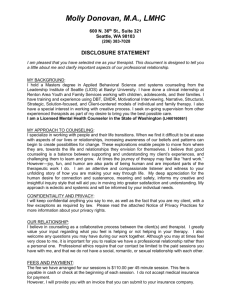

Client Assistance Fund

advertisement

Client Assistance Fund Application (Please read carefully and thoughtfully) Client(s) Name:_______________________________________________________________ Care and Counseling is a private, non-profit organization that was established in 1968. Our mission is to enhance emotional, relational and spiritual well-being through quality and affordable counseling, professional training and community education. We welcome each and every client to our facilities located throughout the St. Louis metro area. We strive to make your visits with us as comfortable and inviting as possible. We have over 20 professionally trained counselors and 4 psychiatrists available to assist children, adults, couples and families from the age of 3 to 93 and everywhere in between. We invite you to feel welcome and a part of our mission of providing anyone who walks through our doors with a little more hope and healing in their lives. If we can ever assist you in any way, please feel free to talk with your counselor or any of our office staff. What is the Client Assistance Fund (CAF)? At Care and Counseling, part of our mission is to provide counseling to people who do not have health insurance coverage and might have difficulty affording our services. Financial need can impact any individual or family. Accordingly, the Care and Counseling Client Assistance Fund is available to subsidize a portion of your fee if you are unable to pay the standard fee. Everyone is required to pay a fee for counseling services, but the CAF reduces the portion you are required to pay. Who provides CAF Funds? Each year the Care and Counseling Board of Directors raises funds to support our CAF through a variety of fundraising activities in which congregations, corporations, foundations and individuals in our community offer contributions in support of our mission. We do not receive funds from United Way, nor do we receive support from any government program. How is my portion of the fee established? Your fee is established based on a combination of household income, resources and expenses. Once you have filled out the CAF Application and have provided proof of income, you will discuss your application and any related financial issues with your counselor who will use a sliding scale to establish the fee - most often in your first session. What should I consider before applying for CAF Funds? The CAF Funds are provided for those who are unable to pay the standard fee. Before applying for CAF Funds, we ask you to consider the following: Do I have a savings account, investments or other assets? Do I have a family member who can provide financial support to aid in my therapy? Do I have an employer or congregation that would be willing to contribute to my therapy? Am I married, but cannot use the income of my partner because I would be physically endangered if they discovered my therapy? Page 1 Client Assistance Fund Application Date of Application: _____/_____/__________ Name of client: _____________________________________________________________ Name of responsible party: ___________________________________________________ List other types of Income (unemployment compensation, any and all government aid, social security, worker’s compensation, pension, rental income, alimony, child support, interest income, cash gifts etc). Source of Income Amount Source of Income Amount 1_____________________________________________ 4____________________________________________ 2_____________________________________________ 5____________________________________________ 3_____________________________________________ 6____________________________________________ List other Assets or Accounts (checking accounts, savings accounts, investments) and Amounts: 1____________________________________________ 3___________________________________________ 2____________________________________________ 4___________________________________________ Other Third Party(ies) who will be paying a portion of the fee (family, employers, church): TOTAL HOUSEHOLD INCOME PER YEAR (GROSS): $_______________________ **NOTE: It is the policy of the Care and Counseling Inc that individuals applying for any Client Assistance Funds provide verification of income, such as tax return and/or pay stub, or similar proof. Please bring copies of these documents with you, to your first appointment. I have read the information on page 1 regarding Client Assistance Funds and confirm that I do not have other means to pay for my fees. __________ (Please initial here). I understand that my financial status will be reviewed on a regular basis and that my fee may be adjusted when/if my financial circumstances change. I understand that a change in my insurance status should be reported immediately, to my counselor. I understand that I will be billed my agreed upon session fee for any missed or cancelled (with less than 48 hours notice) sessions. Client or Parent/Legal Guardian Signature Date Counselor Signature Date FOR CARE AND COUNSELING USE: Of the $150 First/$135 Ongoing Session Fee: Client is to pay this amount: Third Party will pay this amount: Amount of assistance funds used: Name and contact information for third party: Approved By: Page 2 If you would like to apply for additional assistance based on income and expenses, please fill out page 2 of this application. List members of the Household Relationship Birth date Occupation Salary 1_________________________________________________________________________________________________ 2_________________________________________________________________________________________________ 3_________________________________________________________________________________________________ 4_________________________________________________________________________________________________ 5_________________________________________________________________________________________________ List monthly expenditures: Mortgage/Rent $________________ Telephone(s) $ ________________ Food $________________ Auto(s) $________________ Auto Insurance $________________ Medical Insurance $________________ Medications/Dr’s $________________ List other outstanding debts: Name of Company 1 2 3 4 5 6 Please explain any significant financial factors: Property Taxes Electric/Gas/Water Cable/Internet Other Utilities Other Auto Exp Clothing Other_____________ Balance Owed $________________ $________________ $________________ $________________ $________________ $________________ $________________ Monthly Payment