Service tax Overview

advertisement

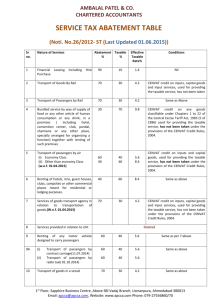

V S Datey Website – http://www.dateyvs.com Background Service tax introduced in July 1994 on three services – scope expanded every year and about 117 services were taxable in year 2011 Practically, excluding statutory activities, basic education, medical services and legal services by individual advocate to individuals, all services were taxable even prior to 1-7-2012 Classification of services Till 1-7-2012, service tax was based on positive list i.e. service listed are taxed in section 65(105) Disputes occur due to wordings in definitions Hence, now service tax all services excluding 17 services in negative list of services w.e.f. 1-7-2012 (In addition there is list of 42 exemptions and some activities excluded from definition of service itself) Constitutional Background India, that is Bharat, shall be a Union of States [Article 1(1)] Article 246 read with Seventh Schedule gives bifurcation of powers between Union and State List I – Union List List II – State List List III – Concurrent List Taxation in Union List – List I Income Tax other than agricultural income (Entry 82) Customs duty (Entry 83) Excise Duty other than alcoholic liquor (Entry 84) Stamp duty on specified transactions (Entry 91) Union List (Continued) Tax on advertisements in newspapers (Entry 92) Inter State Sales (Entry 92A) Tax on Services (Entry 92C – not yet effective) Residual Entry in List I Entry 97 – Any other matter not included in List II, List III and any tax not mentioned in list II or List III (These are residual powers) Service tax is imposed under Entry 97. Thus, if a transaction is covered under List II, service tax cannot be imposed. State List – List II Land Revenue (Entry 45), Agricultural income (Entry 46) Taxes on land and buildings (Entry 49), tax on mineral rights (Entry 50) Excise on alcoholic liquors, opium and narcotics (Entry 51) Octroi and Entry tax (Entry 52) Tax on consumption and sale of electricity (Entry 53) State List II (Continued) Sale within State, other than newspapers (Entry 54) Betting and gambling (Entry 34) Tax on advertisements other than newspapers (Entry 55) State List (Continued) Tax on goods or passengers carried by road or inland waterways [Entry 56] Tax on vehicles [Entry 57] Tolls [Entry 59] Professional Tax [Entry 60] Stamp duty [other than those under Union List) (Entry 63) Deemed Sale of goods– Article 366(29A) – 46th Amendment - 1982 Compulsory Sale (Now not much relevant) Hire purchase and financial Lease Transfer of right to use (Hire or operating lease) Goods Involved in works contract Sale of food articles Sale among unincorporated bodies Service tax on portion of deemed sale of goods Service part of Works Contract Service part of Food in restaurant or outdoor catering or catering as part of other services like mandap, shamiana, convention Overlapping of State Vat and service tax Hire purchase and financial lease Operating Lease (Hire) –Vat and service tax in different situations – disputes in borderline cases Temporary transfer of IPR – disputes in borderline cases Software – entirely goods and service at one and same time Charging section 66B Service tax at the rate of 12% on the value of all services, other than those services specified in the negative list provided or agreed to be provided in the taxable territory by one person to another and collected in such manner as may be prescribed. What is service [section 65B(44)] Any activity carries out by one person to another for consideration Consideration required – may be in cash or kind No service tax on free services ‘service’ includes ‘declared service’ (deemed service’) Some activities specifically excluded from definition of ‘service’ What is not service - 1 Activity of mere transfer of title in goods or immovable property is not ‘service’ Deemed sale of goods under Article 366(29A) of Constitution of India is not ‘service’ Mere transaction in money is not service. What is not service - 2 Mere Actionable claim – claim of debt or beneficial interest in movable property, lottery ticket – it is not service Service - employee to employer – not ‘service’, but service provided by employer to employee is taxable e.g. transport, telephone Fees paid to Court or Tribunal is not service Services of MP, MLA is not service Mere transaction in money is not service Any legal tender (Indian or foreign currency) is ‘money’ Transaction may be by cash, cheque, promissory note, DD, LC, money order, electronic transfer Dividend, loans, deposits, repos, reverse repos is mere transaction in money Transfer of title in goods or immovable property Simple sale of goods or immovable property not service Goods include securities Sale purchase of securities (shares, derivatives) not taxable Forward contracts, future contracts not taxable Grant or Donation is not service Grant stipulating merely proper usage of funds and furnishing of account also will not result in making it a provision of service. Donations are not consideration unless the receiver is obligated to provide something in return Thin distinction between sponsorship and donation Negative List of Services Services by Government, RBI, foreign diplomatic missions Agriculture related services Trading is not service Activity that results in ‘manufacture’ of goods is not ‘service’ Sale of space for Advertisement in print media in negative list – other taxable w.e.f. 1-10-2014 Negative List (Continued) Toll charges (but service for collection of toll is taxable) Entertainment, amusement, gambling Transmission and Distribution of Electricity (Electricity is goods – further it is in List II – hence no serviced tax even if done on private basis) Recognised Educational services, training in arts, culture, sports – no tax on midday meals and school bus services Negative List (Continued) Renting for residential purposes Interest and inter se sale or purchase of foreign currency among Banks and authorised dealers not taxable – other banking services taxable Passenger transport except in tourist vehicles and tour operators and w.e.f. 11-7-2014 – on air conditioned contract carriages Negative List (Continued) Transport of goods by road (except GTA, Courier) No tax on transport of goods from outside India to import of goods by air or vessel upto customs station in India Funeral, burial or crematorium related services not taxable Declared Services Renting of immovable property, construction, software, hiring, leasing, hire purchase, service portion of works contract, service portion of supply of food are ‘declared services’ [section 66E] [really some of these are ‘deemed services’ as these are partly covered under List II i.e. State List] Exemptions – Notification No. 25/2012-ST dated 20-6-2012 Medical services Specified Charitable activities Religious ceremony and renting of religious places Individual advocate and firm of advocates to non- business entity or business entity with turnover less than Rs 10 lakhs – in other cases - the business entity is liable to pay service tax under reverse charge Recreation relating to arts, culture, sports Exemptions (Continued) Copyright, performing arts, sportsman (but not brand ambassador), sports sponsorship Job work of agriculture, textile processing, diamonds and gemstones Job work - where principal manufacturer is paying excise duty Society to its members upto Rs 5,000 p.m. Infrastructure related services for public use Exemptions (Continued) Hotels, guest houses with less than Rs 1,000 per day tariff Restaurants without AC or central heating Goods transport upto Rs 750 per consignee Sub brokers, authorised persons, mutual fund agent exempt Small Service provider Exemption if value of taxable services provided in previous financial year did not exceed Rs 10 lakhs Clubbing provisions applicable Service should not be under brand name of other Each co-owner of immovable property can claim exemption Exemption only to main service Reference of main service shall not include reference to a service which is used for proving that main service [section 66F(1)] Thus, even if main service is exempt, ancillary service or services of sub-contractors may not be exempt Two Exceptions to section 66F Works contract service provided by sub-contractor to main contractor exempt if main contractor is exempt from service tax under works contract service When the sub-contractor himself is providing ‘main service’ which is exempt Rate of tax, value and rate of exchange [section 67A] Section 67A of Finance Act, 1994 has become effective from 28-5-2012. As per section 67A, the rate of service tax, value of a taxable service and rate of exchange, in force or as applicable at the time when the taxable service has been provided or agreed to be provided is relevant. Service tax rate as applicable at the time when taxable service has been provided or agreed to be provided. Point of Taxation Rules relevant only to determine due date of payment of service tax and not rate of service tax, w.e.f. 28-5-2012. Rate of Exchange Relevant in case of export and import of service Rate of Exchange will be as per rules to be notified At present, it is as per Customs Provisions i.e. as notified by CBE&C – usually at the beginning of every month W.e.f. 1-10-2014, it will be as per GAAP i.e. AS-11 Reverse Charge Normally, service tax is payable by service provider. In case of some services, Service tax is payable (partly or fully) by service receiver under Notification No. 30/2012ST dated 20-6-2012 effective from 1-7-2012. Reverse charge provisions have been made applicable to works contract service, manpower supply service, security service, directors’ services, renting or hiring of motor vehicle to carry passengers, support services provided by Government and services of Advocates and firms of Advocates w.e.f. 1-7-2012. This is in addition to import of service, sponsorship service, GTA service and services of insurance agent which were already under reverse charge mechanism. Precautions where reverse charge is applicable The service receiver, who is liable to pay service tax under reverse charge, cannot avail exemption of Rs 10 lakhs generally available to small service providers. He is liable even if the value services received by him is much less than Rs ten lakhs The service receiver is liable to pay service tax (of his portion) even if the service provider is not registered under service tax or is availing exemption available to small service provider. Continued…. Precautions where reverse charge is applicable Where service tax is partially payable by service receiver, the service provider should charge only his portion of service tax (25% in case of manpower supply service, security service and 50% in case of works contract service) and indicate that balance service tax is payable by service receiver under Notification No. 30/2012-ST dated 20-6-2012 effective from 1-7-2012. Service receiver can be held liable to pay service tax even if entire service tax was charged and paid by service provider. Hence, no ‘short cuts’ should be found. Where service tax is payable under reverse charge, it should be paid by cash (i.e. GAR-7 challan only). It cannot be paid through Cenvat Credit. Continued…. Reverse charge in case of some specific services In case of manpower supply service, security service, works contract service and renting of motor vehicle to carry passengers, service receiver is liable only when he is business entity registered as body corporate and service provider is individual, HUF, firm or AOP. In other cases, the service provider himself is liable. Definition of ‘works contract service’ covers both movable and immovable property related services. Hence, in addition to construction related services, services like AMC, job work (where it includes value of material used by job worker) will get covered under reverse charge mechanism. Continued…. Reverse charge in case of some specific services “Supply of manpower” means supply of manpower, temporarily or otherwise, to another person to work under his superintendence or control.’ [Rule 2(g) of Service Tax rules, inserted w.e.f. 1-7-2012]. In case of services like cleaning, piece rate based contract work, the service receiver has to ensure that the labour brought by contractor does not work under the supervision or control of Principal Employer. The agreement should be clear on this aspect. Otherwise, the Principal Employer may be held liable to pay service tax under reverse charge. Reverse charge in case of renting or hire of motor vehicle In case of renting or hire of motor vehicle, reverse charge applies only if vehicle is provided with driver. Service tax payable on 40% of value subject to condition of non-availment of Cenvat credit. Hence, advisable to get certificate from him that he has not availed Cenvat, though not legally required. Continued…. Reverse charge in case of renting or hire of motor vehicle If motor vehicle is provided on hire (operating lease) without a driver, it is ‘transfer of right to use goods’. It is deemed sale of goods and then only State Vat provisions apply and not service tax. If the motor vehicle is given on hire without driver, the person providing such vehicle can claim exemption from State Vat if his turnover is below limits specified under State Vat Act [The limit is Rs five lakhs in many States]. Issue if employee on tour and then submits bill of renting for reimbursement Works contract service Revised definition of works contract service covers works contracts relating to both movable and immovable property (Till 30-6-2012, these covered only immovable property). Comprehensive AMC, job work using own material (.e.g. job of painting car when the job worker uses his own paint), can get covered, in addition to construction services. Hence, service tax payable on 70% of value [Till 30-6-2012, there was no specific provision for these services]. Continued…. Works contract service In case of finishing service relating to immovable property (like painting, flooring etc.), service tax payable on 70% of value w.e.f. 1-10-2014 [Till 1-10-2014, it was 60%]. Value of FOC material (like cement, steel etc. supplied by contractee) was required to be added for composition scheme. To overcome this provision, some service receivers were charging for such supply but at very low price. To get over such tax planning, it has been provided that ‘Fair Market Value’ of material and services supplied by contractee should be added. Deductions for salary of employee when subject to service tax Services provided by employer to employee are not outside definition of service, i.e. these can be taxable. Deduction from salary for services like telephones or transport services provided by employer will be subject to service tax. Deduction for rent for residential quarters will not be subject to service tax as there is no service tax on renting of immovable property. Continued…. Deductions for salary of employee when subject to service tax Deduction for canteen or food facility will not be subject to service tax as the service of food is not in AC or centrally heated restaurant No service tax on statutory deductions like PF, ESIC, TDS etc. Penalty imposed on employee may be subject to service tax. Notice pay recovered from employee should be subject to service tax. Salary to Partners Payment of salary to partner –– but legally partner is not employee – Remuneration to partner is only share of profit – Hence mere ‘transaction in money’ and not subject to service tax Alternate argument – By legal fiction – partner and firm are being treated as separate – hence employer employee relation – should not be taxable [seems litigation prone issue] In any case, exemption of Rs ten lakhs is available to small firms. Directors’ Remuneration Sitting fees and commission to non-wholetime and independent directors - should be subject to service tax Executive directors or wholetime directors – If there is Employer Employee Relation, then no service tax Company has to pay service tax under revere charge mechanism. Company can avail Cenvat credit Agreeing to Tolerate an Act or Situation Agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act is ‘declared service’. Non compete fees, Demurrage, Booking cancellation charges, cheque return charges will be subject to service tax. Late Delivery charges, penalties, forfeiture of deposit or advance as penalty for violation of terms of contract will be subject to service tax. Continued…. Agreeing to Tolerate an Act or Situation Rework charges, deductions on account of quality issues may be subjected to service tax. Notice pay recovered from employees, penalty imposed o employees Better if the service provider issues credit note instead of service receiver issuing debit note or making deduction. Accidental damages not relatable to provision of service are not subject to service tax. Abatement/ composition schemes w.e.f. 1-72012 GTA service - 25% if no Cenvat availed - Hence, certificate should be obtained from GTA that he has not availed Cenvat credit [Till 30-6-2012, the condition about non-availment of Cenvat credit was not there] In case of works contract services, 25%, 30%, 40% and 70% schemes (33% scheme abolished w.e.f. 1-7-2012, 60% scheme abolished w.e.f. 1-10-2014) Accommodation in hotel, inn, guest house - 60% w.e.f. 17-2012 - Cenvat credit of input service available [It was 50% without Cenvat credit upto 30-6-2012] Continued…. Abatement/ composition schemes w.e.f. 1-72012 Restaurant service - 40% with Cenvat credit on input services, capital goods and input goods excluding food items) Fair market value of goods and services supplied to be added. Tax on 60% if provided as outdoor caterer w.e.f. 1-7-2012 Cenvat credit can be taken of input services, capital goods and input goods except of food items Fair market value of goods and services supplied to be added. Tax on 70% if provided with convention centre, pandal, shamina etc. as a bundled service, w.e.f. 1-7-2012 - Cenvat credit can be taken of input services, capital goods and input goods except of food items [It was 60% earlier]. Canteen Services Canteen in factory or office is not ‘outdoor catering’ It is actually eating joint or mess – not taxable if no AC If canteen is AC, no service tax if it is factory and it employs more than 250 persons – in other cases, service tax payable if canteen is AC If service tax is paid, Cenvat credit of service tax paid on canteen services is not available. Earlier definition of ‘outdoor catering’ is not applicable w.e.f. 1-7-2012. Hence, we have to go by trade understanding. Cenvat Credit Cenvat Credit of input goods, input services and capital goods Principle same as that of State Vat Conventional Tax System Detail B C - 110 165 Value Added 100 40 35 Sub-Total 100 150 200 10 15 20 110 165 200 Purchases Add Tax 10% Total A Tax credit System under Vat Transaction without VAT Details A Purchases - B 110 Value Added 100 Subtotal Transaction With VAT A - B 100 40 100 40 Add Tax 100 10 150 15 100 10 140 14 Total 110 165 110 154 Cenvat - Highlights Credit of excise duty on inputs and capital goods and service tax on input services Credit of excise duty and service tax inter-changeable One to one co-relation not required in Vat/Cenvat Instant Credit Cenvat credit only on basis of specified documents Cenvat credit to be taken within 6 months Cenvat credit of input service Cenvat credit can be taken on receipt of invoice of service provider However, if payment is not made within 3 months, the Cenvat credit is required to be reversed. If later payment made, Cenvat credit can be taken No such restriction in case of excise duty on inputs and capital goods Wasteful Expenditure as per department for noneligibility of Cenvat credit Open society - Building for office or factory is a waste – expenditure relating to setting up unit – not eligible Motor vehicle, taxi is luxury – Cenvat not allowed – service tax on air travel permitted Employee benefit is a luxury – canteen, club, LTA, group insurance Consumables eligible as input for service provider, but not parts, steel, cement etc. Exempted goods and services Rule 6 applies where both exempted goods and taxable goods are manufactured or exempted and taxable services provided Three options – (a) Maintain separate inventory and records (b) Pay 6% amount on exempted goods and exempted services (c) Proportionate reversal of Cenvat Credit Input Service Distributor HO or Branch or Depot can pass on credit to factories. They have to register, file returns etc. Monthly Invoice No credit where input service exclusively for exempted goods or exempted service Distribution on turnover basis On basis of turnover of previous year Revamp accounting system Design accounting codes of suppliers to identify whether they are individual, HUF, partnership firm, body corporate etc. Design accounting codes to identify transactions where reverse charge mechanism applicable. Codes for deductions made from salary of employees. Codes on basis of availability or non-availability of Cenvat credit. Identify exempted services and exempt goods for purpose of rule 6 of Cenvat Credit Rules. Keep check list in accounting system itself for passing of bills or entering a transaction in books of account. Two safety nets in law Law is new and many ambiguities are there. Disputes are possible. Law may get settled after 8 or 10 years but assessee has to take decision today itself on course of action. Hence, two safety nets are available. No demand beyond 18 months if no suppression of facts, wilful misstatement, fraud – penalty not imposable – otherwise demand can be upto 5 years and mandatory penalty equal to tax. Hence, advisable to make full disclosure to department, wherever in doubt. Usually not advisable to ask for clarification, as generally clear answers are not given. Continued…. Two safety nets in law (Continued) No penalty if service tax with interest paid before show cause notice and intimation given to department, except in cases of suppression of facts, wilful misstatement, fraud or collusion. Hence, if short payment was noticed either during your internal audit or during audit by service tax department (or even during visit of preventive people - usually called ‘raid’), pay service tax with interest and intimate department. Then penalty cannot be imposed. Thanks Thanks Website – www.dateyvs.com