Cereal products PowerPoint

advertisement

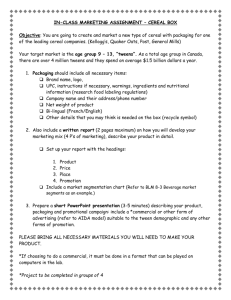

MBA 5060 - Product Strategy CEREAL PRODUCTS Laurie Baron Yvan D’Silva Yu-Hsuan Lai Carolina Quintanilla Valdovino Lalinthip Sriwitanont Matthew Van Heel Friday 30th November, 2007 Agenda Industry overview Environmental trends Threats & opportunities New product opportunities Business Analysis Proposed launch plan Q&A Industry Overview Global Perspective (Food and Drink Industry) Global Revenue Estimate: $7.1T AUD (2005) EU Industry Revenue Estimate: $1.42T AUD (2005) Australian Perspective (Food and Drink Industry) Australian Revenue Estimate: $69.8b AUD (2005-2006) Australia has a range of climates and land types, most of which are used for food production. This variety, combined with high quality ingredients and cutting edge technology, makes Australia a reliable long-term supplier to global markets Industry Overview Australian Perspective (Cereal Products) Revenue Revenue Growth Rate Imports and Exports Industry Overview Australian Perspective (Cereal Products) Breakfast cereals Product Segmentation Pasta Milled rice and rice flour Prepared baking mixes Meal or offal Hulled or shelled oats Oatmeal for human consumption Self-raising flour Jelly crystals Custard powder Baking mixes 8% Other 6% Rice 8% Pasta 16% Breakfast cereals 62% Industry Overview Australian Perspective (Cereal Products) Market Segmentation Geographic Spread of Businesses WA 7% Other 5% Exports 10% SA 11% Grocery wholesalers 43% NSW 33% Hospitality industry and institutions 16% QLD 17% Supermarket chains 26% VIC 32% Industry Overview Australian Perspective (Cereal Products) Competitors Market Size: • Total revenue : $2.62 billion, 2.9% higher than 2005 • Total value added: $731.6 million, 4.2% lower than in 2005 Kellogg Australia Holdings Pty Ltd 17% Australian Health & Nutrition Association Limited 7% General Mills Holding (Australia) Pty Ltd 7% Other 52% Nestle Australia Ltd 5% San Remo Macaroni Company Pty Ltd 4% Manildra Group 1% Goodman Fielder 2% Green's Foods Limited Ricegrowers Limited 3% 2% Industry Overview Demand determinants Changing lifestyle The variety of substitute products Health, nutritional and dietary concerns Household incomes Population growth Changes in the demographic profile of the nation Domestic sales were estimated at $ 2.5 billion in 2005-6 The competition of industry Price : the price will be varied by product segments Selling and distribution: strong relationship with retailer and manufacturer Quality : good quality product enable the firms to charge a premium Product differentiation and functional qualities product innovation and differentiation play a key role Branding and promotion firms have heavily promotion through mass media advertising The external competition alternative breakfast foods ex. Muffins, bread, bagels and take-away stores Industry Overview - PLC Porter’s Five Force • • • • Suppliers • The bargaining power of supplier is between medium to high. (It depends how large is the retailers.) • The importance of value to supplier is high because the margin is not high. Potential entrants Medium entry barriers High capital requirements Economies of Scale Proprietary product differences THE INDUSTRY Degree of Rivalry • The larger competitors • Mature and stable market (low growth rate) • Wide and completed product line Substitutes • Muffin, bread, bagels • Take-away foods • Restaurants Buyers • Consumer has high bargaining power. • The buyers are price sensitive. Environmental Trends Political/Legal Election 2007 Bilateral agreements between Australia and the US Role of ANZFA within the food industry Role of the ACCC Economic/ Environmental Key economic indicators affect buying habit of consumers Global economy is on the tipping point of potentially slowing down Australian economy is continuing good growth Climate change affecting the production of key ingredients used in breakfast cereals i.e. Drought, global warming Industry is being affected by environmental regulations Environmental Trends Socio-cultural Australia’s population is growing approximately 1.2% per year Average household size is increasing Aging Population Increasing multicultural population Demand for products with healthy image due to increases in obesity Demand from consumers for convenient ready to eat foods Technology Major technological changes occurring within the industry. Computerisation has aided quality control and JIT manufacturing CRM Systems E-Business is allowing customers to shop from home GM foods are entering the market GE/McKinsey Screening Grid The Company - Kellogg’s Kellogg’s - Company Profile A wholly owned subsidiary of the U.S. Kellogg Company since 1928 Kellogg Australia operates manufacturing facilities in Botany (NSW), Charmhaven (NSW), and Brisbane (QLD). Kellogg is the largest player in this segment, with over 43% market share. 2006 - Kellogg’s sales revenue reached A$ 470.6m Kellogg’s overall market share is gradually falling Kellogg’s - Product Portfolio Kellogg’s - Brands Corn Flakes All-Bran Rice Bubbles Frosties Coco Pops Corn Flakes Crumbs Variety pack Froot Loops Sultana Bran Special K Nutri-Grain Just Right Sustain Komplete LCM’s cereal & milk bars Nutri-grain bars K-time cereal bars LCM’s shakes Mini Wheats Guardian LCM’s Crispix Kellogg’s Muesli Bars K-time twists Special K bars with Yoghurt All Bran baked bars Special K light muesli Crunchy nut nutty bars Coco Pops Coco Rocks Perceptual Map High product quality High price Low price Low product quality SWOT Analysis Strength Market leadership position Strong Brand recognition - Product variety - Nature of products - Product positioning Kellogg's leads the trend towards better health and nutrition Consumer trust Broad Channel Distribution - Grocery store, Supermarket, Convenient store, etc. Weaknesses High market concentration Growth opportunities via acquisitions are limited The product supply chain depends on many suppliers such as farms, fresh fruit providers, etc. A great number of variable costs SWOT Analysis Opportunities Threats Increasing awareness on health, well being and nutrition Consumption in ready to eat cereals is increasing Improved crop production as a result of GM food technology Consumer trust and brand recognition Largest purchaser of Rice in Australia The growth of health-conscious trend among people across countries Busier lifestyle The continual growth of cereal market (2.9% increasing from 2006) Impact of global warming on availability of raw materials (cereals and rice) Concern over GM food technology and consumer skepticism On going effects of Australian drought on raw material availability and cost Growing strength of competitors (Goodman Fielder, Sanitarium) Highly competitive industry Increased food regulation Increasing cost of raw materials Alternative choices of breakfast e.g. rice New Product Opportunities Megatrend: Convenience, Health, Taste, Ethical Market Opportunity: Easy to consume Convenient Can consume on the run Healthy (low fat, sugar content) Nutritional (vitamin supplement) Tasty Environmentally friendly New Ideas Generation New cereal flavours Edible packaging Milk and cereal combination Space bar breaky (dehydrated & or microwave) Products with salt Screening Criteria 1. Sales/Revenue potential 2. Profit Margin Potential 3. Development Cost 4. Innovation 5. Competition 6. Distribution Screening Criteria Concept Testing Involves designing and presenting representations of the proposed new product/s to a sample of intended customers Objective is to estimate market reaction to a product before committing resources to its physical development Concept Testing 2 research methods will be utilized Qualitative feedback provide information to evaluate the 3 concepts Profile of the market Assess likely purchase intentions and position the product Make improvements to the product Modifications to be made on the product presentation Quantitative Research Estimate trial of the product Compare product with existing buying patterns Identify barriers / issues in adoption Concept Testing Product A – Edible Packaging Product B – Space Bar Product C – Combo A new packaging concept for breakfast cereals Inner plastic coated packaging layer is replaced by an edible package which forms part of the contents to be consumed. A new product category Dehydrated cereal in a small snack bar size that consumed directly or re-hydrated by adding milk and consumed as a traditional breakfast A new product category Disk shaped cereal that consumed directly or by adding milk and consumed as a traditional breakfast using patented technology Consumer need Environmentally friendly Nutritional and low fat Consumer need Convenience Nutritional and low fat Time effective Substitute for snacks Consumer need Convenience Nutritional and low fat Time effective Substitute for snacks Benefits Size/packaging Nutritional and low fat Added health benefits Convenient / no preparation Quality / flavor Easy to consume Benefits Size/packaging Nutritional and low fat Added health benefits Convenient / no preparation Quality / flavor Easy to consume No preparation Benefits Environmentally friendly Reduce packaging waste by up to 40% Nutritional and low fat Vitamin supplement Enhanced flavors & taste Convenient / no preparation Fresh mint flavor (Oral hygiene) Research Results Qualitative Research Edible Packaging Would you be interested in a cereal where the inside package was part of the cereal? Interested in the idea “I’m interested in any thing that reduces waste and is environmentally friendly so I would be interested in finding out more” Found the product credible “I’m not surprised that with the rate of technological change they can come up with cereal packaging that can be eaten with the cereal” Not interested in the idea I don’t believe it is possible and I don’t fancy eating paper of any sort” (35-55) “How do you transport the product”? Conclusion- Most interest in younger ages group (13-25) Most skeptical (45+) Qualitative Research Results – Adolescents and Young adults most interest Research Results Qualitative Research Space Bar Would you be interested in a cereal which is very small and can be either eaten has a snack bar or re re-constituted and consumed as a traditional breakfast Interested in the idea “I really like the convenience facto r- I can sit down and eat it as traditional cereal or if I’m in a hurry I can eat it on the run and still get the same nutritional value”. “ it small enough to be carried around a snack food which is not junk food” Found the product credible “they have been doing this sort of stuff in the space program and the military since the 60’s so the technology should be well advanced”. “It can be eaten on the” “It would fill you like a regular breakfast” Conclusion- Interest across all age groups (13-55) Qualitative Research Results - Adolescents and Young adults and adults Research Results Qualitative Research Combo Would you be interested in a cereal where it can either be eaten as a traditional cereal or a snack on the run? Interested in the idea “I really like the convenience facto r- I can sit down and eat it as traditional cereal or if I’m in a hurry I can eat it on the run and still get the same nutritional value”. Found the product credible “Because it has the additional additives it can be eaten without milk and you still get all of your calcium intake” Conclusion- Interest across all age groups Not interested in the idea (I don’t believe it is possible and I don’t fancy eating paper of any sort” 55+) Qualitative Research Results – Adolescents, Young adults and adults to 50+ most interest Research Results Quantitative Research Edible Packaging Consumed breakfast cereal in the last month Consumed breakfast cereal in the last week Believe it is possible to make edible packaging Said they would try if available Would pay a 20% premium for an environmentally friendly package Space Bar Consumed breakfast cereal in the last month Consumed breakfast cereal in the last week A cereal that can be re-constituted with or without milk interests me Would try if available Would pay a 20% premium for re-constitutable cereal Believe that this would provide an alternative nutritional breakfast when on the go Combo Consumed breakfast cereal in the last month Consumed breakfast cereal in the last week A cereal that can be consumed with or without milk or on the and is available in convenient snack size interests me Would try if available Would pay a 20% premium for combo cereal Believe that this would provide an alternative nutritional breakfast when on the go 75% 80% 33% 15% 5% 85% 83% 55% 40% 10% 80% 65% 85% 75% 80% 18% 80% Kellogg’s New Product Kellogg's Kompact Disk Breakfast cereal eaten on its own as biscuit or with milk Healthy snack Vitamins and minerals added Added value - to be discussed New Product Development IP - Bonding agent MBA – Mono-Bythen-Apyte Lactose New Product Development IP - Bonding agent Lactos MBA – Mono-Bythen-Apyte New Product Development IP - Bonding agent Added Value!! Product of MBA combined with Lactos Fat Globules Business Analysis (preliminary) Sales Forecasting Market size = 12,910 tones Potential Market size (35g servings) % aware of product in the market % who try the product % who like the product for re-buy % who will switch to competitors products % Market Share Predicted 35g servings consumed unit cost @ 80% of initial RRP of $0.40 ($) Annual Sales Forecast Revenue ($,000) Population growth rate (2007) Inflation food (Sep 06 -Sep 07) 31-Dec-08 31-Dec-09 3,688,571,429 70% 12% 40% 0% 3.4% 123,936,000 0.28 34,702 1.5% 1.8% 31-Dec-10 3,743,900,000 75% 16% 45% 0% 5.4% 202,170,600 0.29 57,627 31-Dec-11 3,800,058,500 80% 20% 50% 5% 7.6% 288,804,446 0.29 83,803 http://www.abs.gov.au/ausstats/abs@.nsf/mf/3101.0/ http://www.abs.gov.au/ausstats/abs@.nsf/mf/6401.0/ 31-Dec-12 3,857,059,378 85% 25% 50% 10% 9.6% 368,831,303 0.30 108,950 31-Dec-13 3,914,915,268 85% 25% 50% 15% 9.0% 353,565,785 0.30 106,321 Business Analysis (preliminary) Profitability Analysis Corporation tax rate (30%) Net Sales Value Fixed Costs Plant and equipment Project Management and Management Variable Costs Materials (per unit) Direct Labour (per unit) Warehouse and storage (per unit) Storage and Distribution (per unit) Total Variable costs (per unit) Annual Variable Cost Marketing Costs Profit before tax Corporation tax rate (30%) NPAT NPAT% Award Inflation Rate Inflation rate Tax rate 31-Dec-08 500 200 1,500 (2,200) (2,200) 4% 5% 30% 31-Dec-09 34,702 Figures in $,000 31-Dec-10 31-Dec-11 57,627 83,803 31-Dec-12 108,950 31-Dec-13 106,321 200 50 100 - 100 - 100 - 100 - 0.06 0.03 0.02 0.02 0.13 16,112 2,000 16,340 4,902 11,438 33.0% 0.06 0.03 0.02 0.02 0.13 26,501 2,000 29,026 8,708 20,318 35.3% 0.06 0.03 0.02 0.02 0.13 38,174 1,000 44,529 13,359 31,170 37.2% 0.06 0.03 0.02 0.02 0.13 49,165 1,000 58,686 17,606 41,080 37.7% 0.06 0.03 0.02 0.02 0.13 47,533 500 58,188 17,457 40,732 38.3% Business Analysis (preliminary) Break Even Analysis Break Even Analysis 45,000 40,000 35,000 NPAT ($,000) 30,000 Break Even Q1 2009 25,000 20,000 15,000 10,000 5,000 31-Dec-08 (5,000) 31-Dec-09 31-Dec-10 31-Dec-11 Year Ending 30-Dec-12 30-Dec-13 Business Analysis (preliminary) NPV Analysis Year A. Fixed assets Marketing costs Investments in new product development Investments in plant & equipment Project Management and Engineering CF, invest. in fixed assets B. Working capital Working capital Change in working capital CF, invest. in wk capital C. Operations Revenue Expenses (Variable costs) Depreciation Pretax profit (ignoring fixed costs) Tax Profit after tax Cash flow from operations D. Project valuation Total project cash flow Discount factor PV of cash flow Net present value Discount rate (IRR) Acct receiv. as % of sales (60 days payment) Inven. as % of expenses Tax rate Figures in $,000 31-Dec-10 31-Dec-11 2 3 31-Dec-08 0 31-Dec-09 1 31-Dec-12 4 31-Dec-13 5 1,500 300 500 200 -2,300 2,000 2,000 1,000 1,000 500 200 50 -2,200 100 0 -2,100 100 0 -1,100 100 0 -1,100 100 0 -600 2,417 2,417 -2,417 9,759 7,342 -7,342 15,331 5,572 -5,572 21,342 6,011 -6,011 25,288 3,947 -3,947 17,720 -7,568 7,568 - 34,702 16,112 70 18,520 5,556 12,964 13,034 57,627 26,501 80 31,046 9,314 21,732 21,812 83,803 38,174 90 45,539 13,662 31,877 31,967 108,950 49,165 100 59,686 17,906 41,780 41,880 106,321 47,533 110 58,678 17,604 41,075 41,185 -4,717 1.00 -4,717 3,492 0.87 3,037 14,141 0.76 10,692 24,856 0.66 16,343 36,834 0.57 21,060 48,153 0.50 23,941 50 70,355 15% 17% 15% 30% Business Analysis (preliminary) Fixed Asset Expenditure Fixed Asset Expenditure Marketing costs 2,500 Expenditure ($,000) Investments in new product development Investments in plant & equipment 2,000 Project Management and Engineering 1,500 1,000 500 0 2008 2009 2010 2011 End of Year 2012 2013 Product Testing Product Testing Product Testing Results Commercialization Production Plan Modification to the existing production line New tooling for Kompact DisK Shape Launch Strategy and Marketing Plan Roll Out Strategy Test marketing (second half of 2008, before official launch) - Nutri Grain, Just Right - Geographic region: Sydney Customer Segmentation, 4 P Strategies, IMC Plan Launch Strategy and Marketing Plan Launch target: Q1/2009 Offering Summary: Brand: Kellogg Kompact Disk (Special KK) Product: Combo breaky with additives Attribute: Attractive shapes of cereal bar 3 product categories: 1) Sport/Energy, 2) Kids, 3) Health-conscious Benefits: 100% Australian products Convenient, tasty, fun, healthy, assistance in weight reduction. Key competitors: Direct Competitors: Uncle Toby's, Nestle, Sanitarium, Weight-watchers Indirect Competitors: Restaurants, Take-away food, Fast food, hot breakfasts (substitute products) Target Customer Demographic People on the go People with varying needs for breakfast timing People who like breakfast to be interesting People who are concerned about their weight Psychological Attitude and Belief Health-conscious, Convenience-driven and Energy-driven Brand preferences Lifestyle Have the habit of eating breakfast Busy lifestyle Lazy lifestyle Traditional lifestyle Marketing Objectives (SMART Objectives) To increase 75% brand awareness among target customer by the end of 2010. To achieve annual sales volume of “Kellogg’s Kompact DisK” > $50 million by end of 2010 To increase market share by 5% by the end of 2010 Marketing Strategy: Roll Out Product Strategy Product strategy – Positioning as “health, convenience and intriguing” – Product differentiation with “new technology of versatility, health element and unique shape” – Packaging : Various varieties will be tested during market testing (individually rapped in packages of 14, jumbo packs etc) Price Strategy Pricing strategy The price of “Kellogg Kompact Disk” is higher than other similar product because it is emphasized on health and convenience. Brand Weight (standardised) RRP /Unit ($) Kellogg’s Kompact Disk 35g 0.40 Kellogg’s std ready to eats 35g 0.35 Uncle Toby’s Plus 35g 0.30 Uncle Toby’s Vita Brits 35g 0.25 Uncle Toby;s OT bars 35g 0.28 Sanitarium Premium 35g 0.44 Channel Distribution The manufacturing facilities of Kellogg cereal at Botany, on the train line and near to the wharves for convenient shipping of products around Australia and into the Asia-Pacific region. From the factories, the finished products are distributed directly to wholesalers, supermarkets, convenient stores, grocery stores. Possible New channel distribution: “Vending Machine” which suits students and busy people. Wholesalers, Supermarkets Supermarkets Botany Factories Convenient stores Vending Machines Export Consumers Promotion Integrated Marketing Communication (IMC) is a key communication tool to create brand recognition and trigger purchase intention Utilizing both above-the-line and below-the-line media to effectively enhance target customers’ demand ATL: TVC, Radio, Outdoor, Interactive media BTL: In-store media, Point-of-purchase media, sampling distribution Focusing on “Pull strategy” to directly create demand and apply the most efficient media in the right program to reach target audience Stakeholder relationship management to manage the relationship with important company’s stakeholders Communication Strategy SMART communication objectives Communication objective Brand awareness Brand attitude Brand loyalty SMART objective Increase 70% awareness of "Kellogg Compact DisK " in the existing target market within the first year of launch Convince 12% of the target group to consume Kellogg’s Kompact DisK within the first year of positioning. Build a strong relationship with consumers to make Kellogg Compact Disk becoming the first choice of our target consumers’ evoked set after one year of launching Kellogg Kompact Disk . Communication Strategy Marketing Communication Objectives and media Key Communication Objectives Product differentiation Consumer trust and brand recognition Best MC Function MC Objectives Brand awareness Brand loyalty Healthy image of Brand attitude cereal products Advertising Sales & promotion Vouchers Advertising Packaging Promotion Rationale Create the new product image and brand awareness Reach the target customers, enhance the brand image and introduce new product Reach a large amount of audience, associate product with a sense of healthiness through advertising, sponsorship and packaging. IMC Launch Plan Task 2008 Dec Product Launch (Market Testing) OFFICIAL LAUNCH Above-the-Line Media Launch TVC Radio Outdoor Interactive Below-the-Line Media Launch Sampling distribution In-store promotion In-store media Point-of-purchase Media (Vending machine) 2009 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Communication Strategy IMC Schedule and timeframe Priority of media option: High Medium (The number represents frequency) Marketing tactics & Media options Low TV Commercial in 5 cities* Ch 7 - Australian Got Talent Ch 7 - 7 Sport Ch 9 - Mornings with Kerri-Anne Ch 10 - Are You Smarter Than A 5th Grader? Ch 10 - The Biggest Looser (Aus) Radio Fox FM (101.9 FM) MIX FM (101.1 FM) Family FM (96.5 FM) Outdoor advertisement in 5 cities* Billboard Bus/Tram shelters Community pillars at train stations Internet Online advertisement Email updates to consumer Sales & Promotion In-store Media Point-of-purchase Media Packaging Jan 4 4 6 Feb 4 4 4 Mar 2 2 4 10 4 19 10 10 10 6 6 19 6 6 6 6 4 5 6 6 5 2 4 2 2009 Apr May 4 Jun Jul 4 4 4 4 4 0 0 4 0 Aug 2 Sep Oct 4 2 2 0 Nov Dec 2 2 2 0 2 0 6 4 0 5 38 20 43 16 16 16 8 14 7 4 5 94 69 37 8 0 Note: Launching into 5 cities: Melbourne, Sydney, Perth, Adelaide, and Brisbane Freq. 12 16 26 8 12 10 4 6 2 6 IMC Budget Roger’s Five Characteristics Roger’s Five Characteristics Kellogg’s Kompact Disk Relative Advantage Compatibility Complexity Divisibility Communicability MBA 9050 - Product Strategy CEREAL PRODUCTS Questions ? Friday 30th November, 2007