Public Pension Fund Management in India

advertisement

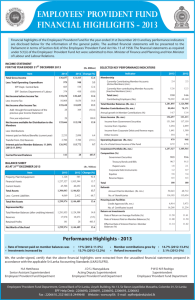

I D B I C A P I T A L Public Pension Fund Management in India Conference on Public Pension Fund Management September 24-26, 2001 1 Outline I D B I C A P I T A L Framework of Old Age Income Security in India Mandatory Retirement Plans in India Governance Structure for the Plans Funding Levels and Coverage Investment Guidelines Historical Returns How do the returns compare Public v. Private Management Benchmarking of Returns Role of Funds in allocation of capital Corporate Governance Future Direction 2 I D B I C A P I T A L Framework of Old Age Income Security in India 3 Public Pillar – Poverty Alleviation Programmes India does not have Social Security Programmes of OECD Countries Government’s taxation power is used to fund Poverty Alleviation Programmes • • • I D B I C A P I T A L 26% of population below poverty line (1999-2000) Employment Generation, Food for Work, Food Subsidy, Subsidised Education and Health Care Programmes Public Investments in a big way in industry and infrastructure during 1950-90 National Old Age Pension Scheme Monthly Pension for the poor of above 65 years old 5.3 million beneficiaries Several welfare programmes covering agricultural workers, construction workers and home workers 4 Mandatory Pillar – Covers Formal Employment I D B I C A P I T A L Government employees are covered under provident fund and pension fund with a pay as you go system Mandatory Provident and Pension Funds exist for the workers in organised sector Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 governs mandatory plans All employees of notified industries and establishments with more than 20 employees mandatorily covered by three EPF Plans Compliance responsibility with the employer Special enactments for certain groups with funded plans Armed forces, Coal Mine Workers, Tea Plantation Workers, Jammu & Kashmir, Merchant Navy, Banking Sector High coverage of occupational plans among organised workers Only 15.2% of total work force in Regular Salaried Employment Self-employed is 53.6%. Casual employment is 31.2%. 5 Voluntary Pillar – Main Stay of Income Security India has well-developed financial markets to provide savings opportunities I D B I C A P I T A L Established banking system with a vast reach – 65,000 branches with deposits of over Rs 9,62,000 crore (US$ 205 billion – 44% of GDP) Post Office Savings products cover the whole country – 133,000 post offices with outstanding deposits of Rs 1,55,000 crore (US$ 33 billion – 7% of GDP) Market Capitalisation of Stock Market – Rs 9,12,000 crore (US$ 194 billion – 42% of GDP) Large market of Government Bonds – Outstanding of Rs 8,95,000 crore (US$ 190 billion – 41% of GDP). Growing Corporate Bond market. Fairly stable macro-economic environment Informal Arrangements are important sources of security for the old Cultural factors emphasise caring for the old 6 I D B I C A P I T A L Mandatory Retirement Plans in India 7 Mandatory Plans in India I D B I C A P I T A L All covered employees mandatorily become members of three EPF plans Provident Fund Scheme (DC Plan) – Accumulation paid out on retirement. Early withdrawals allowed for specified purposes. Pension Scheme (DB Plan) – Monthly Life Pension after retirement with Survivor and Disability Benefits. Deposit Linked Insurance Plan – Additional payment based on accumulation amount in case of death while in service Combination Benefit Structure of DC and DB Plans High Contribution Rates 12% Employee Contribution + 12% Employer Contribution = 24% In five specified industries, contribution is 10% + 10% = 20% Some companies have additional superannuation schemes with up to 15% employer contribution Bonus and Special Allowances not included for computation of contribution 8 Employees’ Provident Fund Scheme, 1952 I D B I C A P I T A L Defined Contribution Plan Contributions 12% Employee Contribution + 3.67% Employer Contribution = 15.67% 10% + 1.67% = 11.67% in five industries Benefit Structure Accumulated Balance paid out on retirement. Balance = Employee and Employer Contributions + Interest credited – Non-refundable Loans No annuitisation Non-Refundable Loans allowed for for housing, major illness, marriage or education of children and special circumstances Portable between employers Investment Risk is Borne by the Employee 9 Employees’ Pension Scheme, 1995 Defined Benefit Plan Contributions 8.33% Employer Contribution + 1.16% Government Contribution (subject to limit) Benefits I D B I C A P I T A L Monthly Superannuation Pension for life at 50% of Average of last 12 months’ Salary (for 33 years of service) One-third pension can be commuted. Reduced pension with return of capital possible Disablement Pension – Full Superannuation pension without minimum service Survivor Pension – to surviving spouse and children (50% of pension for spouse and 25% for each dependent child) No cost of living increases Portable at EPF Investment Risk borne by the Fund Government has the power to increase contribution or reduce benefits Pension increased by 4% & 5.5 % after the last two biennial actuarial valuations 10 Deposit Linked Insurance Plan, 1971 Life Insurance Plan Contributions I D B I C A P I T A L 0.5% Employer contribution Benefits Additional payment made to employee in case of death while in service Amount equal to accumulated balance in the Provident Fund Subject to a limit of Rs 60,000 Investment Risk borne by the Fund 11 I D B I C A P I T A L Governance Structure 12 Governance Structure I D B I C A P I T A L The three mandatory plans are administered by Employees’ Provident Fund Organisation Set up under the EPF Act Central Provident Fund Commissioner appointed by the Federal Government is CEO. Usually a civil service bureaucrat. Supported by Assistant and Regional Provident Fund Commissioners Central Board of Trustees is the supervisory authority Minister of Labour is the Chairman Central Provident Fund Commissioner Five Federal Government Representatives Fifteen State Government Representatives Ten Employer Representatives Ten Employee Representatives All trustees are appointed by Federal Government after consultation 13 Administrative Structure I D B I C A P I T A L EPFO carries out Benefit Administration and Record keeping Set up an extensive administration network with offices all over the country Headquartered at New Delhi. 281 offices throughout the country. Employers pay contributions at designated banks Fund Management is contracted out to a professional fund manager State Bank of India is presently the fund manager No change in fund manager for several years 14 Exempted Funds I D B I C A P I T A L Employers can opt out of the Government Schemes by setting up their own Provident Fund and Pension Fund Need to get an exemption from the Government under EPF Act Need to get an authorisation under Income Tax Act for tax exemption Employers allowed to set up Exempted Funds when: Contributions and Benefits under the Employer’s Scheme are not inferior to that of the Government Scheme Agree to follow all guidelines including Investment Pattern Employers can set up own trust Full funding required Trustees are representatives of Employer and Employees Benefit Administration, Record-keeping and Funds Management done in-house 2970 Exempted Funds with 4.5 million subscribers (18.8% of total subscribers) 15 I D B I C A P I T A L Funding Levels and Coverage 16 Funded Schemes I D B I C A P I T A L Provident Funds Both Employees Provident Fund and Exempted Funds are fully funded Assets of the Funds are represented by portfolios of securities Pension Funds Employees Pension Fund is funded by contributions of Employer and Government Actuarial deficits, if any, of EPS not known Pension Funds managed by Employers in Banking Sector and Public Sector are fully funded with regular actuarial valuations All Funded Schemes are required to follow prescribed Investment Pattern 17 Growth in Coverage of EPF Year Covered Covered Establish- Employees ments (Million) 1952-53 1,400 1.20 1959-60 7,373 2.70 1969-70 46,504 5.60 1979-80 93,094 10.46 1989-90 194,961 14.66 1999-2000 331,504 23.96 Total Covered Employees EPF Act Coal Mine Workers Assam Tea Plantation Workers Seamen's PF J & K PF Banking Sector 177 industries and classes of establishments covered today Govt Employees Total Coverage Started with 6 industries in 1952 All establishments with more than 20 employees covered within specified industries 24 million subscribers covered I D B I C A P I T A L (Million) 23.96 0.80 0.76 0.03 0.15 1.00 26.70 11.14 37.84 Approximately 9.7% of labour force covered 53.6% is Self Employed 31.2% is in Casual Employment 18 Total Pension Assets Total Pension Assets On 31-3-1999 (Rs Crore) Provident Fund EPF Exempted Funds Pension Fund EPF DLI Fund EPF Other Funds Coal Mines Assam Tea Plantation (est) Banks (est) Total Assets I D B I C A P I T A L Asset Growth Rates EPF 41,310 28,691 22,016 1998-99: 16% 1997-98: 14% Exempted Funds 1998-99: 7.5% 1997-98: 8.1% 2,188 22,000 10,000 8,000 134,205 US$ 28.5 billion 7% of GDP 19 Reasons for low asset base I D B I C A P I T A L Total GDP (2000-01) – Rs 1,972,700 crore (US$ 420 billion) Gross Domestic Savings – 22.3% ( of which Total Household Savings – 19.8%) Financial Savings – 10.5% (53%) Physical Savings – 9.2% (47%) Provident and Pension Funds form 23% of total household financial savings Reasons for low asset base 2.1% of GDP every year goes into Provident and Pension Funds No annuitisation in provident fund High Premature Withdrawals: Rs 2715 crore in EPF and Rs 1437 crore in Exempted Funds (in 1998) • 60.8% of New Contributions New Contributions in 1998 EPF – Rs 3643 crore. Exempted Funds – Rs 3175 crore. Total– Rs 6818 crore 20 I D B I C A P I T A L Investment Guidelines for Provident and Pension Funds 21 Investment Guidelines Prescription I D B I C A P I T A L Funds are required to follow Investment Pattern prescribed by the Government Both Employees Provident Fund and the Exempted Funds follow the same pattern Investment Pattern prescription comes from two sources: • Ministry of Labour under EPF Act – Failure to comply could result in withdrawal of Exempted Fund status and imprisonment up to 6 months • Ministry of Finance under Income Tax Act – Failure to comply could result in withdrawal of tax exemption for the Fund Objectives not explicitly defined. Appear to be: Ensuring complete safety of employees’ funds and confidence in the system. Channel funds to Government sector Pay a reasonable return to the employee 22 Asset Class Prescription I D B I C A P I T A L Investment Guidelines define permitted Asset Classes Almost entirely channeled to Government or Government Enterprises Percentage to be invested in each asset class specified No investments allowed in International Securities – Strict Capital Account Controls exist in India. No Indian citizen or corporate can invest overseas. Stocks – India has a large stock market Real Estate – Only Financial Assets allowed Gold – Only Financial Assets allowed No investments permitted in Bank or Corporate Deposits Investment allowed only in marketable securities No loans to individuals or Corporates Only exception is Federal Government’s Special Deposits 23 Investment Pattern since inception I D B I C A P I T A L 100% 90% 80% 70% Federal Govt Bonds Federal Govt Deposits 60% 50% 40% State Govt Bonds Bonds of Public Enterprises 30% 20% Any Public Category 10% Private Sector Bonds 19 53 19 55 19 57 19 59 19 61 19 63 19 65 19 67 19 69 19 71 19 73 19 75 19 77 19 79 19 81 19 83 19 85 19 87 19 89 19 91 19 93 19 95 19 97 19 99 20 01 0% Pvt Sector Bonds State Govt Bonds Any Public Category Fed Govt SDS Public Enterprises Bonds Fed Govt Bonds 24 Investment Pattern in the past 10 years 100% 90% Federal Govt Bonds 25% 70% 60% 50% 40% 30% 20% 10% State Govt Bonds 15% Bonds of Public Enterprises 40% Any Public Category 10% Pvt Sector Bonds 10% 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 0% Federal Govt Special Deposits Almost entirely channeled to Government or Government Enterprises 80% I D B I C A P I T A L Divided among Federal Govt, State Govts and Public Enterprises Share of Government Enterprises has gone up at the cost of direct Government flows Private Sector Bonds allowed up to 10% since 1998 Not Mandatory; Can be invested at the option of Trustees EPF Trustees decided against investment in Private Sector Many Exempted Funds also do not invest in Private Sector 25 One Investment Pattern fits all I D B I C A P I T A L No distinction between Provident Fund and Pension Fund in the Investment Pattern Risk lies with Employee in a Provident Fund Risk lies with Employer in a Pension Fund Today, advocates of relaxation in Investment Pattern are focusing on Pension Funds No choice to the Employer or the Employee Only choice is for the Employer to opt out by setting up an Exempted Fund No choice of alternate investment patterns based on risk preferences of Employees and Empoyers 26 I D B I C A P I T A L Returns on Provident and Pension Funds 27 EPF Interest Rate in the past 12 years 16% 15% 14% 13% 12% 12% 11% 11% 9.5% 10% 9% 8% 7% 6% 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 I D B I C A P I T A L EPF Interest Rate remained fixed at 12% from 1991-92 to 1999-2000 Slashed to 11% in 2000-01 consequent to fall in market interest rates Being further reduced to 9.5% in 2001-02 due to sharp fall in interest rates 10 year Govt Bond Yield 1997 12.9% 1998 11.9% 1999 11.9% 2000 10.4% 2001 9.2% 28 Deposit Account Concept I D B I C A P I T A L Provident Fund works like a Deposit Account Unlike a Mutual Fund, NAV of underlying portfolio not computed Members’ Accounts are credited annually with an interest rate declared based on current income of the Fund Members get annual Statements of Account No loss of principal amount. Interest credited every year. Fairly Stable Interest Rate. Changed in the event of substantial changes in market interest rates No Disclosure of Portfolio or Actual Returns 29 No Active Management I D B I C A P I T A L Funds are required to hold all investments until maturity Sale before maturity requires approval of Provident Fund Commissioner No Valuation of investments. No marking to market. Accounted like long term investments. No permission to Fund Managers to churn portfolio Cannot generate profits based on market views Cannot sell a security when issuer’s financials deteriorate But funds are protected from market risk Specified Pattern applies to fresh accretion only New contributions and redemption proceeds are required to be invested according to the pattern Interest in any asset category is required to be reinvested in the same category Changes in interest rates affect Provident Funds with a lag effect 30 Special Deposit Rate determines EPF Rate I D B I C A P I T A L Special Deposit Scheme started by the Government as a convenience to Provident Funds Available round the year - A big help when Government Bond issuances are infrequent and secondary market liquidity is poor Withdrawals permitted without any loss of interest Interest Rate on Special Deposits determined by Federal Government Broadly tracks government bond yields Government equalises the EPF rate with • Government Provident Fund Rate • Public Provident Fund Rate • Small Savings Schemes distributed through Post Offices • Special Deposit Scheme Rate These are few of the administered interest rates in the country Special Deposits were to mature in 1998 Federal Government unilaterally extended the maturity to 2003 31 Portfolio Composition of Funds I D B I C A P I T A L Portfolio Composition of Funds depends on their age Older funds are weighted towards Federal Government Special Deposits and Government Bonds Newer funds are weighted towards Bonds of Public Financial Institutions and Public Enterprises Typical New Fund (set up in 1998) Typical Old Fund (set up in 1948) Federal Govt Bonds State Govt Bonds Bonds of PSEs Special Deposits 32 Confidence in the System I D B I C A P I T A L Public Confidence maintained in PF System Unquestioned confidence in the system from employees PF considered the safest investment Government thought to be behind the system PF interest rate works like an administered rate despite full funding and separate portfolio 33 Real Rates of Return 16% 14% 12% 10% 8% 6% 4% 2% 0% -2% -4% I D B I C A P I T A L Consumer Price Inflation is sharply down in the last 3 years 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 Despite fall in nominal rates, Real rate of interest has risen PF Rate Real Rate CPI 34 I D B I C A P I T A L How do the Returns compare 35 Where do public savings flow? Distribution of Financial Savings Of Households in 1999-2000 Total Financial Savings of Households (1999-2000): Rs 2,05,898 crore (US$ 43.8 bn) Top 5 Investments Currency Stocks Govt Schemes Provident and Pension Funds Bank Deposits Mutual Funds Insurance Others I D B I C A P I T A L Bank Deposits (33.6%) Provident and Pension Funds (23.1%) Post Office Savings (12.2%) Insurance (12.1%) Currency (8.9%) Stocks, Bonds and Mutual Funds form a small part 36 PF Returns compared to Bank Deposits 14% 12% 10% I D B I C A P I T A L Most of the time, Bank Deposit rates are lower than PF Interest Rate Banks have higher administrative costs Banks have to follow Cash Reserve, Liquidity Ratio stipulations 8% 6% 4% 2% 0% 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 PF Rate 2% 1% Bank Deposits Bank Deposits over PF Rate 1% 0% -1% 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 -1% -2% -2% -3% 37 Returns on Underlying Assets – Government Bonds 16% 15% 14% 13% 12% I D B I C A P I T A L Since 1993, yields on Federal Government Bonds are marketdriven Bonds issued in auctions Banks, PFs, LIC required to invest in Govt Bonds up to specified percentage Banks hold Govt Bonds much in excess of requirement 11% 10% EPF Rate 9% 8% 7% 6% 1991 1992 1993 1994 1995 PF Rate 1996 1997 State Govt 1998 1999 2000 2001 2002 Central Govt Central Govt Bonds over PF Rate 2.00% 1.50% State Govt Bonds yield 15-20 bp over Federal Govt Govt Bond yields have fallen sharply in the past four years 1.00% 0.50% 0.00% -0.50% 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 -1.00% 38 PF Rate compared to Mutual Funds How are mutual funds doing? Annual Return Category % Equity-Diversified -33.82 Equity-ELSS -32.72 Equity-Index -27.17 Sectoral-Basic -6.01 Sectoral-FMCG -22.7 Sectoral-MNC -23.9 Sectoral-Pharma -12.59 Sectoral-TMT -58.27 Gilt Mutual Funds is a nascent industry in India Experience for only 2-3 years Equity Funds have made big losses due to market conditions Gilt Funds are the only exception with 18% return during last one year 18 Income 5.59 Liquid 9.01 MIP -6.66 Balanced I D B I C A P I T A L -16.89 39 Returns on Stocks Returns on BSE Sensex In the last five years I D B I C A P I T A L 14.7% over 9 years from 1992-93 to 1999-2000 22.3% over 10 years from 1980-81 to 1989-90 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 1997 1998 1999 2000 2001 Average Returns over long periods Regular crises on Indian stock markets have affected confidence of retail investor Substantial volatility has resulted in individual investor turning away -10.00% -20.00% -30.00% -40.00% 40 Tax Benefits I D B I C A P I T A L Tax benefits for contributions Employees get tax rebate on their contribution to Provident Fund Employer’s contribution is tax free Interest is tax free Taking tax benefits into account, returns are unmatched 41 Can PF Returns be increased? I D B I C A P I T A L Without disturbing Deposit Account Concept Private Sector Bonds can give a higher return • Will increase risk. PF managers need to have skills to evaluate risk. Government Securities give higher return compared to Special Deposits By Shifting to NAV Concept Investment in Stocks will sharply increase risk and give higher return potential International Diversification can increase yield Active management of portfolio 42 I D B I C A P I T A L Public v. Private Management 43 Exempted Funds Employers can contract out of EPF and set up privately managed funds Only 3,000 companies have opted to set up Exempted Funds Most Exempted Funds manage funds in-house. Few engage a professional fund manager Exempted Funds have obligation to declare at least the EPF Rate I D B I C A P I T A L Employer to bear the cost in case of shortfall Little evidence of Private Management producing better returns Some Exempted Funds declare more than EPF Rate This is related to age of the fund Higher return by taking higher risk Small privately managed funds are at disadvantage compared to EPF Professional management can increase returns marginally Guidelines drive the returns 44 No Minimum Rating Stipulation I D B I C A P I T A L Guidelines do not stipulate minimum rating for investment Only for Private Sector Bonds are required to be rated at investment grade (BBB and above) by two rating agencies Implicit assumption that public enterprises are safe Many trustees have internal guidelines stipulating minimum rating EPF and CMPF Trustees have minimum rating criteria Some Exempted Funds also have such criteria Most Exempted Funds do not have capability to evaluate investments Very few Exempted Funds engage a professional fund manager Often consider all eligible securities as equal Assume that market interest rates represent risk-adjusted return Implicit assumption that public enterprises are safe is coming increasingly under challenge 45 I D B I C A P I T A L Benchmarking of Returns 46 Benchmarking I D B I C A P I T A L Exempted Funds are benchmarked against EPF Rate for interest declared Performance can be evaluated by outperformance over EPF No risk parameters available Age of the fund becomes critical Actual Returns are not disclosed NAV not computed Hence no benchmarking is possible No satisfactory benchmarks even for debt funds Couple of Govt Bonds benchmarks available in the market Not followed by the market Equity Indices are well-established Not relevant since PFs do not invest in equities 47 I D B I C A P I T A L Role of Funds in Allocation of Capital 48 Government Bonds and Special Deposits support fiscal deficit 120000 Central and State Governments run large deficits Government has been running revenue deficit with high consumption expenditure financed by borrowing In old funds, almost 90% of funds are with government 8.00% 100000 7.00% Rs Cr 6.00% 5.00% 60000 4.00% 40000 3.00% 2.00% 20000 1.00% 0 0.00% 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 Revenue Defict Fiscal Deficit % of Fiscal Deficit to GDP Government Bonds are used for deficit financing 9.00% 80000 I D B I C A P I T A L Pay as you go system in substance Does Investment Pattern encourage government deficit? Banks and LIC are biggest subscribers of Government Bonds Banks invest more than SLR requirements in Government Bonds 49 Private Sector funded through Public Financial Institutions Total Privately Placed Bond issuances in 2000-01 (Rs 52,433 crore – US$ 11.2 bn) Private Sector 17% State PSEs 22% Financial Institutions are biggest issuers of bonds Make loans to private enterprises for setting up new projects PSE Bonds has created productive infrastructure in the country FIs and Banks 46% I D B I C A P I T A L State Govt enterprises have set up projects in irrigation, road development, power projects Central PSEs 15% 50 I D B I C A P I T A L Corporate Governance 51 Corporate Governance Provident and Pension Funds play no role in corporate governance I D B I C A P I T A L No investment in equities Even mutual funds are yet to play an active role Recently, stock exchanges have issued guidelines for disclosure towards corporate governance 52 I D B I C A P I T A L The Future 53 Future Pension Reforms OASIS Project initiated by Ministry of Social Justice to identify pension reforms required Key recommendations I D B I C A P I T A L Establishment of a Pensions Authority Introduction of Individual Retirement Accounts To be managed by approved Pension Managers (committee recommended six) A common servicing and record-keeping infrastructure Three funds from each company representing conservative, balanced and aggressive investment styles Group of Ministers constituted by Government to examine suggested reforms 54 Possible Future Direction I D B I C A P I T A L Introduction of Retirement Funds NAV based funds Different investment objectives and management styles Capital preservation funds Option to Employees to shift fully or partially to Retirement Funds managed by approved pension companies Employees may take time to get used to variable returns Marketing and administration costs will increase Strict Regulation and Disclosures required Requires distribution and servicing infrastructure to be set up Common infrastructure as suggested by OASIS may be a good option 55 I D B I C A P I T A L Thank you for your attention 56