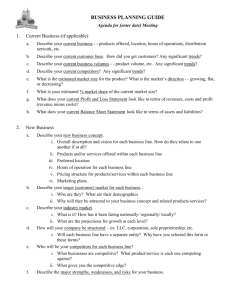

Foundations of Strategy Chapter 3 Resources and Capabilities

advertisement

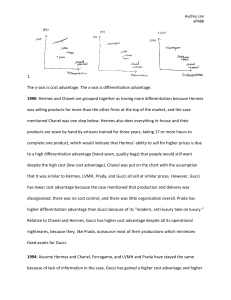

Foundations of Strategy Chapter 3 Resources and Capabilities BY: SPENCER BROWN, LAURA CARR, IKE HUESTIS, BRAD KLINGBERG, TREANNE TURNER Summary The Role of Resources and Capabilities in Strategy Formulation Emphasis on correlation between strategy and the internal environment of a firm Relationship between strategy and the resources and capabilities of a firm Two main reasons for this change Internal resources and capabilities are more secure when forming a strategy Competitive advantage has become the source of profitability Resource-based view Competitive Advantage Strategy Industry Key Success Factors Organizational Capabilities Resources Tangible Financial (cash, securities, borrowing capacity) Physical (plant equipment, land, mineral reserves) Intangible • Technology (patents, copyrights, trade secrets) • Reputation (brands, relationships) • Culture Human • Skills/knowhow • Capacity for communication and collaboration • Motivation Identifying Resources Tangible Resources Easiest to identify and evaluate Financial resources and physical assets are located in a firm’s financial statements How does a firm create additional value? Improving efficiency Using existing assets more profitably Identifying Resources Intangible Resources Brand names and trade marks are a form of reputational asset Value lies in the confidence it instills in customers Technological and artistic resources Patents Copyrights Trade secrets Trade marks Identifying Resources Human Resources Comprised of the expertise of employees Most firms devote considerable time into improving HR Competency Modeling Comparing potential employees to a set of skills they are looking for Company Culture Organization’s values and traditions Classifying Capabilities Organizational Capability Using resources to attain desired goals Must find a firm’s distinct and core competencies What a firm does to make them superior relative to competitors Important success factors a firm competes on Classifying Capabilities Identifying a firm’s capabilities Functional Analysis Identifies capabilities in relation to certain functional areas Value Chain Analysis Determine capabilities according to the sequential chain of activities of the firm Functional Functional Area Capability Example Corporate Functions Financial Control Exxon Mobil Management Information Comprehensive MIS network Wal-Mart Research and Development Innovative Product Development Apple Operations Efficiency in Volume Briggs and Stratton Product Design Design Capability Nokia, Apple Marketing Brand Management Proctor and Gamble Sales and Distribution Customer Service Caterpillar Value Chain Type of Activity Generic Value Chain Label Examples of Activities Primary Activities Logistics Purchasing, SCM Operations Design, Assembly, Quality Control Marketing and Sales Market Research, Ads, Promoting, Pricing Service Warranties, Parts, Recycling Infrastructure Global Communications, Risk Management HR Management Training, Recruitment Technology Development Technology managed design and manufacture Procurement Database and Inventory management Support Activities Profit-Earning Potential of a Resource/Capability The extent of the competitive advantage established The sustainability of the competitive advantage Appropriability of the returns Establishing Competitive Advantage Scarcity Resource/capability must be widely unavailable within the industry Relevance Resource/capability must be relevant to the key success factors in the market Sustaining Competitive Advantage Durability Resource/capability must have a useful lifespan Transferability Resource/capability must be mobile between companies Replicability Product can not be imitated by competitors Appropriating the Returns to Competitive Advantage Property rights Relative bargaining power with determining the division of returns between the firm and its individual members Embeddedness Deeply embedded individual skills and knowledge leads to dependence on corporate systems and reputation Competitive Advantage: Gucci French retailer PPR acquires Gucci Group in 2001. Chairman Domenico De Sole and vice chairman Tom Ford leave Gucci in 2004. The duo had masterminded Gucci’s transformation into a Global style leader, and the combination of talented CEO and designer proved to be a competitive advantage for the company. As a result, Gucci’s share price fell from $86.10 to around $75, losing the company an estimated $1.2 billion. Putting Analysis Into Practice Step 1: Identify the key resources and capabilities Step 2: Appraising resources and capabilities which resources are most important in conferring sustainable competitive advantage? what are the firms strengths/weaknesses compared to its competitors? Step 3: Developing strategy implications Exploiting key strengths Managing key weaknesses Utilizing inconsequential strengths Organizational Capabilities Develop over long time periods Can be traced back to prevailing circumstances during the founding and early development of a company. Embodied within organizational structure The more complex the task, the greater the gains from learnby-doing. Embedded with organizational culture Collaboration without managerial direction depends upon shared perceptions, common values and behavioral norms. Approaches to Capability Development Acquiring Capabilities acquisitions and alliances Internal Development focus and sequencing Acquiring Capabilities Acquisitions Can help fast track the process of capability development, especially in technological environments. However, major risks include culture clashes, expenses, and surpluses. Alliances Quick and low-cost means of extending capabilities available to a firm. However, building trust and managing alliance relationships is critically important. Internal Development Focus Must limit the number and scope of the capabilities that it is attempting to create at any point of time. Sequencing Develop capabilities incrementally through several stages, and target no more than a few capabilities in each time period. Comparison 20 Mile March Elements Performance markers Self-imposed constraints Tailored to the enterprise Lies largely within your control A proper timeframe Designed and self-imposed by the enterprise Must be achieved with great consistency • GREAT BY CHOICE Why it Wins It builds confidence in your ability to perform well in adverse circumstances It reduces the likelihood of catastrophe when you’re hit by turbulent disruption It helps you exert self-control in out-of-control environments • GREAT BY CHOICE Six Paths Framework Path 1: Look across alternative industries Path 2: Look across strategic groups within industry Path 3: Look across the chain of buyers Path 4: Look across complementary product and service offerings Path 5: Look across emotional or functional appeal to buyers Path 6: Look across time • BLUE OCEAN STRATEGY Classes Economics Competitive advantage An advantage that a firm has over its competitors, allowing it to generate greater sales or margins and/or retain more customers than its competition. Example: firm's cost structure, product offerings, distribution network and customer support. Strategy An adaption or complex of adaptions that serve an important function Identify means of resources Human Resource Development Human Resources Current Trends in HR Training Leading and Managing Change Motivation Employee Engagement Accounting Intangible Assets Tangible Assets Profit Earning Potential Strategic Analysis Financial Analysis Assessing worth of on Asset Functional Areas Capability Exemplars Corporate functions Financial control Exxon Mobil, PepsiCo Management development General Electric, Shell Strategic innovation Google, Haier Multidivisional coordination Unilever, Shell Acquisition management Cisco, Systems, Luxottica International Management Shell, Banco Santander Comprehensive, integrated MIS network linked to managerial decision making Wal-Mart, Capital One, Dell Computer Management information Examples of Hyundai’s Capabilities by function Corporate functions Management information Research and Development Operations Product Design Marketing Our Company: Dick’s Sporting Goods Resources: Tangible Financial 2012: $5.64 Billion in revenue $294.49M Total cash on hand Physical 511 Stores in 44 states Resources: Intangible Relationships with high margin brands, such as Nike and Under Armour. Private brands that create customer loyalty. Reputation for customer service. Resources: Human Stores employ experts in their fields PGA and LPGA golf pros Certified fitness trainers Specialty trained footwear sales associates Professional fisherman and kayakers Capabilities Specialty shops within stores. Dicks combines their tangible resources (massive stores) with intangible resources (relationships with high margin brands) to create specialty shops to help promote brands. Currently have 45 Under Armour All-American shops and 105 Nike Field House shops Capabilities - Continued Specialty stores also include more specialized markets The Lodge Fitness Footwear Appraising Resources Resource Importance Relative Strength Finance 8 9 Technology 2 3 Location 7 9 Distribution 8 4 Brands 8 10 Appraising Resources Key Strengths Superfluous Strengths 12 10 8 6 4 2 Key Weaknesses Zone of Irrelevance 0 0 2 4 6 8 10 Dealing With Key Weaknesses Currently has only three distribution centers, barely enough to keep up with current stores. Plans to build a new 600,000 square foot distribution center that will allow for about 250 more stores. Questions?