ROI Marketing Presentation, May 2009

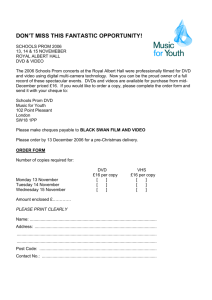

advertisement

Marketing: Return On Investment Updated: May 6, 2009 Agenda 2 Importance of measuring the effectiveness of marketing programs Different ways to calculate ROI Real Life Examples Importance of Measuring ROI 3 Creates the ability to understand and communicate the return on your marketing dollars Helps to better evaluate which programs are the most effective and which need to be modified or eliminated Assists in getting the resources you need Allows you to have an intelligent conversation regarding your marketing budget Prevents you from becoming a Dilbert cartoon The Marketing Process Developing Marketing Strategy/Planning 1. Market Assessment 2. Competitive Analysis Managing the Marketing Function 4. Financial Analysis with ROI 5. Brand Development 6. Brand management 9. Experience and Service Management 10. Retention and Process Improvement 18. Marketing Role Definition 17. PR and Internal Comm. 16. Product Pricing and Offer 15. Sales Support 14. Promotions/ Merchandising Executing the Marketing Plan 4 Brand Mgmt. 8. Client Understanding & Segmentation Effectively Managing the Twenty Activities of Marketing 19. Staff and Partner Management 7. Internal 13. Marketing Message & Creative 12. Media Mix Selection 11.Operational & Systems Planning Understanding and Managing Clients 20. Measuring Performance & Quality Control 3. New Product and Offer Creation Defining Brand Strategy/Managing the Brand Budget Approaches 5 Percent of Assets -- “Rule of thumb” formula is 1/10 of one percent of bank assets or $1,000 for every million dollars of bank assets Incremental Increase -- Adds an “inflation factor” -- usually 2 to 5% -- to previous year’s budget Budget Approaches 6 Comparative Parity -- “Keeping up with the other guys” or spending in line with the competition to retain share of voice position All We Can Afford -- Marketing/advertising funding is established last in the bank budget process and allocated only those dollars remaining in non-interest expense forecast Budget Approaches Objective and Task -- Marketing/advertising budget based on measurable business objectives and the cost of programs required to achieve these objectives 7 Factors that Affect Your Budget Strategic Direction of Your Bank -Consumer vs Business -Market Segments -Market Share -Growth Goals -Orientation towards Marketing and Branding 8 Media Costs in Your Markets Number of Branches Ability to provide ROI A Day in the Life of a Marketing Director: Real Life Examples 9 “I think giving away a free DVD player for a free checking account is a stupid idea and will never pay for itself.” “I do not think that home equity direct mail did us any good, should we save the money next quarter and just drop it?” “We are projected to sell 46,000 new small business checking accounts this year. How much could we sell next year?” “I liked our TV commercials, but did they really do anything for us?” “I think giving away a free DVD player for a free checking account is a stupid idea and will never pay for itself.” 10 Calculation of Required Sales Lift (RSL): RSL = Offer Cost /(Product Profitability-Offer Cost) It answers: How much of an increase in sales volume will I need to pay for my marketing program? 11 DVD Checking Offer Analysis What is the lift required on Checking Account Sales to pay for a DVD Player? Revenue (5 Years) On Going Expense (5 Years) Set Up Costs Marketing Costs Profit Before DVD Offer DVD Expense (Delivered) Profit (Full Life) RSL (61/(528-61) 12 NO DVD $ 851 267 10 46 528 0 528 DVD Offer $ 851 267 10 46 528 61 467 0% 13% “I do not think that home equity direct mailing did us any good, should we save the money next quarter and just drop it?” 13 Calculation of Return on Investment: ROI = Incremental Profit - Marketing Investment Marketing Investment It answers: What kind of return did I get on my Marketing Expenditure? 14 What should your hurdle rate be? 15 Recover the cost of your marketing expenses, or achieve a 100% ROI Recover your expenses and produce a 20% return on your investment, or a 120% ROI Double the return on your marketing dollars, or produce a 200% ROI Home Equity Direct Mail Analysis Mailed 120,000 Home Equity Pieces and Tested $100 Home Depot Offer 16 Response Rate Cost of Mailing Applications Approvals Loans Booked Cost of Home Depot Cards Profit of Loans Booked (Full Life) Total Marketing Expenditures 60,000 0.66% 46,200 396 178 125 0 292,500 46,200 60,000 0.80% 46,200 480 218 153 15,300 351,900 61,500 ROI (292,500-46,200)/46,200 533% 472% Business Checking Projections We are projected to sell 46,000 new small business checking accounts this year. How much could we sell next year?” 17 Definition of Insanity: “Doing the same things over and over again and expecting different results.” 18 Calculation of Projected Sales Units (PSU): PSU = Current Sales Run Rate + New Marketing Programs It answers: The collection of marketing activities will generate this number of sales 19 Business Checking Projections Projections estimate a 15% increase in 2005 2004 Current Branch Run Rate New Branch Offices in 2005 Special Offer Prospect Direct Mail Customer Direct Mail Small Business Bankers Small Business Specialists Telemarketing Program Adverse Effects of Competitors Total Accounts 20 26,000 0 0 4,000 4,500 3,500 6,000 2,000 0 46,000 2005 26,000 2,000 2,500 6,000 6,000 3,500 10,000 2,000 -5,000 53,000 We can make a sales goal of 53,000 new accounts if we can have…….. 21 A new offer to give away a $50 Office Max gift card for the first quarter Our prospect direct mail budget increases from 1.5 million pieces to 2 million pieces Our customer direct mail budget increases from 300,000 to 500,000 pieces We add 10 new sales people Multimedia Campaign Analysis “I liked our TV commercials, but did they really do anything for us?” 22 Acquisition / Retention Process Recommend Retain Acquisition Advocate Communication & WOM Driven Commitment “Rational” and “emotional” elements Active Consideration Seek Information Accept Information Aware Unaware 23 Understand / Value Purchase CrossSales Positive Experience Consider Retention/ Growth Experience Driven “Rational” and “emotional” elements Multimedia Campaign Analysis Examine both sales and awareness level changes 24 Required Sales Lift Actual Sales Lift Denver Dallas Phoenix 28% 22% 18% 9% 21% 34% Denver Dallas Phoenix Awareness Level-Pre 5% 10% 15% Awareness Level-Post 11% 20% 19% Worth Try Worth Try Pre Post 17% 22% 26% 24% 27% 34% Summary 25 Focus on creating intelligent conversations with your managers Build a strong partnership with your Finance Group Results for programs work best when both the field and Marketing have ownership Pilot programs are a great tool for testing new ideas and creating realistic projections Always have your results close to you