MODERN AUDITING

7th Edition

William C. Boynton

California Polytechnic State

University at San Luis Obispo

Raymond N. Johnson

Portland State University

Walter G. Kell

University of Michigan

Developed by:

Gregory K. Lowry, MBA, CPA

Saint Paul’s College

John Wiley & Sons, Inc.

CHAPTER 15

AUDITING THE EXPENDITURE CYCLE

Nature of the Expenditure Cycle

Control Activities — Purchases

Transactions

Control Activities — Cash

Disbursements Transactions

Substantive Tests of Accounts

Payable Balances

Value-Added Services

Nature of the Expenditure Cycle

The expenditure cycle consists of the

activities related to the acquisition of and

payment for goods and services. The core

expenditure cycle activities are:

1. purchasing goods and services — purchase

transactions, and

2. making payments — cash disbursement

transactions.

Purchases and cash disbursements have a

pervasive effect on the financial statements,

as depicted in Figure 15-1.

Purchases and Cash Disbursements

Figure 15-1

Debit

Merchandise inventory

Raw materials inventory

Purchases

Prepaid expenses

Plant assets

Other assets

Credit Debit

Credit

Accounts payable

Cash

Purchase discounts

Purchase returns

Various expenses

Purchase

Payment

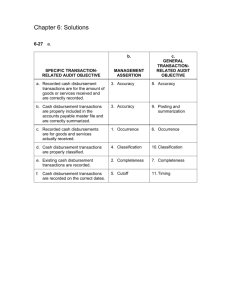

Selected Specific Audit Objectives

for the Expenditure Cycle

Figure 15-2

Assertion

Category

Existence or

Occurrence

Transaction

Class or

Balance

Transaction

Balance

Completeness

Transaction

Balance

Rights and

Obligations

Transaction

Balance

Specific

Audit

Objectives

Recorded purchases represent goods, services, and

productive assets received during the period.

Recorded cash disbursement transactions were made

during the period to suppliers and creditors.

Recorded accounts payable represent the amounts the

entity owes at the balance sheet date.

All purchases and cash disbursements made during

the period were recorded.

Accounts payable include all amounts owed to

suppliers of goods and services at the balance sheet

date.

The entity is liable for the payables resulting from the

recorded purchase transactions.

Accounts payable are obligations of the entity at the

balance sheet date.

Assertion

Category

Valuation or

Allocation

Transaction

Class or

Balance

Transaction

Balance

Presentation

and Disclosure

Transaction

Balance

Specific

Audit

Objectives

All purchase transactions and cash disbursements are

valued using GAAP and correctly journalized,

summarized, and posted.

Accounts payable are stated at the correct amount

owed.

Related expense balances are in conformity with

GAAP.

The details of purchases and cash disbursements

support their presentation in the financial statements

including their classification and related disclosures.

Accounts payable and related expenses are properly

identified and classified in the financial statements.

Adequate disclosures have been made pertaining to

commitments, contingent liabilities, and collateralized

and related party payables.

Nature of the Expenditure Cycle

Understanding the Client’s

Business and Industry

Before designing an expenditures

audit program, the auditor must

consider the client’s business, the

external market forces driving the

business sector, and how these

forces impact the entity’s

expenditure cycle.

Nature of the Expenditure Cycle

Materiality

The expenditure cycle is a core process for

many industries and given the amount and

volume of transactions in this cycle the risk of

material misstatement is high. Figure 15-1

illustrates the fact that the transactions in this

cycle affect more financial statement accounts

than other cycles.

The allocation of materiality to accounts

affected by transactions in this cycle will vary

according to the considerations explained in

Chapter 8. The importance of the expenditure

cycle varies by the type of business.

Nature of the Expenditure Cycle

Inherent Risk

In assessing inherent risk for expenditure cycle

assertions, the auditor should consider pervasive factors

that may affect assertions throughout financial

statements as well as factors pertaining only to specific

assertions in the expenditure cycle. Pervasive factors

that might motivate management to misstate

expenditure cycle assertions include:

1. Pressures to understate expenses in order to report

achieving announced profitability targets or industry

norms, which were not achieved in reality owing to

factors such as global, national, or regional economic

conditions that affect operating costs, the impact of

technological developments on the entity’s

productivity, or poor management.

Nature of the Expenditure Cycle

2. Pressures to understate payables in order to report

a higher level of working capital when the entity is

experiencing liquidity problems or going-concern

doubts.

Both of these factors lead to a greater risk of

understatement than overstatement of expenditures and

payables.

The auditor should also consider the industry-related

factors of the availability and price volatility of the raw

materials and products needed by the entity to remain in

business.

Nature of the Expenditure Cycle

Analytical Procedures Risk

Analytical tests are effective in identifying

expenditure cycle accounts that are misstated.

Analytical procedures risk is the element of

detection risk that analytical procedures will

fail to detect material errors. Analytical

procedures are extremely cost effective.

Analytical procedures that focus only on

purchases and accounts payable provide the

most reliable information. If a company is

growing, it is common to expect purchases,

inventory, and accounts payable to grow at

consistent rates.

Analytical Procedures Commonly Used

to Audit the Expenditure Cycle

Figure 15-3

Ratio

Formula

Audit

Significance

Accounts

Payable Turn

Days

Average Accounts Payable ÷

Purchases x 365

Prior experience in accounts

payable turn days combined with

knowledge of current purchases

can be useful in estimating

current payables. A shortening of

the period may indicate

completeness problems.

Cost of Goods

Sold to Accounts

Payable

Cost of Goods Sold ÷ Accounts

Payable

Unless the company has changed

its payment policy, these amounts

should change by approximately

the same percentage from year to

year.

Payables as a

Percentage of

Total Assets

Accounts Payable ÷ Total

Assets

Common-sized balances in

accounts payable are useful in

comparing with industry data. A

significant decline in this ratio

may indicate completeness

problems.

Quick Ratio

Current Monetary Assets ÷

Current Monetary Liabilities

A significant increase in the

quick ratio compared to prior

year’s experience may indicate a

completeness problem. However,

this ratio may also be influenced

by changes in asset accounts.

Nature of the Expenditure Cycle

Consideration of Internal Control

Components

The auditor’s understanding of internal

control components is obtained by reviewing

prior experience with the client, when

applicable, and by inquiring of management

and other entity personnel, observing

activities and conditions, and inspecting

documents, records, manuals, and so forth.

The understanding should be documented in

the form of completed questionnaires,

flowcharts, or narrative memoranda.

Nature of the Expenditure Cycle

Control Environment

Numerous opportunities for employee fraud in

processing purchase and cash disbursements

transactions, and for fraudulent financial reporting

by management of expenditure cycle account

balances, make the control environment factor of

integrity and ethical values extremely important in

the expenditure cycle.

Management’s commitment to competence should be

reflected in the hiring, assignment, and training of

personnel involved in processing purchase and cash

disbursement transactions, maintaining custody of

purchased assets, and reporting on expenditure

cycle activities.

Nature of the Expenditure Cycle

The client’s organizational structure and

management’s assignment of authority and

responsibility over expenditure cycle activities should

be clearly communicated and provide for clear lines of

authority, responsibility, and reporting relationships.

When understanding how management is held

accountable for resources, it is helpful to determine:

1. The reports used by management to evaluate the

entity’s performance review.

2. How often and how quickly management reports are

reviewed.

3. The decisions that are based on the reports.

4. The entity’s policies for following up on issues

raised by key reports.

Nature of the Expenditure Cycle

Management Risk Assessment

Management risk assessments related to expenditure

cycle activities include consideration of such matters as:

1. The entity’s ability to meet cash flow requirements for

purchase transactions.

2. Loss contingencies associated with purchase

commitments.

3. The continued availability of important supplies and

the stability of important suppliers.

4. The effect of cost increases on the entity.

5. Attention to the risk of duplicate payments by the

entity.

6. Attention to the risk of employee fraud by the entity.

Nature of the Expenditure Cycle

Information and Communication

(Accounting System)

An understanding of the accounting system

requires knowledge of the methods of data

processing and key documents and records

used in processing expenditure cycle

transactions. It is important to understand

the flow of transactions through the

accounting system from initiating the

transaction to its recording in the general

ledger and eventual summarization in the

financial statements.

Nature of the Expenditure Cycle

Key information the auditor should understand

includes:

1. How purchases, payments, and returns are

initiated.

2. How purchase transactions are accounted for as

goods and services are received or goods are

returned.

3. What accounting records, documents, accounts,

and computer files are involved in accounting for

the various stages of each purchase cycle

transaction?

4. The process by which an entity initiates payment

for goods and services.

Nature of the Expenditure Cycle

Monitoring

Several types of ongoing and periodic

monitoring activities in this

component may provide management

with information concerning the

effectiveness of the other internal

control components in reducing the

risk of misstatements related to

expenditure cycle transactions and

balances.

Nature of the Expenditure Cycle

Monitoring activities about which the auditor

should obtain knowledge, when applicable,

include:

1. ongoing feedback from the entity’s suppliers

concerning any payment problems or future

delivery problems,

2. communications from external auditors

regarding reportable conditions or material

weakness in relevant internal controls found

in prior audits, and

3. periodic assessments by internal auditors of

control policies and procedures related to the

expenditure cycle.

Nature of the Expenditure Cycle

Initial Assessments of Control Risk

The auditor’s procedures to obtain an understanding

of the 4 internal control components just discussed

extend to the design of policies and procedures and

whether they have been placed in operation, but not

to determining the effectiveness of such controls.

Thus, based on the information from the

understanding only, the auditor’s initial assessment

of control risk must be at the maximum.

The auditor may perform some tests of controls

concurrently with the procedures to obtain the

required understanding. In such cases, limited

assurance may be obtained about the effectiveness

of those controls.

Control Activities —

Purchase Transactions

Virtually every company that requires an audit

has a computerized accounting system. There

are 2 types of computer controls:

1. General controls, which relate to the

computer environment and have a

pervasive effect on computer applications.

2. Application controls, which relate to the

individual computerized accounting

applications, such as the expenditure cycle.

Control Activities —

Purchase Transactions

Common Documents and Records

The following documents and records are found in

most accounting systems:

1. Purchase requisition. Written request for goods or

services by an authorized individual or department

to the purchasing department.

2. Purchase order. Written offer from the purchasing

department to a vendor or supplier to purchase

goods or services specified in the order.

3. Receiving report. Report prepared on the receipt of

goods showing the kinds and quantities of goods

received from vendors.

Control Activities —

Purchase Transactions

4. Vendor invoice. The bill from the vendor stating

the items shipped or services rendered, the amount

due, the payment terms, and the date billed.

5. Voucher. An internal form indicating the vendor,

the amount due, and payment date for purchases

received. It is used to authorize recording and

paying a liability. Many purchase systems require a

complete voucher packet before approving

payment. The voucher packet usually contains a

copy of the appropriate purchase requisition,

purchase order, receiving report, vendor invoice,

and voucher — all the documentation supporting

the purchase transaction.

Control Activities —

Purchase Transactions

6. Exception reports. Reports with information

about transactions identified for further

investigation by computer application controls.

7. Voucher summary. Report of total vouchers

processed in a batch or during a day.

8. Voucher register. Formal accounting record of

recorded liabilities approved for payment.

9. Approved vendor master file. Computer file

containing pertinent information on vendors and

suppliers that have been approved to purchase

services from and make payments to.

10. Open purchase order file. Computer file of

purchase orders submitted to vendors for which

the goods or services have not been received.

Control Activities —

Purchase Transactions

11. Receiving file. Computer file with

receiving information on quantities of

inventory received from vendors.

12. Purchase transactions file. Computer

file containing data for approved

vouchers for purchases that have

been received. Used to print the

voucher register and update the

accounts payable, inventory, and

general ledger files.

Control Activities —

Purchase Transactions

13. Accounts payable master file.

Computer file containing data on

approved unpaid vouchers. The file

may be organized by vendor. It

should sum to the balance in the

accounts payable control account.

14. Suspense files. Computer file that

hold transactions that have not been

processed because they have been

rejected by computer application

controls.

Control Activities —

Purchase Transactions

Functions

The processing of purchase transactions

involves the following purchasing functions:

1. Initiating purchases. The request by an

entity for a transaction with another

entity, including:

a. Placing vendors on an authorized

vendor list.

b. Requisitioning goods and services.

c. Preparing purchase orders.

Control Activities —

Purchase Transactions

2. Receipt of goods and services. The physical

receipt or shipment of a product or service,

including:

a. Receiving the goods.

b. Storing goods received for inventory.

c. Returning goods to a vendor.

3. Recording liabilities. The formal recognition by

an entity of a legal obligation, including:

a. Preparing the payment voucher and recording

the liability.

b. Accountability for recorded transactions.

Control Activities —

Purchase Transactions

Obtaining an Understanding and Assessing

Control Risk

The auditor should obtain an understanding of the

purchase cycle that is sufficient to plan the audit.

If the auditor plans to assess control risk as low for

an assertion, it is particularly important that he or

she obtain an understanding of control procedures

for that assertion.

Tests of controls provide the means for determining

the effectiveness of such controls. The extent of

the auditor’s consideration of factors related to

assessing control risk for any given assertion

depends on audit strategy.

Control Activities —

Purchase Transactions

Inherent risk for purchase transactions is

often considered to be at the maximum or

high, because:

1. the purchase cycle has a pervasive effect

on the financial statements and

2. the susceptibility of assets to

misappropriation.

The auditor should also consider the results

of analytical procedures to determine the

planned assessed levels of control risk and

tests of details risk.

Control Activities —

Purchase Transactions

If the auditor plans to assess control risk as

low, he or she will usually have to:

1. test the effectiveness of general controls,

2. use computer-assisted audit techniques

(CAATs) to evaluate the effectiveness of

programmed controls, and

3. test the effectiveness of procedures to

follow up on exceptions identified by

programmed controls.

Control Activities —

Cash Disbursement Transactions

Common Documents and Records

Important documents and records used in processing

cash disbursement transactions include the following:

1. Check. Formal order to a bank to pay the payee the

amount indicated on demand.

2. Check summary. Report of total checks issued in a

batch or during a day.

3. Cash disbursement transaction file. Information on

payments by check to vendors and others. Used for

posting to the accounts payable and general ledger

master files.

4. Cash disbursement journal or check register. Formal

accounting record of checks issued to vendors and

others.

Control Activities —

Cash Disbursement Transactions

Functions

The cash disbursement function is the

process by which a company provides

consideration for the receipt of goods

and services. The cash disbursement

function normally involves

simultaneously paying the liability and

recording the cash disbursement.

Example control procedures are

summarized in Figure 15-7.

Control Risk Components —

Cash Disbursement Transactions

Figure 15-7

Function

Cash

Disbursement

Potential

Misstatement

A check may

not be

recorded.

A check may

not be

recorded

promptly.

Computer Controls

Manual Controls

in Italics

Account Balance Audit Objectives

EO2

C2

RO2

VA2

PD2

Computer accounts

for prenumbered

check series.

Computer compares

the total on the

check summary with

the total vouchers

submitted for

payment.

Access to blank

checks and signature

plates is controlled.

D

Computer prints

report of checks due

but not yet paid.

Run-to-run totals

compare beginning

cash, less cash

disbursements, with

ending cash balance

as well as beginning

accounts payable

less disbursements

with ending accounts

payable.

D

P

P

D

Function

Cash

Disbursement

Potential

Misstatement

Checks may

be issued for

unauthorized

purchases.

Computer Controls

Manual Controls

in Italics

Account Balance Audit Objectives

EO2

C2

RO2

VA2

PD2

Computer compares

check information

with purchase order

and receiving

information or other

authorization.

Computer performs a

limit test on large

disbursements and

checks must be

manually signed

D

A voucher

may be paid

twice.

Computer has a field

that identifies that a

voucher has been

paid and the voucher

number cannot be

reused.

D

A check may

be issued for

the wrong

amount.

Computer

comparison of check

amount with related

voucher amount.

D

P

D

Function

Cash

Disbursement

Potential

Misstatement

Computer Controls

Manual Controls

in Italics

A check may

be altered

after being

signed.

Manual control

requires that check

signers mail checks.

Independent bank

reconciliation.

Errors may be

made in

recording the

check.

Computer

comparison of

information on check

summary with

related voucher

information.

Independent bank

reconciliation.

Cash

disbursements

may be made

for

unauthorized

purchases or

they may be

made in the

wrong amount.

Management

Control

An appropriate level

of management

monitors cash daily,

including the amount

of checks written

daily, the

reasonableness of the

amounts, and the

amount of debits to

accounts payable

daily.

Account Balance Audit Objectives

EO2

C2

RO2

VA2

PD2

P

D

D

D

D

D

D

D

D

D

D

Control Activities —

Cash Disbursement Transactions

Obtaining an Understanding and Assessing

Control Risk

The auditor should obtain an understanding of

internal controls that is sufficient to plan the audit.

If the auditor plans to a low assessed level of control

risk for an assertion, he or she will probably need to

understand specific control procedures related to

that assertion.

Tests of controls provide the means for assessing

the effectiveness of internal controls. The nature

and extent of tests of controls will vary inversely

with the auditor’s planned assessed level of control

risk.

Substantive Tests of

Accounts Payable Balances

Determining Detection Risk for Tests of

Details

Accounts payable are affected by both

purchase transactions that increase the

balance and by cash disbursement

transactions that decrease the balance.

Thus, tests of details risk for accounts

payable assertions is affected by inherent

risk, analytical procedures risk, and control

risk factors related to both of these

transaction classes.

Correlation of Risk Components —

Accounts Payable Assertions

Figure 15-9

Existence

or

Occurrence

Completeness

Rights

and

Obligations

Valuation

or

Allocation

Presentation

and

Disclosure

Audit Risk

Low

Low

Low

Low

Low

Inherent Risk

High

High

Moderate

High

High

Moderate

High

Moderate

Moderate

High

Control Risk

— Purchase

Transactions

Low

High

Moderate

High

Moderate

Control Risk

— Cash

Disbursement

Transactions

Moderate

Low

Low

Low

Low

Combined

Control Risk

Moderate

High

Moderate

High

Moderate

Acceptable

Tests of

Details Risk

Moderate

Very Low

Moderate

Moderate

Very Low

Risk

Component

Analytical

Procedures

Risk

Substantive Tests of

Accounts Payable Balances

Designing Substantive Tests

The general framework for developing

audit programs for substantive tests

that was explained in Chapter 11 and

illustrated in Chapter 14 for accounts

receivable can also be used in

designing substantive tests for

accounts payable. Multiple tests are

keyed to each account balance audit

objective.

Substantive Tests of

Accounts Payable Balances

Accounts Payable Confirmations

Unlike the confirmation of accounts

receivable, there is no presumption made

about the confirmation of accounts payable.

This procedure is optional because:

1. confirmation offers no assurance that

unrecorded payables will be discovered

and

2. external evidence in the form of invoices

and monthly vendor statements should be

available to substantiate the balances.

Value-Added Services

Generally accepted auditing standards do

not require that the auditor perform

value-added services. Nevertheless, when

auditors complete an audit they are

usually very knowledgeable about the

client’s business and business practices,

the results of its operations and cash

flows, as well as the entity’s internal

controls. Management and the board of

directors normally want to take full

advantage of the auditor’s knowledge.

CHAPTER 15

AUDITING THE EXPENDITURE CYCLE

Copyright

Copyright 2001 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work

beyond that permitted in Section 117 of the 1976

United States Copyright Act without the express

written permission of the copyright owner is

unlawful. Request for further information should

be addressed to the Permissions Department, John

Wiley & Sons, Inc. The purchaser may make backup

copies for his/her own use only and not for

distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages,

caused by the use of these programs or from the

use of the information contained herein.