Summary of proposed amendment

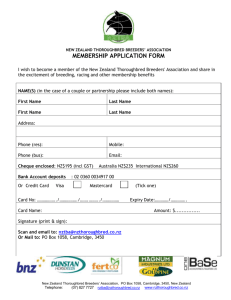

advertisement