Financial accounts

advertisement

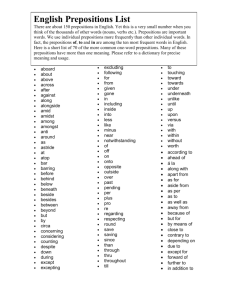

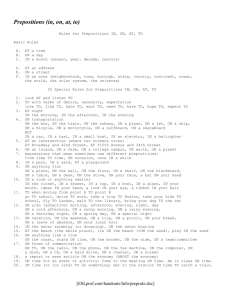

Company performance Why is it important to know how your company performes? Companies need to know how they are performing in order to analyse problems, find solutions and make plans for the future. Management accounts provide data about operational efficiency Financial accounts show how net lending or borrowing is achieved by financial transactions. It also records transactions in external assets and liabilites. Financial account consists of direct investment, portfolio investment and reserve assets. Financial accounts also give information about revenue the company receives. Revenue is the entire amount of income before any deductions are made. It is the amount of money ( both cash and non cash) that a company actually receives from its activities, mostly from sales of products or services to customers. With this information a company can then calculate how much money it has made (profits) or how much it has lost (losses) during a specific period. The companies whose shares are sold on the stock exchange are called: Listed companies These companies have to present their accounts to the public in an annual report. The annual report is the formal financial statement issued yearly by a corporation. It shows asstes, liabilities, revenues, expenses and earnings how the company stood at the close of the business year. The annual report also: Discusses the company’s financial affairs and performes a useful function in a free market system because it transmits information from the company to its shareholders and investing public. Although the report is addressed to shareholders, other people who have a stake in the business (employees, suppliers, customers and lenders) will also find it informative. A typical annual report consists of: Auditor’s report: This summary written by independent public accountants shows whether the financial statements are complete, reliable, and prepared according to generally accepted accounting principles (GAAP). Report of management: This letter, usually from the board chairperson, takes responsability for the validity of the financial information in the annual report. Financial statements and notes: These provide the complete numbers for the company’s financial performance and recent financial history. The SEC (Securities and Exchange Commission) requires: statemant of earnings, statement of cash flows and statement of financial position. Management discussion: This information summarizes a company’s financial condition and performance over five years or longer, including gross profit and net earnings (net income). Selected financial data: This series of short, detailed reports discusses and analyses the company’s performance. It covers results of operations, and the adequacy of resources to fund operations. Board of directors and management: This list gives the names and position titles of the company’s board of directors and top management team. Stockholder information: This information covers the basics-the company’s headquarters, the exchanges on which the company trades its stock, the next annual stockholders’ meeting, and other general stockholder service information. Corporate message: This may be from the chairperson of the board of directors, the chief executive officer, or both. It can provide an analysis and a review of the year’s events, including any problems, issues, and the successes the company had. It usually reflects the busienss philosophy and management styles of company’s executives, and it often lays out the company’s direction for the next year. Letter to stockholders: Some consider this an advertisement for the company. However, it almost always reflects how a company sees itself, or how it would like others to see it. Here, the company can explain itself to the stockholders, using photographs, illustrations, and text. It may cover the company’s lines of business, markets, mission, management philosophy, corporate culture and strategic direction. Financial highlights: Problably the most often-read section of any annual report, these give a quick summary of a company’s performance. The figures appear in a short table, usually accompanied by supporting graphs. Nouns and prepositions Some nouns are always followed by the same prepositions. Match the prepositions with the nouns below: The resut An enquiry Involvement An interest Support Satisfaction A percentage A tax Research An effect With For Of On Into In Complete the following passage with suitable prepositions: A report ___ the performance of the European vending machine industry shows that companies have had to invest heavily in the past years in order to prepare for the introduction ___ the euro. As European national currencies gradually disappeared to make room for the euro coins and banknotes, the vending industry had been discretely conducting research ___ the best way to prepare for the switchover. The findings ___ their studies revealed that most operators would face two major dilemmas. The first question was whether or not to join in the movement __ electronic money, and to equip machines with card readers. Some companies opted early on to do this and one major European operator had already converted 70% ___ his machines to electronic cash well before the introduction of the euro. But the trouble ___ this approach was that it involved heavy expenditure ___ new systems. The alternative was to retrofit exsisting machines with new electronic chips that could recognise the coins. Another worry was whether the national authorities would make enough of the new coins available for the customers to use. While national governments had responsibility ___ minting the coinage, in some cases they did not have the capacity to produce the millions of coins that were necessary for a smooth transition ___ the new currency.