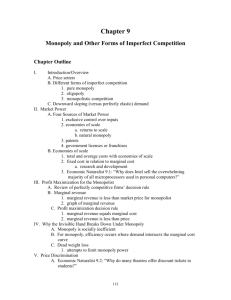

Ch8

advertisement

Monopoly ECO 230 J.F. O’Connor Market Structure • Perfect Competition – participants act as price takers and cannot by individual behavior affect market outcome • Imperfect Competition – An individual firm has some degree of control over the price for its good – If it increases price, it does not lose all its customers Forms of Imperfect Competition • Monopoly – A firm that’s the only supplier of a unique product with no close substitutes • Oligopolist – A firm that produces a product for which only a few rival firms produce close substitutes • Monopolistically competitive firm – One of a large number of firms that produce slightly differentiated products that are reasonably close substitutes for one another Understanding Monopoly • • • • • Bases for monopoly Profit maximization for a monopolist Social efficiency of monopoly Regulation of monopoly Pricing strategies Bases for Monopoly • Economies to scale relative to the size of the market • Transmission and transportation networks • Control of an input • Patent • Copyright • Exclusive franchise from government • Legal cartel Examples of Monopoly • One grocery store, one bakery or a funeral home in a small town • Telephone, electricity, water firm • Alcoa, Picasso, • Drugs, Roundup • Stephen King • Pepsi on campus • Baseball Returns to Scale • Constant returns to scale – When all inputs are changed by a given proportion and output changes by the same proportion • Increasing returns to scale – When all inputs are changed by a given proportion and output changes by a higher proportion – Also know as Economies of Scale Economies of Scale • With Economies of Scale – Average total cost of production falls as output increases – There are high start-up costs – There are low marginal costs Profit Maximization • Key is to understand that under simple monopoly, where there is one price for all units, selling an additional unit requires lowering the price of all units sold. Therefore, marginal revenue (MB of selling another unit) is less than the price received for the unit. A monopolist faces the market demand curve. Profit Maximization • AK Water Co. has a monopoly on the supply in a region • Fixed cost is $20 • Average variable cost is $4 per unit and therefore, MC =$4 • Problem is to decide on the profit maximizing level of output Revenue,Cost, & Profit Price Quantity 20 0 18 1 16 2 14 3 12 4 10 5 8 6 6 7 4 8 2 9 0 10 TR(Q) TVC(Q) 0 0 18 4 32 8 42 12 48 16 50 20 48 24 42 28 32 32 18 36 0 40 FCTC(Q) Profit 20 20 -20 20 24 -6 20 28 4 20 32 10 20 36 12 20 40 10 20 44 4 20 48 -6 20 52 -20 20 56 -38 20 60 -60 Profit Maximizing Output • Looking at the table, TR is price time quantity, TC is Total Variable Cost + FC, and Profit is TR – TC. • At output of 4, profit is a maximum, $12. • Total revenue and total cost are are graphed in the next slide. Profit at any given level of output is the vertical difference between the two, which is greatest at output of 4. Total Revenue and Cost 60 TC 50 40 Dollars TR 30 20 10 0 0 1 2 3 4 5 Quantity 6 7 8 9 10 Marginal Analysis • Instead of looking at total revenue and total cost, one can look at profit maximization in per unit terms. • Compare addition to revenue (MR) with addition to cost (MC) from changing output. Per Unit Data Q 0 1 2 3 4 5 6 7 8 9 10 AR(Q) 20 18 16 14 12 10 8 6 4 2 0 TR(Q) 0 18 32 42 48 50 48 42 32 18 0 MR(Q) 18 14 10 6 2 -2 -6 -10 -14 -18 MR' 20 16 12 8 4 0 -4 -8 -12 -16 AVC=MC ATC(Q) 4 4 24.00 4 14.00 4 10.67 4 9.00 4 8.00 4 7.33 4 6.86 4 6.50 4 6.22 4 6.00 Average and Marginal Revenue 20 18 AR 16 14 12 $/unit 10 MR 8 6 4 2 0 -2 -4 0 1 2 3 4 5 Quantity 6 7 8 9 10 Unit Curves 20 18 16 ATC 14 12 AR $/unit 10 8 6 MC=AVC 4 2 0 -2 -4 0 1 2 3 4 5 Quantity MR 6 7 8 9 10 Profit Maximizing Conditions • Find the output at which marginal revenue = marginal cost • On the demand curve, find the price at which the output can be sold. • Check to see that P is greater than AVC • Compute economic profit, [P-ATC(q)]q Some Comments • Having a monopoly allows you to set price but not quantity. Buyers decide on quantity. • A monopoly does not guarantee an economic profit or even covering of variable costs. Note that many patents have never been exercised. • Some monopolists have positively sloped marginal cost curves (see text) Social Inefficiency of Monopoly • One condition for an efficient allocation of resources is that the valuation of the marginal unit to the consumer (price) equal the opportunity cost of producing it (marginal cost) • Under monopoly, P> MR=MC. Hence the allocation is socially inefficient. In our example, the value of the marginal unit is $12 while the marginal cost is only $4. The Social Cost of Monopoly • We can use our graph to measure the social cost or deadweight loss because of monopoly • The socially efficient outcome is 8 units at a price of $4, Price = MC • The social cost is the area under the demand curve from 4 to 8 units and above the MC, namely, .5(12-4)(8-4) = $16 Measuring the Social Cost of Monopoly 20 18 16 ATC 14 12 AR $/unit 10 8 6 MC=AVC 4 2 0 -2 -4 0 1 2 3 4 5 Quantity MR 6 7 8 9 10 Why Do We Grant Monopoly? • To take advantage of economies of scale • To encourage innovation in art, science, and literature • In return for granting a monopoly that takes advantage of economies to scale, society reserves the right to regulate the price charged by the monopolist. Regulation of Monopoly • Socially Efficient Regulation – Set a price ceiling at AR=MC and pay a lumpsum subsidy to the monopolist to ensure zero economic profit. • Fair Rate of Return Regulation – Set a price ceiling where AR=ATC. This ensures zero economic profit but output is less than socially efficient. It may be close enough. • Public Ownership Current Developments • Electricity, natural gas, telephone, cable • Airlines • Privatization of state monopolies Price Discrimination • A monopolist can sometimes increase profit by charging different prices to different customers or for different units. • Charging different prices for the same good is called price discrimination. • Price discrimination is illegal in the U.S.! Kinds of Price Discrimination • Third degree – separate buyers into two or more markets. E.g. movie theaters, ailines • Quantity discounts – electric utility • Perfect or first degree price discrimination – charge the reservation price for each unit - Third Degree • Firm produces a product with essentially zero marginal cost • Two possible markets, one high priced, one low priced One Price Market 1 Price Quantity 40 35 30 25 20 15 10 5 0 0 500 1000 1500 2000 2500 3000 3500 4000 Market 2 Price 10 5 0 Quantity 0 2000 4000 TR 0 17500 30000 37500 40000 37500 30000 27500 0 • If the firm charges one price for all units, it will maximize total revenue, and in this case, profit by selling 2,000 units at $20 per unit. • Note that it does not sell in the second market. • If the buyers can be separated, it could sell another 2,000 in the second market at $5 and add $10,000 to revenue and profit.