ADD PROPOSAL TITLE HERE (All Caps, Calibri, 36pt)

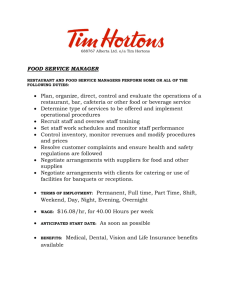

advertisement