FREE Sample Here

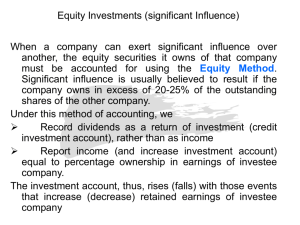

advertisement