Week 6 Treasury * the department with the power

advertisement

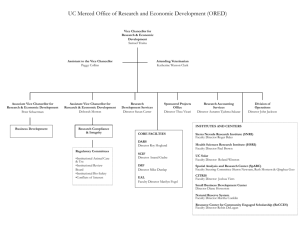

Week 6 Treasury – the department with the power The Chancellor of the Exchequer – the real Deputy Prime Minister Joy Johnson Levers of Power • • • • • • • • • • Control of spending Fiscal policy Budget process Comprehensive Spending Review Independent Central Bank – Bank of England Monetary Policy Committee Office of Budget Responsibility Office of Fair Trade Privatisations Private Finance Initiatives (PFI) – fund investment for infrastructure projects • Initially introduced by John Major • Embraced by New Labour as PPPs (Public Private Partnerships to fund schools hospitals etc – scandals now on how much they cost in the long term) Issues • Cutting the deficit (number one priority for the coalition government as stated in the coalition agreement) • Growth – flat lining (?) • Public spending cuts • Reform of the Banks – tensions with Chancellor and Secretary Of State for BIS • Unemployment • Inflation • Interest rates – tensions within the MPC over policy Key texts • • • • • Morrison – Public Affairs Politics – Jones et al Coalition Agreement 22 Days in May – Laws If time various books on the financial crash; inc. Larry Elliott the Gods that Failed; Vince Cable, The Storm: The World Economic Crisis and What it Means & Gordon Brown, Beyond the Crash, the first crisis of globalisation The real Deputy Prime Minister Chancellor – George Osborne & his Chief Secretary Danny Alexander Chancellor and his team • Chancellor of the Exchequer after the PM most senior member of the cabinet • Chief Secretary to the Treasury: Liberal Democrat Danny Alexander (member of cabinet, in charge of public spending, conducts bilateral meetings). During coalition negotiations leadership wanted to be tied into the cuts (David Laws) • Financial Secretary to the Treasury: Mark Hoban • Economic Secretary to the Treasury: Justine Greening Chancellor of the Exchequer • • • • No 11 Downing Street Dorney Wood Treasury – Whitehall Responsibilities : overseeing government’s public spending commitments by managing fiscal policy; managing the national debt; promoting economic growth; controlling domestic inflation and unemployment • Treasury select committee shadows the department Controlling the economy • Fiscal policy and Taxation • John Maynard Keynes • 2 types of taxation – direct up front from individuals and businesses and indirect i.e. VAT • Income tax – progressive ability to pay • Regressive tax i.e. Indirect taxes • Corporation tax paid by companies on profits • Capital Gains Tax (CGT) paid by the owners of financial assets such as property • Inheritance Tax – death duties Managing the economy • Highlight of the Chancellor and the government’s year the Budget and the accompany Finance Act • Gordon Brown introduced a pre-budget statement • Comprehensive Spending Review (CSR) the one last November fixed spending budgets for each Government department up to 2014-15. • Budget Process • • • • • • • • • • • • Finance Bill speaker designates it a ‘money Bill’ Budget is fast tracked through Parliament Speech regarded as first reading 2nd reading must be heard within 30 days Scrutiny at committee stage 3rd reading steamed through on same day as report stage then Royal Assent Lords can’t interfere Budget speech designed to forecast short to medium term movements in the economy 1-3 years Announces new taxes, tax breaks, and or benefits to finance investment Other measures of help to low paid, the elderly etc likely to be in short supply in the age of austerity Leader of the Opposition responds (difficult Parliamentary occasion as there are likely to be surprises) Debate on the floor of the Commons Business Innovation and Skills (BIS) • Vince Cable Secretary of State for Business, Innovation and Skills and President of the Board of Trade • Responsible for business and banking and regulation (lost out on Rupert Murdoch and News Corporation bid for BSkyB) tension with Chancellor over banks (banking reform important issue) • David Willetts Minister of State for Universities and Science (attends Cabinet) • BIS select committee shadows department Economic terms • Fiscal Policy – taxation and economic policy of a government • Post war – mixed economy • Thatcher years – privatisation – monetary policy (economist Milton Friedman) • New Labour adopted neo-liberal economics • Fiscal rectitude – cutting public expenditure and reducing the amount of government borrowing Economic terms - globalisation • Neo-liberalism theoretically makes trade between nations easier. • Freer movement of goods, resources and enterprises • Light touch or no touch regulation, tariffs, restrictions on capital flow and investment • The free market naturally balances Economic terms cont • The national deficit – the annual difference between government spending and its receipts (mainly taxation) – government has to borrow to make up the difference • The national debt the accumulation of these annual deficits and the borrowing incurred to make up the difference • Lehman Brothers (September 2008) collapse triggered meltdown in the financial system Economic terms cont • Banks too big to fail • Bailed out by the government – nationalised 2 big banks • http://www.telegraph.co.uk/finance/financet opics/financialcrisis/3187946/Financial-crisisBanks-nationalised-by-Government.html# • One view of the financial crash • http://www.guardian.co.uk/business/video/2 008/sep/17/larry.elliott.hbos Economic terms cont • Gross domestic product (GDP) – total output of goods and services • Gross National Product (GNP) GDP + with net property incomes from abroad • Group of Seven finance ministers and central bank governors of the leading Western economies • Group of Eight • Group of Twenty following banking crisis Group of 8 grow to group of 20 Davos – talking shop of the most powerful players in global economy Independence to the Central Bank • New Labour gave independence to the Bank of England in the first few weeks following their landslide first victory (1997) • Established Monetary Policy Committee chaired Governor of the Bank (currently Mervyn King chair). Responsibility to set interest rates. Takes the decision out of the political arena • Created new regulation system Financial Services Association (FSA)( (widely accused now to have failed when it came to the global banking crisis) Bank of England independence • interest rates set by Bank’s governor and the monetary policy committee – tensions within Economic terms cont • Inflation – rise in price levels which reduces purchasing power • Inflation used to be past scourge • “No more ‘boom and bust’” - hubristic boast of Gordon Brown then Chancellor of the Exchequer • Low interest rates to help stimulate economy • Now inflation going up • Governor of the Bank of England has to write letter to the PM saying why target of 2% has been overshot • Fear of stagflation – combination of high price inflation, high unemployment and low economic growth Office of Budget Responsibility • The Office for Budget Responsibility (OBR) was formed in May 2010 to make an independent assessment of the public finances and the economy for each Budget and Pre-Budget Report. • Shaky start chaired on interim basis, by Sir Alan Budd. • New chairman Robert Chote (formerly director of Institute of Fiscal Studie (IFS respected independent think tank) Other Bodies & terms • • • • • • • • Office of Fair Trading (OFT Confederation of Business Interests (CBI) Institute of Directors (IoD) Trade Union Congress (TUC) Privatisation – selling government assets Part Privatisation – hybrid Nationalisation – government owned Utilities – essential services i.e. Water, gas, electricity • Regulatory bodies i.e. Ofgas, Ofcom, Ofwat Stock Exchange • Shares in plcs traded on global stock market – one of the biggest London Stock Exchange • Limited Liability companies • Private Limited companies • Public Limited companies (plcs) – floated and listed on the LSE • Hostile takeovers (see Morrison for examples) seminars • Outline role of the Treasury and the mechanics of the Budget • Outline and explain important and relevant economic terms associated with public finance and economics • Identify Government regulatory controls • Role of the Bank of England and Monetary Policy Committee – familiarise yourself with the new regulatory body. • Identify current issues Next week Disengagement with the Political system