McMaster Investment Council

advertisement

TransAlta Renewables Inc.

December 2015

This presentation is for educational purposes only, and is not intended to serve as a buy or sell recommendation on any security,

investment product or other financial product or service. Any views or opinions presented are solely those of the authors and do not

necessarily represent those of the investment council.

Power and Utilities Team

Asem Mosmer

Portfolio Manager

Blake Klasios

Research Analyst

Alexandra Finstad

Research Analyst

Argjend Jakupi

Research Analyst

Moe Al-Nabhan

Research Analyst

Paige Ferneyhough

Research Analyst

Nick Cevallos

Research Analyst

Agenda

1. Industry Overview

2. Company Overview

3. Investment Theses

4. Valuation

5. Catalysts and Risks

6. Questions

1

Industry Overview

1. Notes & Key Industry Terms

Key Terms

Renewable Energy

• Energy coming from resources that are naturally replenished over time (e.g. wind, waves, sunlight, and

geothermal heat)

Non-renewable energy

•

Comes from sources that will not be replenished over time. Most are fossil fuels (e.g. coal, petroleum, and

natural gas)

Purchase Power Agreements (PPA)

• Contract between producer and consumer, where the power producer takes on risk of supplying power for

fixed price to buyer.

Drop-down transaction

•

A sale of assets by a parent company to its subsidiaries (TransAlta Corp. TransAlta Renewables)

Generation Capacity

• Intended full –load sustained output of a facility

Device

Wattage

Hours Used

kWh

Light Bulb

100 Watts

700h (all month)

70 kWh

Megawatt Hour (MWh)

• The basic industrial unit for electricity (1 MWh = 1000 kWh = 1,000,000 Wh)

• An average household uses 0.8 -1.3 MWh/month

• The average annual residential energy use in the U.S. is about 3,000 kilowatt-hours for each person. So we

can figure out how many people our dam could serve by dividing the annual energy production by 3,000

1. Industry Overview – Canadian Renewables

Main Sources for Electricity Generation

Industry Snapshot

0.20%

Revenue

$26.5 bn

Annual Growth (2010-15)

Profit

1.50%

15.30%

Hydro

Convetional Steam

Nuclear

Internal Combustion

Tidal

Wind

1.7%

$4.1bn

15.00%

Exports

$2.1bn

Businesses

63.30%

46

Industry Supply Chain

•

•

•

•

•

Generation

Hydro Quebec

BC Hydro

Manitoba

Hydro

Ontario Power

Generation

Other

•

•

•

•

•

Generation

Transmission

Distribution

•

•

Distribution

Industrial

Markets

Residential

Markets

Commercial

Markets

Exports

Public

Administration

Agriculture

Transportation

1. Industry Overview (cont.)

Industry Drivers

Consumer, businesses and

manufacturers (overall

growth)

Electric

Power

Consumptio

n (Demand)

Highly

regulated

Price of

Electric

Power

Industrial

Capacity

Utilization

Macro

Trends

GDP Growth

Interest Rate Hikes

Consumer Demand

Decrease in price of

natural gas

World Price

of Natural

Gas

World Price

of NonRenewable

Power

High energyintensive

manufacturing

promotes industry

revenue growth

Low prices of coalgenerated electricity

increases

competition

2

Company Overview

2. Company Overview

Share Price History

Company Summary

TransAlta Renewables (RNW)

•

TransAlta Renewables Inc. is a Canada-based renewable

power company engaged in developing, owning and

operating renewable power generation facilities

•

TransAlta Renewables was incorporated in May 2013 as a

sponsored vehicle of TransAlta Corporation

•

Owns and operates around 17 wind farms, 12 hydro

facilities, and 7 gas facilities in Canada, the US, and most

recently acquired a Western Australian plant

14

13

12

11

10

9

8

Geographic Breakdown

Company Snapshot

Ticker

Stock Price

IPO Date

TSX: RNW

10.13

August 9, 2013

Market Cap

$1.93 billion

Revenue

$0.23 billion

Shares Outstanding

$190.8 million

2. Company Overview

Company Stock Performance

Nov 23, 2015:

Agreed to invest $540 million in 3 TransAlta wind and hydro

projects & entered into an agreement with AIMCo for the

sale of $200 million of their common shares

Dec 20th, 2013:

Acquired an economic interest

in a 144 MW wind farm in

Wyoming

14

2,500

2,000

12

1,500

11

1,000

10

500

Volume

Closing Price

9-Nov-15

9-Oct-15

9-Sep-15

9-Aug-15

9-Jul-15

9-Jun-15

9-May-15

9-Apr-15

9-Mar-15

9-Feb-15

9-Jan-15

9-Dec-14

9-Nov-14

9-Oct-14

9-Sep-14

9-Aug-14

9-Jul-14

9-Jun-14

9-May-14

9-Apr-14

9-Mar-14

9-Feb-14

9-Jan-14

9-Dec-13

9-Nov-13

9-Oct-13

0

9-Sep-13

9

9-Aug-13

Closing Price ($)

13

Jul 27th, 2015:

Announcement of classaction law-suit against

TransAlta – timed

power outages to driveup prices

May 7th, 2015:

Invested in an economic

interest in TransAlta’s

Western Australia Portfolio

Volume (Thousands)

Aug 9th, 2013:

Acquired 28 hydroelectric and wind facilities from

TransAlta & completed an IPO of 22.1 million common

shares @ $9.98/share

2. Company Overview

Supply Chain Breakdown

Resources

Counterparties

High Quality

Counterparties

AAA

BB

BBB

AA

A

•

TransAlta Renewables uses production facilities and natural resource to create renewable energy, which is then

sold through PPAs with 6 high quality counterparties

•

These counterparties are all primarily owned by the provincial government of their respective regions

•

TransAlta Renewabes is fully contracted through PPA agreements, having a weighted average term of 17 years

2. Company Overview (cont.)

Management Overview

Brett M. Gellner

CEO

Donald Tremblay

CFO

Cynthia Johnston

COO

Brett is also the current

Chief Investment Officer

at TransAlta Corp. and

was previously the cohead of CIBC World

Market’s Power &

Utilities group.

Donald is the current

CFO of TransAlta Corp.

and was previously

Brookfield Renewable

Power’s Executive VP

and CFO

Cynthia is also the

Executive VP of

TransAlta. Previously, she

was TransAlta’s VP of

Renewable Operations

John Kousinioris

Corporate Secretary

John is also the corporate

secretary at TransAlta

Corp. He was co-head of

the corporate commercial

department at Bennett

Jones LLP.

3

Investment Theses

3. Investment Thesis 1: Climate Change

Increasing focus on reducing emissions

•

Scientific research has proven that the world continues to warm YoY

• The Earth has warmed every year since 1880 with 2015 being the hottest year on record

•

According to National Oceanic and Atmospheric Administration (NOAA), the globe’s temperature in October had

increased 0.98 degrees Celsius higher than average – it is the highest recorded global temperature in recent

historical records

•

30,000 delegates globally are currently meeting in Paris to discuss climate change

• Canada will be playing a big part due to the Liberal Party’s “green” agenda

Trends in Land & Ocean Temperatures

Global Temperature Increase

Investment Thesis 1: Climate Change

Renewable Energy Growth Story

2012 WORLD POWER MIX

Coal

Natural Gas

Oil

Nuclear

Renewable

2040 WORLD POWER MIX

Coal

Natural Gas

Oil

Nuclear

Renewable

21%

Coal

41%

Renewable

Coal

31%

Renewable

32%

Nuclear

11%

Oil

5%

Nuclear

12%

Natural Gas

22%

Oil

1%

Natural

Gas

24%

The International Energy Agency predicts that renewable energy will grow by 11% over 28 years

Investment Thesis 1: Climate Change

•

Canada has invested $24 billion in renewable energy since 2009

• The Liberal government has pledged $300 million more in funding for the space

Canada is the 6th largest consumer of electricity on the planet

63% of TransAlta Renewables energy portfolio is in wind turbines – this is the most heavily invested and funded

space in Canada as well as the fastest growing

TransAtla’s acquisition of Wyoming Wind will allow for renewable energy push into the Republican stronghold of

the Midwestern United States

The Street has underestimated the severity of climate change and has no longer priced it into renewable stocks due

to the current drop in oil and natural gas prices

•

•

•

•

Clean Energy Canada Snapshot

Canada Renewable Energy

Growth (%)

Canadian Five Year National

Investment (in $Billions)

10

25

8

20

6

15

4

10

2

5

0

0

2009

2010

Wind

2011

Solar

2012

Hydro

2013

2009

2010

Wind

2011

Solar

2012

Hydro

2013

3. Investment Thesis 2: Upside to association with TA

Market over-reaction due to association with TransAlta Corp.

Headwinds Affecting Stock Price

1. August legal trouble with Alberta

Market Surveillance Administrator

• Alleged price manipulation by

taking outages at coal-fired

generating facilities

• Settlement on September 30

2015 to pay $56 million

2. Alberta economy

• Low demand for power from oil

companies due to oil price

• NDP phase out of coal (2030)

RNW vs TA

Share Price ($)

$18

$17

$16

$15

$14

$13

$12

$11

$10

$9

RNW

TA

Date

“Dial Down” Coal, “Dial Up” Renewables

•

TA Focus on Growing RNW

100000

90000

80000

70000

60000

50000

40000

30000

20000

10000

0

Coal

•

•

TA Generation by Fuel Type

TA strengthening balance sheet thorough asset dropdowns to

RNW

TA focusing “dialing up” renewable energy and recent

dropdowns show commitment:

Gas

Cogen

Renewables

2030

2029

2028

2027

2026

2025

2024

2023

2022

2021

2020

2019

2018

2017

Sarnia Cogen. Plant

2016

Annual Generation (GWh)

TA has set mandatory renewables targets: 15% of total load

in 2020, 20% of total load in 2025, 25% of total load in 2030

Ragged Chute Hydro Plant

Le Nordais

Wind Farm

3. Investment Thesis 3: Strong and Sustainable Growth

Generation Capacity (MW) – Proven Track Record for Growth

3000

2500

South

Hedland

Ontario/Quebec

Acquisition

(recently announced)

2000

Australia

Portfolio

1500

1000

500

0

2012

2013

2014

Wind

2015

Hydro

2016

2017

3. Investment Thesis 3: Strong and Sustainable Growth

Increasing CAFD & DPS

•

Substantial production increase through dropdowns from parent company

• Estimated CAFD from 2014 to 2018 is ~140%

• Taking advantage of low borrowing fees to position themselves for long-term benefits

•

Acquiring assets with lower P/CAFD

• Most recent acquisition of Ontario/Quebec Hydro and wind plants

have an overall P/CAFD of 10x, while the company as a whole trades at 12x

•

Increasing diversity of asset base

• Gas in Australia, different wind patterns in Eastern Canada vs West (+Australia)

Estimated CAFD ($ million)

Estimated Dividend/Share ($)

250

1

0.9

200

South Hedland

0.7

Operating

Ontario/Quebec

Assets

150

100

0.8

0.6

~9%

Australian

Acquisition

2.7%

Wyoming

Acquisition

0.5

~6%

South

Hedland

~5%

Ontario

/Quebec

Acquisition

0.4

Operating

Australian

Portfolio

50

0.3

0.2

0.1

0

2014 (Actual)

2015

2016

2017

0

IPO

2014

2015

2016

2017

4

Valuation

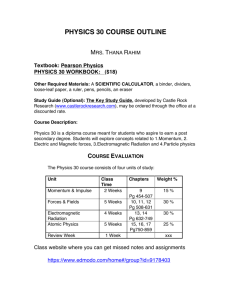

4. Valuation – Relative Valuation

Canadian Renewable Power Industry – Target Peer Group

Canadian Power Industry – Broader Industry

4. Valuation – DCF Analysis

Drop in Sales as result of resigning PPAs

with TA at a slight discount

Australian

Portfolio ~428 MW

Recent Acquisition

of Ontario/Quebec ~611 MW

South

Hedland ~150 MW

Transalta Renewables

Discounted Cash Flow Analysis

Mid-Year Convention

Y

Market Price

Model Price

Historical

Net Installed Capacity (MW)

Output (GWh)

$

2014

2015

2016

2017

2018

2019

('15 - '19)

1255

1255

1683

`

2294

2444

2444

2444

14.3%

2995

4016

5475

5832

5832

5832

14.3%

200,822

NA

22500

22019

245,341

(13709)

231,632

115.3%

(40,693.0)

$

EBITDA

% margin

Depreciation & Amortization

$

190,939

77.8%

76,589

$

EBIT

% margin

Taxes

EBIAT

$

114,350

56.9%

28588

85763

$

$

$

$

$

Plus: Depreciation & Amortization

Less: Capital Expenditures

Less: Increase in Net Working Capital

Unlevered Free Cash Flow

WACC

8.5%

Discount Period

Discount Factor

Present Value of Free Cash Flow

($ in million

CAGR

Implied Return

2013

866

Sales

% growth

Lease Revenues

Government Incentives

Total Sales

Royaties

Gross Profit (Total Sales - Royalties)

% margin

Operating Expenses (exc. D&A)

$13.50

Projection Period

186,865 $

(6.9%)

25445

21134

233,444 $

(12951)

220,493 $

118.0%

(46,605.0)

173,888

74.5%

73,951

250,593 $

34.1%

25445

28341

304,379 $

(17368)

287,011 $

114.5%

(62,648.2)

341,568 $

374,820 $ 386,065 $

397,646 16.3%

36.3%

9.7%

3.0%

3.0%

26717

28053

29456

30929 4.0%

38631

41157

41157

41157 14.3%

406,916 $

444,030 $ 456,677 $

469,732

(23673)

(25221)

(25221)

(25221)

383,243 $

418,809 $ 431,456 $

444,511 15.1%

112.2%

111.7%

111.8%

111.8%

(85,392.1)

(93,705.0)

(96,516.1)

(99,411.6)

$

224,363 $

73.7%

81,443

297,851

73.2%

90,516

$

325,104 $

73.2%

95,579

334,940

73.3%

98,446

99,937 $

53.5%

24984

74953

142,921 $

57.0%

35730

107190

207,336 $

60.7%

51834

155502

229,525 $

61.2%

57381

172143

236,493 $

61.3%

59123

177370

73,951

(8000)

(2492)

81,443

(12000)

(10566)

90,516

(8000)

(5380)

95,579

(8000)

(2956)

$

98,446

(8000)

691

345,099

73.5%

101,400

14.7%

243,699 19.5%

61.3%

60925

182774 19.5%

101,400

(8000)

808

-

$

138,412

$

166,067 $

8.5%

0.9

0.93

232,637 $

8.5%

1.9

0.86

256,766 $

8.5%

2.9

0.79

268,507 $

8.5%

3.9

0.73

276,982

8.5%

4.9

0.67

14.9%

$

138,412 $

154,185 $

199,071 $

202,506 $

195,176 $

185,563

6.0%

3.6%

4. Valuation – DCF Analysis

WACC Calculation

Target Capital Structure

Debt-to-Total Capitalization

Equity-to-Total Capitalization

Cost of Debt

Cost of Debt

Tax Rate

After-tax Cost of Debt

Cost of debt

27.3%

72.7%

5.1%

25.0%

3.8%

Value of Debt (mn)

$346,698.0

$35,000.0

$178,364.0

$100,912.0

Effective Yield Weighted Yield

5.91%

3.1%

5.28%

0.3%

4.00%

1.1%

4.00%

0.6%

5.07%

WACC Sensitivity Analysis

Debt-to-Total

Capitalization

Pre-tax Cost of Debt

Cost of Equity

Risk-free Rate(1)

Market Risk Premium(2)

Levered Beta

2.5%

7.1%

0.15

Cost of Equity

3.6%

WACC

3.6%

0.0

7.3%

17.3%

27.3%

37.3%

47.3%

4.1%

3.4%

3.3%

3.3%

3.4%

3.4%

4.6%

3.4%

3.3%

3.3%

3.4%

3.5%

5.1%

3.4%

3.3%

3.3%

3.4%

3.6%

5.6%

3.4%

3.3%

3.3%

3.4%

3.7%

6.1%

3.5%

3.3%

3.3%

3.5%

3.8%

Despite the actual WACC that was calulctaed, a WACC of 8.5% was used for the DCF

(1) Interpolated yield on 20-year U.S. Treasury

(2) Obtained from Ibbotson SBBI Valuation Yearbook

Implied Equity Value and Share Price

Terminal Value

$936,500.9 Enterprise Value

Less: Total Debt

Less: Preferred Securities

Terminal Year EBITDA (2019E)

$345,099.1 Less: Noncontrolling Interest

Exit Multiple

Terminal Value

Discount Factor

10.0x

Plus: Cash and Cash Equivalents

$3,450,990.6 Shares outstanding

0.67

Present Value of Terminal Value

% of Enterprise Value

$2,311,978.3

71.2%

Enterprise Value

$3,248,479.2

Implied Share Price

$3,248,479.2

(658,455.0)

-

Share Price

(37,847)

####

23,726

190,800.0

$13.50

WACC

Enterprise Value

Cumulative Present Value of FCF

6.5%

7.5%

8.5%

9.5%

10.5%

Exit Multiple

10.0x

11.0x

8.0x

9.0x

$12.29

$11.67

$11.08

$10.52

$9.99

$13.61

$12.93

$12.29

$11.68

$11.10

$14.94

$14.20

$13.50

$12.84

$12.20

$16.27

$15.47

$14.71

$13.99

$13.31

12.0x

$17.60

$16.74

$15.92

$15.15

$14.42

4. Valuation – LBO Analysis

•

•

Another tool used to value RNW was a quick and dirty LBO model

Using a linear regression tool and hardcoding an IRR of 20%, a share price of $12.56 was

calculated as an appropriate bid price for RNW.

SOURCES AND USES OF FUNDS

Uses of Funds

Acquisition Equity

Existing Net Debt Refinanced

Total Transaction Costs

Total Uses of Funds

$ 2,949,221

(672,576)

(44,238)

$ 3,666,035

New Equity

New Debt

Total Sources of Funds

$ 916,509

2,749,526

$ 3,666,035

ASSUMPTIONS

28/11/2015

$ 12.37

25.0%

$ 15.46

190,800.000

Current Stock Price

Transaction Premium

Acquisition Stock Price

Shares Outstanding

25%

75%

TEV as a Multiple of Year 0

Revenue

EBITDA

10.6x

10.0x

INCOME STATEMENT

Year 0

$ 233,444

Net Revenue

Expenses

Royalties + Other Exp.

RE

& Other

SG&A

$

(12,951) $

(46,605)

Year 1

$ 304,379

(17,368) $

(62,648)

Pro Forma

Year 2

Year 3

$ 406,916

$ 444,030

(23,673) $

(85,392)

(25,221) $

(93,705)

Year 4

$ 456,677

(25,221) $

(96,516)

Year 5

$ 469,732

(25,221)

(99,412)

Total Expenses

$ (59,556)

$ (80,016)

$ (109,065)

$ (118,926)

$ (121,737)

$ (124,633)

Operating Income

Interest Income

Interest Expense

Pre-Tax Income

$ 173,888

949

(192,467)

$ (17,630)

$ 224,363

949

(192,467)

$ 32,845

$ 297,851

949

(186,621)

$ 112,179

$ 325,104

949

(175,332)

$ 150,721

$ 334,940

949

(161,496)

$ 174,393

$ 345,099

949

(145,961)

$ 200,088

Taxes

Net Income

(4,407)

$ (13,222)

8,211

$ 24,634

28,045

$ 84,134

37,680

$ 113,040

43,598

$ 130,795

50,022

$ 150,066

4. Valuation – LBO Analysis

LBO CAPITAL STRUCTURE - 5 YR OVERVIEW

Year 1

Year 2

Pro Forma

Year 3

Year 4

Year 5

Exit EBITDA Multiple 10.0x

Implied Enterprise Value

Less: Net Debt

Implied Equity Value

$ 3,058,058

(2,826,468)

$ 231,590

$ 3,883,668

(2,674,867)

$ 1,208,800

$ 4,206,828

(2,487,381)

$ 1,719,447

$ 4,333,863

(2,276,160)

$ 2,057,702

$ 4,464,989

(2,039,277)

$ 2,425,712

Implied Multiple of Capital

IRR Return

0.2x

-76%

1.2x

11%

1.8x

21%

2.1x

21%

2.5x

20%

Billions

IRR ANALYSIS

$3.0

5 year investment horizon

$2.5

$2.0

CREDIT & LEVERAGE STATISTICS

Total Debt / EBITDA

Net Debt / EBITDA

EBITDA / Interest

EBIT / Interest

Total Debt / Equity

Total Debt / Capital

Year 0

11.8x

11.8x

1.2x

0.8x

2.9x

74.1%

Year 1

9.6x

9.1x

1.5x

1.1x

2.7x

73.3%

Pro Forma

Year 2

Year 3

7.5x

7.0x

6.6x

5.5x

1.9x

2.2x

1.5x

1.7x

2.4x

2.1x

70.8%

67.4%

Year 4

6.7x

4.8x

2.5x

1.9x

1.7x

63.3%

$1.0

Year 5

6.5x

4.1x

2.8x

2.1x

1.4x

58.3%

25%

Equity

$0.0

At Purchase Year 0

At Exit Year 5

Debt

Valuation Sensitivity to Purchase Premium and Exit Multiple

Exit

Multiple

Exit

Multiple

IRR

Purchase Price (per share, before 25% premium)

### $ 11.33 $

12.33 $

13.33 $

14.33 $

15.33

8x

19%

14%

9%

5%

-1%

9x

23%

19%

15%

11%

7%

10x

28%

24%

20%

16%

12%

11x

31%

28%

24%

21%

17%

12x

35%

31%

28%

24%

21%

45%

Equity

$0.5

Equity

IRR Sensitivity to Purchase Price and Exit Multiple

55%

Debt

75%

Debt

$1.5

$ 9x

10x

11x

12x

13x

$

$

$

$

$

15.0%

10.88

12.58

14.26

14.56

16.54

Share PriceShare Price

Purchase Premium

Purchase Premium

20.0%

25.0%

30.0%

35.0%

$ 10.58 $ 10.28 $ 10.24 $ 9.84

$ 12.18 $ 11.78 $ 11.38 $ 11.08

$ 13.76 $ 13.33 $ 12.90 $ 12.60

$ 13.96 $ 13.36 $ 12.76 $ 12.46

$ 15.74 $ 14.94 $ 14.14 $ 13.34

4. Valuation – LBO Analysis

•

•

Another tool used to value RNW was a quick and dirty LBO model

Using a linear regression tool and hardcoding an IRR of 20%, a share price of $13.33 was calculated

as an appropriate bid price for RNW.

• This comes with assuming a 25% acquisition premium, 75% leverage, a 10x terminal EBITDA multiple

and conservative operating scenarios

SOURCES AND USES OF FUNDS

Uses of Funds

Acquisition Equity

Existing Net Debt Refinanced

Total Transaction Costs

Total Uses of Funds

Sources of Funds

New Equity

New Debt

Total Sources of Funds

$ 2,996,244

(672,576)

(44,944)

$ 3,713,764

Current Stock Price

Transaction Premium

Acquisition Stock Price

Shares Outstanding (a)

Transaction Enterprise Value

TEV as a Multiple of Year 0

Revenue

EBITDA

$ 928,441

2,785,323

$ 3,713,764

IRR ANALYSIS

Year 1

Exit EBITDA Multiple 11.0x

Implied Enterprise Value

Less: Net Debt

Implied Equity Value

Implied IRR

Implied Multiple of Capital

IRR Return

11/28/2015

$ 12.56

25.0%

$ 15.70

190,800.000

$ 2,323,668

$ 2,959,413

(2,687,311)

$ 272,101

(70.7)%

0.3x

-71%

Year 2

$ 3,755,072

(2,547,243)

$ 1,207,829

14.1%

1.3x

14%

Pro Forma

Year 3

$ 4,057,386

(2,376,618)

$ 1,680,768

21.9%

1.8x

22%

10.6x

10.0x

Year 4

$ 4,170,711

(2,186,962)

$ 1,983,749

20.9%

2.1x

21%

Year 5

$ 4,287,435

(1,977,177)

$ 2,310,258

20.0%

2.5x

20%

4. Valuation - Summary

Current Price: $10.09

Our Valuation

Valuation

Methodology

Min

25th Percentile

Median

75th percentile

Max

52 Week Low/High

LBO (2)

DCF (1)

2016 EV/EBITDA

2016 P/E

5

10

15

20

25

30

Other Analysts’ Target

Share Price ($ CAD)

Current Price: $10.09

9

10

11

12

Share Price ($ CAD)

13

14

15

5

Catalysts And Risks

4. Risks

Power Purchase Agreements Risk

Highly Regulated Industry

• TransAlta Renewables sells majority of its energy to

third parties through a PPAs and there is possibility

that the third party could be unable or unwilling to

fulfill their obligations of the PPA

• The energy industry is heavily influenced by federal,

provincial, and local government regulations that

relate to renewable energy development and

electricity pricing, especially with regards to coal

power generation

• Mitigation: RNW enters in the majority of PPAs

with their parent company, and other reputable

companies with strong credit history and strong

historical performance.

Risk of Inconsistent Income

• The strength and consistency of the wind resources at

the Company's wind facilities may vary from what

the Company anticipates due to a number of factors

• Mitigation: The company builds wind farms in areas

that have consistent wind data, and have access to

wind without any interference from any natural

barriers or man made buildings. Also, TransAlta

Renewables diversifies its energy mix, limiting

season-to-season variability in energy production

• Mitigation: Transalta is effectively on track to phase

out coal production in line with the recent

announcement by the Alberta Government to phase

out coal generation by 2030

Risk of Foreign Investments

• Foreign laws or regulations may not provide for the

same type of legal certainty and rights, which may

adversely affect the Company's ability to receive

revenues or enforce its rights in connection with its

foreign operations.

• Mitigation: TransAlta Renewables limits its overseas

business, and primarily operates in North America.

4. Catalysts

Additional Drop-downs from TA

•

Potential Portfolio dropdown of ~$300M in the near-term from TA

•

These short-term drop downs are to assist TA in reaching its goal of reducing debt

•

Other good fits for drop downs from TA come from recent M&A moves TA has been involved in:

• E.g. through the restructuring of TA’s Poplar Creek gas facility, TA gained interests in 2 wind facilities and

71 MW of renewable generating capacity in the US

•

These assets look to be potential good fits for RNW

New Liberal Government Support of Renewable Gnergy Generation

•

•

•

•

Current and future wind and hydro facilities are eligible to receive incentives under the Wind Power Production

Incentive (ecoENERGY for Renewable Power) sponsored by the federal government

Environmental regulations that do not force compliance costs/shutdowns in excess of the federal carbon framework

are extremely advantageous

The Alberta Government announced increases to provincial Specified Gas Emitters Regulations:

• Jan 1, 2016 increase in the Greenhouse Gas (“GHG”) reduction obligation for large emitters from 12% to

15% of emissions (i.e. reduce emission intensity by 15%) along with the compliance price of the technology

fund (carbon levy) rising from $15/tonne to $20/tonne

• Jan 1, 2017 further increase to a 20% reduction requirement and a $30/tonne levy

Under management guidance, the GHG offsets created by RNW’s current Alberta wind facilities are expected to

increase in value through 2017, as GHG emitters can use them as compliance instruments in place of contributing

to the carbon levy

4. Catalysts

Additional Drop-downs from TA

Facility

Location

Like ly ne ar te rm drop-downs:

Ragged Chute

Ontario

Kent Breeze

Ontario

Wintering Hills

Alberta

Lakeswind

Minnesota

Mass Solar

Massachusetts

Total

Gas fire d asse ts:

Fort Saskatchewan

Poplar Creek

Mississauga

Ottawa

Sarnia

Windsor

Total

Alberta

Alberta

Ontario

Ontario

Ontario

Ontario

Albe rta Hydro

Barrier

Bearspaw

Big Horn

Brazeau

Cascade

Ghost

Horseshoe

Interlakes

Kananaskis

Pocaterra

Rundle

Spray

Three Sisters

Total

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Alberta

Ne t

MWs

7

20

44

50

21

142

35

244

54

37

506

31

907

13

17

120

355

36

51

14

5

19

15

50

103

3

801

Fue l

Re ve nue

Source

Hydro

Wind

Wind

Wind

Solar

LTC

LTC

Merchant

LTC

LTC

Est.

Contract

Expiry Counte rparty Value ($M)

2029

2031

2034

2030+

OPA

IESO

Municipalities

Owne r

TA

TA

TA

TA

TA

TA

~$300M

Nat

Nat

Nat

Nat

Nat

Nat

gas

gas

gas

gas

gas

gas

LTC

2019

Dow Chemical

LTC

2030

Suncor

LTC

2018

OEFC

LTC

2017-2033

OPA

LTC

2022-2025

OPA

LTC/Merchant

2016

OEFC

TA

TA

TA

TA

TA

TA

$1.75B+

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Hydro

Alberta PPA

Alberta PPA

Alberta PPA

Alberta PPA

Alberta PPA

Alberta PPA

Alberta PPA

Alberta PPA

Alberta PPA

Merchant

Alberta PPA

Alberta PPA

Alberta PPA

2020

2020

2020

2020

2020

2020

2020

2020

2020

2020

2020

2020

TA

TA

TA

TA

TA

TA

TA

TA

TA

TA

TA

TA

TA

$850M+

Questions?

THANK YOU.

Appendix

Income Statement

Balance Sheet

Statement of Cash Flows