Economics Principles and Applications

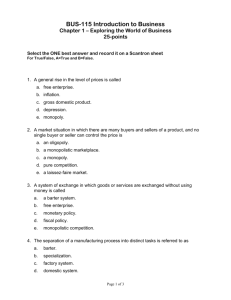

advertisement

Monopolistic Competition And Oligopoly Lecture by: Jacinto Fabiosa Fall 2005 Monopolistic Competition And Oligopoly • On any given day, you are probably exposed to hundreds of advertisements – Advertising is everywhere in the economy • So far in this book not much has been said about advertising – There is a good reason for this • In perfect competition and monopoly firms do little, if any, advertising • Where, then, is all the advertising coming from? – We must consider firms that are neither perfect competitors nor monopolists 2 The Concept of Imperfect Competition • Refers to market structures between perfect competition and monopoly – In imperfectly competitive markets, there is more than one seller, but too few to create a perfectly competitive market – Imperfectly competitive markets often violate other conditions of perfect competition • Such as the requirement of a standardized product or free entry and exit • Types of imperfectly competitive markets – Monopolistic competition – Oligopoly 3 Monopolistic Competition • Hybrid of perfect competition and monopoly, sharing some of features of each – A monopolistically competitive market has three fundamental characteristics • Many buyers and sellers • Sellers offer a differentiated product • Sellers can easily enter or exit the market 4 Many Buyers and Sellers • Under monopolistic competition, an individual buyer is unable to influence price he pays – But an individual seller, in spite of having many competitors, decides what price to charge • Our assumption of many sellers, however, has another purpose – To ensure that no strategic games will be played among firms in market • There are so many firms, each supplying such a small part of the market – That no one of them needs to worry that its actions will be noticed—and reacted to—by others 5 Sellers Offer a Differentiated Product • Each seller produces a somewhat different product from the others • Faces a downward-sloping demand curve – In this sense is more like a monopolist than a perfect competitor – When it raises its price a modest amount, quantity demanded will decline (but not all the way to zero) 6 Sellers Offer a Differentiated Product • What makes a product differentiated? – Quality of product – Difference in location • Product differentiation is a subjective matter – A product is different whenever people think that it is • Whether their perception is accurate or not • Thus, whenever a firm (that is not a monopoly) faces a downward-sloping demand curve, we know buyers perceive its product as differentiated – This perception may be real or illusory, but economic implications are the same in either case • Firm chooses its price 7 Easy Entry and Exit • This feature is shared by monopolistic competition and perfect competition – Plays the same role in both – Ensures firms earn zero economic profit in long-run • In monopolistic competition, however, assumption about easy entry goes further – No barrier stops any firm from copying the successful business of other firms 8 Monopolistic Competition in the Short-Run • Individual monopolistic competitor behaves very much like a monopoly • Key difference is this – While a monopoly is the only seller in its market, a monopolistic competitor is one of many sellers – When a monopolistic competitor raises its price, its customers have one additional option • Can buy similar good from some other firm 9 A Monopolistically Competitive Firm in the Short Run 10 Monopolistic Competition in the Long-Run • Under monopolistic competition—in which there are no barriers to entry and exit—the firm will not enjoy its profit for long – Entry will continue to occur, and demand curve will continue to shift leftward • Under monopolistic competition, firms can earn positive or negative economic profit in short-run – But in long-run, free entry and exit will ensure that each firm earns zero economic profit just as under perfect competition • In real world, monopolistic competitors often earn economic profit or loss in the short-run – But—given enough time—profits attract new entrants, and losses result in an industry shakeout • Until firms are earning zero economic profit 11 A Monopolistically Competitive Firm in the Long Run 12 Excess Capacity Under Monopolistic Competition • In long-run, a monopolistic competitor will operate with excess capacity – Will produce too little output to achieve minimum cost per unit • Excess capacity suggests that monopolistic competition is costly to consumers • May tempt you to leap to a conclusion – Consumers are better off under perfect competition; however • In order to get beneficial results of perfect competition, all firms must produce identical output • Consumers usually benefit from product differentiation 13 Nonprice Competition • If monopolistic competitor wants to increase its output it can cut its price – Move along its demand curve • Any action a firm takes to increase demand for its output— other than cutting its price—is called nonprice competition – Examples include better service, product guarantees, free home delivery, more attractive packaging • Nonprice competition is another reason why monopolistic competitors earn zero economic profit in long-run • All this nonprice competition is costly – Must pay for advertising, for product guarantees, for better staff training – Costs must be included in each firm’s ATC curve, shifting it upward • None of this changes conclusion that monopolistic competitors will earn zero economic profit in long-run 14 Oligopoly • When just a few large firms dominate a market – So that actions of each one have an important impact on the others – Would be foolish for any one firm to ignore its competitors’ reactions – In such a market, each firm recognizes its strategic interdependence with others • An oligopoly is a market dominated by a small number of strategically interdependent firms 15 Market Definition • In oligopoly, a few large firms dominate market • In many cases, common sense provides a sufficient guideline – Should broaden market definition just enough to include all reasonably close substitutes • In some cases, common sense isn’t definitive 16 Number of Firms • Oligopoly requires that a few firms dominate the market – Even if we can agree on a market’s definition, what number qualifies as “a few”? • At some point, number of firms is large enough— and interdependence weak enough—that oligopoly becomes a poor description – Monopolistic competition would fit better – No absolute number at which oligopoly ends and monopolistic competition begins 17 Market Domination • Strategic interdependence requires that a few firms—whatever their number— dominate the market – Their share of market is large • As combined market share shrinks, strategic interdependence becomes weaker • Oligopoly is a matter of degree – Not an absolute classification 18 Economies of Scale: Natural Oligopolies • When minimum efficient scale (MES) for a typical firm is a relatively large percentage of market – A large firm—supplying a large share of the market— will have lower cost per unit than a small firm • Since small firms can’t compete, only a few large firms survive – Market becomes an oligopoly • Tends to happen on its own unless there is government intervention – Such a market is often called a natural oligopoly—analogous to natural monopoly 19 Reputation as a Barrier • A new entrant may suffer just from being new – Established oligopolists are likely to have favorable reputations • In some cases, where potential profits are great, investors may decide it is worth the risk and accept initial losses in order to enter industry • In other industries, the initial losses may be too great and probability of success too low for investors to risk their money starting a new firm 20 Strategic Barriers • Oligopoly firms often pursue strategies designed to keep out potential competitors – Maintain excess production capacity as a signal to a potential entrant that they could easily saturate market and leave new entrant with little or no revenue – Make special deals with distributors to receive best shelf space in retail stores – Make long-term arrangements with customers to ensure that their products are not displaced quickly by those of a new entrant – Spend large amounts on advertising to make it difficult for a new entrant to differentiate its product 21 Legal Barriers • Patents and copyrights—which can be responsible for monopoly—can also create oligopolies • Like monopolies, oligopolies are not shy about lobbying government to preserve their market domination • Government barriers can operate against domestic entrants, too 22 Oligopoly vs. Other Market Structures • Oligopoly presents the greatest challenge to economists • Essence of oligopoly is strategic interdependence – Wherein each firm anticipates actions of its rivals when making decisions • In order to understand and predict behavior in oligopoly markets – Economists have had to modify the tools used to analyze other market structures and to develop entirely new tools as well • One approach—game theory—has yielded rich insights into oligopoly behavior 23 The Game Theory Approach • Game theory – An approach to modeling strategic interaction of oligopolists in terms of moves and countermoves • In all games—except those of pure chance, such as roulette—a player’s strategy must take account of the strategies followed by other players • Game theory analyzes oligopoly decisions as if they were games by – Looking at the rules players must follow – Payoffs they are trying to achieve – Strategies they can use to achieve them 24 The Prisoner’s Dilemma • Easiest way to understand how game theory works is to start with a simple, noneconomic example—the prisoner’s dilemma – Explains why a technique for obtaining confessions, commonly used by police, is so often successful • Each of four boxes in payoff matrix represents one of four possible strategy combinations that might be selected in this game – – – – Upper left box: Both Rose and Colin confess Lower left box: Colin confesses and Rose doesn’t Upper right box: Rose confesses and Colin doesn’t Lower right box: Neither Rose nor Colin confesses 25 The Prisoner’s Dilemma 26 The Prisoner’s Dilemma • Regardless of Rose’s strategy Colin’s best choice is to confess – In this game, the strategy “confess” is an example of a dominant strategy • Strategy that is best for a player regardless of strategy of other player • Outcome of this game is an example of a Nash equilibrium—appropriately named after the mathematician John Nash, who originated the concept – Exists when each player is taking the best action—given actions taken by other players • As long as each player acts in an entirely self-interested manner Nash equilibrium is best outcome for both of them 27 Simple Oligopoly Games • Same method used to understand behavior of Rose and Colin in prisoner’s dilemma can be applied to a simple oligopoly market • Duopoly – Oligopoly market with only two sellers • Assume that Gus and Filip must make their decisions independently – Without knowing in advance what the other will do • No matter what Filip does, Gus’s best move is to charge a low price— his dominant strategy – A similar analysis from Filip’s point of view, using the red-shaded entries of Figure 4, would tell us that his dominant strategy is the same: a low price • Notice that outcome is a Nash equilibrium – Equilibrium price in market is the low price 28 A Duopoly Game 29 Oligopoly Games in the Real World • Will typically be more than two strategies from which to choose • Will usually be more than two players • In some games, one or more players may not have a dominant strategy – A game with two players will have a Nash equilibrium as long as at least one player has a dominant strategy • Whether the other has a dominant strategy or not – When neither player has a dominant strategy, we need a more sophisticated analysis to predict an outcome to the game 30 Oligopoly Games in the Real World • We’ve limited the players to one play of the game – In reality, for gas stations and almost all other oligopolies, there is repeated play • Where both players select a strategy • Observe the outcome of the trial • Play the game again and again, as long as they remain rivals • One possible result of repeated trials is cooperative behavior 31 Cooperative Behavior in Oligopoly • In real world, oligopolists will usually get more than one chance to choose their prices • The equilibrium in a game with repeated plays may be very different from equilibrium in a game played only once – Often, firms will evolve some form of cooperation in the long run 32 Explicit Collusion • Simplest form of cooperation is explicit collusion – Managers meet face-to-face to decide how to set prices • Most extreme form of explicit collusion is creation of a cartel – Group of firms that tries to maximize total profits of the group as a whole • If explicit collusion to raise prices is such a good thing for oligopolists, why don’t they all do it? – Usually illegal – Penalties, if the oligopolists are caught, can be severe • But oligopolists can collude in other, implicit ways 33 Tacit Collusion • Any time firms cooperate without an explicit agreement, they are engaging in tacit collusion • Tit for tat – A game-theoretic strategy of doing to another player this period what he has done to you in previous period • However, gentle reminder of tit-for-tat is not always effective in maintaining tacit collusion – Oligopolist will sometimes go further • Attempting to punish a firm that threatens to destroy tacit cooperation 34 Tacit Collusion • Another form of tacit collusion is price leadership – One firm—the price leader—sets its price and other sellers copy that price • With price leadership, there is no formal agreement – Rather the decisions come about because firms realize—without formal discussion—that system benefits all of them – Decisions include • Choice of leader • Criteria it uses to set its price • Willingness of other firms to follow 35 The Limits to Collusion • Oligopoly power—even with collusion—has its limits – Even colluding firms are constrained by market demand curve – Collusion—even when it is tacit—may be illegal – Collusion is limited by powerful incentives to cheat on any agreement 36 The Incentive to Cheat • Go back to Gus and Filip for a moment – One way or another they arrive at high-price cooperative solution – Will the market stay there? • Maybe, and maybe not – Problem—each player may conclude that he can do even better by cheating – Two players would be back to noncooperative outcome based on their dominant strategies – May be in each player’s interest to cheat occasionally • Analyzing this sort of behavior requires some rather sophisticated game theory models – Economists are actively engaged in building them 37 When is Cheating Likely? • While no firm wants to completely destroy a collusive agreement by cheating – Since this would mean a return to the noncooperative equilibrium wherein each firm earns lower profit – Some firms may be willing to risk destroying agreement if benefits are great enough – Suggests that cheating is most likely to occur—and collusion will be least successful—under the following conditions • Difficulty observing other firms’ prices • Unstable market demand • Large number of sellers 38 The Future of Oligopoly • Some people think U.S. and other Western economies are moving toward oligopoly as dominant market structure – In 1932, two economists—Adolf Berle and Gardiner Means—noted trend toward big business • Predicted the 200 largest U.S. firms would control nation’s entire economy by 1970 – Unless something were done to stop it • Prediction has not come true – Today, there are hundreds and thousands of ongoing businesses in United States 39 Antitrust Legislation and Enforcement • Antitrust enforcement has focused on three types of actions – Preventing collusive agreements among firms • Such as price-fixing agreements – Breaking up or limiting activities of large firms—oligopolists and monopolists—whose market dominance harms consumers – Preventing mergers that would lead to harmful market domination • Managers of other firms considering anticompetitive moves have to think long and hard about consequences of acts that might violate antitrust laws • While thrust of these policies is to preserve competition – Type of competition preserved—and zeal with which policies are applied—can shift 40 The Globalization of Markets • By enlarging markets from national ones to global ones, international trade can increase the number of firms in a market – Decreasing market dominance by a few, and increasing competition • Although oligopolists often try to prevent it, they face increasingly stiff competition from foreign producers • Entry of U.S. producers has helped to increase competition in foreign markets for movies, television shows, clothing, household cleaning products, and prepared foods • While consumers in each nation may have access to more firms, these may be larger and more powerful firms – Creating greater likelihood of strategic interaction and danger of collusion 41 Technological Change • Technological change works to increase competition by creating new substitute goods • Can reduce barriers to entry in much the same way that globalization does – By increasing size of market • Technology—the internet—has enabled residents in many smaller towns to choose among a dozen or more online sellers of the same merchandize – Trend can also be seen as encouraging oligopoly – Result could be strategic interaction, or collusion, among large national players • Finally, some technologies actually increase MES of typical firm – Thereby encouraging formation of oligopolies 42 Advertising in Monopolistic Competition 43 Using the Theory: Advertising in Monopolistic Competition and Oligopoly • Perfect competitors never advertise and monopolies advertise relatively little – But advertising is almost always found under monopolistic competition and very often in oligopoly • Why? – All monopolistic competitors, and many oligopolists, produce differentiated products • Since other firms will take advantage of opportunity to advertise, any firm that doesn’t advertise will be lost in shuffle 44 Using the Theory: Advertising and Market Equilibrium Under Monopolistic Competition • A monopolistic competitor advertises for two reasons – To shift its demand curve rightward (greater quantity demanded at each price) – To make demand for its output less elastic • So it can raise price and suffer a smaller decrease in quantity demanded • Can summarize impact of advertising as illustrated in panel (a) – Since each firm must pay costs of advertising, and more competitors have entered the market, Narcissus and its competitors are each earning normal economic profit—just as they were originally • Advertising has raised the price from $60 to $100 in longrun – But this is not the only possible result 45 Using the Theory: Advertising and Market Equilibrium Under Monopolistic Competition • Because you and I and everyone else is buying more perfume – Each producer can operate closer to capacity output, with lower costs per unit – In long-run, entry will force each firm to pass cost savings on to us • Analysis suggests the following conclusion – Under monopolistic competition, advertising may increase size of market, so that more units are sold • But in long-run, each firm earns zero economic profit, just as it would if no firm were advertising • Price to consumer, however, may either rise or fall 46 Advertising and Collusion in Oligopoly • Oligopolists have a strong incentive to engage in tacit collusion – But in some cases can use a simple game theory model to show that collusion is almost certainly taking place • Take airline industry as an example • In theory, any airline should be able to claim superior safety – Yet no airline has ever run an advertisement with information about its security policies or attacked those of a competitor • Airlines are playing against each other repeatedly and reach the kind of cooperative equilibrium we discussed earlier 47 An Advertising Game 48 The Four Market Structures: A Postscript • Different market structures – Perfect competition – Monopoly – Monopolistic competition – Oligopoly • Market structure models help us organize and understand apparent chaos of realworld markets 49