Bocconi University Exchange Report: Spring 2015

advertisement

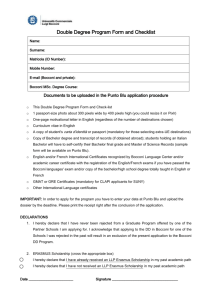

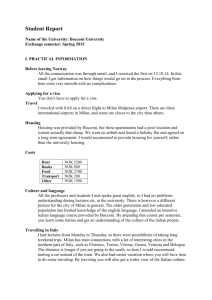

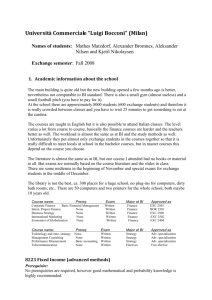

Student Report Bocconi University Spring 2015 Exchange Bocconi University is regarded as the paramount institution in Italy for business related education. It boasts a prestigious reputation and high scores across the major university ranking indexes. Bocconi University is notably renowned for its economics and finance subjects and therefore attracts many serious students interested in these respective fields of study. In addition, the university offers a wide selection of management focused courses, followed by a fair amount of law and marketing orientated classes. A semester at Bocconi is unquestionably more demanding than the equivalent at BI in terms of workload and self-learning requirements. Thus, I highly recommend an exchange semester at this school for students who have an interest in finance/economics, want to gain knowledge in these fields that exceeds BI’s curriculum, and are willing to make studying a priority over traveling/social activities if necessary. The process preceding the actual exchange to Bocconi is a relatively smooth one. After the International Office at BI has nominated you for exchange, the International Student Desk (ISD) at Bocconi will contact you via email with instructions to their online application process as well as key information regarding course selection, student housing, language courses, and various future deadlines. Among other typical documentation, a passport-sized photo must be uploaded. Relative to the other universities my classmates exchanged to, the application process began later at Bocconi; however, it was also one of the most convenient. The ISD at Bocconi is very proficient and systematic with respect to the exchange procedures. The postponement of the application process is because the school semesters in Italy begin later than in many other countries. Eventually the time window will arrive where one must choose his/her courses. At Bocconi, the vast majority of subjects offer 6 ECTS rather than the typical 7.5 at BI, meaning you must complete five subjects in order to fulfil a semester’s credit requirements. It is worth mentioning that while the credits earned per subject are lesser, the courses at Bocconi will require at least as much time and effort as a typical course at BI (from my experience with finance subjects). Many of the courses available in English will be third year electives from the Bocconi curriculum, so anticipate some course schedule overlapping. The courses’ scheduled lectures will be visible on the online selection platform so you can account for this when choosing subjects. As some of your choices will inevitably overlap, make sure to have many preapproved courses (by BI) on your learning agreement to avoid wasting time during the selection period. The courses at Bocconi are allocated on a first come first serve basis, so it is important to be ready as soon as the selection platform opens, as some of the “favorites” will fill up quickly. It is possible to register for courses that have overlapping classes. I chose a subject in which due to time clashes, I could only attend 50% of its lectures. It was difficult and took much self-teaching diligence but was worthwhile because the courses were of high relevance to my career aspirations. Some courses have separate exams for students deemed to be non-attending (below a certain attendance threshold). They tend to be the qualitative subjects where in-class participation accounts for some of the grade. There is a time-limited option to change courses after two weeks of classes. I changed one course for another upon the realization that I would be otherwise be writing two exams in one day. It was an easy process with the help of the ISD at Bocconi but it took some extra effort to catch up in the new subject. As Bocconi is situated in Italy, EU/EEA nationals will not need a visa to participate in an exchange semester there. In addition, recent legislative changes allow non EU/EEA nationals to temporarily reside in Italy for the purpose of an exchange semester given they hold a valid student visa pertaining to an EU/EEA country (such as Norway) extending throughout and following the duration of their stay. Hence, as a Canadian citizen with a Norwegian student visa, I did not need an Italian visa to study at Bocconi University. For other foreigners going on exchange to Italy, it is advisable to confirm with the Italian Embassy in Oslo. However, Italy does require that all non-EU/EEA citizens obtain a “permit of stay” shortly after arrival to Milan: a bureaucratic and confusing paperwork filled affair involving both post office staff and local police, costing 124 Euros. The majority of the paperwork is in Italian, so the “permit of stay seminar” offered by Bocconi’s ISD office is necessary to attend for any non-EU/EEA national. Bocconi offers student housing for exchange students, which one must register for during the application period. I decided not to opt for student housing, as I was under the impression that most of the dorms are not situated close to campus. The majority of exchange students were given rooms in Residenza Arcobaleno, south of the city center and roughly a half hour’s commute by public transit to the University. I decided to arrange a private vacation apartment with some of the other exchange students from BI. We used VRBO.com and Airbnb.com to search for (and find) an apartment available for the five month duration in Milan. Vacation apartments are most convenient because they come fully furnished and with a contract tailored to your desired stay. Many private rentals otherwise demand a one year contract which has the potential to prove difficult to exit from prematurely. The apartments listed on the two respective websites above are expensive and do not necessarily have longer-term price quotations, however, from my experience many of the apartment owners/managers are willing to negotiate a lower price for a longer-term commitment. Rent in Milan can be expensive relative to other costs of living, so anticipate rental prices comparable to those in Oslo. Student housing is of course cheaper. There are quite a few Facebook pages dedicated to student (and exclusively Bocconi) apartment rentals in Milan. There are lots of departing students as well as owners listing available living spaces. This is also a good solution for non-Italian speakers, but approach with caution as there are some likely frauds occurring with “apartment” advertisers requesting preliminary rent and deposits via Western Union, which is very risky. Aside from rent and gym memberships, livings costs in Milan are significantly lower than in Oslo. A student transit pass can be purchased for 22 Euro a month and an Italian sim card for roughly 25 Euro. The cell phone provider WIND is a good option for exchange students as they provide service including 4G for about 12 Euro a month, no commitment. There are many WIND shops around the city. A meal at a local restaurant can be had for as little as six Euros and one can eat very well by buying groceries for say 15 Euro a day on average. You can save a lot of money by registering for a free customer loyalty card at your grocery store. This is necessary to take advantage of the often-occurring sales on food and alcohol. Nightclubs can be expensive, with 10 Euros the going rate for any kind of drink. Entrance is typically 10 Euros but includes a free drink or two. Upon one’s arrival in Milan, it is necessary it check in at the ISD office at Bocconi. You are presented with a welcome package that includes a preloaded USB stick with helpful information regarding the university and noteworthy events. At this time, you are given your Bocconi student card that is made using the passport-sized photo provided during the preceding online application. There is a typical welcoming ceremony, campus/city tours, and other introductory events taking place through exchange students’ arrival period. The International Student Desk at Bocconi does a great job in arranging social activities for incoming students. There is a week or two of dinner/aperitivos and nightclub outings organized in collaboration with Erasmus Student Network Bocconi. This is a good way to make new friends and get to know your classmates before the lectures pick up. Nights out at certain clubs on corresponding days of the week continue throughout the semester. This is popular with many of the exchange students so there is always some familiar faces on these evenings out. In addition to this, numerous trips are arranged for exchange students to destinations nearer to Milan, such as Lago di Como, Verona, Genova and Venice. The trips are shorter, from a day to a weekend, and take place just during the start of the school semester. The Bocconi Campus is larger and more spread out relative to BI. There are three main buildings where bachelor students may have lectures, a separate library and student gym and MBA school (SDA Bocconi). It can take some time to get between buildings for different classes. I chose a subject that had lectures ending exactly when another course of mine was beginning. At Bocconi, the lectures last 1.5 hours without breaks and the professors usually teach right up to the last minute of class. Hence, every week I had to leave one course 10 minutes early or be 10 minutes late for the following class. It was unpleasant having such a tight schedule so this is something to bear in mind when choosing your courses. Each subject has two lectures per week and the professors move at a fast pace through the curriculum (typically one chapter/topic per lecture). The classrooms at Bocconi are smaller, comparable to the ones on the second floor at BI. This is good because it encourages class discussion and more professor/student communication but it can feel overly crowded compared to the BI norm. On campus there is an academic bookstore called Egea that carries all the texts necessary for the semester. Its prices are comparable to those at Akademika. There are three cantinas at Bocconi with prices similar to those at BI for food but much cheaper coffee. The majority of the cantina staff do not speak English and can be impatient so it is advisable to pick up a few key Italian words before beginning there. The printing system in place at Bocconi is nowhere near as efficient and convenient as at BI. This was frustrating as I felt much time was wasted queuing to print lecture slides. Because of this shortcoming, many students choose to use private printing shops located near campus instead of the Bocconi facilities. With respect to promoting BI, an international fair takes place at Bocconi aimed at informing local students about exchange opportunities with partner institutions. All incoming exchange students at Bocconi receive an email prior to the event from the ISD asking for their participation. I chose to represent BI at the international fair and it was a fun experience. Many interested Italian students came with questions about BI and life in Norway. BI sends a package to Bocconi with t-shirts and information brochures for the occasion. As mentioned earlier, one must take five subjects at Bocconi to fulfill the semester’s credit requirement. I elected to take finance/economics courses as I find these more interesting, and they are the disciplines for which Bocconi is most renowned. I will follow with a brief discussion of each course I completed. 30184 - Risk Management with Derivatives This was my favorite subject that I took at Bocconi. Two excellent professors, one of whom has much industry experience working at Lehman Brothers, teach it. It was one of the most challenging subjects that I took because of an ambitious curriculum and the use of an advanced textbook (Futures, Options, and Other Derivatives by J.Hull). The first half of the course begins with forward contracts: attention given to arbitrage scenarios, pricing, and valuing. The course then progresses to futures, focusing on the margin system, trading strategies and hedging. Finally, swap contracts take up the remaining first half of the semester, primarily devising and valuing interest rate/currency swaps. The term’s second half largely focuses on options, namely pricing using binomial trees, Monte Carlo simulations and the Black & Scholes model. In addition, trading strategies, the Greek letters, and stochastic calculus are incorporated into the options unit. Credit risk, weather derivatives, and the LIBOR Market Model compromise the rest of the curriculum. The final grade is determined by a midterm and final exam, each lasting approximately an hour and contributing 50% to the grade. I highly recommend this subject for any student interested in derivatives, especially if you are forgoing the derivatives course at BI by going on exchange. This course is quantitative and it would be very helpful having some prior exposure to derivatives. 30185 - Business Valuation Business Valuation is taught by three different professors, two of whom work in M&A concurrent to teaching at Bocconi. I felt that this brought an industry-orientated perspective to the course that I valued. In addition, guest speakers from Deutsche Bank, JP Morgan, and Borsa Italiana held a few lectures throughout the semester bringing an even more work relevant aspect to the subject. Business Valuation begins with a refresher of the principle valuation methodologies: discounted cash flow, adjusted present value, economic profit and cash flow to equity. Following this, attention shifted to reorganizing and analyzing financial statements, as well as business planning with excel (i.e. future projection of financial performance). Subsequently we covered the approach to estimating a firm’s terminal value and cost of capital. Finally, the course covers the multiples methodology to enterprise valuation, as well as a practical approach to M&A and leveraged buy-outs. The textbook used in this course (Valuation by Koller/Goedhart/Wessels) is advanced; it is important to attend all the lectures in order to gain a full understanding of the subject. In addition, application of the theories taught comes by casework that is covered in the second half of the program. The grade is determined by a final exam that lasts for one hour. I suggest Business Valuation for students interested in corporate finance and investment banking, whom have at least introductory knowledge of finance and financial accounting. Often this subject is taught in the master degree, thus I think it is advantageous if given the opportunity, to gain exposure to enterprise valuation on the bachelor level. 30176 - Financial Contracting This is the easiest subject (relative to the others) that I took at Bocconi, but it is by no means a light course. The professor teaching Financial Contracting is one of the best I have encountered through my education. He is very enthusiastic in his teaching, and obviously values class discussion as he puts a lot of effort in ensuring his students express their opinions. Content wise, Financial Contracting opens with a short coverage of capital structure and the Modigliani-Miller propositions. This is something I previously studied at BI so it was not particularly challenging. The course progressively gets more difficult, moving into inefficiencies that arise from risk shifting, debt overhang, adverse selection, moral hazard, and bankruptcy law. It teaches how to mitigate such inefficiencies using financial contracts, incorporating collateralization, control rights, diversification, taxation, and capital structure decisions. This subject also draws on some game theory. What makes this course difficult is the use of models to quantify the abovementioned topics. It can feel very “academic” at times, but the professor does a great drawing on real life examples/applications of the material taught. Financial Contracting does not require the purchase of textbooks because the professor’s lecture slides are very informative and important readings are uploaded. The grade is based on an equally weighted midterm and final exam, each lasting for an hour. I would suggest this course for students with an interest in agency theory or a theoretical approach to capital structure and investment decisions. 30055 - Financial Economics Financial Economics is an investments orientated course. It is very similar in terms of content to Investment Analysis (EXC 3612) taught at BI, thus it should be a priority selection for finance students forgoing that subject by choosing an exchange semester at Bocconi. This was my motivation for taking up this course along with an interest in investments. The content covered though Financial Economics is narrow in scope but is taught in much depth. Topics include capital allocation decisions, risky portfolio optimization, CAPM and its variants, arbitrage pricing theory and fixed income (properties, term structure of interest rates, and portfolio strategies). I was very impressed with the professor teaching this subject. He does not use power point slides in his lectures, which I found refreshing, and he is very engaging with the students, encouraging lots of interesting class discussion of relevant matters. This is a moderately challenging course and its grade is entirely founded on an hour-long final exam. 30177 – Financial Modelling Financial Modelling was the most difficult subject that I took at Bocconi. It is an Excel based course, entirely taught in a computer room. The reason I chose this course was due to my previous lack of exposure to Excel. I think having a good knowledge of Excel is important for one’s employability and this subject was perfect for getting me up to speed. Thus, I highly recommend it for anyone in a similar situation whom has a good theoretical understanding of at least half of the material covered. The reason for this is that the professor moves quickly through the course content, because there is lots of it. If I had not already seen some of the content we applied in Excel, this subject would have been too difficult. In class, theoretical explanations are quantitative and it will be helpful to have an understanding of basic matrix algebra. Financial Modelling is taught in units, starting with Excel tools for finance, fixed income, portfolio optimization, asset pricing, options, event studies, mutual fund performance and credit risk. Although the course is excel taught, the exam is hand written, requiring one to remember Excel function inputs. The grade is decided by a final exam that lasts for 1.5 hours. Looking back, I consider my exchange semester at Bocconi to be an advantageous experience. It was certainly a challenge: both academically and through the process of adjusting to a different culture and surroundings. However, the new insights I developed and additional knowledge I gained over and above what I would have had I remained at BI for my final semester are invaluable. Further, my exchange to Bocconi allowed me to expand my network of friends and add another highly respected institution to my educational history.