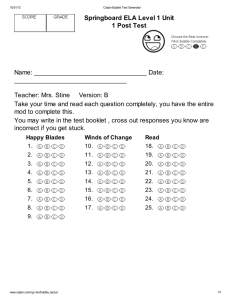

Teaching Financial Crises - Texas Council on Economic Education

Jean Walker

West Texas Center for Economic Education

College of Business

West Texas A&M University

Canyon, Texas

1

. . . presents an organizing framework for putting into context the media attention that has been paid to the

2008 financial crisis . . .

This publication, in it’s entirety, is included on the Virtual Economics

CD, version 4.

2

3

Common elements of financial crises worldwide throughout history

Lesson 1 – compares 1907 & 2007 crises

Lesson 2 – compares 2007 crisis with: (emphasis on reading eco. Data)

▪ Recession of 2001

▪ Recession of 1990-1991

▪ Recession of 1981-82

(Dot-Com bubble burst, Enron, Worldcom, et.)

(oil price shock due to Gulf War)

(tight money to control inflation)

▪ Recession of 1973-75 (stagflation; OPEC oil embargo spiked oil prices)

▪ Great Depression 1929-38 (stock market crash; falling demand)

Lesson 3 – a historical look at five bubbles & panics:

▪ Tulipmania in the Dutch Republic – 1630’s

▪ The South Sea Bubble – Great Britain 1711-1721

▪ The Roaring 20’s Stock Bubble – 1920’s

▪ Japan’s Bubble Economy – 1985-90

▪ The Dot-Com Bubble – 1990’s

Lesson 4 – comparison to Lost Decade in Japan

4

Specific focus on the recent financial crisis

Lesson 5 – focuses on monetary policy

▪ Students role play as Federal Reserve Board governors

Lesson 6 – examines the housing bubble

▪ Heavy use of supply/demand graphs

▪ Securitization simulation for students

Lesson 7 – helps students learn terminology about modern financial markets

▪ Quiz bowl game on terminology

Lesson 8 – interaction between modern financial markets and monetary and fiscal policies

▪ Students take part in mock trial

5

What happened?

Why?

In 5 years, how far have we come?

6

7

8

9

The Case-Schiller Price

Index represents the real price of housing throughout the country, so it is inflation-adjusted.

The index equals 100 for the price of housing in

1890.

Prices peaked in 2006.

10

In the fall of 2007, the “subprime crisis” was a concern, and we began to realize the real estate bubble had burst. (Home prices peaked in 2006.)

However, the stock market peaked, and GDP in the

2nd & 3rd quarters of 2007 was especially strong.

Generally, people deeply involved in finance began to talk about problems in the credit markets and a lack of liquidity.

11

12

13

December, 2007

Dec. 11 – Fed begins lending to banks for longer than overnight. (By

October 2008, many banks are on Fed life support.)

January

Jan. 12 – Bank of America agrees to buy Countrywide Financial, the largest mortgage lender, and casualty of the mortgage-default crisis.

February

Feb. 8 – Congress approves a $168 billion economic stimulus plan.

Feb. 29 – Dollar hits record low against euro.

March

March 17 – Bear Stearns, which traded at a share price of nearly $90 per share in January, sells itself to J.P. Morgan Chase for $2 per

share, with the Fed providing special financing. Mortgage-backed securities took them down.

14

April

April 18, 19 – Merrill Lynch posts a $1.96 billion loss; Citigroup posts a $5.1 billion quarterly loss.

April 30 – Countrywide Financial posts a $893 million loss.

May

May 9 – AIG posts $7.8 billion quarterly loss.

June

June 9 – Average price of gasoline in U.S. first hits $4 a gallon.

June 21 – Bond insurers MBIA and Ambac lose AAA ratings from Moody’s.

July

July 12 – Regulators seize IndyMac bank.

July 14 – Treasury and Fed place Fannie Mae and Freddie Mac under govt. control.

July 31 – Pres. Bush signs a housing-rescue bill.

15

August

August 7 – Freddie Mac posts an $821 million loss; AIG reports a $5.4 billion loss.

September – Wall Street Journal calls Sept. 14 – 21, “The Week That Wall Street

Died”

Sept. 7 – Govt. seizes Fannie and Freddie; Treasury replaces CEOs and buys $1 billion of preferred shares in each.

Sept. 14 – Merrill Lynch sells itself to Bank of America .

Sept. 15 – Lehman Brothers files for bankruptcy. Fed and Treasury choose to let

Lehman fail. (In hindsight, probably a disastrous decision.)

Sept. 16 – Banks stop lending to each other.

Sept. 17 - Govt. seizes control of AIG, makes $85 billion loan and receives warrants in exchange.

Sept 21 – Fed converts the last two major investment banks, Morgan Stanley and

Goldman Sachs into traditional bank-holding companies.

Sept. 24 – Goldman Sachs gets $5 billion investment from Warren Buffett.

Sept. 26 – Feds seize Washington Mutual and sell it to J.P. Morgan Chase—largest bank failure in U.S. history.

Sept. 30 – Citigroup agrees to acquire Wachovia, and Wells Fargo makes higher bid.

Congress passes the bailout bill.

16

October

Oct. 4 - President Bush signs $700 billion bailout bill.

Oct. 8 – Fed says it will lend directly to U.S. corporations for the first time since the

Great Depression.

Oct. 9 – World Central Banks coordinate lowering of short-term rates.

Dow down 14% in October, worst month in % terms in 10 years.

November

Nov. 10 – Govt. scraps $123 billion deal with AIG and replaces it with a $150 billion package on better terms.

Govt. injects $20 billion into Citigroup and guarantees $300 billion of its troubled assets.

December

Dec. 9 – On this date, only McDonald’s and Walmart in the Dow have higher stock prices that this date last year.

Dec. 12 – Fund advisor Bernie Madoff is arrested by federal agents in a $50 billion Ponzi scheme.

Dec. 17 – Fed funds rate cut to 0 - .25%.

Dec. 17 – Goldman Sachs posts $2.12 billion loss, first since going public in 1999.

Dec. 20 – White House agrees to lend GM and Chrysler $17.4 billion.

17

Sample of Bankruptcy filings in 2008:

Sharper Image

Lillian Vernon

Aloha Airgroup, ATA Airlines, Skybus Airlines,

Frontier Airlines

Linens ‘N Things

Tropicana Entertainment (casino operator)

Circuit City

Pilgrim’s Pride (chicken processor)

Tribune (newspaper publisher)

18

19

20

One of the very few beneficiaries of the Recession

21

Unintended consequence of low rates since 2009: when interest rates are low, corresponding investment yields are low and investors move to riskier assets trying to find yield.

22

Introduce the 2007 Financial Crisis with

Activity 3 – Characters in the Financial Crisis

Announcer

Joe, who needs money for his kid’s college tuition

Bruce, the mortgage banker/mortgage broker

Mortimer, the old-time banker

Uncle Sam

Wall Street banker

Investment salesman

Village treasurer of Narvik, Norway

Bruce’s boss

The World – (all together)

(Nine characters plus “the world”)

23

Have students complete

Activity 1 as you progress through the slides of visual 1.

If you have not taught about the recent financial crisis, you will find information in other lessons to assist with explanations.

FYI:

The slides for Activity 1 are available in powerpoint on www.councilforeconed.org/financialcrises

24

THE PANIC OF 1907

THE FINANCIAL CRISIS OF

2007

DEVASTATION SAN FRANCISCO EARTHQUAKE

Shortly after 5 a.m. on April

18, a 7.8-magnitude quake, unleashed offshore, shook the city for just less than a minute.

UNCONTROLLABLE BLAZE 80% OF THE CITY DESTROYED

Though the damage from the quake was severe, the subsequent fires from broken gas lines caused the vast majority of the destruction.

3,000 PEOPLE DIED

THE FIRES RAGED FOR FOUR

DAYS

TOUGH BALANCING ACT INFLEXIBLE CURRENCY

Between 1870 and 1914, many countries adhered to a gold standard.

This strictly tied national money supplies to gold stocks.

Currency was redeemed for gold at a fixed exchange rate.

At the end of 1905, nearly 50% of the fire insurance in San Francisco was underwritten by British firms.

The earthquake gave rise to a massive outflow of funds—of gold—from

London.

The magnitude of the resulting capital outflows in late summer and early autumn 1906 forced the Bank of England to undertake defensive measures to maintain its desired level of reserves.

The central bank responded by raising its discount rate 2.5% in 1906.

Actions by the Bank of England attracted gold imports and sharply reduced the flow of gold to the United States.

Interest rates rose and by May 1907, the United States had fallen into one of the shortest, but most severe, recessions in American history.

At the beginning of the century, the nation was brimming with a great amount of optimism.

Here is a list of familiar companies founded between 1900 and

1905.

Eastman Kodak

Firestone Tire

Ford Motors

Harley-Davidson

Hershey

U.S. Steel

J.C. Penney

Pepsi-Cola

Texaco

Sylvania Electric

In October 1907 two brothers,

Otto and F. Augustus Heinze, attempted to manipulate the stock of a copper company.

They planned to corner the market in the copper company's shares by buying aggressively in hopes they could later force short sellers to buy them at high prices.

The plan did not have sufficient backing and failed.

News a number of prominent New York bankers were involved in the failed scheme began a crisis of confidence among depositors.

As additional institutions were implicated, queues formed outside numerous banks as people desperately sought their savings.

Trust companies were a financial innovation of the

1890s. They had many functions similar to state and national banks but were much less regulated.

KNICKERBOCKER TRUST COMPANY

Illustration from Harper's Weekly December 20, 1913 by Walter J.

Enright

They were able to hold a wide array of assets and were not required to hold reserves against deposits.

They earned a higher rate of return on investments and paid out higher rates, but, to do this, they had to be highly leveraged.

They took more risks than traditional banks.

The runs on deposits that sparked the Panic of 1907 were at two of the largest

New York City trust companies:

Knickerbocker

Trust and Trust

Company of

America.

A NEW YORK CITY BANK RUN IN NOVEMBER 1907

The crash and panic of 1907 had a dramatic effect on the health of the

American and worldwide economies. In the United States:

Commodity prices fell 21 %.

Industrial production fell more than in any other crisis in American history to that point.

The dollar volume of bankruptcies declared in November was up 47 % from the previous year.

The value of all listed stocks in the U.S. fell 37 %.

In October and November 1907, 25 banks and 17 trust companies failed.

Thousands of depositors lost their life savings.

Gross earnings by railroads fell by 6 % in December and production fell

11%.

Wholesale prices fell 5 %.

Imports shrank 26 %.

In a few short months, unemployment rose from 2.8 % to 8%.

Immigration reached a peak of 1.2 million in 1907 but fell to around 750,000 by 1909.

J.P. MORGAN

NEITHER ELECTED NOR

APPOINTED, HE FELT IT WAS HIS

TIME TO ACT

In the absence of a strong federal regulatory structure or any safety nets, the response to this crisis had to be delivered by a private citizen, J.P. Morgan, the world’s most powerful banker.

He used all of his influence to convince fellow titans of industry to pool their resources and salvage the nation.

The Panic subsided after six weeks.

SPECULATION IN OFF-STREET

MARKETS

Bucket shops were blamed for fueling the speculation in 1907.

They enabled people to speculate on the value of a stock without having to purchase the stock itself.

The actual order to purchase went in the “bucket.” Beginning in

1909, New York banned bucket shops and other states followed.

A BUCKET SHOP IN 1907

THE WORLD MADE HUGE INVESTMENTS IN

THE U.S. HOUSING MARKET

……….AND LOST!!

By ignoring risk, remaining irrationally optimistic, and forgoing transparency through an array of fantastically complicated investment vehicles, the world’s financial markets were extremely dependent on housing prices.

The underlying assumptions were

(1) that housing prices never fall and

(2) homeowners almost always pay their mortgages.

DURING AND AFTER THE MILD

RECESSION OF 2001, THE FED LOWERS

INTEREST RATES

FORMER FED CHAIRMAN ALAN

GREENSPAN

FORMER PRESIDENT GEORGE

BUSH

STRONGLY PROMOTED

HOMEOWNERSHIP

“We can put light where there’s darkness, and hope where there’s despondency in this country. And part of it is working together as a nation to encourage folks to own their own home” –President Bush,

October 15, 2002.

HIGHLY COMPLEX FORMS OF

FINANCING

The momentum behind the expansion of homeownership led the government to reduce regulations and capital requirements for making loans.

This led to a dizzying number of innovative ways to get less-qualified

borrowers a mortgage and seemed to reduce risk for the lender.

Mortgages could be

bundled and sold around the world as securities.

THIS WAS TOO TEMPTING FOR

THE FINANCIAL INSTUTIONS

TRUSTED AGENCIES FAILED TO

WARN INVESTORS

Mortgage-backed securities were constructed of mortgages of differing quality levels.

The obligations of solid and sub-

prime borrowers were mixed in a manner that made it very difficult for experts to calculate risk.

The assumption that U.S. housing prices would continue to rise and incentives to provide good ratings led agencies to rate these

securities as AAA, lowering investors’ concerns.

RISK-RATING AGENCIES

WHAT WERE WE THINKING?

THE PERFECT STORM

Homeownership peaks in early 2005 at 70% of households.

The Fed raises interest rates.

Home prices fall.

Higher adjustable interest rates

increase payments for borrowers.

Borrowers default in waves.

Dozens of subprime lenders file for bankruptcy.

Mortgage-backed securities lose

value as investors question their contents.

Financial institutions struggle to find buyers for the MBSs.

“FINANCIAL

WEAPONS OF

MASS

DESTRUCTION”

Financial institutions could purchase credit default

swaps.

A CDS is a private insurance contract that paid off if the investment failed.

One did not actually have to own the investment to collect on the insurance.

These promises were unregulated, and the sellers did not have to set aside money to pay for losses.

Bank failures: 183 (2%) 12/07-

2/10 (No deposits lost)

Unemployment rate: 10.1%

(10/09)

Economic decline: -4.1% (4Q

2007-2Q 2009)

Biggest drop in DJIA: -53.8%

(12/07-3/09)

Emergency spending and tax

reduction programs: 2.5% of

GDP in 2008 and in 2009

Aggressive increase in

monetary stimulus by the Fed

6.7 million jobs lost in

2008 and 2009

Capital investment levels lowest in 50 years

Domestic demand declines

11 consecutive quarters

Industrial production

down worldwide: Japan

31%, South Korea 26% ,

Russia 16% , Brazil 15% ,

Italy 14%, Germany 12%

THE FINANCIAL CRISIS OF 2007-2009

The federal government unleashed a series of remedies in an attempt to limit the contagion.

Massive sums of bank reserves were created to ease fears.

In the process, the taxpayers took over or funded several familiar financial and nonfinancial companies .

This time the government bails out the economy and business leaders and bankers are criticized.

1907

Highly complex and linked financial system

Strong growth in the economy starting in 1900

Many people and institutions highly leveraged

Innovative form of finance: trust companies

Stock market setting all-time highs

A limited role for government

Markets swing from great optimism to great pessimism

2007

Global interdependent financial system

Vibrant economic recovery after recession in 2001

Lenders willing to take more risk in making loans

Unregulated financial institutions: hedge funds

Companies reporting record earnings

Absence of many safety buffers

Dow 14,164 to 6,500 in 16 months

1907

J.P. Morgan, a private citizen, orchestrated the bailout

The Panic lasted for six weeks, though the economy didn’t return to pre-

Panic levels until 1909

Many banks were closed and many depositors lost their savings

The nation was on the gold standard and the supply of money was fixed

The San Francisco earthquake was a catalyst for the Panic

The climate toward business was hostile prior to crisis

2007

The Federal Reserve and Treasury

Department organize the reaction

The event has been unfurling for more than five years

Many banks closed and folded into healthier banks, but depositors did not lose any of their savings

The nation uses Federal Reserve notes, creating a flexible money supply

Hurricane Katrina was generally benign as a catalyst

The climate toward business was friendly prior to crisis

Community Reinvestment Act – signed in 1977 by Jimmy Carter

Induced lenders to enter underserved or “red-lined” areas.

1993 -1995, President Clinton asked regulators to reform the CRA to

"deal with the problems of the inner city and distressed rural communities”--availability of credit should not depend on where a person lives.

The Interstate Banking and Branching Efficiency Act of 1994, which repealed restrictions on interstate banking, used CRA ratings as a consideration when determining whether to allow interstate branches

George Bush, as early as 2002, pushed home ownership—”an ownership nation.”

In 2007 Ben Bernanke suggested further increasing the presence of

Fannie Mae and Freddie Mac in the affordable housing market to help banks fulfill their CRA obligations by providing them with more opportunities to securitize CRA-related loans.

52

The rise in housing prices represented a bubble.

A price bubble is a situation where increases in price are not justified by fundamental factors affecting supply or demand, and therefore not sustainable.

A price bubble is often caused by contagion, which is prices increasing because people observe them going up and think they will continue to go up.

At one point, people who couldn’t pay their mortgages were taking out home equity lines of credit and using the cash to pay the mortgages! They could do this because equity in homes rose as home prices rose, and “personal bankers” were pushing home equity lines of credit.

This causes people to purchase houses with the expectation that they will be able to sell them for a higher price in a relatively short time.

It was a speculative bubble.

When the bubble burst in 2006, house prices tumbled.

53

54

U.S. Homeownership rate:

2000 67.4%

2004 69.0%

2010 66.9%

55

Positives:

Spreads risk. Not all eggs in one basket. Diversified.

Made a liquid investment from an illiquid investment.

Allowed smaller investors to invest in housing.

Meant more money flowed into mortgage markets.

Negatives:

Reduced the incentive for investors to be concerned about the creditworthiness of borrowers.

Reduced the incentive for banks and mortgage brokers to be concerned with creditworthiness.

Exported the risk around the world because the MBS securities were stamped AAA by the ratings agencies and sold worldwide.

56

Before teaching this lesson, make sure students understand the concept of business cycles:

Expansion

Recession

Peaks

Troughs

57

Growth of real GDP measures health of economy

Generally, we say two quarters of declining GDP is a recession, but economists at the National Bureau of Economic Research actually make the determination

GDP = C + I + G + Net Exports

▪ Consumer spending is 60-70% of U.S. GDP

▪ Investment spending, government spending, and net exports make up the rest

Contributing factors to growth:

Level and rate of change of technology

Investment in tools, machines, computers, infrastructure, and building

Skill and experience levels of the economy’s labor

The main activity in this lesson asks students to work in groups to analyze 6 of the 14 recessions between 1929 and 2007. Before working, they should understand

business cycles and how GDP and Unemployment affect or are affected by recessions.

58

The Great Depression (1929-

1938)

Duration: 1929-1933 (43 months)

& 1937-1938 (13 months)

Began with falling demand for durables and investment goods

Stock market crashed in Oct. 1929

By March 1933, 25% of the workforce was out of work.

More than 9,000 bank failures between 1929 and 1933

Fed did not act as the lender of last resort, even raising interest rates in late 1931

59

Remember Gerald Ford and the WIN buttons – Whip Inflation Now!

The Recession of 1973-1975

Duration – Nov. 1973 to March

1975 (16 months)

Peak unemployment - 9.0%

(May, 1975)

Inflation rate - 11%

Economic stagflation

Causes

▪ 1973 Oil Crisis – OPEC’s oil embargo caused “oil price shock”, which slowed production of goods and services

▪ Vietnam War

60

President Reagan was in office and is often credit with “breaking the back of inflation.”

The Recession of 1981-1982

Duration – July 1981 to Nov.

1982 (16 months)

Peak unemployment - 10.8%

(Nov., 1982)

Inflation rate – 8.9%

Business bankruptcies up 50%

Farmers especially hard hit

▪ Ag exports declined

▪ Crop prices fell

▪ Interest rates rose

Causes

▪ Iranian Revolution increased oil prices and new Iranian regime exported oil inconsistently

▪ FED adopted tight money policy

(high interest rates) to break the back of inflation

61

The Recession of 1990-1991

Duration – July 1990 to March

1991 (8 months)

Peak unemployment - 7.8%

(June, 1992)

Although brief, the recession caused George H.W. Bush to be defeated by Bill Clinton

Causes

▪ 1990 oil price shock because of the Gulf War

▪ Ongoing concerns of savings and loan crisis

▪ After a long expansion, inflation began to increase so the FED increased interest rates

▪ Debt accumulated in the 1980’s was a concern

62

Since most dot.com stocks were traded on the NASDAQ, the stock graph tells the story of the bubble collapse that was a cause of the recession.

The Recession of 2001

Duration – March 2001 to

November 2001 (8 months)

Peak unemployment -

6.3% (June, 2003)

NASDAQ returns

▪ 2000 (40%)

▪ 2001 (21%)

Causes

▪ Collapse of speculative dot.com bubble

▪ Uncertainty after attacks of

9-11-2001

▪ Accounting scandals and fraud at Enron, Worldcom, etc.

63

The Financial Crisis of 2007-

09

Duration – December 2007 to

June 2009 (18 months)

Peak unemployment - 10.1%

(October, 2009)

GDP Decline peak to trough:

(4.1%)

Bank failures (2007 – 2009): 168

Causes

▪ Subprime mortgage crisis led to housing market collapse

▪ Collapse of MBS brought down

Bear Stearns, Fannie Mae, Freddie

Mac, Lehman Brothers, and AIG

▪ Investment banks used too much leverage

▪ All remaining investment banks turned into commercial banks

▪ Government bailout of financial services and auto industries

64

▪ Tulipmania in the Dutch Republic – 1630’s

▪ The South Sea Bubble – Great Britain 1711-1721

▪ The Roaring 20’s Stock Bubble – 1920’s

▪ Japan’s Bubble Economy – 1985-90

▪ The Dot-Com Bubble – 1990’s

http://www.library.hbs.edu/hc/historicalreturns/fb/movie.html

65

Hyman Minsky’s phases of a bubble:

Displacement

▪ Crisis begins with an outside shock to the system—war, new invention, political event, etc.

Boom

▪ Rapid rise in prices of a financial or physical asset as investors and speculators earn profits

Euphoria

▪ People take more risk as more credit is offered. High profits repeat the cycle, and at some point rational decision-making succumbs to manic behavior.

Profit-taking

▪ A few insiders begin to take profits and get out, and price increases begin to level out.

Panic

▪ The failure of a large institution, the realization of a swindle, or an increase in the supply of the asset bring everyone back to their senses. People scramble to sell as the price falls.

Bailout (not a part of Minsky’s description)

▪ A central bank may expand the money supply to salvage essential financial institutions.

▪ Rationale: don’t make the whole economy pay for the actions of a few.

▪ Negative externality: the anticipation of a bailout may indirectly add to the problem because people may take greater risks if they know there is a safety net—this is known as a moral hazard.

▪ John Kenneth Galbraith suggests investors have a short financial memory and investors have a tendency to attribute greater intelligence to individuals who have higher income or control more wealth.

66

67

“The four most expensive words in the

English language are, this time it’s different.” attributed to Sir John Templeton

68

S

O

N

L

E

S

4

69

Strong demand for Japanese exports

Large amounts of foreign currency flowed to Japan as a result

Low interest rates

Speculative surge in Japanese stock market

Speculative surge in Japanese real estate

Boom in stocks and real estate were supported by debt

Japanese govt. feared an asset bubble and decided to

“pop the bubble” by increasing interest rates

It had been easy for the Japanese to borrow money to invest in stocks or real estate because rates had been low

Collapse in prices led to a credit crisis —banks suffered massive losses as defaults on loans rose

70

Govt. injected massive amount of money into banks—was controversial

Government said banks were “too big to fail”

This led to “zombie banks ”

The problems in real estate and stock spilled over into the rest of the economy

Housing prices peaked in 1991

The whole economy fell into recession

A series of graphs in Activity 2 compares the

2007 recession in the U.S. to Japan’s lost decade

71

By 1995, the Japanese had spent nearly $2.1 trillion on public projects to stimulate the economy.

In 1994-95 the economy began to rebound, but it was a false recovery.

The stimulus plans had created huge budget deficits.

Some argued the govt. stopped spending too soon; others argued reducing taxes would have been better.

The govt. increased taxes to reduce the deficits, and by

1997, growth was again at zero.

Between 1994 and 2009, prices declined (deflation) in all but one year.

Growth recovered in 2003-04.

72

Through opinion pieces in the Financial Times and

Washington Post, Larry Summers, former economic adviser to Barack Obama and Treasury secretary under Bill Clinton’s presidency, expressed concern that the United States is heading for a “lost decade” similar to Japan’s lost decade in the 1990s.

This country has already experienced five years of economic growth under 1% annually, and that’s half way to a decade.

73

74

Jean Walker

Director, West Texas Center for Economic

Education

College of Business

West Texas A&M University

Canyon, Texas 79016

806-651-2515 jwalker@wtamu.edu

75