Discussion Session 2

advertisement

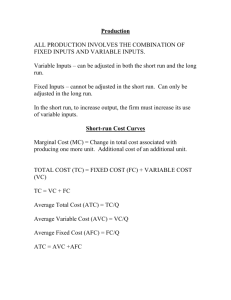

Discussion Session 2 Marginal Benefit • The following table shows Abby’s willingness to pay for apples • Calculate her marginal benefit from apples. Quantity of apples (pounds) 0 Willingness to pay 1 2 3 $7 $13 $18 4 5 $22 $25 $0 Marginal Benefit Marginal Benefit • The following table shows Abby’s willingness to pay for apples • Calculate her marginal benefit from apples. Quantity of apples (pounds) 0 Willingness to pay Marginal Benefit $0 - 1 2 3 $7 $13 $18 7 6 5 4 5 $22 $25 4 3 Marginal Benefit • Let’s draw Abby’s individual demand curve for apples. • If the market price of apples is $5/lb, how many pounds of apples will Abby buy? • Abby will buy if P<MB, until P = MB, so she will buy 3 lbs of apples. • What is her consumer surplus? • It is TB – P x Q = 18 – 5 x 3 = 18 – 15 = 3 Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) 0 1 8 12 2 3 4 5 15 21 30 50 Average TC (ATC) Average VC (AVC) Marginal Cost (MC) 1) Fill out the entries in the table. 2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 Average TC (ATC) Average VC (AVC) Marginal Cost (MC) 1) Fill out the entries in the table. 2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 0 1 8 12 8 8 Marginal Cost (MC) 4 2 3 4 5 15 21 30 50 8 8 8 8 3 6 9 20 1) Fill out the entries in the table. 2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 0 1 8 12 8 8 4 Marginal Cost (MC) 4 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 3 6 9 20 1) Fill out the entries in the table. 2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 0 1 8 12 8 8 4 12 Marginal Cost (MC) 4 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3 6 9 20 1) Fill out the entries in the table. 2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) 4 Average TC (ATC) 12 Average VC (AVC) 4 Marginal Cost (MC) 4 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 4 12 4 Marginal Cost (MC) 4 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 2) Suppose that the firm is a price taker, and market price is $9. What quantity will the firm produce? The firm produces quantity where P = MC. When MC = $9, Q = 4 Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 3) What is the profit/loss? Average TC (ATC) Average VC (AVC) 4 12 4 Marginal Cost (MC) 4 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 4 12 4 Marginal Cost (MC) 4 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 3) What is the firm’s profit/loss? Profit = Total Revenue – Total Cost = P x Q – ATC x Q = 9 x 4 - 7.5 x 4 = 6 Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 4 12 4 Marginal Cost (MC) 4 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 4) What is the break-even price? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 4 12 4 Marginal Cost (MC) 4 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 4) What is the break-even price? The break-even price equals to the minimum of ATC = $7 Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 4 12 4 Marginal Cost (MC) 4 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 5) What is the shut-down price? Cost Curves Quantity Total Cost Fixed Cost Variable (TC) (FC) Cost (VC) Average TC (ATC) Average VC (AVC) 4 12 4 Marginal Cost (MC) 4 0 1 8 12 8 8 2 3 4 5 15 21 30 50 8 8 8 8 7 13 22 42 7.5 7 7.5 10 3.5 4.33 5.5 8.4 3 6 9 20 5) What is the shut-down price? The shut-down price equals to the minimum of AVC = $3.5 Deriving the Market Supply Curve Quantity 0 1 2 3 4 5 Firm A MC Firm B MC 10 20 15 25 35 55 45 65 80 100 Derive the market supply curve The Rise and Fall of Industries Suppose that apple farming in the United States can be represented by a competitive industry. Currently the industry is in long run equilibrium. Consider the case of cost-reducing technologies. For examples, scientists develop new high-yield seeds that produce more apples at a lower cost. 1) Explain how the industry would adjust to a decrease in cost of production of apples. 2) Analyze what happens in the short run as well as in the long run.