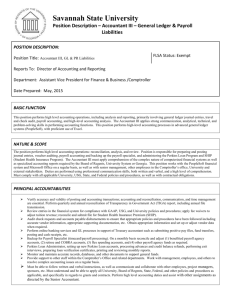

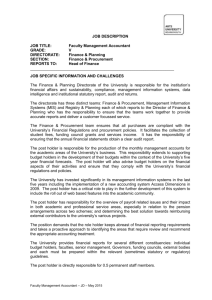

Position Description – Accountant III – General Ledger & Payroll

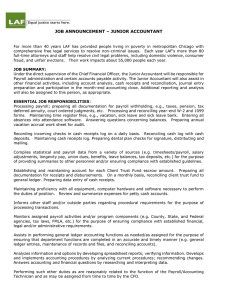

advertisement

Savannah State University Position Description – Accountant III – General Ledger & Payroll Liabilities POSITION DESCRIPTION: Position Title: Accountant III, GL & PR Liabilities FLSA Status: Exempt Reports To: Director of Accounting and Reporting Department: Comptroller Date Prepared: May, 2015 BASIC FUNCTION This position requires high level accounting operations, such as analysis and reporting, primarily involving general ledger journal entries, travel and check audit, payroll accounting, and high-level accounting analysis. This position requires strong communication, analytical, technical, and problemsolving skills. Must be an advanced computer (PC) user, able to perform high-level accounting processes in advanced general ledger systems (PeopleSoft), and proficient in the use of Excel. NATURE & SCOPE The position performs high level accounting operations, such as reconciliation, analysis, and review. Position is responsible for preparing and posting journal entries, voucher auditing, payroll accounting and backing up the payroll specialist, and administering the Perkins Loan Program and SHIP (Student Health Insurance Program). Must be able to comprehend the complex nature of computerized financial systems as well as specialized accounting reports required by the Board of Regents, University System or Georgia. This position works with the PeopleSoft financial system and Microsoft Office on a regular basis, as well as with senior management, other employees in the Comptroller’s office, University and external stakeholders. Must possess professional communication skills, both written and verbal, and a high level of comprehension. Must comply with all applicable University, USG, State, and Federal policies and procedures, as well as with contractual obligations. PRINCIPAL ACCOUNTABILITIES Verifies accuracy and validity of posting and accounting transactions; accounting and reconciliation, communication, and time management are essential. Performs quarterly and annual reconciliation of Transparency in Government Act (TIGA) report, including annual file transmission. Reviews entries in the financial system for compliance with GAAP, USG, and University policies and procedures; applies fee waivers to adjust tuition revenue; reconciles and submits file for Student Health Insurance Premium (SHIP). Audits check requests and accounts payable disbursements to ensure that appropriate policies and procedures have been followed including accurate vendor information, appropriate supporting documentation, etc. Obtains appropriate information and sets up or adjusts vendor data when required. Performs online banking services and GL processes in support of Treasury accountant such as submitting positive pay files, fund transfers, posting and cash receipts, etc. Backup for Payroll Specialist (timecard/payroll processing). On a monthly basis reconciles and adjusts (1) benefitted payroll agency accounts, (2) retiree and COBRA accounts, (3) flex spending accounts, and (4) other payroll agency funds as required. Perkins Loan Administrator, setting up new Perkins Loan accounts, processing advances and credit balance refunds, performing exit interviews, preparing loan verification certificates, printing and reviewing monthly reports. Monitors and maintains accurate records, databases, and other documents to support general funds. Provides support to other staff within the Comptroller’s Office and related departments. Works with management, employees, and others to resolve complex accounting issues on a regular basis. Must be able to follow written and verbal instructions, as well as communicate and collaborate with other employees, project managers, sponsors, etc. Must understand and be able to apply all University, Board of Regents, State, Federal, and other policies and procedures as applicable, and specifically in regards to grants and contracts. Performs high level accounting duties and assists with other assignments as directed by the Senior Accountant. SPECIALIZED KNOWLEDGE AND EXPERIENCE REQUIRED Position requires a minimum of a Bachelor’s degree in Accounting, but an advanced degree is desired. Must have a minimum of five (5) years’ experience in a complex accounting environment. Governmental accounting is desired. Requires strong analytical and technical skills, the ability to work independently, and professional communication skills to work with employees of the University and external parties.