sec.2 Capt of Industry or Robber Baron - UMUS1

advertisement

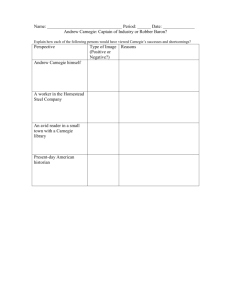

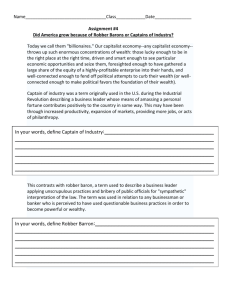

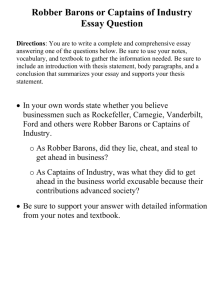

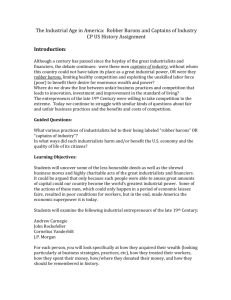

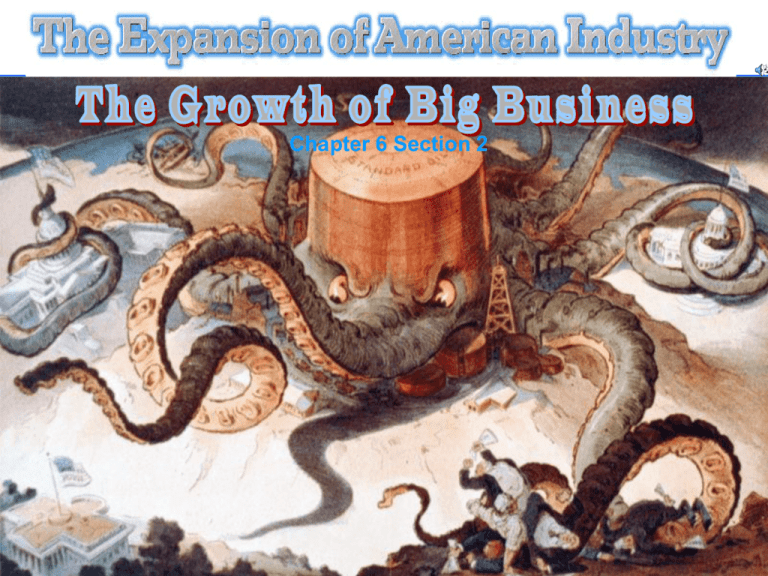

Chapter 6 Section 2 Chapter 6 Section 2 ESSENTIAL QUESTIONS 1. Why were American industrialists of the late 1800s called both “robber barons” and “captains of industry”? 2. How did social Darwinism affect Americans’ views on big business? 3. In what ways did big businesses differ from smaller businesses? 4. How did industrialists gain a competitive edge over their rivals? THE BIG IDEA Big business created wealth for its owners and for the nation, but it also Prompted controversy and concern over its methods. Chapter 6 Section 2 KEY TERMS: KEY PEOPLE: 1. Robber Barons 2. Captains of Industry 3. Social Darwinism 4. Oligopoly 5. Monopoly 6. Cartel 7. Vertical consolidation 8. Economies of scale 9. Horizontal consolidation 10.Trust 11.Sherman Antitrust Act 1. John D. Rockefeller 2. Andrew Carnegie Captains of Industry or Robber Barons? During the late nineteenth century into the early twentieth century America experiences a wave of industrialism driven by a group of men known as industrialists. There is no doubt that these industrialists were driven by one motive, and that was wealth. However, historians and others debate the title to be bestowed on these men – that of “captains of industry” or “robber barons”! By identifying these individuals as captains of industry, we offer a positive impression of their achievements as men of inventiveness who through hard work and ingenious strategies transformed the American economy of the post-Reconstruction era and the early 20th century. These men are to also be honored for their charitable activities (philanthropy). In extending the title of robber baron to these men, we emphasize the cruel and self-centered entrepreneurs who took advantage of the worker, whether it be immigrant, female, or child to accumulate wealth. The factory was a place where the worker experienced harsh conditions and poor pay. ASSIGNMENT: The industrialists of the late nineteenth century and early twentieth centuries are best characterized as ________________. Defend your choice. Visit the links below. Read the selections. Create a brief fact sheet on each of the individuals below. Describe the contributions to each of the industrialists listed below. In what ways did they achieve their wealth? What tactics did they use in “building their empires”? What were their accomplishments in business? What was each one’s reputation as a business man? What philanthropic activities did they support? Write a response to the prompt: The industrialists of the late nineteenth century and early twentieth century are best characterized as ________________. Defend your choice. Use these Web Sites for your Research: Write a response to the prompt: The industrialists of the late nineteenth century and early twentieth century are best characterized as ________________. Include a sentence with 3 supportive ideas. Defend your choice by providing 3 supportive paragraphs giving details/explanation with support from one of the Industrialists. Andrew Carnegie Biography of Andrew Carnegie (PBS) Cornelius Vanderbilt Cornelius Vanderbilt (Bartleby) Cornelius Vanderbilt J. Pierpoint Morgan JP Morgan (PBS) Biography of J.P. Morgan J.P. Morgan John D. Rockerfeller John D. Rockerfeller (PBS) Jay Gould Jay Gould: Famous Americans Jay Gould Henry Frick Henry Frick (PBS) Leland Stanford Leland Stanford (PBS) James J. Hill James J. Hill Biography (PBS) Captain of Industry Robber Baron The age of Robber Barons began with an enormous fraud in the building of the transcontinental railroad in the 1860’s known as the Credit Mobilier Thomas Clark Durant and others of the Union Pacific Railroad formed a company called the Credit Mobilier of America which was given the contract to build a portion of the transcontinental railroad. Credit Mobilier sold or gave shares of the company to prominent congressmen, who approved federal subsidies for the cost of railroad construction. The company charged the government about twice the actual cost of construction, making huge profits for everyone involved. Basically Durant and others were stealing money from the government. Part of the route Credit Mobilier was responsible for constructing The age of Robber Barons began with an enormous fraud in the building of the transcontinental railroad in the 1860’s known as the Credit Mobilier • The scandal was uncovered by a New York newspaper in 1872. The Speaker of the House James G. Blaine created a congressional committee to investigate. • The investigation uncovered involvement by several congressmen and led to the censure of two House members, implicated outgoing vice president Schuyler Colfax, incoming vice president Henry Wilson, and Representative James A. Garfield. Garfield denied the corruption charges and was later elected president. • The scandal exposed the degree to which corruption existed in politics, and how far “robber barons” would go to increase profits. Cornelius Vanderbilt and James Fisk are shown in a race for control of New York's rails during the Erie War. Vanderbilt Fisk The Erie War: the battle for control of the Erie Railroad Company 1866-1868 • Cornelius Vanderbilt, who owned the New York Central Railroad, wanted to take over the Erie Company. Drew, Gould, and Fisk prevented this by issuing fake shares of stock which Vanderbilt purchased in hopes of gaining majority control of the company. The price of the shares was highly inflated and Vanderbilt lost millions in the process. • Vanderbilt fought back by appealing to the politicians he had been bribing in New York to arrest the men. Drew, Gould, and Fisk escaped to New Jersey and upon their return proceeded to bribe the same politicians into preventing the sale of the Erie line to Vanderbilt. • This bitter war resulted in: monetary losses for Vanderbilt and many other investors, victory for Drew, Gould, and Fisk, and a lack of profitability for the Erie line for many more decades. Cornelius Vanderbilt 1794-1877 •Law? Who cares about the law. Hadn't I got the power? —Comment alleged to have been made by Cornelius Vanderbilt, when warned that he might be violating the law Newspapers called him the “Worst Man in the World” because he gained great wealth through dishonest means, often bribing elected government officials and threatening or plotting against opponents. He pioneered the practice of declaring bankruptcy as a business strategy. He used stock manipulation and insider trading (now illegal). He was one of the architects of a consolidated national railroad and communication system. One of his major achievements was to lead Western Union to dominance in the telegraph industry. Jay Gould 1836-1892 Classic Robber Baron Gould was famous for saying, "I can hire one half of the working class to kill the other half." Jay Gould 1836-1892 Classic Robber Baron John Pierpont Morgan 1837-1913 Hated competition and instability in the economy and dedicated his career to brokering and financing deals that yielded consolidations in the electric and steel industries In 1901 created U.S. Steel, the world's first billion-dollar corporation By the early 1900s, Morgan controlled almost all of the major industries in the U.S. and had a large stake in the financial and insurance industries J.P. Morgan lived his life on a large scale, spending massive amounts of money, gambling, on “toys” like yachts, huge parties, palatial homes and art. One of his famous quotes, “If you have to ask how much it costs you can’t afford it”, typifies his beliefs about money. Morgan as the piper that people of various professions & nationalities, including some countries in the distance, are following. John D. Rockefeller 1839-1937 In 1862 met and went into business with Samuel Andrews who had developed a better and cheaper way of refining crude petroleum. They named the company Standard Oil. Rockefeller negotiated his first major deal to lower his cost of transporting oil and refined oil by guaranteeing the railway company sixty carloads a day. This allowed him to lower the prices he charged for oil, his sales skyrocketed, and in less than a year some of his competitors went out of business. Rockefeller bought out Andrews for a million dollars and eventually monopolized oil refining in Cleveland. John D. Rockefeller 1839-1937 Rockefeller dominated the oil industry across the nation by putting local companies out of business through his aggressive maneuvering and lower prices. By 1890 Standard Oil was a monopoly that could fix its own prices and terms of business because it had no competitors. Rockefeller was worth about $9 billion dollars ($190 billion in 2002 dollars). Andrew Carnegie 1835-1919 Later invested in the Bessemer process for making cheap steel and came to dominate the industry with the Carnegie Steel Corporation Different from other robber barons in the sense that he did support worker’s right to organize even though he violently broke up a strike at his Homestead Plant in 1892 Richest man in the world after Rockefeller Author of The Gospel of Wealth in which he argued that the wealthy had an obligation to give away their money. Spent the last part of his life donating money to create over 3,000 public libraries worldwide as well giving to education including the creation and major funding of several universities The Gospel of Wealth: Religion in the Era of Industrialization $ Wealth no longer looked upon as bad. $ Viewed as a sign of God’s approval. $ Christian duty to accumulate wealth. $ Should not help the poor. Russell H. Conwell “On Wealth” Andrew Carnegie $ The Anglo-Saxon race is superior. $ “Gospel of Wealth” (1901). $ Inequality is inevitable and good. $ Wealthy should act as “trustees” for their “poorer brethren.” Carnegie attacks the rich, presumably because of his belief that the rich have a duty to help the poor, as he advocated in Gospel of Wealth. • This, then, is held to be the duty of the man of wealth: First, to set an example of modest, unostentatious living, shunning display or extravagance; … and, after doing so, to consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer… to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience and ability to administer, doing for them better than they would or could do for themselves • —From "Wealth," by Andrew Carnegie, North American Review (1889) The millions made by the robber barons is at the expense of the workers Robber Barons Robber Baron is an insult term used to describe a class of enormously rich businessmen that emerged in the post civil war era. Today300 they would be known as 279 billionaires. They were both admired and hated at the time. They used 250 ruthless, unscrupulous, and often illegal methods to create monopolies and200develop overwhelming economic power and 1865 control their industries. Inknown the late 1800’s aleaders handfuland of Someover of the more commonly industrial 1900 150 these businessmen over 90 percent total U.S. bankers whocontrolled were called Robber Baronsof include: 2004 wealth. 100 Andrew Carnegie 50 John D. Rockefeller 22 3 Cornelius and0William Vanderbilt Jay Gould Total number of billionaires shows the comparison in the number J. PierpontChart Morgan Jim Fisk Daniel Drew of billionaires from 1865 through 2004 How rich were the “robber barons” compared to Microsoft founder Bill Gates? 200 180 160 140 120 100 80 60 40 20 0 Rockefeller Carnegie Vanderbilt Bill Gates Jay Gould JP Morgan James H. Hill $ billions $ Contemporary political cartoon comparing robber barons of the 19th century with robber barons from the Middle Ages http://safari.mciu.org/SAFARI/montage/playlistedit.php?playlistkeyindex=360&location=local New Forms of Business Organization Business Consolidation – Corporations in the same type of business joined together to create large combinations. Advantages – Control competition, control prices, and maximize profits Monopoly – Dominance in or control of a market for certain goods Interlockingordirectorate boards of directors which share at services by–aTwo single company or combination of companies. least one director in common; illegal if the two companies are competitors. (J.P. Morgan) Corporation Pools – Competing firms agree to divide the market, establish prices, and place profits in a common pool or fund. These arrangements, which first emerged in the railroad industry, were also known as “gentlemen’s agreements. (Railroads) Impact of Corporate Evolution Trust – is a formattempted of business combination in which stockholders affiliated The corporation to eliminate cutthroat competition and of business companies turn over their securities and their authority to a board of trustee. instability. The stockholders receive trust certificates and the board of trustees exercises full control of the business. Oil pioneered thisthat formconcentrated of business What emerged was a systemStandard of economic organization consolidation in 1882. D. Rockefeller) Power in the hands of a (John few men, bankers such as J.P. Morgan and Industrial magnets such as Andrew Holding Company – In this form of Carnegie. business organization, a company owns Sufficient stock in other companies and is thus able to dominate their activities Public Reaction to Big Business 1. Early, most Americans agreed that the government should not interfere with private businesses. As a result, the government neither taxed businesses’ profits nor regulated their relations with their workers. 2. By the 1880s and 1890s opinions changed quickly as Big Business exploited human and natural resources to accumulate great amounts of wealth. Few people truly liked trusts and other large business organizations. 3. The people knew that big business did not have consumer or worker interests at heart. 4. Rapid industrial growth did lead to strains on the economy. The country experienced periods of Economic Depression in the 1870s, 1880s, and 1890s. Laissez-faire Social Darwinism Individualism Laissez faire ■Term originated in France during the Enlightenment ■Based on the idea that the government should not intervene in business or the economy; instead natural law or market forces would regulate ■Adam Smith popularized the term and concept in his book Wealth of Nations in 1776 ■This approach was embraced by industrialists during this era who did not want the government to regulate them in any way Herbert Spencer “Social Darwinism” Spencer, an Englishman, was a philosopher who is best remembered for his ideas that have become known as “Social Darwinism”. “Each individual should be allowed to do as he or she wills as long as it doesn’t infringe on the rights of another person.” Social Darwinism advocated laissezfaire capitalism, an economic system that allows businesses to operate with little government interference. Spencer believed that competition was “the law of life” and resulted in the “survival of the fittest”, a phrase he used years before Darwin. Spencer argued in his various writings that society is best served when its fittest members operate without opposition. Herbert Spencer “Social Darwinism” Unlike Darwin, Spencer also believed that individuals genetically pass on their learned characteristics to their children. This meant the fittest persons inherited positive qualities such as intelligence, the desire to own property, and the ability to accumulate wealth. On the other hand, the unfit inherited laziness, stupidity, and immorality. Spencer argued that the number of unfit would eventually disappear because of their inability to effectively compete with the fit. He was against any government aid to the poor because it interrupted the correct evolution of civilization. Spencer’s Social Darwinism Opposed government aid to the poor because he believed it bred immorality Against a public school system since it forced taxpayers to pay for the education of other people's children Opposed laws regulating housing, sanitation, and health conditions because they interfered with the rights of property owners Disease was punishment for the ignorant and should not be tampered with Against most taxation because it interfered with the natural evolution of society Advocated a laissez-faire system in which there was no government regulation of private enterprise Spencer was against any legislation that regulated working conditions, maximum hours, and minimum wages because they interfered with the property rights of employers. He believed labor unions took away the freedom of individual workers to negotiate with employers 2. Social Darwinism in America $ Individuals must have absolute freedom to struggle, succeed or fail. William Graham Sumner Folkways (1906) $ Therefore, state intervention to reward society and the economy is futile! New Business Culture: “The American Dream?” 3. Protestant (Puritan) “Work Ethic” Horatio Alger [100+ novels] Is the idea of the “self-made man” a MYTH?? Individualism The idea that a person should not rely upon others for success This philosophy was evident from the beginning of United States history Author Horatio Alger made this concept the theme of his books in which a poor young man is able to create wealth and success through his hard work Later the term “rugged individualism” becomes popular Horatio Alger PLEASE DO NOW! As a Team, discuss how Laissez Fair and Social Darwinism contributed to the Growth of Industry during the late 1800s. Second Industrial Revolution defined U.S. became an industrial giant Horizontal versus vertical integration Trusts Technology and Inventions Corporate business organization LaissezFaire attitude of Abundant resources Second Industrial Revolution government Capital for investment Large labor supply National market Large corporations developed in two major ways: horizontal or vertical integration Horizontal (Consolidation) integration is the growth of a business through acquiring additional business activities in the same industry. A business either combines with other similar companies or buys them, called “mergers and acquisitions”. The benefits to the firms that horizontally integrate include cheaper operating costs because production is on a larger scale, increased market control of the product including over suppliers and distributors, and greater control over treatment of workers. An example of this form of expansion would be Standard Oil’s acquisition of almost all oil refineries around the U.S. Large corporations developed in two major ways: horizontal or vertical integration Vertical Consolidation (integration) is the growth of a business through the acquisition of the materials that make the product, the factories that manufacture the products including the machines needed to produce the product, as well as the distribution channels to take the product to market. This allows the business to control all aspects of the industry and provides large profits. An example would be Carnegie Steel’s control of raw materials, production of steel, transportation, and companies that made products out of steel. How trusts worked A trust was a business entity designed to create a monopoly over an industry. Some were formally organized as trusts under the law. They were created when corporate leaders convinced, often through coercion, the shareholders of all the companies in one industry to turn over their shares of a corporation to a board of trustees, in exchange for dividend-paying certificates. The board would then manage all the companies in "trust" for the shareholders. Sherman Antitrust Act (1890) First federal act that outlawed monopolistic business practices. Any combination “in the form of trust or otherwise that was in restraint of trade or commerce among the several states, or with foreign nations” was declared illegal. Persons forming such combinations were subject to fines of $5,000 and a year in jail. Individuals and companies suffering losses because of trusts were permitted to sue in federal court for triple damages. The law was not immediately effective because of the lack of definitions of “trust,” “combination,” “conspiracy,” and “monopoly”. Sherman Antitrust Act (1890) Five years later, the Supreme Court ruled in United States v. E. C. Knight Company that the American Sugar Refining Company had not violated the law since it was only manufacturing the product, even though the company controlled about 98 percent of all sugar refining in the U.S. The law was not effectively used until President Theodore Roosevelt’s “trust busting” campaigns at the turn of the century. Most recently used in the 1990s against the Microsoft computer software company. Modern ‘Robber Barons’?? Causes Features 1. Effects 1. 1. 2. 2. 2. 3. 3. 3. 4. Methods 1. 4. 4. 5. Growth of Big Business Gov’t Relations 1. 2. 3. 2. 4. Name __________________ Period _____ Causes 1.Period of invention 2.Technology 3.Shrewd Business people 4.Investors 5.Create large companies Methods 1. Vertical consolidation 2. Horizontal consolidation 3. Formation of trusts 4. Underselling competitors Features Effects 1. Large amounts of capital 2. Diversification to encompass the total production of a product 3. Revised role of ownership & management 4. New management methods 1. U.S. became wealthy 2. Created thousands of jobs 3. Created new products at low costs 4. Safety and well being of labor was not a priority Growth of Big Business Gov’t Relations 1. Most Americans agreed that gov’t should not interfere with private business 2. End of 1800s, fed. & state gov’t passed laws to prevent monopolistic practices