Life Insurance - Harding University

advertisement

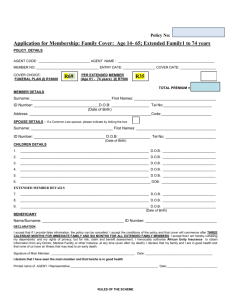

Life Insurance Chapter 11 Planning Your Financial Future, 4e by: Boone, Kurtz & Hearth Why Purchase Life Insurance? If you are single with no dependents, you may not need any life insurance But if you have family members who are financially dependent on you, reasons include: Cash for immediate needs Readjustment funds Will spouse need time to find work, relocate, etc.? Replacement income Special situations Help pay off the mortgage, finance child’s college, etc. 2 Figure 11.1: Estimating Life Insurance Needs 3 How Your Life Insurance Needs Change Over Time When you’re young, you may have no need for life insurance As you get married, have children, have a mortgage payment, etc., your need for life insurance increases As you get older (and have paid down your mortgage and have substantial investments), your life insurance needs may decrease DEFINITELY review your needs as you experience major life changes 4 Types of Life Insurance Policies Term insurance Only provides death benefit Whole life insurance Combines a savings feature with death benefits Universal life insurance Combines a savings feature with death benefits 5 Term Insurance Offers protection for a specified term (period of time) and has no value at end of term If policy expires and you don’t die, insurance company has no further obligation to you Advantage Inexpensive Can generally buy five to ten times as much term insurance as other life insurance for same premium 6 Term Insurance Level term vs. decreasing term Level term: fixed premium and a fixed amount of coverage Commonly issued for one-, five-, and ten-year terms Decreasing term: policy with a declining amount of coverage over time (but premiums remain the same) As you pay off mortgage, children leave home, etc., need less insurance 7 Term Insurance Conversion and renewable features Many term policies offer these features at additional cost Automatic renewal at term end Can renew for at least one more term w/o another physical exam Many companies permit renewal as many times as you’d like up to age 70 or so Term insurance can be converted to another type of life insurance Usually limited to coverage equal to or less than current coverage May require that the conversion occur within a certain time period (well before term expires) 8 Term Insurance Deposit term insurance Pay a deposit (about $10 for every $1,000 of coverage) on top of regular premium Deposit is placed into high-rate, interest-bearing account If you maintain insurance coverage for term period, you’ll get back deposit plus interest If you let policy lapse, you lose deposit plus interest If you die during term, your beneficiary gets deposit plus interest and face amount of policy Cheapest form of life insurance, if you keep policy One of most expensive if you let policy lapse 9 Whole Life Insurance Purchase for your entire (whole) life Premiums spent on whole life insurance are divided between insurance protection and savings Makes whole life more expensive Cost during early years of policy exceeds actual cost of insurance protection, while cost in later years is less than needed Insurance company invests the excess amount collected in early years of policy to cover increasing risk in later years of policy 10 Whole Life Insurance Straight life insurance (AKA continuous premium whole life insurance or ordinary whole life insurance) Premiums remain same over life of policy Premiums determined by your age/health at inception of policy Most life insurance policies are of this type Within first three years of policy, it begins to build a cash value (accumulated savings). As time passes, cash value increases You can borrow all or a portion of this cash value at a relatively low interest rate, which doesn’t have to be paid back (but policy payout upon insured's death is reduced by loan plus interest) 11 Whole Life Insurance Limited-payment whole life insurance Lasts entire life of policyholder, but premiums are only paid for a limited number of years—10, 20 or 30 years Premiums are higher, but cash value increases more rapidly Critics argue why pay higher premiums during years when your need for living income is greater, whereas by the time you pay off your policy (say 30 years from now), your need for life insurance may be less (or zero) 12 Universal Life Insurance Combines term insurance protection with a savings account Part of each year’s premium is used to buy lowcost term insurance and remainder placed into high-yield investments Policyholders are not taxed on investment earnings When policyholder dies, beneficiaries receive policy amount plus accumulated earnings 13 Universal Life Insurance Advantages Policyholder can vary amount contributed to savings portion once initial premiums are paid Can adjust (up [assuming good health] or down) the amount of term insurance coverage Can use cash value to pay part of all of annual premiums or to raise death benefit Can make tax-free withdrawals from investment portion as long as withdrawal doesn’t exceed total amount already paid in premiums Disadvantage Much more expensive than term insurance A 30-year-old spending $200 a year in premiums can buy $250,000 of term insurance, but only $50,000 universal life insurance 14 Other Life Insurance Options Group life insurance Available at rates lower than rates for most individuals Often available as a perk with your job If you leave your job, coverage ends May have option of converting group coverage to individual coverage Variable life insurance Combines a straight life policy with an investment that could increase the death benefit (but only if the insurance company’s investments perform well) Policy’s cash value can fall from year to year if investments do poorly 15 Other Life Insurance Options Credit life Guarantees your debt will be paid off if you die Protects lender and your family It’s actually decreasing term insurance with the term equal to the length of loan Very expensive Some critics view as a rip-off May be worth it if you’re in poor health and find it difficult to obtain life insurance 16 Which Type of Life Insurance is Right for You? Do you need or want Just insurance protection Insurance protection combined with savings Why not pay lower (in some cases, MUCH lower) term life insurance rates and put the extra money you’d be saving since you didn’t buy whole life, etc. into investments yourself ? You’ll probably earn more money in the long run 17 Table 11.1: Comparing the Cost of Term to Whole Life Insurance 18 Term vs. Whole Life Most insurance companies argue that term life policyholders will outlive their terms and to obtain a new policy will be very expensive Experts argue that term insurance is still a good buy for people in their 50s May not need much insurance at this stage anyway Goal could be to be self-insured by age 60 19 The Life Insurance Contract Beneficiary clause Names the person(s) or organization to receive policy proceeds Proceeds aren’t subject to income taxes but may have to pay estate taxes Names secondary beneficiaries Can be changed—unless you name an irrevocable beneficiary Settlement options Lump sum vs. periodic payments (life income, fixed income, interest only with principal in lump sum at later date) 20 The Life Insurance Contract Premium payment clause Premium amount, how often (quarterly, monthly, annually) Dividend clause Only with mutual life insurance companies Specifies how dividends are paid Reducing future premiums May offer various options Cash, premium reduction, purchase additional life insurance 21 The Life Insurance Contract Accidental-death clause If policyholder dies by accident, get extra benefit AKA as double- (or triple-) indemnity clause Restrictions Suicide Riot/insurrection Airplane disaster During commission of a felony Suicide clause Limits company’s liability within first two years of policy to amount already paid in premiums 22 The Life Insurance Contract Waiver-of-premium clause If you become disabled (or lose your job), the insurance company may waive the premium for some time period so that you don’t lose coverage (and company doesn’t lose client) Guaranteed insurability clause Policyholder has right to purchase additional insurance without physical Usually obtainable through age 40 Good idea for younger policyholders who can’t afford premiums for additional insurance right now 23 The Life Insurance Contract Nonforfeiture option Protects you if policy lapses and your policy has cash value May surrender policy for portion of cash accumulated by your premium payments May use cash value as a single premium and buy a reduced amount of paid-up life insurance May use cash value to buy term insurance for as long as the single premium will provide Policy reinstatement Allows policyholders to put a lapsed policy back into effect if policyholder Offers proof of continued insurability Pays accumulated premiums plus interest May have to meet specified time frame 24 Buying Life Insurance Shop around Impossible to compare value of term insurance to cash-value policies Make sure you compare similar policies (amount, term, renewability options, etc.) Rates are usually quoted per $1,000 of coverage But, rates on larger policies don’t increase in a linear fashion 25 Net Cost Method With policies having cash value Value of premiums paid less accumulated cash value Can even show a negative net cost (suggesting policy ‘pays for itself ’) Ignores interest you could have earned if you had invested premiums Company could assume an abnormally high investment return on cash value 26 Interest-Adjusted Cost Index Method Considers total premiums paid, accumulated cash value, value of accrued dividends, and what interest buyer could have earned had premiums been invested You’d like to see this value for different points in time 5-, 10-, 20-years You should request to see this method The lower the index, the cheaper the policy 27 Choosing the Right Company and Agent Check out their financial rating Standard & Poor’s or A.M. Best Only buy from firm with high rating Remember, most agents receive a commission Higher the more insurance you buy Higher with cash value policies Analyze your needs, read up on the policies, and buy straight from insurance company—bypass the agent Use an online quotation service Such as http://www.insurance.com/ 28 Web Links Information about ratings is available at: http://www.ambest.com/ http://info.insure.com/ratings 29 Common Sales Pitches You wouldn’t be able to afford term life insurance when you’re old May not need life insurance then A cash value policy is a form of forced savings True, but you’ll probably earn more reinvestment return if you invest the money yourself Cash value policies offer tax-deferred savings So does a 401(k) and other retirement plans and will probably earn higher returns! 30 Common Sales Pitches You may not need insurance now but if you buy it now it will cost less and guarantee future insurability Odds of developing a health problem that will cause future uninsurability are small After X number of years, you’ll no longer have to pay a premium Often based on assumption that insurance company will earn very high interest rates 31 Long-Term Care Insurance About 40% of all people who recently turned 65 will need long-term care Odds are higher for women Long-term care is very expensive Average cost of nursing home is $125 per day Rising at a rate greater than inflation Medicare doesn’t pay for extended long-term care Medicaid does pay, but only after you’ve used up your assets 32 Should People Purchase LongTerm Care Insurance? It is expensive Typical nursing home stay is fairly short Highly unlikely a long-term care policy will ever pay for itself Unless you stay in a nursing home for a lengthy time period and few people do Medicare will pay the bulk of nursing home bills if certain conditions are met Medicaid will pay if a person depletes his assets Some nursing homes won’t take Medicaid patients 33 Buying the Right Long-Term Care Policy Relatively new type of insurance Policies and premiums differ widely Shop around and do your homework The younger you are when you buy the policy, the cheaper the policy Typical policy doesn’t increase the benefits paid in tandem with the expected increase in costs Thus the gap between costs and benefits paid will be greater than younger you are when you buy your policy 34 Figure 11.6: The Impact of Inflation on a Long-Term Care Insurance Policy 35