EXPORT AND IMPORT MANAGEMENT Chapter Seventeen

advertisement

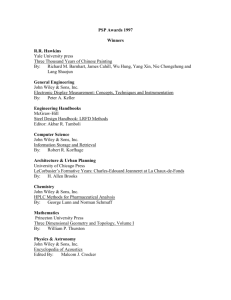

Global Marketing Management, 5e 1 Chapter 16 Export and Import Management Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Chapter Overview 2 1. 2. 3. 4. 5. 6. 7. 8. Organizing for Exports Indirect Exporting Direct Exporting Mechanics of Exporting Role of the Government in Promoting Exports Managing Imports—the Other Side of the Coin Mechanics of Importing Gray Markets Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Introduction 3 Exporting is the most popular way for many companies to become international. Exporting is usually the first mode of foreign entry used by companies. Selling to foreign markets involves numerous high risks, arising from a lack of knowledge about and unfamiliarity with foreign environments, which can be heterogeneous, sophisticated, and turbulent. Furthermore, conducting market research across national boundaries is more difficult, complex, and subjective than its domestic counterpart. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Introduction 4 With every export transaction there is an import transaction. Aside from differences between the procedure and rationale for exports and imports, both are largely the same the world over For successful development of export activities, systematic collection of information is critical. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 1. Organizing for Exports 5 Research for Exports: First use available secondary data to research potential markets. The identification of an appropriate overseas market involves the following criteria: 1. Socioeconomic characteristics 2. Political and legal characteristics 3. Consumer variables (lifestyle, preferences, culture, taste, purchase behavior) 4. Financial conditions Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 1. Organizing for Exports 6 It is also noted that export research for markets such as China and the Commonwealth of Independent States must still be done largely in the field, because very little prior data exist, and even when available, they are often not reliable. Export Market Segments Homogeneous market segments and clusters Geographical and psychographic segments Issues of standardization vs. adaptation Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 2. Indirect Exporting 7 Indirect exporting involves the use of independent middlemen to market the firm’s products overseas. Combination Export Manager (CEM) Export Merchants Export Broker Export Commission House Trading Companies (sogoshosha) (See Exhibit 16-1.) Piggyback Exporting Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Exhibit 16-1: Major Types of Trading Companies and Their Countries of Origin 8 Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 3. Direct Exporting 9 Direct exporting occurs when a manufacturer or exporter sells directly to an importer or buyer located in a foreign market (Exhibit 16-2). Export Department Export Sales Subsidiary Foreign Sales Branch Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Exhibit 16-2: Comparison of Direct and Indirect Exporting 10 Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 4. Mechanics of Exporting 11 The Automated Export System (AES) on the Internet In the U.S., the AES which was launched in October 1999, enables exporters to file export information at no cost over the Internet. AES is a nationwide system operational at all ports. Legality of Exports- can be proactively dealt with Export license (general or validated license) Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Exhibit 16-3: U.S. Government Departments and Agencies with Export Control Responsibilities 12 Copyright (c) 2007 John Wiley & Sons, Inc. Chapter 17 4. Mechanics of Exporting 13 Export Transactions The terms of sale Monitoring the transportation and delivery of the goods to the assigned party Shipping and obtaining the bill of lading Bill of lading A straight bill of lading A shipper’s order bill of lading Commercial invoice Freight forwarders Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 4. Mechanics of Exporting 14 Terms of Shipment and Sale INCOTERMS 2000 (International Commercial Terms) Terms of Shipment (Exhibit 16-4): Ex-Works (EXW) at the point of origin Free Alongside Ship (FAS) Free on Board (FOB) Cost and Freight (CFR) Carriage Paid To (CPT) Cost, Insurance and Freight (CIF) Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Exhibit 16-4: Terms of Shipment 15 Copyright (c) 2007 John Wiley & Sons, Inc. Chapter 17 4. Mechanics of Exporting 16 Payment Terms (Exhibit 16-5) Advanced Payment Confirmed irrevocable letter of credit Unconfirmed irrevocable letter of credit Documents Against Payment (D/P) Documents Against Acceptance (D/A) Open account Consignment Currency Hedging Done through a banker or the firm’s treasury to counter foreign risk in the export transaction. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Exhibit 16-5: Terms of Payment in an Export Transaction 17 Copyright (c) 2007 John Wiley & Sons, Inc. Chapter 17 5. Role of the Government in Promoting Exports 18 Export promotion activities generally comprise: 1. Export service programs 2. Market development programs Export Enhancement Act of 1992 Some governments encourage inward FDI as a way to increase their exports (e.g., Argentina) Export - Import Bank (Ex-Im Bank) Tariff Concessions Foreign Trade Zone Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 5. Role of the Government in Promoting Exports 19 American Export Trading Company The Export Trading Company Act of 1982 Export Regulations The Trade Act of 1974 The Foreign Corrupt Practices Act (FCPA) of 1977 COCOM (Coordinating Committee for Multilateral Exports) U.S. Antitrust Laws Tariffs and local laws of foreign governments which may include: tariffs, local laws relating to product standards and classification, and taxes. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 6. Managing Imports – the Other Side of the Coin 20 For organizations in the United States, importing is considerably easier than for most firms in the rest of the world. About 60 percent of the world’s trade is still denominated in U.S. dollars. Most of the time, a U.S. importer does not have to bother with hedging foreign exchange transactions or with trying to accumulate foreign currency to pay for imports. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Exhibit 16-6: Model of Importer Buyer Behavior 21 Copyright (c) 2007 John Wiley & Sons, Inc. Chapter 17 6. Managing Imports – the Other Side of the Coin 22 Model of Importer Buyer Behavior Stage 1. Need recognition and problem formulation (triggered by competition and unavailability) Stage 2. Search (guided by country characteristics, vendor characteristics, and information sources) Stage 3. Choice (vendors evaluation and selection) Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 7. Mechanics of Importing 23 Steps in Importing Finding a bank that either has a branch in the exporter’s country or has a correspondent bank Establishing a letter of credit with the bank Deciding on the mode of transfer of goods from exporter to importer Checking compliance with national laws of the importing country Making allowances for foreign exchange fluctuations Fixing liability of payment of import transactions and warehousing Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 7. Mechanics of Importing 24 Import Documents and Delivery Entry documents filed by the consignee: The bill of lading Customs form 7533 Customs form 3461 Packing list Commercial invoice Also accompanied by evidence that a bond is posted with customs to cover any potential duties, penalties, and taxes For Special Permit for Immediate Delivery, use Customs form 3461 for fast release after arrival. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 7. Mechanics of Importing 25 Import Duties in the United States Ad valorem duty Specific duty Compound duty Antidumping import duty Countervailing duty Duty drawback: Direct identification drawback Substitution drawback All countries have procedures allowing for the temporary of goods across their borders. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 8. Gray Markets 26 Gray market channel refers to the legal export/import transaction involving genuine products into a country by intermediaries other than the authorized distributors. From the importer side, it is also known as parallel imports. Three conditions are necessary for gray markets to develop: 1. Products must be available in other markets. 2. Trade barriers must be low enough for parallel importers. Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 8. Gray Markets 27 3. Price differentials among various markets must be great enough to provide the basic motivation for gray marketers. Such price differences arise for various reasons: Currency fluctuations Differences in market demand Legal differences Opportunistic behavior Segmentation strategy The WWW’s information transparency Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 8. Gray Markets 28 How to Combat Gray Market Activity (See Exhibit 16-7.) Reactive Strategies Strategic Confrontation Participation Price cutting Supply interference Promotion of gray market product limitations Collaboration Acquisitions Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 8. Gray Markets 29 Proactive Strategies Product/service differentiation and availability Strategic pricing Dealer development Marketing information systems Long-term image reinforcement Establishing legal precedence Lobbying Copyright (c) 2009 John Wiley & Sons, Inc. Chapter 16 Exhibit 16-7: How to Combat Gray Market Activity 30 Copyright (c) 2007 John Wiley & Sons, Inc. Chapter 17 Exhibit 16-7: How to Combat Gray Market Activity, cont’d 31 Copyright (c) 2007 John Wiley & Sons, Inc. Chapter 17