Unit 3 * Recording Transactions in T-Accounts

advertisement

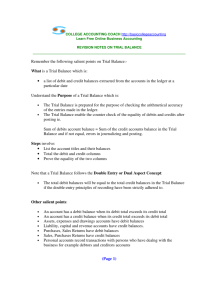

Unit 3 – Recording Transactions in T-Accounts Key Concepts • • • • • • Balance sheet to T-account ledger Analyze transactions using debits and credits Record transactions in T-accounts Calculate the balances in accounts Trial balances New balance sheet from Trial Balance Accounts • Transaction analysis sheet – impractical due to the large number of financial events that occur each day in business. • More efficient method is to keep a separate record of the changes for each item in a balance sheet = Account Ledger: is a group or file of accounts that can be recorded on paper or via computer T-Accounts Account Title Left Side Debit Right Side Credit - As transactions occur, (as in Unit 2) we will make the resulting changes to the T-accounts that were affected by the transaction. - T- Accounts are not needed in business but are often used by accountants for their rough work when they analyze transactions. Recording Balances in Accounts • there is a separate account for each asset and liability and for the owner’s equity. Opening balance of an asset Recorded on the left or debit side of its account ****************************************** Opening balance of liabilities and owner’s equity Recorded on the credit or right side of their accounts. Opening the Ledger - You can visualize the balance sheet as a large “T”. Asset accounts normally have debit balances (left side), while liability and owner’s equity accounts have credit balances. (right side) Opening the Ledger To open accounts in the ledger: 1) Place the account name in the middle of each account 2) Record the date and opening balance from the balance sheet on the appropriate side in the account Sep. 30 Sep. 30 Sep. 30 Sep. 30 Sep. 30 Sep. 30 Sep. 30 Sep. 30 Sep. 30 Double-Entry Accounting • Requires a …. Debit Amount = Credit Amount for each transaction. ** Remember, the LHS must equal the RHS ** Here, this is known as having the ledger in balance. Recording Transactions in Accounts - Step 1: Determine which accounts change in value as a result of the transaction. ** 2 or more accounts will change for each transaction ** - Step 2: Identify the type of account that has changed. (asset, liability, owner’s equity) - Step 3: Is the change an increase or decrease in the account? - Step 4: Is the change a debit or a credit in the account? The Ledger must remain in balance. Examples – Recording Transactions • Go through 5 examples. – Pages 41-44 Summary Rules – Adjusting Records as a result of Transactions. Types of Accounts Increases Decreases Asset accounts Debit Credit Liability and Owner’s Equity accounts Credit Debit ** Please make sure your answer makes sense. Take some time to think about it. In other words, I do not want you to simply memorize the above table when you are doing these exercises. Calculating New Balances in the Accounts 1) Add up the debit side of the account. 2) Add up the credit side of the account. 3) Subtract the smaller amount from the larger and place the answer on the larger side of the account. This is the new account balance. ** The difference between the totals of the two sides of an account is called the account balance. New Account Balances… Cash Jul. 31 6 325 Aug. 5 705 Aug. 2 500 7 535 7 5 000 1 240 11 825 New Balance 10 585 11 825 – 1 240 = 10 585 (Debit total) (Credit total) New Account Balance New Account Balances… Accounts Payable Aug. 5 705 Jul. 31 4 680 Aug. 5 25 7 1 100 5 805 New Balance 5 805 – 705 = 5 100 (Credit total) (Debit total) 5 100 New Account Balance Apply your knowledge! Questions (1-2) Preparing a Trial Balance - is a list of all the accounts with their current balances. (listed in the order that they appear in the ledger) • Purpose: to check the accuracy of the ledger - In other words, to double-check that… ($) Debit Balances = ($) Credit Balances …after a series of transactions. If they are equal, the ledger is said to be in balance. (if not, it is out of balance) - Trial balances are usually done at the end of each week or month. Trial Balances • are used within a business… • Therefore they are considered informal statements, whereas balance sheets are considered to be formal statements. • Therefore, abbreviations are permitted. Example Trial Balance Another Example in the textbook on pages 46-47. Limitations of the Trial Balance • the trial balance does not indicate if the wrong accounts were used to record a transaction. – Reversing the debit and credit (example page 47) – Trial balance will balance mathematically because the errors offset each other. – Trial balance can easily be transferred back to a Summary Unit 3 - GAAP • Double-entry accounting – Total debits = Total credits (before and after transactions) • Assets – Increase on the debit (left) side and decrease on the credit (right) side. • Liabilities and owner’s equity – Increase on the credit (right) side and decrease on the debit (left) side. • A trial balance – Proves mathematical accuracy of the ledger. It does not indicate that transactions were all correctly recorded as debits and credits. Apply your knowledge! Questions (3-10)