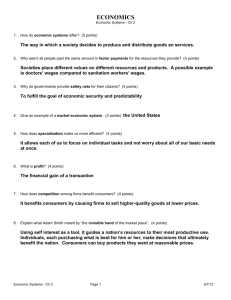

Economic-Political Systems

advertisement

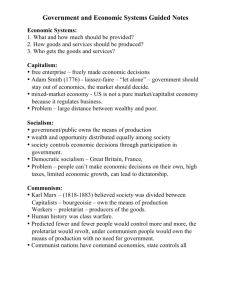

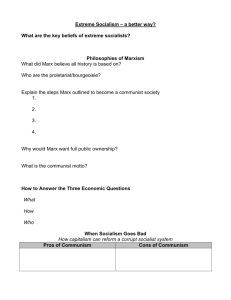

Each country has an economic and political system. The political system determines the economic system. Three basic types: Capitalism Socialism Communism Capitalism is an economic-political system in which private citizens are free to go into business for themselves, to produce whatever they choose, and to distribute what they produce. the right to own property. Also known as the free enterprise system Socialism is an economic-political system in which the government controls the use of the country’s factors of production. Socialists do not agree as to how much of the productive resources government should own. Socialism is often associated with mixed economies. Socialism is generally disliked in the U.S. because it limits the right of the individual to own property for productive purposes. The right to own property exists in socialism, in different degrees, depending upon the amount of government ownership and control. Ex. Sweden, Italy. Communism is extreme socialism, in which all or almost all of a nation’s factors of production are owned by the government. The government decided what and how to produce and how to divide the results of production among the citizens. Consumer goods are often in short supply. The government channels a large proportion of production toward capital formation. People do not own property. All economic decisions are made by government leaders. Right to private property. Right of each business to make profit. Right of each business to set its own prices. Right to compete. Right to determine wages paid to its workers Private property consists of items of value that individuals have the right to own, use, and sell. Individuals can control productive resources. They can own land, hire labor, and own capital goods. They can use these resources to produce goods and services. Individuals own products made from their resources. In capitalism, the incentive and reward for producing goods and services with utility is profit. Profit = Sales - Expenses The profit earned by a business is often overestimated by society. The average profit is about 5 percent of total receipts. Being in business does not guarantee that a company will make a profit. Demand for a product refers to the number of products that will be bought at a given time at a given price. Demand is not the same as want. Wanting an expensive luxury car without having the money to buy one does not represent demand. Demand is represented buy those people who want it, have the money to buy it, and are willing to spend the money for it. There is a relationship between price and demand. With increased demand, prices generally rise in the short run. When demand decreases, prices generally fall. The supply of a product also influences its price. Supply of a product refers to the number of like products that will be offered for sale at a particular time and at a certain price. If there is a current shortage of a product, its price usually rises as consumers bid against one another to obtain the product. Generally changes in prices determine what is produced and how much is produced in our economy. Price changes indicate to businesses what is profitable or not profitable to produce. Prices are determined by the forces of supply and demand. Competition is the rivalry among sellers for consumer’s dollars. Competition benefits society in many ways: a business must improve the quality of products develop new products operate efficiently in order to keep prices down Competition serves to ensure that consumers will bet the quality products they want at fair prices. tends to make all businesses use our scarce productive resources efficiently. benefits individuals because it provides the chance for people to go into business for themselves and to share in the profits being made by those already in business. Competition is the opposite of monopoly. Monopoly is the existence of only one seller of a product. A monopolist can charge unreasonably high prices and make extraordinary profits. Legislation exists that can encourages competition and discourages monopolies Countries must also decide how the goods produced will be divided among the people in the society. In a free enterprise economy, the share of goods produced that an individual receives is determined by the amount of money that person has to purchase goods and services. People receive income – wages and salariesby contributing their labor to the production of goods and services. The amount of money received in wages or salary is determined by many factors, including personal traits and abilities. The same factors that determine the prices of goods are also important in determining wages and salaries. Supply and demand. The strength of a nation depends on its economic growth. Economic growth is measured by: annual increase in the GDP increased employment opportunities continuous development of new and improved goods and services Economic growth occurs when a country’s output exceeds its population growth. More goods and services are available for each person. Basic ways to increase the production of goods and services in order to encourage economic growth: increase the number of people in the workforce increase the productivity of the workforce increase the supply of capital goods improve technology redesign work processes in factories and offices to improve efficiency increase the sale of goods and services to foreign countries decrease the purchase of goods and services from foreign countries For economic growth to occur, just increasing the production of goods and services is not enough. They must also be consumed. To know whether the economy is growing at a desirable rate, statistics must be gathered. GDP (Gross Domestic Product) CPI (Consumer Price Index) Employment Retail Sales New Home Sales The total market value of all final goods and services produced in a country in a given year, equal to total consumer, investment and government spending, plus the value of exports, minus the value of imports. The CPI indicates what is happening in general to prices in the country. It measures the average change in prices of consumer goods and services typically purchased by people living in urban areas. An economic condition marked by the fact that individuals actively seeking jobs remain unhired. Unemployment is expressed as a percentage of the total available work force. The level of unemployment varies with economic conditions and other circumstances. broad consumer spending patterns based on the retail sales of consumer-durables (goods that usually last more than three years) and consumer non-durables (that usually last less than three years). Measure of how many new homes were for sale and how many were sold. Problems occur with the economy when the growth rate jumps ahead or drops back too quickly. Recession is a decline in the GDP that continues for six months or more. Occurs when demand for the total goods and services available is less than the supply Inflation is the rapid rise in prices caused by an inadequate supply of goods and services. Total demand exceeds supply. Results in a decline in purchasing power of money. Most industrialized nations experience business cycles, a pattern of irregular but repeated expansion and contraction of the GDP. Business cycles last about five years. Four phases: Expansion Peak Contraction Trough They can vary in length and intensity. Some can be severe. When statistics show that the economy may be about to enter a recessionary period (contraction) or an inflationary period (expansion), the government can take certain actions. Controlling taxes, regulating government expenditures, and adjusting interest rates. Controlling Taxes Taxes are raised to slow growth and lowered to encourage growth. When taxes are raised, there is less money to spend, which discourages economic growth. When taxes are lowered, people and businesses have more money to spend which encourages growth. Government Expenditures Federal government spends billions of dollars each year to pay salaries and buy equipment. Government can increase its spending to stimulate a slow economy or reduce spending to slow economic growth. Interest Rates Interest rates is the money paid to borrow money. Borrowing by businesses and consumers generates spending. Spending stimulates the economic growth. When interest rates are lowered, businesses are encouraged to borrow. Using these and other methods, the economic growth can be somewhat controlled, however, it is usually kept to a minimum in a free enterprise system.