the mentoring model for college level professionals

advertisement

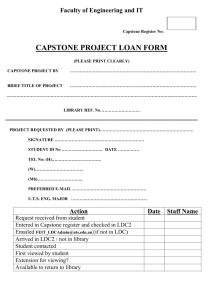

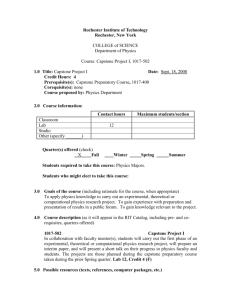

MARYLAND BMF PROGRAM AFFILIATE Presented By: Dr. Nicole Buzzetto-More 10-21-2011 Baltimore Museum of Industry Baltimore , MD PROGRAM AFFILIATE FOR BMF The goal of the Maryland Business, Management, & Finance Program Affiliate is to provide curriculum development & professional development for business education teachers in schools that are implementing the Business, Management, & Finance Maryland Programs of Study. This program represents a partnership between the MSDE & UMES. 2 CURRICULUM PLANNING AND DEVELOPMENT INNOVATION/ FOCUS ON AOL PROVIDE UPDATES SERVE AND REPRESENT BMF AREA FORUMS, WEBSITE, WORKSHOPS MSDE/ MBEA THE MARYLAND BMF PROGRAM AFFILIATE DEVELOPMENT OF TEACHING/ CURRICULUM RESOURCES PROFESSIONAL DEVELOPMENT INCREASE KNOWLEDGE/ SKILLS WORK ON COLLEGE CREDIT/ CERT FOR STUDENTS MOAS & CLEP 3 CURRICULUM WEBSITE & LOR VISIT OUR WEBSITE www.BusinessEducationMSDE.com 4 CTE COUNTS One recent study from Georgetown University (2010) predicts that, from 2008 to 2018, about twothirds of the job openings in the U.S. will require at least some postsecondary education & training. 14 million of those job openings will be in the middle-skill occupations, filled by workers w/ an associate's degree or occupational certificate. 5 “For far too long, CTE has been the neglected stepchild of education reform. That neglect has to stop & second, the need to re-imagine & remake career & technical education is urgent. CTE has an enormous, if often overlooked impact on students, school systems, & our ability to prosper as a nation. The mission of CTE has to change. It can no longer be about earning a diploma & landing a job after high school. The goal of CTE 2.0 should be that students earn a postsecondary degree or an industry-recognized certification--& land a job that leads to a successful career.” USDE. Secretary Duncan's Prepared Remarks at the Release of the “Pathways to Prosperity” Report February 2, 2011 6 • The percent of teens & young adults who are employed has fallen to its lowest level since the end of the Depression. • Only 9% of older, low-income black teens & 15% of lowincome Hispanic teens now have jobs. • White teenagers from middle to upper income families, are 4X more likely to be working than low-income black teens. Source Harvard Pathways to Prosperity Report, (2011) 7 “For all its importance, the role that CTE plays in building the nation's economic vitality often gets overlooked. In effect, the President has suggested that every American earn a minimum of two pieces of paper—a high school diploma, & a degree or industry-recognized certification. In the years ahead, young adults are likely to need those two credentials to secure a good job. That will become the ticket to success & a positive future. ” USDE. Secretary Duncan's Prepared Remarks at the Release of the “Pathways to Prosperity” Report February 2, 2011 8 Nationwide, more than 15 million high school & post-secondary students are enrolled in CTE courses. & more than half of high school graduates who participate in CTE today now go on to some form of postsecondary education. USDE. Secretary Duncan's Prepared Remarks at the Release of the “Pathways to Prosperity” Report February 2, 2011 9 RESEARCH HAS SHOWN THAT Students who complete a rigorous academic core coupled w/ a CTE program of study: • • • • • • have test scores that equal or exceed “college prep” students are more likely to pursue postsecondary education, have a higher grade point average in college, are less likely to drop out of college in the first year, & have an easier time finding internships & employment opportunities.. more likely to report that they developed problem-solving, project completion, research, math, college application, work-related, communication, time management & critical thinking skills during high school. • • • Grasmick, N. (2011). Across the nation during the month of February, Career and Technology Education programs are being celebrated during CTE Month. Maryland State Department of Education. Retrieved from: 2/16/2011 http://www.marylandpublicschools.org/NR/rdonlyres/F1D78DCC-1403-4029-A4CBBF6BB8106752/27453/oped_career__technology_03_2012.pdf Shatkin, L. (2008). Best Jobs for the 21st Century. St Paul, MN, Jist Publishing. U.S. Department of Education, National Center for Education Statistics. (2010) Digest of Education Statistics, 2009 (NCES 2010-013) 10 Top College Major Business remains the number 1 college major in the State of Maryland & in the Nation. *Source 2010 Princeton Review http://www.princetonreview.com/college/top-ten-majors.aspx. 11 From the Literature Published studies consistently find that • Business remains is the number 1 college major in the nation regardless of gender. • In terms of persistence to graduation & number of degrees awarded, business also holds the top spot. • Business programs represent nearly 25% of all degrees awarded annually. • Undergraduate business degrees rank highest in terms of employability & transference across industry sectors • Princeton Review. (2010). Top 10 College Majors. Retrieved 1/20/2011 from http://www.princetonreview.com/college/topten-majors.aspx U.S. Department of Education, National Center for Education Statistics. (2010) Digest of Education Statistics, 2009 (NCES 2010-013) Goudreau, J. (2010). Most Popular College Majors for Women. Forbes.Com. Retrieved 3/10/2011 from http://www.forbes.com/2010/08/10/most-popular-college-degrees-for-women-forbes-woman-leadership-educationbusiness.html Shatkin, L. (2008). Best Jobs for the 21st Century. St Paul, MN, Jist Publishing. 12 Do BMF programs of study prepare students for academic studies in undergraduate business programs? Yes, students who take business courses while in high school are found to be better prepared for academic success in college business programs. • Sweitzer, K. (2011). High School Preparation Tips for Aspiring Business Majors. Retrieved 3/17/2011 from http://businessmajors.about.com/od/undergradbusinessmajors/a/HighSchoolPrep.htm 13 What you teach makes a difference & Maryland has a commitment to strengthening the BMF cluster. 14 Maryland BMF State Approved Programs Of Study The Business, Management, & Finance (BMF) programs of study include: • • • • • Business Administrative Services, Business Management, National Academy of Finance, Accounting & Finance, & Marketing. They represent programs of study all found at the University level. 15 Curriculum Updates The BMF has been working on State-wide curriculum aligned w/ the Microsoft Office Specialist (MOS) certification exams and/or the CLEP exams for Accounting, Marketing, & Management. In the spring of 2011 the Administrative Services Pathway curriculum was completed. A draft accounting curriculum is currently in the review & revision process w/ an anticipated completion date of spring 2012. The marketing curriculum is in draft form & the management curriculum is under development both w/ an anticipated completion release in the summer of 2012. 16 Incorporating certification and/or national standardized examinations into the curriculum is designed to increase the career & college readiness of students across the State of Maryland, insure program validity & effectiveness as well as measure student achievement. 17 Assessment CLEP exams & Microsoft Certification testing provide external validation of a teaching program, while helping students to earn college credit and/or valuable professional industry certification. At the same time they yield student learning outcomes assessment data which is norm referenced. 18 !BIG NEWS! In the fall of 2011, the MSDE announced that changes would be made to the course sequences in the BMF approved programs of study. These changes reflect feedback received at a number or events across the State, advisory meetings, as well as other MSDE discussions. 19 So, What are the changes? • CLEP requirement for Business Management, Accounting, & Marketing Pathways. MOS 2007 or 2010 Certification Exams in the Business Administrative Services Pathway. • Elimination of the Financial Management Using Software Applications course, (customarily taken as the second course in the sequence) • Principles of Accounting and Finance now second course in all sequences. • The addition of a Capstone course requirement for the Management & Accounting Pathways to be taken as the final course in a pathway. • Complete Redesign of the Principles of Business & Management Course • Redesign of all courses in all pathways 20 New Sequences 21 THE CAPSTONE COURSE The CAPSTONE course is an independent/guided study course. In schools w/ fewer numbers of completers, completers from multiple pathways may be enrolled in a single capstone experience. The Capstone project is a personally-designed independently conducted activity which enables students to further their knowledge/skill in one or more of the course topics. The project represents a significant portion of effort & is therefore expected to represent attainment of advanced knowledge/skill levels in a particular area. 22 WHAT’S THE PURPOSE The capstone is designed as a way for students to: • • • • • • • Integrate & apply learned concepts into a single project Take a step toward their educational and/or career goals. Engage in deep learning Learn in a constructivist environment Complete a complicated real-world project Showcase their research skills & academic interests in anticipation of college or the job market Learn & hone leadership & organizational skills as they work through the capstone process 23 Capstone Projects • • • • • • • • Research paper • Primary research (focused research question, design instrument, collect data, analyze, interpret, & report). • Secondary research (gather knowledge that is not original, but do something w/ it that hasn’t been done before. Literature Review w/ Synthesis of Knowledge Business Plan or other proposal Entrepreneurial • (design, develop, initiate, & evaluate a small entrepreneurial endeavor) Creative project • (film a documentary covering a relevant topic, create a sample Website to promote an e-commerce endeavor, or another approved project includes a supporting paper, etc.) Case studies • (select a particular issue, phenomena, or concept & locate & discuss several cases relevant • For example in business ethics a student may select Enron, Tyco, WorldCom, & Arthur Anderson to examine. • Then they would address: background information about the company(ies) involved, background of the problem, the prevailing ethical culture of the company that allowed the events to transpire, the actual events, any ethical compliance or other program that either were or were not in place, why the case is ethically relevant to explore, the ethical issues at stake, what are the long & short term ramifications of the events, what did you learn from the case, what could have prevented the events, recommendations, & offer personal reflections.) Internship supported by a detailed report ****Dual enrollment 24 Expectations Exceeds standard Meets standard Almost meets standard Capstone Proposal Clearly defines the core question & the learning activities Defines the core question & the learning activities. Attempts to defines the core question & the learning activities Demonstrates an understanding of the theoretical support for the project. Demonstrates an attempt to theoretical support for the project. Provides background information & justification. Some attempt to provide background information & justification. Skillfully demonstrates an understanding of the theoretical support for the project. Provides robust background information & justification. Methodology proposed logically supports the core question Uses a sound & well-developed methodology for the project. Perceived Difficulty/Effort & Thoroughness of Project Writing Quality of Presentation Methodology supports the core question Skillfully analyzes a condition or situation of significance as the Analyzes a condition or situation of basis for exploration & reflection. significance. Timeline included. Thoughtful & realistic timeline included. The project is clearly challenging, requiring a sizable effort & The project is challenging, & will require effort commitment on the part of the student. The project is & commitment on the part of the student. multifaceted & complex. The project will require the student to The project is fairly & complex. The project implement/explore multiple program concepts. The project will require the student to implement/explore clearly comprehensive & represents a culmination of the program concepts. The project represents a learning experience. culmination of the learning experience. Skillfully uses precise & descriptive language that clarifies & Uses language that clarifies & supports intent. supports intent & establishes an authoritative voice. Demonstrates control of grammar, usage, Demonstrates consistent control of grammar, usage, punctuation, mechanics, syntax, sentence punctuation, mechanics, syntax, sentence structure, & spelling. structure, & spelling. Professional: The presentation is professional in style, color, format, & overall design. Slides are neither be empty or cluttered. All required slides as identified are included. (See separate Properly Cited: The presentation is clearly cited & the work grading criteria) should not be plagiarized Mechanics: The presentation should be free from errors in spelling, grammar, word usage, & punctuation. Content: The content is clear, complete, & demonstrates an ability to critically analyze concepts. Adherence to Proposed Deliverables & Schedule Overall Quality of Project Content: The content is clear, & indicates an effort to critically analyze concepts. Components are either inadequate or missing Methodology addresses the core question Attempts to analyze a condition or situation of significance . Attempt to include timeline. Project requires some effort & commitment , attempts to be complex., and attempts to require the student to implement/explore program concepts. The project attempts to represents a culmination of the learning experience. Attempts to use appropriate wording, grammar, usage, punctuation, mechanics, syntax, sentence structure, & spelling w/ some errors clearly evident. Presentation is for the most part professional Presentation attempts to be professional. in style, color, format, & overall design. The presentation has citations & the work is not Attempt is made to include citations plagiarized The presentation attempts to employ proper mechanics; however, errors are Mechanics: The presentation is mostly free from errors in spelling, grammar, word usage, evident. & punctuation. Below standard Components are either inadequate or missing Components are either inadequate or missing Components are either inadequate or missing Attempt is made to have content that is clear, & indicates an effort to analyze concepts. Delivery: Appropriate verbal & non-verbal Delivery: Exemplary verbal & non-verbal communications is communications . Presentation is employed. The presentation is extemporaneous w/ no reading extemporaneous . Student wears of content. Student wears professional attire. Delivery indicates professional attire. Shows preparation. student practice presentation in advance of delivery. Attempt at appropriate verbal & nonverbal communications is employed. Attempt at an extemporaneous presentation. and professional attire. Student continuously meets all project deliverables in accordance w/ planned timeline. Student is clearly able to organize his/her time appropriate to the project. Student meets project deliverables in accordance w/ planned timeline. Student is usually able to organize his/her time appropriate to the project. Student attempts to meet project Components are deliverables. Student attempts to organize either inadequate his/her time appropriate to the project. or missing Clearly defines the core question & the learning activities. Supports question (s) w/ an analysis of relevant & accurate evidence. Elaborates on significance of knowledge acquired& makes insightful connections to thesis/topic. Skillfully analyzes a condition or situation as basis for reflection. Makes connections between personal ideas & experiences leading to new perspective or insights. Thoroughly maintains focus. Provides closure leaving audience w/ something provocative to think about. Defines the core question & the learning activities. Supports the core question w/ analysis. Presents new knowledge acquired or makes connections to thesis/topic . Makes connections between ideas & experiences . Maintains focus. Provides conclusion. Attempts to defines the core question & Components are the learning activities. Attempts analyses. either inadequate Attempts to present new knowledge or missing acquired or makes connections to thesis/topic. Attempts to makes connections between ideas & experiences . Attempts to remains focused. Conclusion attempted.. 25 GRADING CRITERIA FOR CAPSTONE PROJECTS Capstone Proposal 10% Perceived Difficulty/Effort and Thoroughness of Project 10% Writing 10% Quality of Presentation 20% Adherence to Proposed Deliverables & Schedule 10% Overall Quality of Project 40% 26 Capstone Presentation All students will be required to present their CAPSTONE project before their fellow students. PowerPoint Presentation grading criteria: • • • • • Professional: The presentation should be professional in style, color, format, & overall design. Slides should neither be empty or cluttered. All required slides as identified are included. Properly Cited: The presentation must be cited & the work should not be plagiarized Mechanics: The presentation should be free from errors in spelling, grammar, word usage, & punctuation. Content: The content should be clear, complete, & indicate an effort to critically analyze concepts. Delivery: Appropriate verbal & non-verbal communications is employed. The presentation is extemporaneous w/ no reading of content. Student wears professional attire. Delivery indicates student practice presentation in advance of delivery. 27 GUIDE CAPSTONE GUIDE IS UNDER DEVELOPMENT 28 Principles of Business Administration & Management Redesigned course: • Much more robust • Better reflective of AACSB AOL Standards • Aligned w/ most Intro to Business Courses found in Higher Education • Incorporates more management concepts 29 Course Information: Principles of Business Administration and Management Course Description: This course provides a foundational understanding of the role of business in a global society, American business as a dynamic process, forms of business ownership, management concepts, marketing, production and distribution, and accounting and finance. Along with a brief historical perspective, business terminology and principles will be emphasized. Students will learn to analyze the functions of business through evaluating, planning, organizing, and controlling. Students will develop the communication skills that will be necessary for success in the workplace and college. This course will help students to contribute to the improvement of economic citizenship and professional literacy through analysis of the business and economic environment, in which we all live. Goals 1. 2. 3. 4. 5. 6. Upon successfully completion of the course, each student will be able to: Describe fundamental business concepts, key terminology, and the role of business in society. Discuss major management concepts. Discuss and apply oral, written, organizational, interpersonal, and leadership business communications skills. Identify core business ethics and business law concepts. Explore different career options in business. 30 Principles of Business Administration and Management Learning Goals and Indicators Describe fundamental business concepts, key terminology, and the role of business in society. 1. i. ii. iii. iv. v. vi. vii. viii. ix. x. xi. xii. xiii. xiv. xv. xvi. xvii. xviii. xix. Explain the role of business in a local and global society Identify current topics and new concepts in the world of business Explain key words and phrases used frequently in the business community Identify the characteristics of the American enterprise system and how it compares with other economic systems. Discuss the impact of computer and internet technologies on businesses, individuals, and the economy. Identify different business classifications (agricultural and mining, service, transportation, utility, consumer, financial, manufacturing, real estate, hospitality, information, entertainment/recreation) Discuss the role of profit motive and the free market system Describe the importance of marketing Discuss consumer rights and responsibilities and the development of consumer knowledge for effectively obtaining and using economic goods and services. Explain the basic factors involved in product mix decisions, the product life cycle, and pricing Explain the basic elements of production and distribution Discuss the role of accounting and finance in contemporary business practices Explain assets and liabilities Discuss the function of the financial services industry Discuss the function of credit in business and how to use credit wisely in the management of family and personal finances. Describe the importance of having a savings plan and the most common types of saving and investments. Identify three major sources of short term financing (short term loans, trade credit, commercial paper) Explain the nature and cause of economic risk and how insurance protects from the risk of property loss or earning power. Explain basic forms of business ownership (sole proprietorship, partnership, cooperative, corporation) 31 2. Discuss major management concepts. i. Discuss management concepts, principles, and values ii. Describe the process of management iii. Define basic management theories including (TQM, Contingency Theory, Maslow’ Hierarchy of Needs, Human Relations Approach, Theory X/Y, Japanese Theory Z, Scientific Management, Chain of Command) 3. Discuss and apply oral, written, organizational, interpersonal, and leadership business communications skills. i. Discuss key aspects of Business Communications ii. Identify and prepare all Forms of business communications iii. Incorporate appropriate leadership and supervision techniques, customer service strategies, and personal ethics standards to communicate effectively with various business constituencies. iv. Judge how relationships, communication, and networking skills can contribute to successful career growth. v. Identify all of the elements of a successful business plan (Entrepreneurship) 32 4. Identify core business ethics and business law concepts. i. ii. iii. Discuss the fundamentals of business ethics Describe the rights, and responsibilities of the workers, investors, managers and the government in the American business environment. Discuss the major categories of law impacting business 5. Explore different career options in business. i. ii. Explain and give examples of, the need for well trained workers and for the necessity of considering careers in which each individual can make the greatest contribution to personal, civic, social and economic well-being. Identify career opportunities in the world of business 33 34 ACCOUNTING PATHWAY OBJECTIVES Upon completion of the Financial Accounting Pathway and passage of the CLEP examination students will have been able to demonstrate: 1. Knowledge through the ability to recall and to make associations between accounting concepts, terminology, procedures, and rules such as the rules of double entry accounting, the accounting cycle, forms of businesses, transaction analysis, accounting principles, etc.); 2. Comprehension and application through the student’s ability to recognize, explain, and associate elements in an income statement; 3. Analysis through a student’s ability to analyze data contained on a balance sheet such as depreciation/amortization/depletion, valuation of inventories, long term liabilities, cash and internal controls, retained earnings, preferred and common stock, liquidity/solvency/activity analysis 4. Analysis and synthesis through a student’s ability to analyze and utilize cash flow information such as Operating, financing and investing acting 5. Synthesis through a student’s ability to make predictions and/or propose actions based on investments and contingent liabilities 35 FINANCIAL ACCOUNTING CLEP EXAM COMPOSITION 20-30% General Topics 20-30% The Income Statement 30-40% Cash and internal controls Valuation of accounts and notes receivable (including bad debts) Valuation of inventories Acquisition and disposal of long-term asset Depreciation/amortization/ depletion Intangible assets (e.g., patents, goodwill, etc.) Accounts and notes payable Long-term liabilities (e.g., bonds payable) Owner's equity Preferred and common stock Retained earnings Liquidity, solvency, and activity analysis Statement of Cash Flows Less than 5% Presentation format issues Recognition of revenue and expenses Cost of goods sold Irregular items (e.g., discontinued operations, extraordinary items, etc.) Profitability analysis The Balance Sheet 5-10% Generally accepted accounting principles Rules of double-entry accounting/ transaction analysis/accounting equation The accounting cycle Business ethics Purpose of, presentation of, and relationships between financial statements Forms of business Indirect method Cash flow analysis Operating, financing, and investing activities Miscellaneous Investments Contingent liabilities 36 Course Information: Principles of Accounting & Finance Course Description: The Principles of Accounting & Finance course provides students w/ knowledge necessary to manage & maintain a company’s financial resources in daily operating decisions. A mastery of fundamental accounting concepts, skills & competencies is essential to making informed business decisions. Students will learn to apply generally accepted accounting principles to determine the value of assets, liabilities, & owner’s equity as they apply to various forms of business ownership. Students will prepare, interpret, & analyze financial statements using manual & computerized systems for service & merchandising businesses. Students will apply appropriate accounting principles to payroll & tax liabilities. Students will identify positions & career paths in the field of accounting. Students will examine the role of ethics & social responsibility in decision making. When students complete this course, they will know & be able to: Recognize & define basic accounting principles, concepts, & terminology using Generally Accepted Accounting Principles (GAAP as it applies to assets, liabilities, & owner’s equity. Explain the forms of businesses & the purpose of all steps of the accounting cycle for the different types of business entities & recognize, explain, & associate elements in an income statement; Apply basic accounting principles to prepare & complete payroll & tax records. Use MS Excel & other software for basic accounting Apply internal controls to maintain & protect cash within the organization. Assess the financial condition & operating results of a company by analyzing & interpreting balance sheets, income statements, & other information to make informed business decisions. Discuss ethical & legal issues in business & accounting such as the FSGO & SOX Discuss careers in accounting, & identify the role that accountants play in business & society. Discuss fundamental financial concepts. Assessments Teacher-designed end-of-course assessment School system-designed end-of-course assessment E-Portfolio Project Partner-developed exam Nationally recognized examination: (other) 37 Course Information: Advanced Accounting Course Description: This course is designed to be the second accounting course for students enrolled in the Financing & Accounting Program of Study. This course provides students w/ accounting knowledge that will prepare them for post-high school levels of education & entry-level positions in the work force. Focus will be on accounting procedures necessary to address long & short-term assets & investments, long & short-term liabilities, inventory management & accounting ratios used the decision-making process. A comprehensive study of the accounting procedures used in establishing corporations, declaring & paying dividends, the formation & dissolution of partnerships, distribution of net income & owners’ equity statements is included in this course. Career pathways for accounting will be examined & the use of accounting knowledge in a variety of career clusters is also explored. Awareness of ethical issues & application of ethical decision-making models will be reinforced throughout the course. Upon completion, opportunities will be made for students to earn college credit through such methods as articulation agreements w/ local colleges, dual enrollment & CLEP exams. When students complete this course, they will know & be able to: • • • • • • • Apply advanced accounting theory including generally accepted accounting principles (GAAP). Explain the forms of businesses & the purpose of all steps of the accounting cycle for the different types of business entities & recognize, explain, & associate elements in an income statement; Assess the financial condition & operating results of a company by analyzing & interpreting financial statements using the appropriate the ratios. Demonstrate the ability to journalize, post & make necessary calculations needed for long & short-term assets & investments, long & short-term liabilities, & inventory management. Use MS Excel & other software for accounting Complete necessary calculations & entries as they apply to corporations & partnerships. Discuss ethical & legal issues in business & accounting such as the FSGO & SOX Discuss careers in accounting, & identify the role that accountants play in business & society. Assessment: Nationally recognized CLEP examination 38 Advanced Accounting Performance Indicators (Sample) Apply advanced accounting theory including generally accepted accounting principles (GAAP). Explain the forms of businesses and the purpose of all steps of the accounting cycle for the different types of business entities and recognize, explain, and associate elements in an income statement; 1. • • Define and use advanced accounting terminology throughout the course. Explain the principle of: Going Concern, Business Entity, Unit of Measurement, and Fiscal/Accounting Period/Cycle, Adequate and Full Disclosure, Consistency of Reporting, Historical Cost, Matching Expenses with Revenue, Realization of Revenue and Objective Evidence. Assess the financial condition and operating results of a company by analyzing and interpreting financial statements using the appropriate the ratios 2. • • • Use given amounts to calculate specific ratios Interpret ratios as they apply to specific financial statements Describe the proper use of the following ratios in analyzing the performance of a business. • • • • • • • • Acid Test Price Earnings Ratio (PPE) Working Capital Ratio Inventory Turnover Ratio Ratio of PPE to Long Term Liabilities Ratio of Stockholders Equity to Liabilities 39 Sample Unit Unit 4 The value of long term assets The depreciation of property, plant and equipment using multiple methods. Necessary accounting procedures to dispose of property, plant and equipment Factors in computing depreciation: cost, residual value, depreciable cost, and estimated useful life. Set up a basic depreciation schedule, defining each element of the schedule (cost, annual depreciation, accumulated depreciation, and carrying value). Revising depreciation rates and how this works. Intangible assets Owner's equity Preferred and common stock Retained earnings Liquidity, solvency, and activity analysis Valuation of accounts and notes receivable (including bad debts) Valuation of inventories Using the direct write-off method to journalize and post entries for uncollectible accounts. Journalizing estimated uncollectible accounts using the net sales and the aging method. The allowance method, journalize Estimated uncollectible accounts. Reinstate previously written off accounts. The parts of a promissory note. How to calculate maturity dates, interest amounts and maturity values. Journalize and post entries to accept note receivable. Journalize and post entries to retire or renew a note receivable. Journalize and post entries to discount a note receivable. Interest and non-interest bearing notes payables. Interest bearing note payable. A non-interest note payable. Renewing notes payables. Accounting procedures related to mortgage payables The different types of bonds. The purposes, advantages and disadvantages to issuing a bond Post entries for issuing a bond payable at face value and at a premium. Post entries for bond interest. Post entries for establishing and maintaining a bond sinking fund. Post entries redeeming a bond 40 PROFESSIONAL DEVELOPMENT •Week long MOS Cert Training Course Each Summer at UMES •Currently developing an accounting workshop to help prepare teachers for the new curriculum to be offered at BMI •Will be offering a 6 week long MS Word Workshop/Course here at BMI •Annual 1-Day Workshop Each October in conjunction w/ MSTA Day •Update sessions at annual MBEA conference in March in Ocean City 41 ANY QUESTIONS? 42 THANK YOU www.BusinessEducationMSDE.com