industry Presentation GM Seed Market 2014 March 2015 15 © PhillipsMcDougall Industry Presentation GM Trait Introductions Since 1995 GM Planted Area New GM Seed Products 500 14 12 Planted area (million acres) 400 10 350 300 8 250 6 200 150 4 100 2 50 0 0 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 16 2003 2002 2001 2000 1999 1998 1997 1996 1995 March 2015 © PhillipsMcDougall Number of trait product introductions 450 Industry Presentation Crops Planted with GM Varieties in 2014 NAFTA 46.4% Canada Canola – 91.5% Soybean – 91.7% USA Soybean – 96.0% Maize – 93.1% Cotton – 99.5% Canola – 91.0% Sugar beet – 98.1% Asia 11.4% China Cotton – 82.8% Argentina Soybean – 96.9% Maize – 90.7% India Cotton – 97.2% Brazil Soybean – 91.2% Maize – 85.4% Rest of World 1.5% Latin America 40.7% Total = 441.9 million acres (+3.5% over 2013) March 2015 17 © PhillipsMcDougall Industry Presentation Agrochemical Industry Structure and R&D Focus March 2015 18 © PhillipsMcDougall Industry Presentation Company Sales Increases 2014 (preliminary) US $ % sales change over 2013 Company Syngenta Bayer BASF Dow Monsanto DuPont FMC Cheminova KWS Vilmorin Agrochemical 4.0 6.9 4.2 3.0 13.1 4.0 1.3 2.2 Seed and Traits -1.0 13.4 n/a -0.6 3.9 -7.0 n/a n/a n/a n/a 7.9 7.0 Note –results are for company fiscal year March 2015 19 © PhillipsMcDougall Industry Presentation Crop Protection Company Market Shares 2013 Market Share >15% 15% - 5% 5% - 1% 1%-0.5% <0.5% European Bayer BASF Cheminova Sipcam Oxon Isagro Syngenta Helm Phyteurop Agriphar USA Dow FMC Chemtura Monsanto Platform Specialities Amvac DuPont Japan Albaugh Gowan Sumitomo Chemical Ishihara Agro Kanesho Arysta Kumiai SDS Biotech Nihon Nohyaku OAT Agrio Nippon Soda Nippon Kayaku Nissan Kyoyu Agri Hokko Mitsui Chemicals Other Adama Red Sun Rotam Nufarm Wynka Rallis UPL Sinon Sinochem Excel Nutrichem Gharda March 2015 20 © PhillipsMcDougall Industry Presentation Company Sales and R&D Expenditure 2013 Agrochemicals Seed and Traits 12000 10000 Sales $m. 8000 6000 4000 2000 0 Monsanto DuPont Syngenta BASF Dow Bayer Monsanto Syngenta BASF Dow Bayer 1800 R&D Expenditure $m. 1600 1400 1200 1000 800 600 400 200 0 March 2015 DuPont 21 © PhillipsMcDougall Industry Presentation R&D expenditure of Leading Agrochemical Companies 4000 3500 Agrochemical US$ million 3000 2500 2000 Seed & Trait 1500 1000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 March 2015 22 © PhillipsMcDougall Industry Presentation Cost of Bringing a New Product to Market Agrochemical Plant biotechnology trait 300 300 Total = $256 m. 250 200 32 Development 54 Field Trials Chemistry 36 100 11 32 50 Research 200 Environmental Chemistry Toxicology Tox/Env chemistry Introgression breeding & testing 150 100 13.6 50 42 0 0 Agrochemical Commercial event production Construct optimisation Late discovery 28.3 13.4 17.6 Early Discovery Crop Biotech trait Agrochemical costs based on 2009 Crop Life America/ECPA study March 2015 17.2 17.9 28 Biology Chemistry Registration & Regulatory Affairs Regulatory Science Registration $ million $ million 250 25 24 150 Total = $136 m. 23 Plant biotechnology trait costs based on 2011 Crop Life International study © PhillipsMcDougall Industry Presentation Agrochemical Active Ingredients in Development a.i.s in development 80 70 60 50 40 30 20 10 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 March 2015 24 © PhillipsMcDougall Industry Presentation Future Developments in Agrochemical and Seeds Input Traits - Maize, Soybean, Cotton, Canola o Additional herbicide tolerant traits – dicamba, 2,4-D (Enlist), HPPD o Insect resistant traits for soybean o Expansion of insect coverage from new insect resistant traits – e.g.VIP Output traits o Drought / Stress tolerance/ Abiotic stress RNAi Precision Agriculture March 2015 25 © PhillipsMcDougall Industry Presentation Patents for Abiotic Stress 2009-2013 250 Other Institutions Big Six Multinationals Number of Patents 200 150 100 50 March 2015 26 2013 2012 2011 2010 2009 0 © PhillipsMcDougall Industry Presentation Patents for Abiotic Stress 2009-2013 25 20 Temperature Stress 15 Water Stress 10 March 2015 27 Dow Bayer Unclassified Monsanto 0 Syngenta Multiple BASF 5 DuPont Pioneer Number of Patents Salt Stress Other © PhillipsMcDougall Industry Presentation RNAi – Gene Silencing Ribonucleic acid interference (RNAi) is a method of gene silencing in target organisms Potential applications of RNAi in agriculture include: • In-plant insect protection – e.g. corn rootworm • Foliar spray / seed treatments • Weed Control March 2015 28 © PhillipsMcDougall Industry Presentation Precision Farming Applications Farm Management • Singulation and Spacing • Variable Rate Application • Steering Guidance and Autosteer Systems • Display Screen • • • • • Data Analysis GPS Systems Agronomic Advice Wireless Connectivity Irrigation Agchems & Fertiliser Seed • Variable Rate Application • Chemical/Nutrient Application • Steering Guidance and Autosteer Systems • Display Screen Precision Farming • • • • • Soil Analysis Remote Sensing Field Sensors Mapping Weather March 2015 Field Monitoring 29 Harvest • Yield monitor • Display Screen • Steering Guidance and Autosteer Systems © PhillipsMcDougall Industry Presentation Market Environment in 2015 March 2015 30 © PhillipsMcDougall Industry Presentation Monthly Crop Prices 400 700 Corn Soybean 350 600 Futures 250 Futures US $ per tonne US $ per tonne 300 500 400 200 300 150 100 200 J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM 2009 2010 2011 2012 2013 2014 2015 J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM 2016 2009 Rapeseed 600 2010 400 2011 2012 2013 2014 2015 2016 Wheat 550 350 Futures Futures 300 450 US $ per tonne € per tonne 500 400 350 250 200 300 150 250 200 100 J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM J S N J MM 2009 2010 March 2015 2011 2012 2013 2014 2015 31 2016 J M M J S N J M M J S N J M M J S N J M M J S N J M M J S N J M M J S N J M M J S N J M 2009 2010 2011 2012 2013 2014 2015 © PhillipsMcDougall 2016 Industry Presentation Maize Prices 2010 - 2016 USDA $8.4 bushel 350 300 US $ per tonne 250 Futures 200 150 $4.1 bushel $4.1 bushel 100 50 J M M J S N J M M J S N J M M J S N J M M J S N J M M J S N J M M J S N J M M 2010 March 2015 2011 2012 32 2013 2014 2015 2016 © PhillipsMcDougall Industry Presentation Wheat Prices 2012 - 2016 € 274 /T 290 270 250 € per tonne Futures 230 210 €183 / T 190 170 150 March 2015 33 © PhillipsMcDougall Industry Presentation Crop Protection Market Outlook 2015 NAFTA: Lower crop prices Maize area expected to decline Soybean area anticipated to rise Record EtOH production in 2014 Continuing dryness in south and west USA Modest decline in glyphosate prices Hard 2014/15 winter US Registration review Latin America: Increased soybean but decline for maize and wheat area in Brazil and Argentina, Dryness in Brazil in early 2015 Weaker Real affects Brazil crop exports Increased GM uptake in Region High inflation in Argentina High interest rates in Brazil Weaker sugar and cotton price Economic improvement drives developing markets World Sustained demand for crop commodities Weakening glyphosate prices Crop prices depressed Farm economies weakening Asia: Japan: modest improvement Further GM uptake in China and India Drive for grain production in China Quest for rice self sufficiency in Malaysia and Indonesia Low palm oil, but rising rice prices Increasing food demand Dry weather affects East Australia Africa / Middle East: Modestly developing markets Speciality crops for export Improved political stability benefits North Africa Political and infrastructure problems Water availability Growth Markets March 2015 Europe: Wheat price weakening CAP reformed to Basic Payment Scheme Ecological Focus Areas – Non cultivated land EU-15 wheat area expected to decline Re-registration under revised criteria Mild winter promotes Autumn crop survival Potential for high disease pressure Static to Slow Growth 34 Static to Decline © PhillipsMcDougall Industry Presentation European Market Outlook Short term: Futures Crop prices reduced but potential for further volatility Challenging economic environment Agrochemical Prices Changes in EU CAP Longer term: Increasing demand for grain and oilseed crops Agrochemical product re-registration Resistance and regulatory issues create opportunities for new products New farming technologies March 2015 35 © PhillipsMcDougall Industry Presentation Disclaimers The information contained in this presentation constitutes our best judgement at the time of publication, but is subject to change. Phillips McDougall do not accept any liability for any loss, damage or any other accident arising from the use of the information in this presentation. The information given in this presentation has been drawn from analyses and reviews presented in the Phillips McDougall products AgriService, Seed Service, AMIS Global and AgreWorld. Phillips McDougall maintain a wide range of databases covering the crop protection and seed industries, this presentation presents only headline information. Access to these databases can be gained through subscription or consultancy. Our market research databases track product sales from global market totals down to brand level sales by crop and country in both volume, value and area treated terms. For more information about these products please visit www.phillipsmcdougall.com www.agreworld.com March 2015 36 © PhillipsMcDougall