Process Costing

advertisement

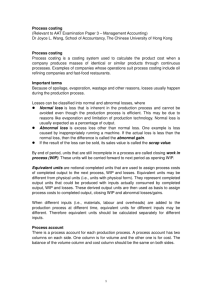

Process Costing 1 Process costing Process costing is adopted when there is mass production through a sequence of several processes Example include chemical, flour and glass manufacturing It computes the average cost per unit by dividing the costs or production for a particular period by the number of units produced during the period 2 Direct material Direct labour overheads Process 1 Direct material Direct labour overheads Process 2 Direct material Direct labour overheads Process 3 Finished goods Cost of goods sold 3 Accounting for Process Costing Costs are accumulated by each process Each process maintains its process account The process account is debited with the costs incurred and credited with goods completed and transferred to other process account When the goods are completed, they will be transferred to finished goods account When the goods are sold, the amount will be transferred to the cost of goods sold account 4 Process A Process B Material 500 Process B Labour 100 Overhead200 800 800 800 Process C 1100 1100 1100 Finished Goods Process B 1100 Finished Gds 1500 Material 80 Labour 110 Overhead 210 1500 Process A800 Process C Material 50 Labour 150 Overhead100 1500 Process C 1500 Cost of GDs Sold 1300 Bal c/d 200 1500 1500 5 Accounting for losses and scrap in process account 6 Accounting for losses in process costing In a production process, losses are inherent and unavoidable Nature of losses Normal loss Abnormal loss 7 Accounting for scrap Damaged goods may be sold as scrap Revenue arising from the scrap should be treated as a reduction in cost rather than an increase in sales revenue 8 Transactions Normal loss Accounting treatment Losses within expected level Not assigned cost Abnormal loss Excess loss over the expected level Assigned cost Accounting entries No entry Dr. Abnormal loss Cr. Process account Abnormal gain Gain resulted when Dr. Process the actual loss is account less than the Cr. Abnormal normal or gain expected loss 9 Transactions Accounting treatment Scrap value of Reducing material normal loss cost Scrap value of Reduce cost of abnormal loss abnormal loss Loss of scrap The actual units value due to sold as scrap will abnormal gain be less than the scrap value of normal loss Accounting entries Dr. Scrap Cr. Process account Dr. Scrap Cr. Abnormal loss Dr. Abnormal gain Cr. Scrap 10 Transactions Accounting treatment Actual cash Reducing material received from cost the sale of scrap Accounting entries Dr. Cash Cr. Scrap 11 Example 12 Joyce Ltd. operates a factory involving two production Processes. The output of process 1 is transferred to process 2. The information of production for January 2005 is as follows: • • • • Cost for Process 1 Materials: 3000 units at $5 per unit Labour $2400 Cost for Process 2 Materials: 2000 unit at $8 per unit Labour $1680 No opening and closing work in progress Output for January 2005 Process 1: 2300 units Process 2 4000 units 13 • General overhead, for January 2005 amounted to $7140, are absorbed into the process cost at a rate of 375% of direct labour costs in process 1 and 496.4% of direct labour cost in process 2. • The normal output of process 1 and process 2 is 80% and 90% of input respectively • Waste matters from process 1 and sold for $4 per unit and those from process 2 for $6 per unit Required: (a) Process 1 (b) Process 2 (c) Scrap (d) Abnormal loss (e) Abnormal gain 14 Process 1 account Units $ Units $ Materials 3000 15000 Scrap: normal loss (4*600) 600 2400 ($5 *3000) Process 2 Labour 2400 ($10*2300) 2300 23000 Overhead 9000 Abnormal loss (2400*375%) ($10 *100) 100 1000 3000 264000 3000 26400 Cost per unit = Total expected cost Total expected output = $26400-$2400 3000-600 = $10 per unit 15 Process 2 account Units $ Units $ Process 1 2300 23000 Scrap: normal loss 430 2580 Materials 2000 16000 ($6*430) Labour 1680 Finished goods 4000 48000 Overhead 8340 ($12*4000) (1680*469.4%) 4300 49020 Abnormal gain ($12 *130) 130 1560 4430 50580 4430 50580 Cost per unit = = $49020-$2580 4300-430 = $12 per unit 16 Abnormal loss account Process 1 Units $ 100 1000 Scrap Profit and loss 100 1000 Units $ 100 400 600 100 1000 Abnormal Gain account Scrap: value of abnormal gain Profit and loss Units 130 100 $ 780 780 1000 Process 2 Units $ 130 1560 100 1000 Loss on scrap value due to abnormal gain 17 Scrap account Units $ 600 2400 Units $ Abnormal gain Normal loss (Process 2) 130 780 (Process 1) Normal loss 430 2580 (130*$6) Cash –process 1 (Process 2) 700 2800 Abnormal loss 100 400 (600+100)*$4 Cash – process 2 (Process 1) (430-130)*$6 300 1800 (100*$4) 1130 5380 1130 5380 18 Wk 1: Determining the output and loss: Process 1 Input 3000 units Less: normal loss (20%) 600 units 2400 units Expected output Actual output 2300 units Abnormal loss 100 units Wk 2: Determining the output and loss: Process 2 Input (2300+2000) 4300 units Less: normal loss (10%) 430 units 3870 units Expected output Actual output 4000 units Abnormal gain 130 units Back 1 Back 2 19 Equivalent units of production 20 Equivalent units of production If there is no opening or closing work in progress (WIP) the unit cost of products can be obtained as follows Unit Cost = Sum of production costs Production quantity 21 However, If there is opening or closing work in progress, the partly completed production will have a lower cost than the fully completed production We have to converted the work in progress into finished equivalent units of production (EUP) 22 Example 23 The total production cost for January 2005 was $40000. 8000 units had been completed and 4000 units wee 50% complete. Equivalent units of production 8000 units completed 8000 4000 units were 50% completed 2000 10000 Finished goods = $40000/10000 * 8000 = $32000 Closing work in progress = $40000/10000*2000 = $8000 24 Three categories in determining the equivalent units of production Opening work in progress Started and completed units Closing work in progress 25 Opening work in progress (OWIP) These units were started in the previous period and are to be completed in the current period 1/3 EUP completed In previous period 2/3 EUP completed in current period 26 Started and completed units (SACU) These units are started and completed in the current period 1 EUP completed in current period 27 Closing Work in progress (CWIP) These units are started in the current period and are to be completed in the coming period 1/3 EUP completed in current period Incomplete part 28 Two methods of cost flows in process costing First in First out Weighted average cost 29 First-in-first-out method The opening work in progress is the first group of units to be processed and completed during the current period It separates the cost computations of the opening work in progress and the current period production Weighted average method The opening work in progress is merged with the production of the current period to form one batch of production The average cost per unit of the opening work in progress and the current period production is the same 30 First-in-first-out method The EUP computation ignores the work performed on the opening work in progress during the prior period Cost per unit = Current cost EUP Weighted average method The EUP computation includes all work performed on the opening work in progress during the prior period Cost per unit = Cost of OWIP + Current Cost EUP 31 FIFO Method WAVCO Method 10 units of OWIP (60% completed in previous Period) 4 EUP 70 SACU 70 EUP + + 40 units of CWIP (20% completed) 8 EUP 82 EUP 10 units of OWIP (60% completed in previous Period) 70 SACU 40 units of CWIP (20% completed) 10 EUP + 70 EUP + 8 EUP 88 EUP 32 Example 33 Lucky Ltd. makes toys in a one-department production process. The following information is available related to the production in February 2005. Opening work in progress: 1000 units Degree of completion % Direct materials 100 Conversion (labour + overhead) 60 February production: 20000 units Cost $ 6000 1200 7200 $ Direct materials 30000 Conversion 52200 82200 Closing work in progress: 3000 units (20% as complete as to conversion 34 You are required to : Prepare Process 1 account using (a)The FIFO method of valuation; and (b)The weighted average method of valuation 35 First in First out 36 Wk 1: Number of Equivalent units (EU) Total Materials Conversion Units EU EU Opening work in progress 1000 0 400 (40%) Other completed units 17000 17000 17000 Total completed units 18000 17000 17400 3000 3000 600 (20%) Closing work in progress 21000 20000 18000 20000-3000 Wk 2: Costs Total Materials Conversion No opening WIP $ $ $ 30000 52200 Costs incurred in the period 82200 Costs per equivalent units 4.4 1.5 2.9 37 Wk 3: Cost of units transferred to finished goods and closing WIP Total Materials Conversion $ $ $ Opening WIP 7200 6000 1200 (Wk 4) 1160 1160 Cost to complete 8360 6000 2360 1000 units completed 74800 25500 (Wk 5) 49300 17000 units completed 51660 Transfer to finished goods83160 31500 Closing WIP 6240 4500 (Wk 6) 1740 89400 36000 53400 Wk:4 Conversion: $2.9*400= 1160 Wk 5: Materials: 17000*$1.5 = $25500 Conversion: 17000*$2.9 = $49300 Wk 6: Materials: 3000*$1.5 = $4500 Conversion: 600*$2.9 = $1740 38 Process account Units $ Units $ Opening WIP 1000 7200 Finished goods 18000 83160 Materials 20000 30000 Closing WIP 3000 6240 Conversion 52200 21000 89400 21000 89400 39 Weighted average cost method 40 Wk 1: Number of Equivalent units (EU) Total Materials Conversion Units EU EU Opening work in progress 1000 1000 1000 Other completed units 17000 17000 17000 Total completed units 18000 18000 18000 3000 3000 600 (20%) Closing work in progress 21000 21000 18600 20000-3000 Wk 2: Costs Total Materials Conversion $ $ $ 7200 6000 1200 Opening WIP Costs incurred in the period 82200 30000 52200 89400 36000 53400 41 Costs per equivalent units 4.5853 1.7143 2.8710 Wk 3: Cost of units transferred to finished goods and closing WIP Total Materials Conversion $ $ (Wk 4) $ 51678 Transfer to finished goods82535 30587 6865 5143 (Wk 5) 1722 Closing WIP 89400 35730 53400 Wk 4: Materials: 18000*$1.7143 = $30587 Conversion: 17000*$2.8710 = $51678 Wk 5: Materials: 3000*$1.7143 = $51678 Conversion: 600*$2.8710 = $1722 42 Process account Units $ Units $ Opening WIP 1000 7200 Finished goods 18000 82535 Materials 20000 30000 Closing WIP 3000 6865 Conversion 52200 21000 89400 21000 89400 43 Lost units in process costing 44 Nature of losses Normal loss Abnormal loss 45 Normal loss Normal loss are the losses within the expectation during the production Reasons: Low quality materials and workers are engaged There may be an inherent problem in production process 46 Abnormal loss The lost units that is out of expectation 47 Continuous loss Continuous losses occur evenly throughout the production process For example, the weight loss in making mild powder 48 Discrete loss Discrete losses occur at the specific point A firm will not be aware of discrete losses unless the products are inspected at the inspection point For example, wrong buttons on a garment and wrong colour of toy cars m 49 Types and natures EUP calculation Continuous normal loss Excluding the lost units Continuous and abnormal loss Including the lost units Discrete and normal loss Including the lost units Discrete and abnormal Including the lost loss units 50 Types and natures Treatments for losses and costs Continuous normal loss Losses are included as product costs Costs are not assigned to the lost units Continuous and abnormal loss Losses are charged as period cost Costs are assigned to the lost units Abnormal loss will be written off to the profit and loss 51 Types and natures Treatments for losses and costs Discrete and normal loss Loss are included as product cost Cost are assigned to lost units Determining the point of work in progress: 1. Before passing inspection point, cost of lost units are only assigned to units transferred 2. After passing inspection point, cost of lost units are allocated between units transferred and closing WIP 52 Types and natures Discrete and abnormal loss Treatments for losses and costs Loss are charged as period cost Cost are assigned to lost units Abnormal losses will be written off to the profit and loss account 53 Example 54 Lucky Ltd. makes toys in a one-department production process. The following information is available related to the production in February 2005. Opening work in progress: 1000 units Degree of completion % Direct materials 100 Conversion (labour + overhead) 60 February production: 20000 units Cost $ 6000 1200 7200 $ Direct materials 30000 Conversion 52200 82200 Closing work in progress: 3000 units (20% as complete as to conversion 55 Loss: 2000 units You are required to : Prepare Process 1 account using the FIFO method: Case 1: Continuous normal loss Case 2: Discrete normal loss Case 3: Abnormal loss (both continuous and discrete loss) 56 Case 1: Continuous normal loss 57 Wk 1: Number of Equivalent units (EU) Total Materials Conversion Units EU EU Opening work in progress 1000 0 400 (40%) Other completed units 15000 15000 15000 Total completed units 16000 15000 15400 Normal loss 2000 3000 3000 600 (20%) Closing work in progress 21000 18000 16000 Wk 2: 20000-3000-2000 Costs Total Materials Conversion No opening WIP $ $ $ 30000 52200 Costs incurred in the period 82200 Costs per equivalent units 4.9292 1.6667 3.2625 58 Wk 3: Cost of units transferred to finished goods and closing WIP Total Materials Conversion $ $ $ Opening WIP 7200 6000 1200 (Wk 4) 1305 1305 Cost to complete 8505 6000 2505 1000 units completed 73938 25000.5(Wk 5) 48937.5 15000 units completed 51442.5 Transfer to finished goods82443 31000.5 Closing WIP 6957 5000 (Wk 6) 1957 89400 36000.5 53399.5 Wk:4 Conversion: $3.2625*400= 1305 Wk 5: Materials: 15000*$1.6667 = $25000.5 Conversion: 15000*$3.2625 = $48937.5 Wk 6: Materials: 3000*$1.6667 = $5000 Conversion: 600*$3.2625 = $1957 59 Process account Units $ Units $ 2000 Opening WIP 1000 7200 Normal loss Materials 20000 30000 Finished goods 16000 82443 6957 Conversion 52200 Closing WIP 3000 21000 89400 21000 89400 60 Case 2: Discrete normal loss It is assumed that the inspection point is set at 100% completion, all work has been performed. As a result, the costs of lost units are assigned to the units transferred Material added Closing WIP (20%) Inspection point (100%) 61 Wk 1: Number of Equivalent units (EU) Total Materials Conversion Units EU EU Opening work in progress 1000 0 400 (40%) Other completed units 15000 15000 15000 Total completed units 16000 15000 15400 Normal loss 2000 2000 2000 3000 3000 600 (20%) Closing work in progress 21000 20000 18000 Wk 2: 20000-3000-2000 Costs Total Materials Conversion No opening WIP $ $ $ 30000 52200 Costs incurred in the period 82200 Costs per equivalent units 4.4 1.5 2.9 62 Wk 3: Cost of units transferred to finished goods and closing WIP Total Materials Conversion $ $ $ Opening WIP 7200 6000 1200 (Wk 4) 1160 1160 Cost to complete 8360 6000 2360 1000 units completed 66000 22500 (Wk 5) 43500 15000 units completed 45860 Transfer to finished goods74360 28500 6240 4500 (Wk 6) 1740 Closing WIP 8800 3000 5800 Normal loss 89400 36000 53400 Wk:4 Conversion: $2.9*400= 1160 Wk 5: Materials: 15000*$1.5 = $22500 Conversion: 15000*$2.9 = $43500 Wk 6: Materials: 3000*$1.5= $4500 Conversion: 600*$2.9 = $1740 63 Process account Units $ Units $ 2000 8800 Opening WIP 1000 7200 Normal loss Materials 20000 30000 Finished goods 16000 74360 6240 Conversion 52200 Closing WIP 3000 21000 89400 21000 89400 64 Case 3: Abnormal loss (both continuous and discrete) For the discrete losses, it is assumed that the inspection point is set at 100% completion 65 Wk 1: Number of Equivalent units (EU) Total Materials Conversion Units EU EU Opening work in progress 1000 0 400 (40%) Other completed units 15000 15000 15000 Total completed units 16000 15000 15400 Normal loss 2000 2000 2000 3000 3000 600 (20%) Closing work in progress 21000 20000 18000 Wk 2: 20000-3000-2000 Costs Total Materials Conversion No opening WIP $ $ $ 30000 52200 Costs incurred in the period 82200 Costs per equivalent units 4.4 1.5 2.9 66 Wk 3: Cost of units transferred to finished goods and closing WIP Total Materials Conversion $ $ $ Opening WIP 7200 6000 1200 (Wk 4) 1160 1160 Cost to complete 8360 6000 2360 1000 units completed 66000 22500 (Wk 5) 43500 15000 units completed 45860 Transfer to finished goods74360 28500 6240 4500 (Wk 6) 1740 Closing WIP 8800 3000 5800 Abnormal Normal loss 89400 36000 53400 Wk:4 Conversion: $2.9*400= 1160 Wk 5: Materials: 15000*$1.5 = $22500 Conversion: 15000*$2.9 = $43500 Wk 6: Materials: 3000*$1.5= $4500 Conversion: 600*$2.9 = $1740 67 Process account Units $ Opening WIP 1000 7200 Materials 20000 30000 Conversion 52200 21000 89400 Units $ Abnormal normal loss 2000 8800 Finished goods 16000 74360 Closing WIP 3000 6240 21000 89400 68