Slajd 1 - KDPW_CCP

advertisement

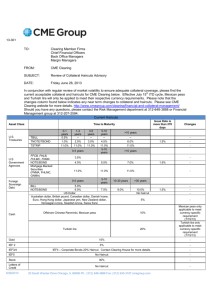

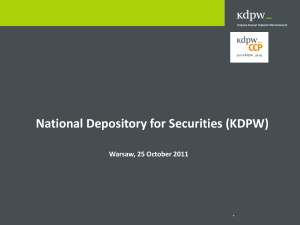

Project launching OTC derivative and repo clearing in KDPW_CCP using novation Project Environment Adverse impact of the financial crisis • Adverse impact of the crisis on the stability of the financial sector • Reduced liquidity on the OTC market • Increased volaility of trade values • Rising awareness of credit risk in the ‘world after Lehman’ New regulations • UE: EMIR – Regulation on OTC derivatives, central counterparties and trade repositories – pending approval of the European Parliament • USA: Dodd-Frank Act - implemented 21/07/2010 • Basel III, CRD IV – in market consultation 2 Identifying the Legal Environment EMIR - Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on OTC derivative transactions, central counterparties and trade repositories. • Central clearing of trades mandatory clearing via a CCP (central counterparty) of all standard derivatives traded outside the regulated market • Reporting to trade repositories mandatory reporting of all trades, both cleared centrally and bilaterally, to trade repositories • Rules for CCPs and trade repositories - authorisation and supervision of CCPs - capital requirements - organisational requirements - precautionary requirements (risk guarantee system) - interoperability 3 Identifying the Legal Environment Basel Committee on Banking Supervision Consultative Document Capitalisation Of Bank Exposures To Central Counterparties • • Exposures to CCPs in respect of MtM and margins subject to low (2% risk weight) capital requirements owing to multilateral netting of liabilities and loss protection mechanisms offered by CCPs Bank exposure to the default fund determined on the basis of the current financial resources of the CCP in relation to hypothetical capital requirements. CCP hypothetical capital determined under CEM (Current Exposure Method). 4 List of Active and Planned CCP Services for OTC Derivatives Country Service Scope Status Germany Eurex Clearing IRS Planned Japan JSCC IRS Planned Poland KDPW_CCP IRS, FRA Planned Sweden Nasdaq OMX IRS Active UK CME Clearing E. IRS Planned UK LCH.Clearnet Ltd IRS Active France LCH.Clearnet SA IRS Active USA CME IRS Active USA IDCG IRS Active USA NYPC IRS Planned Bank for International Settlement, CGFS Papers No 46 5 Why KDPW_CCP? • Experience in clearing: new clearing guarantee model of the clearing house KDPW_CCP spun off from KDPW in July 2011 • Technical and technological infrastructure and existing communication infrastructure with participants • KDPW_CCP’s neutral position as a counterparty to market participants • Clearing Model accepted by the Banking Expert Team • Relations with PFSA, NBP, market participants • KDPW_CCP ability to use collateral in securities, which greatly reduces the cost of collateral • Own capital of KDPW_CCP 6 Consultations with the Banking Expert Team The Banking Expert Team has approved: • • • • • • Clearing model Scope of cleared instruments Instrument valuation model Staged implementation of the project Use of confirmation platforms Risk management All banks have been invited to participate in KDPW_CCP consultations; 64 representatives of 17 banks took part in the consultations. 7 Proposed OTC Clearing Model Client Trading Member A External trading platform Trading Member B Client Terminatio n Platform (TriOptima) Clearing Member A Clearing Member B •Trade clearing •Trade repository •Clearing risk and position management •Clearing guarantee system •Processing settlement in third-party systems Thomson Reuters •market data transfer KDPW_CCP KDPW Member A Payer Bank A KDPW (CSD) •Cash settlement •Collateral in securities PFSA MarkitWire SWIFT Accord •Trade validation •Trade affirmation •Trade matching KDPW Member B additionally in payer bank function NBP Settlement in PLN 8 KDPW_CCP Clearing Model: Key Functionalities Third-party trading platform MarkitWire SWIFT Accord KDPW_CCP Accepting trades for clearing Clearing Formal and substantive check of instructions Reporting Interpositioning KDPW_CCP as legal counterparty Calculating interest payments and MtM Prowadzenie Backloading Contributions to the clearing guarantee system(margin s and fund) Sending instructions for settlement rozliczeń Early termination (Auction) (Tri Optima – automatic termination) Risk management •Defining and calculating risk parameters •HVar •Price monitoring •Back testing •Stress tessting •Exposure limits Collateral administration •Securities register •Collateral valuation Trade repository 9 Collateral Processing Model Collateral processing KDPW Member Credits and debits in respect of contributions to the clearing guarantee fund CASH SECURITIES COLLATERAL REGISTER Collateral valuation Determining the haircut Transfer of ownership in KDPW_CCP account with KDPW Accepting collateral securities: a) Treasury bonds b) W20 index shares NBP KDPW_CCP settlement in PLN 10 in Instruments: List Approved with Banks Phase 1 – 01 January 2013 • Forward Rate Agreements • Interest Rate Swaps • Overnight Index Swaps • Basis Swaps • Repos Phase 2 – 01 January 2014 • Cross Currency Interest Rate Swaps • Options • Other 11 Proposed Introduction of Clearing Novation to Regulations Clearing novation means that the clearing house takes over the rights and obligations of a counterparty to a trade. Once a trade has been accepted for clearing, the rights and obligations arising from the trade expire in the relations between the trade counterparties and are replaced by new legal relations. Clearing novation will be used on the organised market and outside the organised market. 12 Novation Trade #1 Member A Member B BUY SELL KDPW_CCP Trade #2 SELL BUY Trade #2 If a counterparty to a trade is a clearing member and has committed itself to the clearing house to perform obligations arising from the clearing of its trades, it is entitled to receive or liable to provide a benefit resulting from the clearing of the trade vis-a-vis KDPW_CCP. 13 Consequences of Clearing Novation to KDPW_CCP • • • • • Rights and obligations arising from the trade expire while new legal relations arise, to which the clearing house is a party. The clearing house is entitled to claim the benefits arising from the trade with regard to the trade counterparty (if it is a member) or a member which is a party to clearing. Once a trade has been accepted for clearing, a member which is a party to clearing and the clearing house may only raise claims arising from the legal relations which have replaced the original trade. A member which is a party to clearing cannot raise claims against the clearing house arising from the legal relation between the member and the entity which concluded the trade. Collateral established by the entity concluding the trade subject to clearing by the CCP is excluded from the liquidation assets of the member. 14 Legislative Amendments As a result of consultations initiated by KDPW with market institutions (PFSA, NBP, WSE, Chamber of Brokers, Polish Banks Association, BondSpot, Custodian Banks Council), a draft has been submitted to the Finance Ministry, requesting an amendment of the Act on Trading in Financial Instruments. Key amendments include: • Art. 45b Act on Trading in Financial Instruments: - amendment of the definition of trade clearing: addition of the clearing house as entitled to receive or liable to deliver cash and non-cash benefits arising from concluded trades; Art. 45e - amendment excluding collateral established by the entity concluding the trade outside of organised trading subject to clearing by the clearing house from the liquidation assets of the member Art. 45g-45i - amendment introducing clearing novation. Art. 50, Art. 68b - amendment adding new functionalities in the clearing house and KDPW regulations Art.68 - amendment concerning guarantee funds, including establishment of guarantee funds for trades concluded outside the organised market • Harmonising amendments of the Act on Public Offering (Art. 67,90) and the Act on Civil Law Transaction Tax (Art. 9). 15 KDPW_CCP Clearing Guarantee System Participant requirements Price monitoring Margins Back Testing MTM Monitoring exposures / concentration Default fund + additional margins Stress Testing CCP capital 16 State-of-the-art Risk Management System • Valuation – instrument valuation model customised to market specificity • Calculating risk based on HVaR (historical VaR) • 5-day risk calculation horizon • Confidence level – 99.9% • 500 days – look back period • Default fund – covers stress-test risk • Additional margins – cover individual participant exposure between default fund updates • Stress-tests – test the adequacy of resources pooled in the clearing guarantee system • Back-tests – test the adequacy of the risk estimation model and its parameters 17 Guarantee System Resources I. Individual margins II. Default fund III. Additional margins IV. KDPW_CCP capital 18 Staged Project Implementation 1. 2. 3. 4. 5. 6. 7. Establish co-operation with Banking Expert Team Jointly develop OTC trade clearing model Approve standards of OTC instruments covered by phase 1 Develop risk management methodology and valuation rules Develop functional and technical specification of the new IT solution Select IT solution vendor Initiate Design Study with selected vendor 8. Implementation work 9. Present technical documentation and draft regulations to participants 10. Expected introduction of novation to Polish regulations Jun 2012 11. Amendment of KDPW_CCP regulations 12. Signing agreements with participants 13. Testing the system with participants 14. Increase of KDPW_CCP capital 15. Production rollout 2013 D O N E P L A N N E D Jan-Jun 2012 Mar 2012 AprJan-Jun 2012 Dec 2012 Aug-Nov 2012 Q2-3 2012 Jan 19