Module 20/21D- "Automatic Stabilizers"

advertisement

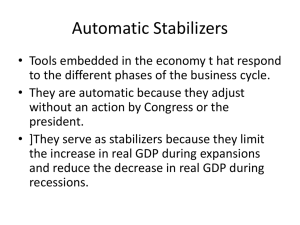

Automatic Stabilizers 1 Discretionary Fiscal Policy in Practice • Time Lags • Recognition Time Lag • The time required to gather information about the current state of the economy- “ID the problem” • Action Time Lag • The time required between recognizing an economic problem and putting policy into effect • Political debate delays putting policy into effect • Short for monetary policy • Long for fiscal policy • Effect Time Lag • The time it takes for a fiscal policy to affect the economy 2 Automatic Stabilizers • Discretionary fiscal policy is a deliberate change in government spending and taxation to achieve economic goals. • Automatic Stabilizers effect the economy without government action 3 Automatic Stabilizers • Automatic Stabilizers • Changes in government spending and taxation that occur automatically without deliberate action of Congress • Examples • The progressive income tax • Unemployment compensation 4 Progressive Income Tax as an Automatic Stabilizer During a Recession- jobs lost/wages down • Income tax being paid but at a lower marginal tax rate because people making less money. As a result of the progressive tax system, disposable income doesn’t fall as drastically because your income is less. In other words, the individual isn’t hurt as much because of the progressive (marginal) tax. 5 Progressive Income Tax as an Automatic Stabilizer During an Overheated Economy- employment up, wages up • Disposable income does not go up as rapidly as their gross income because of the progressive income tax. Taxes rising at a greater rate. More taxes will slow down the overheated economy. In this situation, progressive tax tends to stabilize any drastic, abrupt increases in the economy. 6 Unemployment Insurance as an Automatic Stabilizer • During a Recession- Unemployment insurance(gov’t transfer) tends to alleviate the severity of a recession by giving individuals some disposable income. 7 Automatic Stabilizers Government Transfers and Tax Revenues Government transfers The automatic changes tend to drive the economy back toward its fullemployment output level Budget deficit Lower taxes and higher Y2 Yf Y1 Unemploy.0 Real National Income per Year Insurance tends ($ trillions) To lessen effect of recession. Tax revenues Budget surplus Higher taxes/ and lower unemployment insurance tends to slow overheated 8 economy. Result budget surplus.