Identification

advertisement

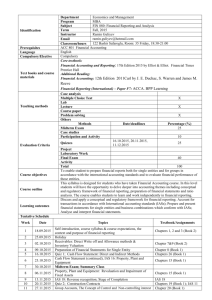

Identification Prerequisites Language Compulsory/Elective Text books and course materials Teaching methods Evaluation Criteria Course objectives Course outline Learning outcomes Economics and Management Department Graduate Program ACC 870 International Accounting Practices - 3KU/6ECTS credits Subject Spring 2014 Term Orkhan Karimov Instructor okarimovqub@gmail.com E-mail: Bashir Safaroglu 122, Room #21, Monday 18:30 – 21:00 Classroom/hours ACC 801 Financial Accounting English Compulsory Core textbook: Connolly, C. (2011), International Financial Accounting and Reporting, 3rd Edition, Dublin: Chartered Accountants Ireland.F. Deegan, C. and Unerman, J. (2006), Financial Accounting Theory: European Edition, McGraw Hill. Elliott, B. and Elliott, J. (2009), Financial Accounting and Reporting, 13th Edition, FT Prentice Hall. Scott, W. R. (2008) Financial Accounting Theory, 5th Edition, FT Prentice Hall. Case analysis X Group discussion Lab X Lecture Course paper X Problem Solving Others Methods Date/deadlines Percentage (%) 20 Midterm Exam Case studies 5 Participation and Activity 15 Quizzes 20 Project Laboratory Work 40 Final Exam Activity 100 Total The main objective of this course is to give the students deep knowledge into separate accounting standards and prepare financial statements. The course focuses on the mostly used IFRS and IAS. It will cover their aspects like general rules for using them, application in financial reports, preparation, presentation and consolidation of financial statements considering international standards. The aim of the module is to develop the participants’ appreciation of financial accounting concepts in the construction and application of the theory and practice of international financial accounting and reporting. In particular, this module seeks to enable students to: * apply international financial reporting standards in the preparation and presentation of single company and group financial statements; * be aware of the main concepts and theories of financial accounting and reporting currently engaging the attention of both the academic community and the accounting profession; and Week Tentative Schedule Textbook/Assignments Date 1 10.02.14 2 17.02.14 3 24.02.14 Topics Framework for the Preparation and Presentation of Financial Statements Conceptual Framework for Financial Reporting 2010 Presentation of Financial Statements IAS 1 Presentation of Financial Statements Analysis and Interpretation of Financial Information Revenue Recognition IAS 18 Revenue Recognition Property, Plant and Equipment IAS 16 Property, Plant and Equipment Chapters 1 and 2 Chapter 35 Chapter 4 and 6 4 03.03.14 5 10.03.14 6 17.03.14 7 24.03.14 8 31.03.14 9 07.04.14 10 14.04.14 11 21.04.14 12 28.04.14 13 05.05.14 14 12.05.14 15 19.05.14 Borrowing Costs IAS 23 Borrowing Costs Impairment of Assets IAS 36 Impairment of Assets Non-current Assets Held for Sale and Discontinued Operations IFRS 5 Non-current Assets Held for Sale and Discontinued Activities Investment Property IAS 40 Investment Property Accounting for Government Grants and Disclosure of Government Assistance IAS 20 Accounting for Government Grants and Disclosure of Government Assistance Provisions, Contingent Liabilities and Contingent Assets IAS 37 Provisions, Contingent Liabilities and Contingent Assets Midterm Exam Events After the Reporting Period IAS 10 Events after the Reporting Period Accounting Policies, Changes in Accounting Estimates and Errors IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors Statement of Cash Flows IAS 7 Statement of Cash Flows Connolly Earnings per share IAS 33 Earnings per Share Consolidated Statement of Financial Position IFRS 3 Business Combinations ; IAS 27 Consolidated and Separate Financial Statements Consolidated Statements of Comprehensive Income and Financial Position Revision and Discussion Final Exam Chapter 7, 10 and Chapter 15 ,16 and 20 Chapter 15 Chapter 15, 14and 21 Chapter 23 Chapter 19 Chapter 23 Chapters 26 and 27 Chapters 27 and 28