Market Presentation

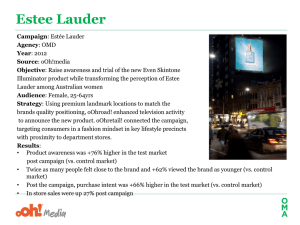

advertisement

Agenda: 1 2 Jon Baron Ed Pushman Head of Search Media Strategist Multinational Sales Using online to tap into the booming Asian travel market The Search Travel market & adCenter Eastern Opportunity: How online advertising can help you unlock the potential of the booming Asian travel market Why Asia? – Tapping into the Consumer Potential With about 61% of the world’s population living in the region in 2007, AsiaPacific is a huge consumer market China and India account for 37% of the world’s population Source: US Census Bureau, International Data Base, July 16 2007. Emarketer calculations, August 2007 Asian Travellers Are Big Spenders Singapore currently biggest spenders on travel (6th of personal disposable income) China, India and Indonesia will be among the world’s fastest-growing countries in travel and tourism Growth in Chinese spend on travel & tourism expected to be 4 times US growth Personal travel and tourism spending for select countries/regions worldwide, 2007 (% of total personal consumption) Singapore 15.6% Australia 12.5% UK 11.9% Japan 11.2% European Union 11.1% China 10.1% US 9.0% South Korea India Worldwide Source: www.Emarketer.com 7.0% 4.0% 9.7% And a lot of that money is going online... “In 2007, $17.7 billion worth of leisure or unmanaged business travel will be booked online in the Asia-Pacific region - up 28.3% from 2006. Strong future growth will ensure that the market about doubles to $35.5 billion by 2010 and approaches $42 billion in 2011.” Jeffrey Grau, Senior Analyst, eMarketer 73% of affluent Asians are online (pax) and spend more time online than any other medium (Asiabus) 1 in 5 of all travel sales in Asia-Pac will be online next year The Ones to Watch: China & India Market share of online leisure/unmanaged business travel bookings for India and China – 2006 & 2011 (% of Asia-Pacific* total) Note: includes all online travel bookings whether paid for online or offline * Australia, China, India, Japan, New Zealand, South Korea; Source: eMarketer Sept 2007 China and India are two of the region’s largest and fastest growing online travel markets Last year they combined to capture just over 15% of the total online travel market share By 2011 their share will triple to 46.3% What the Money Is Being Spent On % Share of Respondents Travel Services bought online in the last 12 months 2006/07 China Hong Kong India Japan Malaysia Air Tickets 30% 20% 48% 37% 47% Hotels 30% 22% 21% 48% 32% Event Tickets 11% 12% 10% 15% 12% Travel Packages 15% 8% 15% 11% 12% Travel Insurance 11% 15% 5% 12% 11% Sample size: 6,736 Source: MSN/Windows Live Online Travel Survey 2007 conducted by Synovate Online Is Not Only A Place To Spend But A Place To Plan, Share and Discuss Travel Purchases % Share of Respondents Sources used for planning/ researching travel 2007 China Hong Kong India Japan Internet 81% 76% 81% 93% 83% Printed Travel brochures 41% 49% 65% 65% 53% Guidebooks 53% 56% 29% 55% 41% Newspapers 40% 33% 40% 15% 49% Travel agents 41% 55% 40% 43% 54% Friends/relatives/colleagues 56% 46% 40% 29% 58% Magazines 39% 34% 40% 15% 49% Base: Those who have traveled for business or leisure (Sample size: 5,871) Source: MSN/Windows Live Online Travel Survey 2007 conducted by Synovate Malaysia Online is a Strong Influencer of Offline Travel Bookings Researched online Purchased/ booked online Purchased offline Hotels 55% 33% 26% Air Tickets 54% 36% 25% Travel packages 37% 12% 18% Sightseeing tours 36% 9% 19% Event tickets 30% 19% 19% Rental Car 17% 9% 13% Other Travel related services 33% 8% 15% European Hot Spots for Asian Travellers UK, Germany & Italy lead the way Number of tourists arriving from China, HK, India, Japan and Malaysia in 2006 > 1,000,000 500,000 – 1,000,000 Source: Euromonitor < 500,000 Who, Where and Why? India Targets Destinations Opportunities China Hong Kong Japan 39% Families 29% Couples 70% Leisure 17% Families 11% Couples 42% Organised Tours 13% Families 26% Leisure 38% Organised Tours Top: Singapore, Dubai US & UK Europe: UK & Switzerland Emerging: Germany Top: Macau & Hong Kong (68%) Emerging: South Africa Europe: Austria, Top: China (70%) Top: South Emerging: Europe, Korea, Thailand Australia. North America Backpackers/ Independent Traveller Business Travellers Cruises and sea trips Bollywood Emergence of low cost Carriers ‘Open Skies’ govt policy Source: Euromonitor 14% Families 14% Couples 49% Organised Tours Leisure tourism & organised tours Malaysia 20% Families 32% Leisure 18% Organised Tours Top: Singapore Emerging: Macau, Hong Kong, Thailand Independent Traveller; Flexible travel packages to Australia & New Zealand Case Study Cathay Pacific The Campaign: • ‘Born to move’ campaign • Aim: to increase brand awareness among frequent travellers within Asia • Improve its position as most admired airline • Ascertain reach and efficacy of online branding for its target audience Campaign results: • The survey results on MSN exceeded expectations: – Brand message association increased by 35% – Unaided brand awareness increased by 26.9% – The campaign was effective in establishing the perception of Cathay Pacific as an airline “There is no doubt in our mind that MSN is a great with the widest network. communications partner for the – Boosted purchase intent by 14.9% airline industry. We derived great value for our investment and the survey results exceeded our expectations.” Celine Ho Manager, Marketing Communications, Cathay Pacific Airways Case Study Tourism Malaysia Tourism Malaysia : Online Global Branding Campaign • Campaign objectives: – Increase brand visibility globally by showcasing Malaysia’s uniqueness – Create hype around Malaysia’s 50th Golden Celebration in conjunction with Visit Malaysia Year (VMY) – Encourage potential tourists to visit Malaysia • Target audience: – Potential travellers globally aged 21+ – Covered a total of 13 countries (Asia, Europe and North America) • Online tools used: – MSN / Windows Live Platform which includes: > > > > MSN Homepage Windows Live Hotmail Windows Live Messenger Windows Live Agent Snapshot of Campaign Impact on target audience : Singapore & Australians 91% Of Australians & 69% of Singaporeans exposed to the campaign were main/ joint decision makers for family travel (the campaign reached the desired audience) Positive uplifts were seen by all key brand metrics indicating the online campaign initiated positive influence and achieved the set objectives. 94% 100 96% +5% 80 +10% 44% 60 49% 54% +5% 47% +3% 52% 41% 44% 34% 40 20 0 +3% 6% 9% Unaided Awareness Aided Brand Awareness Online Ad Awareness Not exposed to the online campaign Exposed to the online campaign Source: AdIndex Advertising Effectiveness Research 2007 conducted by Dynamic Logic Message Association Brand Favorability Purchase Intent Ongoing Online Engagement With Siti • Promotion of Malaysia continues with a Travel World First launched on 1st November 2007 • ‘Siti’ – new digital brand ambassador to promote national tourism via Windows Live Messenger • Taking Tourism Malaysia to the next level of interactivity via innovative technology • Potential to reach more than 285m instant messenger users across multiple markets worldwide Add Siti to your Windows Live Messenger buddy list today : sitimalaysia@hotmail.com Why Microsoft? We connect with your audience all day Global reach, local knowledge, one point of contact 465m unique users in 42 markets and 21 languages MSN & Windows Live Hotmail – more than 300 million active accounts worldwide More than 294 million active Windows Live Messenger accounts worldwide More than 111 million unique users worldwide (Source: Comscore, August 2007) Over 2.16 billion worldwide queries each month Multinational Sales team have offices located in Hong Kong, Japan, London, New York, Paris, Singapore Some of our Travel Customers: adCenter and travel Edward Pushman Search Media Strategist Microsoft adCenter The Search Market Place Live.com Search Live Maps and Virtual Earth adCenter Microsoft’s UK Search Opportunity Share of Queries Share of Users Users (UK-only) 9 29% 5.4% 7 23% 6.1% 28 89% 81.2% Million Million Million Source: comScore MediaMetrix, Aug 2007; queries per user per month No. 2 for share of users Integration Autumn 2007 Core Investments • • Local, Maps Rich Answers Coverage Query Refinement • • Core RankNet • Structured Information Extraction Query Intent • Coverage 4 x increase in index size Query intent Advanced query analysis Query refinement Auto Spell / Query Suggestions RankNet More intelligent algorithm Structured information extraction Product reviews / related people Rich answers Answers & multi media results (Coming soon) High Interest High Value Verticals Local, Maps Shopping Core Health Entertainment Local, Maps Find local business listings quickly and easily Queries have local intent Local search begins at a search engine Active internet users use maps and directions Local, Maps Shopping Core Entertainment Health Sources: Microsoft Research Mapquest User Survey 82007; comScore MediaMetrix, August 2007 Local & Maps The VE platform provides customers, partners, and developers with a set of integrated services for programming and building intelligent Web applications for location-based information. JLScoot: BE boosted online visits to highest levels ever & increased return visits by 47%. Number of unique visits per month increased by 11% Number of new visitors per month increased by 15% Aerial and Satellite Imagery Bird’s Eye View Proximity based Results Microsoft adCenter increasing your ROI Convert more with adCenter High quality audience Paid Search and Travel Future of Search Why Microsoft adCenter? Convert more Our audience is more likely to convert than any other Conversion % 5.8% 4.2% 3.0% MSN/Live Search Google Search Yahoo! Search 3.2% 3.2% AOL Search Total Average Percentage of click throughs that lead to conversion * NNR Jan-March 2007: Conversion equals a visit to a secured section of an advertiser’s website Our audience is more likely to convert than any other Travel Conversion % 9.4% 6.3% 6.7% 6.6% 5.6% MSN/Live Search Google Search Yahoo! Search AOL Search Total Average Percentage of click throughs that lead to conversion * NNR Jan-March 2007: Conversion equals a visit to a secured section of an advertiser’s website Why Microsoft adCenter? High quality audience Our audience is more engaged on your site Higher spend Average time spend on the destination site (mins) The average Windows Live customer spent £2000 or more online in the past six months* 4.01 3.22 2.39 MSN/Live Search Google Search Yahoo! Search Level of Engagement *TGI Internet 2006 ** NNR Jan-March 2007 2.50 2.48 AOL Search Total Average Our audience is more engaged on your site Average time spend on the destination site (mins) Travel 4.11 4.04 3.39 3.46 3.06 MSN/Live Search Google Search Yahoo! Search Level of Engagement *TGI Internet 2006 ** NNR Jan-March 2007 AOL Search Total Average Paid Search and Travel Spend for paid search Paid for search listings increased from £337million in 2005 to more than £531 million in 2006 Spending in first half 2006 £millions £600 UP 57% £500 £400 £300 UP 33% UP 23% £200 £100 DOWN 9% 0% Paid-for Search Online Display Spending 11% of travel companies said they spent more than £500,000 per year on PPC, and 25% said they spent over £1 million Online Interruptive Classifieds Formats Click throughs Average Click Through Rate in Travel Microsoft adCenter 12% 10% 8% 6% 4% 2% 0% Average Click Through Rate Actionable audience Intelligence Females are More Likely to Click! 70 Search Impressions 65 60 55 50 45 40 35 0 Ski Flights Car Hire Hotels Cruises Categories Female Male Holidays Generic Holidays Brands Impact of Events Monaco Grand Prix Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Why Microsoft adCenter? Unique intelligent targeting Using our unique demographic targeting, adCenter can deliver your ad to the right customer at the right time Eurostar Case Study Compared to other search engines adCenter achieved: •Click-to-sale ratio 35% higher •Cost-to-sale rate 16% lower •Click-through-rate nearly five times higher • The only search engine to achieve an increase in conversion rate from the previous month Key Takeaways • Your audience is online and growing • Spend on travel is on the rise • Internet is key tool in research, planning & purchase of travel • Be relevant, creative and engaging and the opportunity is yours • The web can connect your brand with consumers the other side of the world and in multiple markets simultaneously • Display plus search delivers measureable results Thank you