Mobility Epson

advertisement

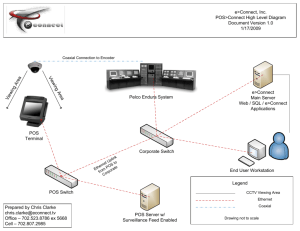

Dave Murphy Strategic Alliances Manager 2014 Mobile POS is Here to Stay •What ultimate form or shape it takes remains to be seen, but in the six years since it disrupted the slowmoving beast we know as Retail, it has definitely changed the landscape. 2 The Key Driver: Apple • While you’ve heard it many times, the key driver of much of this was… Apple. • Milestones: – iPhone: 2007 – iPad: April 2010 – iPhone 4S: October 2011 • Enough horsepower to run mobile POS 3 Key Trends • 3.6M tablets in Retail by 2017 • 69.6% Hospitality operators plan to add mPOS • No more one-trick mPOS Ponies – All merchants, even SMBs, want mPOS solutions to do more for them than enable card payments * Sources: IHL Services, Hospitality Technology, PYMNTS.com 4 Key Opportunities • Tablet POS ISVs are seeking dealers • Domain expertise IS required • There’s money to be made – Networking – Installation – Support • Accounting is different – Monthly residual vs. monolithic 5 How Do Retailers Use Mobile? • Four Stages – Stage 1 – Manager uses tablet instead of back-office PC – Stage 2 – Extended to store associates – Stage 3 – Store mobile POS – Stage 4 – Customer device checkout 6 Top Mobility Applications Source: RIS/IHL Group 2014 Store Systems Study 7 Top Choices: iPad and iPhone Source: IHL Group 2014 Mobile POS Study 8 What Me Worry? Source: IHL Group 2014 Mobile POS Study 9 SMB Advances to Stages 3 and 4 • In the small and medium business space, mobile POS is an absolute reality • Over 500 POS Apps – 294 iOS apps – 240 Android apps * Search Criteria: “point of sale, cash register, POS, mPOS” 10 Advantages of Tablet POS • Cost savings • Zero OS license fees • Elegant interface • Eases employee training • A tool for better customer service • Developer-friendly application environment • Modernizes the operator’s brand 11 Epson mPOS Solutions Epson Printer Options 12 mPOS-Friendly Printers • DHCP-enabled out of the box 13 Introducing OmniLink S m a r te r Way to N ex t G e n e rat i o n P O S 14 OmniLink Models 15 TM-i Use Case 1: Tablet POS Printing • Native or Cloud-based Tablet POS Applications – ePOS-Print SDK and API for print commands 16 TM-i Use Case 2: Device Management • Device Hub for Tablet POS – Peripheral management and control via ePOS-Device – Reliable/cost-effective connectivity vs. Bluetooth or WiFi Scale Payment Device Cash Drawer 17 Bar Code Scanner Customer Display TM-i Use Case 3: Print Server • Network Epson TM Printer Control – Can control printing on up to 20 network printers Kitchen Bar Expo Valet 18 TM-i Use Case 4: Remote Applications • Facilitator for Online Ordering and Remote Requests – ePOS-Print for inbound requests print commands – Server Direct Print for outbound 19 TM-i Use Case 5: Data Parsing • Data Parsing for Cloud Applications – Printer connected to POS terminal – Print stream data is intercepted, parsed and sent to the cloud to be made actionable 20 OmniLink TM-i Recap • Facilitator for Tablet POS Data Points Device Hub Apps Digital Signage Loyalty OmniLink Coupons Mobile POS Analytics Digital Receipts 21 – Receipt printing – Device management • An alternative solution for online ordering applications, replacing: – Fax machines – Desktop printers – Tablets • A limited-use data gateway for adding functionality to POS and ECR environments ePOS Is The Key • ePOS-Print and -Device are the keys – An Epson differentiator – Perfect for cloud/tablet ISVs who just want to code in XML and not have to learn ESC/POS for printing – Ideal solution for tethered peripheral management • • • • • 22 Scanner Scale MSR 2x20 Customer Display Etc. OmniLink Models 23 DT Use Case 1: PC-POS Architecture • PC-POS System – OpenSUSE Linux or POSReady 2009 – APD or UPOS Device Management and Control 24 DT Use Case 2: Web Architecture • Web or Cloud-based Applications – XML to ESC/POS Translation – ePOS-Device Management and Control 25 OmniLink Comparison Model Specs Product Number TM-T20II-i TM-88V-i TM-70-i TM-L90-i TM-88V-DT TM-T70II-DT CPU ARM9 400 MHz ARM9 400 MHz ARM9 400 MHz ARM9 400 MHz Intel Atom 1.8GHz Intel Atom 1.8GHz Main Memory 256 MB 256 MB 256 MB 256 MB DDR2 4.0GB DDR2 4.0GB SSD 16GB, 32GB, larger SSD available SSD 16GB, 32GB, larger SSD available Hard Drive Interface - - - USB USB2.0 x 2 USB2.0 x 4 USB2.0 x 4 USB2.0 x 4 USB2.0 x 6 USB2.0 x 6 Ethernet 10Base-T/ 100Base-x 1 10Base-T/ 100Base-x 1 10Base-T/ 100Base-x 1 10Base-T/ 100Base-x 1 10Base-T/ 100Base-x 1 10Base-T/ 100Base-x 1 Serial D-sub 9 pin x 1 D-sub 9 pin x 1 D-sub 9 pin x 1 D-sub 9 pin x 1 D-sub 9 pin x 1 D-sub 9 pin x 1 VGA x 1 VGA x 1 VGA x 1 VGA x 1 VGA x 1 Display - or or or OS Embedded Linux Embedded Linux Embedded Linux Embedded Linux POSReady 2009 OpenSUSE 11.1 POSReady 2009 OpenSUSE 11.1 Device Drivers ePOS-Print, ePOS-Device ePOS-Print, ePOS-Device, Server Direct Print ePOS-Print, ePOS-Device, Server Direct Print ePOS-Print, ePOS-Device, Server Direct Print ePOS-Print, ePOSDevice, Server Direct Print ePOS-Print, ePOSDevice, Server Direct Print Software 26 - Final Thoughts • Mobile for store associates is the single biggest trend since Internet at the store level. • The core POS market is changing, and much faster than we think. • Apple envy is a very real and very powerful driver. • The mobile trend is being driven by the CEO on down. • It is not going away, and one needs to be mindful of the potential impacts. Source: Lee Holman, IHL Group 27