Opportunity Cost

advertisement

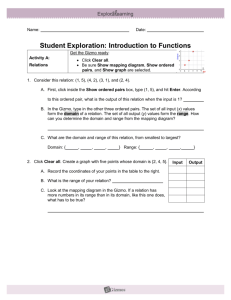

Using Accounting for Decision-Making 27 Equipment Replacement Decision Estimated life Original cost Accum. deprec Disposal value now Disposal value in 4 yrs Operating exp / year Old Equip New Equip 4 yrs 4 yrs $60,000 $20,000 36,000 N/A 2,500 N/A 0 0 7,000 2,000 Should the old equipment be replaced? Consider future cash-in and cash-out… … for all years affected. difference Dropping a Product Line First Class Business (16 seats) (150 seats) $10,000 $ 5,600 $36,000 300 320 300 Contrib Margin $ 9,700 $ 5,280 $35,700 Avoidable fixed 750 500 500 Unavoidable fixed 2,500 4,000 37,500 Operating Income $ 6,450 $ 780 $(2,300) (10 seats) Sales Variable Coach . Should the airline discontinue coach service? difference Watch for unavoidable costs that do not change even when you drop a product line. Beware: some of these costs might be allocated! Special Sales Orders Gizmo Incorporated Sales (8400 units) $294,000 $35 Cost of Goods Sold 268,800 32 Gross Margin $ 25,200 $3 16,800 2 $ 8,400 $1 Selling and Admin Operating Income Should Gizmo accept a special sales order of 1,000 units at $28 per unit? Unit costs can be misleading. Distinguish between fixed and variable costs. How will total costs change? difference Sales ($35/unit or $28/unit) $294,000 Make-or-Buy Decisions DM $ 6,400 Gizmo Incorporated DL 320,000 MOH Super salary $ 40,000 Utilities 11,000 Rent 25,000 Depreciation 564,000 Total MOH 640,000 Total cost $966,400 $0.10 5.00 10.00 $15.10 Should BMI continue to make microprocessors or buy them externally for $12.00? difference Buying a service that was previously performed within the firm. Buying a component part that was previously made by the firm. Opportunity Cost Potential benefit that may be obtained by following an alternative course of action. What is the opportunity cost? You cut your own hair. A company just had a very profitable year and is considering paying-off all its loans. The Winona Products example. General Guidelines Beware of unit costs Analyze total revenues and costs. Recognize costs that will not change Many fixed costs are unavoidable. Historical costs are sunk. Beware of allocated costs Many shared costs are unavoidable. Be aware of limited resources Analyze CM per limited resource.