Strategic Transfer Pricing, Absorption Costing and Vertical Integration

advertisement

Chapter 7:

Flexible Budgets, Variances, and

Management Control: I

The use of Planning for Control

1

Basic Concepts

Variance – difference between an actual and an expected

(budgeted) amount

Management by Exception – the practice of focusing attention

on areas not operating as expected (budgeted)

Static budget – a budget prepared for only one level of activity

It is based on the level of output planned at the start of the budget

period.

The master budget is an example of a static budget.

Flexible budget – revenues or costs considered justified by the

actual output level of the budget period

A key difference between a flexible budget and a static budget is

the use of the actual output level in the flexible budget.

In general, flexible budgets can also be conditioned on actual

levels of other external influences

serve to implement responsibility accounting

2

Basic Concepts

Static-Budget Variance (Level 0) – the difference between the

actual result and the corresponding static budget amount

Favorable Variance (F) – has the effect of increasing operating

income relative to the budget amount

Unfavorable Variance (U) – has the effect of decreasing

operating income relative to the budget amount

3

Variances

Variances may start out “at the top” with a Level 0

variance

the difference between actual and static-budget operating

income

Answers: “How much were we off?”

Levels 1, 2, and 3 examine the Level 0 variance into

progressively more-detailed levels of analysis

Answers: “Where and why were we off?”

4

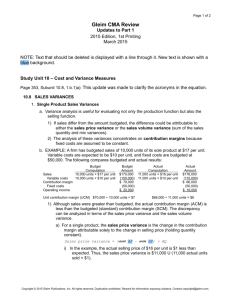

A Simple Example

Operating Indicators:

Indicator

Actual

Results

Units Sold

Selling Price

Static

Budget

100

90

$

35 $

30

Direct Material Cost per Unit

$

Direct Labor Cost per Unit

$

Variable Manufacturing Overhead per Unit $

7 $

10 $

5 $

6

10

6

600 $

700

Fixed Costs

$

5

A Simple Example

Actual Results

Units Sold

100

Static-Budget

Variances

Static Budget

10 F

90

Revenues

$

Variable Costs:

Direct Materials

Direct Labor

Variable Factory Overhead

3,500 $

800 F

700

1,000

500

160 U

100 U

(40) F

540

900

540

Contribution Margin

1,300

580 F

720

600

(100) F

700

700 $

680 F

Fixed Costs

Operating Income

$

$

$

2,700

Level 1

Analysis

Level 0

Analysis

20

6

Flexible Budget

Flexible Budget – shifts budgeted revenues and

costs up and down based on actual operating results

(activities)

Represents a blending of actual activities and

budgeted dollar amounts

Will allow for preparation of Levels 2 and 3 variances

Answers the question: “Why were we off?”

7

A Flexible-Budget Example

Flexible-Budget

Variances

Actual Results

Units Sold

100

-

N/A

Revenues

$

Variable Costs:

Direct Materials

Direct Labor

Variable Factory Overhead

3,500 $

500 F

700

1,000

500

100 U

N/A

(100) F

Contribution Margin

1,300

Fixed Costs

Operating Income

Level 3

Variances will

explore these

figures in detail

$

Sales-Volume

Variances

Flexible Budget

100

$

Static Budget

10 F

90

3,000 $

300 F

600

1,000

600

60 U

100 U

60 U

540

900

540

500 F

800

80 F

720

600

(100) F

700

-

700

700 $

600 F

100 $

80 F

$

Level 2 Variances:

Flexible-Budget

$

2,700

N/A

$

20

Level 2 Variances:

Sales-Volume

Level 1 Variance:

Static-Budget

8

Level 2 analysis

provides information on the two components of the

static-budget variance.

1 Flexible-budget variance:

(Actual – budgeted contribution margin/unit)

× actual sales mix

× actual units sold

2

Sales-volume variance:

(Actual units sold × actual sales mix

– budgeted units sold × budgeted sales mix) ×

× budgeted contribution margin/unit

9

Level 3 Variances

All Product Costs can have Level 3 Variances. Direct Materials

and Direct Labor will be handled next. Overhead Variances are

discussed in detail in a later chapter

Both Direct Materials and Direct Labor have both Price and

Efficiency Variances, and their formulae are the same

Price

Variance

Efficiency

Variance

=

=

{

{

Actual Price

Of Input

Actual Quantity

Of Input Used

-

-

Budgeted Price

Of Input

}

Budgeted Quantity of Input

Allowed for Actual Output

Actual Quantity

Of Input

}

Budgeted Price

Of Input

10

Remark

The above split-up has been derived by introducing the flexible budget

between static budget and actual values:

160 Flex. Budg. Variance F

155

static budget variance (level 1)

= budgeted # of units * budgeted $ per unit

– actual # of units * budgeted $ per unit

+ actual # of units * budgeted $ per unit

– actual # of units * actual $ per unit

10

Sales volume

variance U

Flexible budget variance

Sales volume variance

Formally, a similar split-up could have been derived by developing a

„flexible budget 2“ as follows

160

Flex. Budg. Variance F

static budget variance (level 1)

155

= budgeted # of units * budgeted $ per unit

– budgeted # of units * actual $ per unit

+ budgeted # of units * actual $ per unit

– actual # of units * actual $ per unit

Sales volume

variance U

13

10

13

11

Variances and Journal Entries

Each variance may be journalized

Each variance has its own account

Favorable variances are credits; Unfavorable

variances are debits

Variance accounts are generally closed into Cost of

Goods Sold at the end of the period, if immaterial

12

Sources of Information

1.

Main sources of information about budgeted input

prices and budgeted input quantities:

Actual input data from past periods

2.

averages adapted according to expected inflation and/or cost

reductions due to improvement actions

Standards developed

A standard input is a carefully predetermined quantity of

inputs (such as pounds of materials or manufacturing laborhours) required for one unit of output.

A standard cost is a carefully predetermined cost that is

based on a norm of efficiency.

Standard costs can relate to units of inputs or units of outputs

Standard input

allowed for

one output unit

×

Standard cost

per input unit

13

Cost budgeting, procedure...

• Choose normal capacity xP

• Determine static budget (master budget) KP at normal capacity

• determine budgeted “fixed” cost

• flexible budget as a linear

approximation of the cost

function which is non-linear

in general

KP

K(x), x near xP

KF

xP

x

14

Cost absorption

• charge rate = tg a = KP /xP,

contains costs of used part

of capacity

KP

K(x), x near xP

KF

a

xP

x

15

Standard Costing

Budgeted amounts and rates are actually booked

into the accounting system

These budgeted amounts contrast with actual

activity and give rise to Variance accounts

Reasons for implementation:

Improved software systems

Wide usefulness of variance information

16

Management Uses of Variances

To understand underlying causes of variances

Recognition of inter-relatedness of variances

Performance Measurement

Managers ability to be Effective

Managers ability to be Efficient

Effectiveness is the degree to which a predetermined objective

or target is met.

Efficiency is the relative amount of inputs used to achieve a

given level of output.

Performance evaluation should not be based on Variances

alone

If any single performance measure, such as a labor efficiency

variance, receives excessive emphasis, managers tend to make

decisions that maximize their own reported performance in terms

of that single performance measure

“what you measure is what you get”.

17

Efficiency Variance, graphical

• Determine actual usage xA

• the cost budget consists of

- the cost of idle capacity

- the absorbed cost

KP

• determine actual cost

at budgeted prices and

charge rates

underabsorbed

KF

• excess of actual cost over

budget:

Efficiency variance

a

xA

xP

x

18

Cost budgeting and control, Formulas

Flexible budget:

KS(x)

KF +

=

= KP –

absorbed cost:

A

x

KP· P

x

cost of idle capacity:

KF·(1

efficiency variance:

KA – KS(xA)

A

x

– P

x

(KP–

KF)

KP– KF

xP

x

xP

( xP – x)

)

19

Possible Causes of unfavorable Efficiency

Variances

Purchasing manager received lower quality of

materials.

Personnel manager hired underskilled workers

Maintenance department did not properly maintain

machines.

Poor organization of production process

Shortage of material due to untimely delivery

Patterns or models missing

Fluctuations in motivation or working conditions...

20

Flexible-budget variance for direct materials

= Materials-price

variance

42,500 × ($15.95 – $16.25)

Input price

= $12,750 F

Price variance F

Efficiency variance U

+ Materials-efficiency

variance

$16.25

15.95

(42,500 – 40,000) × $16.25

= $40,625 U

$27,875 U

40

42.5

Quantity

of input

÷ 1000

21

Flexible-budget variance for direct

manufacturing labor?

= Labor-price variance

21,500 × ($12.90 – $13.00)

= $2,150 F

Input price

Price variance F

$13

12.90

Efficiency variance U

+ Labor- efficiency

variance

(21,500 – 20,000) × $13.00

= $19,500 U

$17,350 U

20

21.5

Quantity

of input

÷ 1000

22

Separating price and quantity components

Budget = budgeted price budgeted quantity

Price variance = (actual price - budgeted price)

actual quantity

Quantity variance = Budgeted price

(actual quantity - budgeted quantity)

2nd order

variance

pA

pP

Price variance

Budget

Quantity

variance

A standard cost center in a

production factory usually

has no discretion on purchasing.

Then its budget should be

independent of price fluctuation

xP

xA

23

Activity-Based Costing and Variances

ABC easily lends itself to budgeting and variance

analysis

Budgeting is not conducted on the departmentalwide basis (or other macro approaches)

Instead, budgets are built from the bottom-up with

activities serving as the building blocks of the

process

24

Benchmarking and Variances

Benchmarking is the continuous process of

comparing the levels of performance in producing

products and services against the best levels of

performance in competing companies

Variances can be extended to include comparison to

other entities

25

Possible Causes of unfavorable Efficiency

Variances

Purchasing manager received lower quality of

materials.

Personnel manager hired underskilled workers

Maintenance department did not properly maintain

machines.

Poor organization of production process

Shortage of material due to untimely delivery

Patterns or models missing

Fluctuations in motivation or working conditions...

26

Multiple Causes of Variances

Often the causes of variances are interrelated.

A favorable price variance might be due to lower

quality materials.

It is best to always consider possible

interdependencies among variances and to not

interpret variances in isolation of each other...

Almost all organizations use a combination of

financial and nonfinancial performance measures

rather than relying exclusively on either type.

Control may be exercised by observation of workers.

27

Quiz

60000 15000 10000

5100 5000 700

5000

1. Flexible budgets

a.

accommodate changes in the inflation rate.

b.

accommodate changes in activity levels.

c.

are used to evaluate capacity utilization.

d.

are static budgets that have been revised for changes in prices.

2. The following information is available for the Gabriel Products Company for the month of July:

Units

Sales revenue

Variable manufacturing costs

Fixed manufacturing costs

Variable marketing and administrative expense

Fixed marketing and administrative expense

Static Budget

5,000

$60,000

$15,000

$18,000

$10,000

$12,000

Actual

5,100

$58,650

$16,320

$17,000

$10,500

$11,000

The total sales-volume variance of operating income for the month of July would be

a. $2,550 unfavorable. b. $1,350 unfavorable. c. $700 favorable. d. $100 favorable.

28

30970

3.

Bartholomew Corporation’s master budget calls for the production of 6,000 units

of product monthly. The master budget includes indirect labor of $396,000

annually; Bartholomew considers indirect labor to be a variable cost. During the

month of September, 5,600 units of product were produced, and indirect labor

costs of $30,970 were incurred. A performance report utilizing flexible budgeting

would report a flexible budget variance for indirect labor of

a. $170 U.

4.

396000

5600 170U

12 6000

b. $170 F.

c. $2,030 U.

d. $2,030 F.

Which of the following is not an advantage for using standard costs for variance

analysis?

a.

Standards simplify product costing.

b.

Standards are developed using past costs and are available at a relatively

low cost.

c.

Standards are usually expressed on a per unit basis.

d.

Standards can take into account expected changes planned to occur in the

budgeted period.

29

1500

2.75

2000 5400

30000

5. Information on Pruitt Company’s direct-material costs for the month

of July 2005 was as follows:

Actual quantity purchased

Actual unit purchase price

Materials purchase-price variance

—unfavorable (based on purchases)

Standard quantity allowed for actual production

Actual quantity used

30,000 units

$2.75

$1,500

24,000 units

22,000 units

For July 2005 there was a favorable direct-materials efficiency variance

of

a. $7,950. b. $5,500. c. $5,400.

d. $5,600.

30

3200

241500

34500 20700

34500 34500 35000

6. Information for Garner Company’s direct-labor costs for the month of

September 2005 is as follows:

Actual direct-labor hours

Standard direct-labor hours

Total direct-labor payroll

Direct-labor efficiency variance—favorable

34,500 hours

35,000 hours

$241,500

$ 3,200

What is Garner’s direct-labor price (or rate) variance?

a. $21,000 F b. $21,000 U c. $17,250 U d. $20,700 U

31

Problems

7-17 (=11)(5%),

7-23 (=11.7-21)(8%),

7-21 (7%),

7-37 (=11)(8%),

7-39 (6%)

7-41 (6%) to be presented using Excel®

7-43 (=11.7-41)(8%)

32

7-17

Actual

costs

Static

budget

Variance

Direct materials

$364 000 $400 000 $36 000 F

Direct manufact. labor

78 000

80 000

2,000 F

Direct distribution labor

110 000

120 000 10 000 F

Budgeted

resource

prices per

case

$40

8

12

Actual output: 8 800 cases

Revised performance report based on a flexible budget?

33

7-23

Budgeted sales: 7.8 million minutes

Actual sales:

7.5 million

10% more minutes have to be purchased than are

sold

Budgeted price: 4.5 cents per minute purchased

Actual average: 5.0 cents

Direct labor:

1 hr. per 5000 minutes sold

Actual usage 1 600 hrs.

1.

2.

Budgeted wage rate: $60 per hr.

Actual average price: $62 per hr.

Flexible budget variance for direct materials and

direct labor?

Price and efficiency variances

34

7-21

1.

2.

3.

Budgeted production: 60 000 scones

Budgeted purchases of pumpkin: 15 000 lb. @$0.89

Actual usage: 16 000 lbs @$0.82

Actual output: 60 800 scones.

Flexible budget variance?

Price and efficiency variances?

Comment on results.

35

7-37

Standard direct costs per board:

Data for July:

1.

2.

3.

4.

20 lbs of directs materials @ $2

5 hrs. of direct manuf. Labor @ $12

Units completed

Direct material purchases

Cost of DM purchases

Actual direct manuf. Labor

Actual direct labor cost

Direct materials efficiency variance:

No beginning inventories

6 000

150 000 lbs

$292 500

32 000 hrs

$368 000

$ 12 500 U

Direct manufacturing labor variances July?

Direct material quantity usedin July?

Actual price per lb. purchased?

Direct materials price variance

36

7-39

Direct material

Direct manufacturing labor:

Production volume: 10000 cases

Labor cost: $78 000 for 6 500 hrs.

Materail consumed: 71 000 lbs @ $1.80/lb.

For direct materials and direct nabufacturing labor:

2.

Standard price: $14 /hr.

Standard quantity ½ hr./case

Actual data of May:

1.

standard price $2/lb.

Standard quantity: 6 lb/case of product

price variance, efficiency variance

Discussion of responsibility for variances

37

7-41

Variable Cos

Per Unit Variable Costs

Direct materials

Direct manufacturing labor

Other variable costs

S tandard

2,2 lbs at $5,70 per lb

0,5 hrs at

$12 per hr

First-Quarter 2007

Resul

$12,54 2,3 lbs at

$6,00 0,52 hrs at

$10,00

$28,54

38

7-43

Static Budget Actual amounts

Units produced and sold

Batch size (units/batch)

Cleaning hrs / batch

Cleaning labor cost / hr

1.

2.

30 000

250

3

$14

22 500

225

3.5

$12.50

Flexible Budget variance

Price and efficiency variances for total cleanung

labor cost. Comment!

39