A presentation to the Massachusetts Bankers Community Bank

advertisement

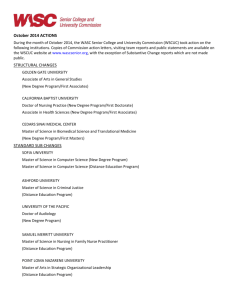

Ceto and Associates Consultants to Bank Management A presentation to the Mutual Community Banking: Unprecedented Challenges, New Opportunities NICHOLAS CETO, JR. CHAIRMAN AND CHIEF EXECUTIVE OFFICER CETO AND ASSOCIATES ATLANTA, GEORGIA March 1, 2012 ROBERT MONTEITH, JR. VICE PRESIDENT Massachusetts Bankers Association Marlborough, Massachusetts Ceto and Associates The Topic of increasing profitability is • Extremely broad and very timely • Discussion of three broad areas First: Current state of the economy and Government’s attempt to fix it Second: Current and historic profitability of mutual banks in Massachusetts Third: Suggestions to increase individual mutual bank profitability 2 © 2012 Ceto and Associates Ceto and Associates Consultants to Bank Management Current State of the Economy Ceto and Associates Current State of Economy U.S. Unemployment Situation Category Unemployed 4 Number Rate 13.7 million 8.5% Underemployed 9.3 million 6.0% Discouraged Workers 2.6 million 1.7% Real Unemployment 25.9 million 16.8% © 2012 Ceto and Associates Ceto and Associates Current State of Economy U.S. Unemployment Situation 600,000 new jobs a month for 5 years to get to 5% again! 5 © 2012 Ceto and Associates Ceto and Associates Current State of Economy Housing Industry 6 Year(s) Number of Housing Starts 1980s 1.5 million/year 1990s 1.4 million/year 2000-07 1.8 million/year 2010 580,000 2011 590,000 2012 650,000 © 2012 Ceto and Associates Ceto and Associates Current State of Economy Housing Industry • Home Prices – Average home value down 40% – Wealth lost in housing bubble: 7.1 Trillion – Reality Trac • Home prices will hit bottom late 2012 – early 2013 7 © 2012 Ceto and Associates Ceto and Associates Current State of Economy Home Mortgages – 3rd Qtr 2011 52 million mortgages • 28 million in good shape • 24 million in trouble – 14.6 million underwater – 3.7 million delinquent – 5.7 million foreclosed There will be no housing boom in the near future 8 © 2012 Ceto and Associates Ceto and Associates Current State of Economy Government Intervention Dodd–Frank Wall Street Reform and Consumer Protection Act • Signed into law on July 21, 2010 • “To promote the financial stability of the United States by improving accountability and transparency in the financial system, to end consumers from abusive financial services practices, and for other purposes” • 2,319 Pages 9 © 2012 Ceto and Associates Ceto and Associates Current State of Economy Government Intervention Durbin Amendment • Gives the Federal Reserve the power to regulate and put a cap on debit card interchange fees. This will cost the larger banks roughly $9.4 billion annually, according to CardHub.com. 10 © 2012 Ceto and Associates Ceto and Associates Current State of Economy Government Intervention Regulation E Modifications • Effective July 1, 2010 • $38.5 Billion Revenue in 2009 • 10% - 20% Projected Revenue Loss ($3.8 Billion - $7.7 Billion) 11 © 2012 Ceto and Associates Ceto and Associates Consultants to Bank Management Current and Historical Profitability of Mutual Banks in Massachusetts Ceto and Associates Non-Interest Income and Efficiency Ratios Massachusetts Mutual Banks Performance Metrics 2008 NII/AA Efficiency Ratio 2009 2010 Q3 2011 0.50 0.57 0.61 0.57 80.28 79.91 76.52 79.64 Notes: Includes All Mutuals Source: FDIC Call Reports All U.S. Banks Performance Metrics NII/AA Efficiency Ratio 2008 2009 2010 Q3 2011 1.04 1.08 1.05 0.95 62.95 65.41 65.31 67.02 Notes: Includes Banks, Savings Banks, Thrifts, excluding Massachusetts Banks Source: FDIC Call Reports 13 © 2012 Ceto and Associates Ceto and Associates Conclusion Community Banks have higher efficiency ratios than larger banks Community Banks have lower levels of non-interest income 14 © 2012 Ceto and Associates Ceto and Associates Consultants to Bank Management Suggestions to Increase Mutual Bank Profitability Ceto and Associates Increasing Bank Profitability The Profit Improvement Process Continuum Increase Earning Assets Optimize Staffing Levels Phase I Increase NonInterest Income Phase III Increase Operational Efficiencies Reduce Vendor Contract Expenses Phase II 16 © 2012 Ceto and Associates Ceto and Associates Increasing Bank Profitability Introduction Initiative Ease of Implementation Cost of Implementation Durability of Initiative Very Easy Minimal Permanent Easy Minimal Permanent Moderate Very Minimal Duration of Contract Increase Operational Efficiencies Fairly Difficult Moderate Semi - Permanent Optimize Staffing Levels Very Difficult Minimal Semi -Permanent Increase Earning Assets Increase Non-Interest Income Reduce Vendor Contract Expenses 17 © 2012 Ceto and Associates Ceto and Associates Increasing Bank Profitability Introduction A prudent, highly cost effective, incremental three (3) phase approach that could result in an increase of 20% or more in ROA… 18 © 2012 Ceto and Associates Ceto and Associates Phase I Revenue Optimization Increasing the level of earning assets, and non-interest and interest income… 19 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Overview Description • A strategic review of core bank products, ancillary services, interest rates and fees on both the asset and liability side of the balance sheet, with the objective of maximizing revenue or product profitability. Concentration • • • • Non-Interest Income Interest Income Interest Expense Non-Earning Assets Organizational Units • • • • 20 Retail Banking Commercial Banking Commercial, Consumer, & Mortgage Lending Deposit Operations, Loan Operations and Administration © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Examples • • Deposit Characteristics Deposit Rates, Fees, & Balance Requirements • • • • • • • • • • • • • • • • • • Courtesy Overdraft Program Cash/Treasury Management Account/Commercial Analysis Electronic Banking ATM/Debit Cards Cashier Checks Money Orders Check Cashing Dormant Accounts Collection Items Stop Payment NSF/OD Fees Charge Back Fees Wire Transfers Night Depository Services Safe Deposit Boxes Waivers, Refunds, & Collection Rates Un-posted Debits/Credits – – – – – Checking Accounts Savings Accounts Money Market Accounts CDs IRAs • • Loan Processing Loan Rates, Fees, & Costs • • • • • • • • • • • Skip-a-Payment Programs Interest Rate Calculations Secondary Market Activities Miscellaneous Loan Fees ATMs Branch/ATM Cash Balances Vault Cash Management FRB Reserve Balances FR2900 Reports Correspondent Banking Wealth Management/Trust Services – – – – – – – – – – – – – Auto/Motorcycle/Boat/RV CD Secured/Savings Secured Unsecured Term Loans Overdraft LOC Unsecured LOC/Credit Cards 1st Mortgages (secondary market) 1st Mortgages (portfolio) 2nd Mortgages HELOCs Commercial Real Estate Construction & Development Commercial & Industrial Commercial LOC Note: This is just a partial list of the areas typically reviewed. The number of areas reviewed depends on the size and complexity of the bank. However, based on experience, 300 - 500 areas are reviewed. 21 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Increasing earning assets a couple of examples… 22 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Retail Sweep Programs What is it? How does it work? Before After Checking SubAccount Reservable Transaction Account Reservable Savings SubAccount Non Reservable • Change is completely invisible to the customer. 23 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Retail Sweep Programs Benefits $6,000 $5,500 $5,000 FRB Balance Reduction of $3 Million $4,000 $3,000 $3,000 $2,500 $2,500 $2,000 $1,000 $1,000 $0 $0 Before Reserve Requirement Reserve Balance at FRB After Branch and ATM cash Benefits in ($000)’s 24 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Branch & ATM Cash Management Managing Costs: Order Cost vs. Carry Cost • • Order Cost = Transportation Costs – Delivery Schedules, Carrier Contracts Carry Cost = Investment Costs – Investment Rates, Order Frequency On average, banks carry 15% - 25% excess cash, and could reduce armored car deliveries by 20% - 25%! 25 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Branch & ATM Cash Management Customer Usage Opportunity to Reduce Cash 26 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Branch & ATM Cash Management Benefits Cash Reduction of 25%, or $625,000 $2,500 $2,500 $1,875 $2,000 $1,600 $1,600 $1,500 $1,000 $1,000 $1,000 $500 $0 After Before Reserve Requirement Branch and ATM cash Customer Usage Benefits in ($000)’s 27 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Increasing non-interest income a couple of examples… 28 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Local Market Analysis & Competitor Surveys 29 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization HELOCs Annual Fee Closing Costs Overdraft Protection Transfer Grace Period & Late Fee Returned Loan Payment Fee Over the Limit Fee Subordination Agreement Fee Rate Floors Rate Discount Options Fixed Rate Options Stop Payments 30 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Account Analysis Reserve Requirement Earnings Credit Rate FDIC Insurance Hard/Soft Charge (NSF, Stop Payment, Wires, etc.) Waivers Negative Collected Balances Service Charges – – – – – – 31 Monthly Service Charge Debit per Check Deposit Ticket Deposit Item Cash Processing Cash Management © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Dormant/Inactive Accounts Account Types • • • • 32 Timing Service Charges Balance Thresholds Escheatment © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Waivers, Refunds, & Collection Rates Hard Code Waivers Refunds & Reversals Miscellaneous Fee Schedule Free Services Collection Rates Bank Employees 33 © 2012 Ceto and Associates Ceto and Associates Revenue Optimization Phase I: Benefits ➢ $1,000 - $2,000 per $1 million in assets For example, a $500 million bank should expect $500,000 - $1,000,000 in new recurring revenue annually! Other Benefits • No Funding Required • No Credit Risk • No Interest Rate Risk • Permanent and Recurring • Less Vulnerable to Economic Downturn 34 © 2012 Ceto and Associates Ceto and Associates Phase II Contract Management Decreasing non-interest expense with vendor contract management and renegotiation. a couple of examples… 35 © 2012 Ceto and Associates Ceto and Associates Contract Management Overview & Examples Primary Vendor Contracts • • • • • • • Core Processing Item Processing ATM/Debit Card Processing Internet Banking & Electronic Bill Payment Check Vendor Telecommunications Armored Car Carrier Considerations • Develop a System • Evaluate All Services • Evaluate Transactional Costs vs. Aggregate Costs • Consider Multiple Vendors • Negotiation Window • Market-based Target Pricing 36 © 2012 Ceto and Associates Ceto and Associates Contract Management Phase II: Benefits ➢ $125 - $250 per $1 million in assets For example, a $500 million bank should expect $62,500 - $125,000 in new recurring cost savings annually! Other Benefits • Reduce & Control Costs • Improve Service Quality & Vendor Performance • No Adverse Impact to Customers • Enhance Legal & Protection Verbiage 37 © 2012 Ceto and Associates Ceto and Associates Phase III Organizational Effectiveness Decreasing non-interest expense with organizational effectiveness and optimizing staffing levels. a couple of examples… 38 © 2012 Ceto and Associates Ceto and Associates Organizational Effectiveness Overview Concentration Organizational Units • • • • • • • • • • Non-Interest Expense – – – – – – • • • • • • • 39 Staffing Marketing & Advertising Information Technology Legal External Audit Office Supplies & Postage Organization Strategy & Design Management Process Risk Management Operations Strategy Service Delivery Strategy Channel Utilization Technology Utilization Retail Banking Commercial Banking Deposit Operations & Loan Operations Consumer & Mortgage Lending Accounting & Finance Trust, Insurance & Brokerage Information Technology Marketing Human Resources © 2012 Ceto and Associates Ceto and Associates Organizational Effectiveness Peer Analysis 40 © 2012 Ceto and Associates Ceto and Associates Organizational Effectiveness Benchmarking Study: Non-Interest Expense SAMPLE Bank Peer Median Peer 75th Percentile Teller Transactions per Teller FTE/Per Month 2,276 2,550 3,490 Total Deposits Accounts Serviced Per Platform FTE 1,403 3,617 5,202 New Accounts Opened per Platform FTE/Per Month 17 81 111 Branch Metrics 41 © 2012 Ceto and Associates Ceto and Associates Organizational Effectiveness Benchmarking Study: Non-Interest Expense SAMPLE Bank Peer Median Peer 75th Percentile Advertising/PR as a % of Non-Interest Expense 3.12% 3.14% 4.23% External Audit as a % of Non-Interest Expense .88% .48% .90% Legal as a % of Non-Interest Expense 1.42% .89% 1.51% Telecommunications as a % of Non-Interest Expense 1.37% 1.29% 1.60% Postage as a % of Non-Interest Expense 1.37% 1.18% 1.59% Non-Interest Expense Category 42 © 2012 Ceto and Associates Ceto and Associates Organizational Effectiveness Management Process ScoreCard 120 Best Practices 7 Categories of Management • • • • • • • Organization Structure Organization Objectives Planning Policies & Procedures Performance Standards & Goals Communications Management Reporting OREO Management Lending 43 Operations Finance & ERM Board of Directors CEO Internal Audit Marketing Human Resources © 2012 Ceto and Associates Ceto and Associates Organizational Effectiveness Risk Management ScoreCard 250 Best Practices 8 Categories of Risk Management • • • • • • • • 44 Internal Environment Objective Setting Risk Identification Risk Assessment Risk Response Control Activities Information Communications Monitoring © 2012 Ceto and Associates Ceto and Associates Organizational Effectiveness Phase III: Benefits ➢ $500 - $1,000 per $1 million in assets For example, a $500 million bank should expect $250,000 - $500,000 in new recurring cost savings annually! Other Benefits • • • • • • • • 45 Optimum Staffing Levels Stronger Organizational Alignment & Management Process Better Controls Shorter Cycle Times Reduced Operating Losses Minimized Internal & External Risks Improved Process & Productivity Higher Levels of Customer Satisfaction © 2012 Ceto and Associates Ceto and Associates Increasing Bank Profitability Summary Summary of Potential Benefits for SAMPLE BANK Potential Pre-Tax Benefits, by Phase Phases Phase I: Revenue Optimization Phase II: Contract Management Phase III: Organizational Effectiveness Total Low Benefit $500,000 $62,500 $250,000 High Benefit $1,000,000 $125,000 $500,000 $812,500 $1,625,000 Notes: • Phase I, Revenue Optimization benefits of new revenue based on $1,000 - $2,000 per million dollars in assets. • Phase II, Contract Management benefits of cost savings based on $125 - $250 per million dollars in assets. • Phase III, Organizational Effectiveness benefits of cost savings based on $500 - $1,000 per million dollars in assets. 46 © 2012 Ceto and Associates Ceto and Associates Increasing Bank Profitability Summary New Regulations & Costs • Reg E and Durbin Amendment alone will cost almost $16 billion in lost income annually or 18% of bank profits of $87 billion in 2010! • The Dodd-Frank bill (and others to come) will also add significantly to bank costs. 47 © 2012 Ceto and Associates Ceto and Associates Increasing Bank Profitability Summary Banks desperately need to do everything they can to replace the permanent loss of this revenue and look for new sources… while at the same time… become more efficient. 48 © 2012 Ceto and Associates Ceto and Associates Increasing Bank Profitability Summary Community Banking is a key element in our nation’s financial system and we must do everything we can to preserve its unique place in our economy!! ****** I hope these ideas are helpful to you in meeting these challenges! Thank You! 49 © 2012 Ceto and Associates Ceto and Associates Contact Us Ceto and Associates 3325 Paddocks Parkway, Ste 400 Suwanee, GA 30024 1.866.227.1361 678.297.1151 (f) cetoinc@ceto.com www.ceto.com 50 © 2012 Ceto and Associates