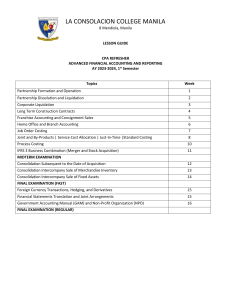

COX 4114ADVANCED ACCOUNTING

advertisement

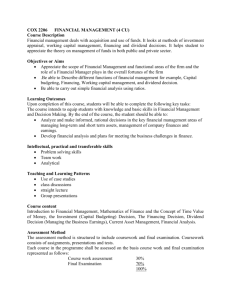

COX 4114 ADVANCED ACCOUNTING (3 CU) Course Description: This course intends to equip students with knowledge in accounting legal frame work, the major standards which govern the accounting discipline and major financial reporting issues. Objectives: At the end of the course, the student should be able: To Prepare and present financial statements in accordance with the IASs/IFRSs To prepare consolidated financial statements To account for business combinations and company liquidation Understand the design of Accounting Information Systems, and be able to analyze, interpret and compare financial information produced. Learning Outcomes: Students should be able to Prepare financial statements ready for publication in accordance with IFRS and IAS. Understand the implications and the whole process of liquidating companies. Handle group accounts and reorganization of businesses. Intellectual, practical and transferable skills Problem solving skills Analytical skills Team work Precise presentation Teaching and Learning Patterns practical examples class discussions Assignments Assessment Method The assessment method is structured to include coursework and final examination. Coursework consists of assignments, presentations and tests. Course work assessment 30% Final Examination 70% 100% The minimum cumulative mark required to pass is 50%, is required to pass this unit. This includes course work and final examination. Each course in the programme is allowed a maximum of three hours for final examination. Course Duration The course is offered in the first semester of third year. It’s taught for 60 hours. Course content Advanced financial accounting & Accounting standards, Accounting Information Systems, Preparation and Presentation of Financial Statements, Business Re Organizations/ Reconstructions, Absorptions and Amalgamations, Analysis, Interpretation and Comparability of Financial statements/ Reports, Preparation of consolidated financial statements ( GROUP ACCOUNTS), Introduction to accounting for group of companies, Consolidation Of Balance Sheets, Consolidation Of Income Statements, Bankruptcy Accounting (Liquidation And Receivership), Current Value Accounting, Non – Current Assets, Earnings per share, Accounting For Substance of Transactions References 1. Alexander and Britton (2002) Financial Reporting 6th edition Thomson 2. M.W.E Glautier and B Under down (2001) Accounting Theory and Practice 7th edition Prentice Hall. 3. International Financial Reporting Standards and International Accounting Standards issued by the International Federation of Accountants