Chlor Alkali Products - B2i Technologies, Inc.

advertisement

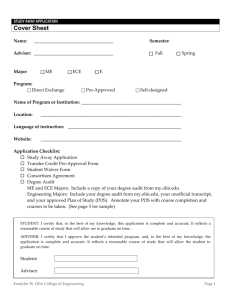

Buckingham Research Group’s 2007 Chemicals and Advanced Materials – Majors Conference June 28, 2007 1 Olin Attendees John E. Fischer Vice President & Chief Financial Officer John L. McIntosh Vice President & President Chlor-Alkali Products Larry P. Kromidas Assistant Treasurer & Director, Investor Relations 2 Company Overview Olin FY 2006 Revenue: $3,152 Pretax Operating Inc.: $ 201 EPS (Diluted): $ 2.06 Metals Chlor Alkali Specialty Copper-Based Products & Related Engineered Materials Revenue: Income: FY 2006 $2,112 $58 Q1 2007 $510 $ 10 North American Producer of Chlorine and Caustic Soda Revenue: Income: FY 2006 Q1 2007 $666 $155 $256 $ 43 Q1 2007 $766 $ 35 $ .31 Winchester North American Producer of Ammunition Revenue: Income: FY 2006 $374 $ 16 Q1 2007 $100 $ 8 All financial data are for the year ending 2006 and quarter ending March 2007 and are presented in millions of U.S. dollars except for earnings per share. Shown above is income before taxes from continuing operations. Additional information is available on Olin’s website www.olin.com in the Investors section. 3 Olin Vision To be a leading Basic Materials company delivering attractive, sustainable shareholder returns • Being low cost, high quality producer, and #1 or #2 supplier in the markets we serve • Providing excellent customer service and advanced technological solutions • Following our customers globally where we can do it profitably • Generating returns above the cost of capital over the economic cycle 4 Olin Corporate Strategy Olin Corporation Goal: Superior Shareholder Returns TRS in Top Third S&P Mid Cap 400 ROCE Over Cost of Capital Over the Cycle 1. Build on current leadership positions in Chlor-Alkali, Metals and Ammunition • Improve operating efficiency and profitability • Integrate downstream selectively • Expand globally where profitable 2. Allocate resources to the businesses that can create the most value 3. Manage financial resources to satisfy legacy liabilities 5 2006 Highlights • • • • • • Highest earnings per share level since 1996 Second consecutive record year for Chlor Alkali Products division Capital expenditures for bleach expansion projects and rail transportation to improve margins and customer service Unprecedented copper, zinc and lead prices increase working capital requirements and production expense Customer surcharges and price increases implemented by Metals and Winchester divisions Metals closure of Waterbury Rolling Mills completed in June, New Haven Copper shutdown completed March 2007, annual savings expected to be $11-$12 million. 6 2006 Highlights Continued • Metals restructuring charges were more than offset by LIFO inventory gains • Winchester revenues increased 8% over 2005 primarily due to increased selling prices and commercial sales • Tax dispute settled favorably with IRS resulting in a reduction in income tax expense of $22 million • Strong investment returns, a higher discount rate and an $80 million voluntary contribution reduced pension under-funding $148 million from year end 2005 levels • Completed $125 million debt exchange extending maturity 5 years and lowering interest rate • Year end cash and short-term investments were $276 million 7 First Quarter 2007 Results • Chlor Alkali operating rates lower than Q4 ’06 due to reduced demand in January and unplanned outages in February; outages fully resolved by mid-March • Metals volumes off 13% with softer demand from automotive, electronics and building products customers; inventory reduction program yields $5.3 million LIFO liquidation gain • Winchester earnings are best first quarter ever reflecting improved volumes and pricing • Copper, zinc and lead prices continue to escalate over 2006 levels 8 Second Quarter 2007 Outlook • Chlor Alkali expects improved ECU netbacks over Q1 from caustic price increases announced in Q4 ’06 and operating rates in mid-90% range • April 1 chlorine and caustic price increases announced and are pending implementation • May price announcement of $50/ton for all grades of caustic soda by Olin and other major producers • May 1 sale of sodium hydrosulphite production to Chemtrade Logistics for approximately $7 million 9 Second Quarter 2007 Outlook (continued) • Metals inventory reduction program is projected to add $5 million to earnings in the second quarter • Inventory reduction program objective is to reduce Metals inventory levels by 20% over 2007 and 2008 • Winchester expects seasonally weaker earnings as compared to record first quarter • $100 million pension contribution made in May and investment policy changes designed to insulate plan from discount rate changes • On our April 27th earnings call, we projected EPS to be in the $0.35 range 10 Pioneer Acquisition • Synergistic, bolt-on acquisition that enhances our chloralkali franchise – – – – #3 in chlor-alkali, up from #4 Diversifies geographic coverage Improves overall cost position #1 in industrial bleach • Further low-cost expansion opportunities in the largest chlorine consuming region of North America • Significant near-term cost synergies of $35 million • Immediately accretive to EPS and remains highly accretive throughout the cycle, and the balance sheet remains strong 11 Pioneer Acquisition (Continued) • Purchase price of $35 per share, or about $420 million • Pioneer cash used to repay their debt, Olin will finance transaction through use of cash and debt • Synergies will come from logistics, purchasing, operations and SG&A expenses • Expect to realize $20 million in synergies in the first 12 months following acquisition and $35 million annually thereafter • Approvals required – Pioneer shareholder approval – Regulatory approval 12 Olin’s Chlor Alkali Strategy • Be the preferred merchant supplier to non-integrated chlor alkali customers • Continue to drive cost improvements through manufacturing and logistic optimization • Continue our partnership philosophy with our customers • Opportunities to increase the value of the business at modest capital investment • Be a strong cash generator and value enhancer to Olin Corporation 13 Olin Has Leading Capacity Share in Eastern U.S. Bayer 2% Mexichem 2% • 4th Overall in U.S. Capacity Other 8% Georgia Gulf 3% Dow 32% Pioneer 5% • Largest Producer East of the Mississippi River • Olin Has 1.23 Million tons ECU Capacity Per Year (1) Formosa 6% Olin 8% PPG 12% Occidental 22% Source: CMAI Chlor Alkali Report • A $10 / ECU Change Equates to an $11 Million Change in Pretax Income at Full Capacity, or $.10 per share @ 35% tax rate (1) Includes 50% of SunBelt 14 Pioneer Acquisition Moves Olin from #4 to #3 Producer and . . . 5,000 4,780 4,000 Chlorine Capacity (-000- short tons) 3,484 3,000 1,992 2,000 1,856 1,218 880 1,000 774 471 430 371 Georgia Gulf Bayer AG Mexichem 0 Dow Occidental PF Olin and Pioneer PPG Diaphragm Olin Formosa Membrane Mercury Pioneer Other 15 . . . Enhances Olin’s Operational and Geographical Platform Dalhousie, NB Tacoma, WA Becancour, Quebec Niagara Falls, NY Tracy, CA Henderson, NV -000- of Short Tons McIntosh, AL Becancour, Quebec (1) Niagara Falls, NY Charleston, TN St. Gabriel, LA (2) McIntosh, AL (50% Sunbelt) Henderson, NV Augusta, GA Dalhousie, NB Chlorine Capacity 401 340 281 270 246 146 152 120 36 Charleston, TN Santa Fe Springs, CA McIntosh, AL Total Augusta, GA 1,992 St. Gabriel, LA (1) Pioneer’s Becancour plant has 275,000 short tons Diaphragm and 65,000 short tons Membrane capacity. Pioneer Chlorine Plants (2) Pioneer’s St. Gabriel plant includes the announced 49,000 short tons capacity expansion and conversion to membrane cell. Pioneer Bleach Plants Source: CMAI. Olin Corporation 16 Chlor Alkali Products • 2005 & 2006 record years, peak ECU netback in Q1‘06: Q2’05 $505 Q3’05 $515 Q4’05 $545 Q1’06 $590 Q2’06 $560 Q3’06 $540 Q4’06 $520 Q1’07 $500 • Chlorine and Caustic price increases announced in Q1’07 • Higher transportation and energy costs • $1 change in Natural Gas MMBTU increases costs of Natural Gas-based producers by $25 to $35/ECU • Natural Gas increases plus capacity reductions have created a more favorable long-term price outlook • North American demand growth rate of 0.8% annually • Net North American capacity has decreased since 2000 17 North America Chlor Alkali Forecast North America Chlor Alkali Capacity Reductions 2000 Through 2006 Company Location Short Tons as Chlorine North America Chlor Alkali Capacity Expansions 2000 Through 2006 Company Location Short Tons as Chlorine Dow Ft. Saskatchewan 610,000 Vulcan C-A Geismer, LA Dow Plaquemine, LA 375,000 Equachlor Longview, WA 80,000 Oxy Vinyls LP Deer Park, TX 395,000 Westlake Calvert City, KY 80,000 Formosa Plastics Baton Rouge, LA 201,000 SunBelt McIntosh, AL 70,000 Pioneer Tacoma, WA 214,000 Oxy Various Sites 22,000 Atofina Portland, OR 187,000 Total Additions La Roche Gramercy, LA 198,000 OXY Delaware City, DE 145,000 Holtra Chem Orrington, ME 80,000 Holtra Chem Acme, NC 66,000 Cedar Chem Vicksburg, MS 40,000 Georgia Pacific (3 locations) 24,000 Oremet Albany, OR 5,000 Total Reductions 462,000 Announced Future Capacity Changes Source: Olin Data Short Tons as Chlorine Company Location Shintech Plaquemine, LA 330,000 2007/2008 Bayer Baytown, TX 220,000 Delayed Oxy Muscle Shoals, AL (154,000) 2008 Pioneer St. Gabriel, LA 49,000 2009 Total Announced Changes 2,540,000 Annual demand growth at 0.8%/Yr = 110,000 Short Tons/Yr 210,000 Timing 445,000* * Includes delayed capacity Reductions Additions Total Reductions 2,540,000 (462,000) 2,078,000 18 Olin’s Chlor Alkali Contracts • Olin contracts nearly 100% of its chlorine and caustic sales • On about two-thirds of the chlorine and caustic volumes, prices change quarterly, with a combination of formula-based and negotiated pricing, and the balance is renegotiated annually or semi-annually • Many contracts have a one quarter lag in them, which delays price increases in a tightening market and delays decreases in a softening market • Competitive forces dictate contract duration and terms 19 Metals • Olin is the leading manufacturer of copper alloy strip, and a leading manufacturer of brass rod in the U.S. • Olin possesses leading technology position – 37 U.S. patents for High Performance Alloys – 40 U.S. patents on various proprietary processing and technical capabilities • Olin is the leading copper alloy strip distributor in the U.S. with 8 service/distribution centers located in the U.S. and Puerto Rico; 2 additional centers are located in Mexico and China 20 Metals • The average price of copper increased from $2.57/lb in January to $2.92/lb in March and is currently about $3.60/lb resulting in increased metal melting loss costs and higher working capital requirements • Improved product pricing partially offsets higher costs • Softer automotive and building products demand masks benefits from plant closures and other actions • Inventory reduction program adds $5.3 million to income in Q1 and is expected to add an additional $5 million to Q2 results • Target of 20% inventory reduction over 2007-8 period 21 Metals Outlook • US dollar coin program should add volume for the strip business, ammunition sales remain strong • We expect automotive to pick-up and we are encouraged by forecasts of a housing pick up in Q2, both of which will add positive results to our cost and inventory reduction accomplishments • Expansion of our China distribution facility by adding stamping capabilities • We believe that we are the low cost metals producer in the U. S. putting us in a preferred position with regards to profitability 22 Winchester Products Products End Uses Winchester ® sporting ammunition -- shotshells, small caliber centerfire & rimfire ammunition Hunters & recreational shooters, law enforcement agencies Small caliber military ammunition Infantry and mounted weapons Industrial products -- 8 Maintenance applications in power & concrete gauge loads & powder- industries, powder-actuated tools in construction actuated tool loads industry 23 Winchester • Profits of $8.1 million reflect best first quarter ever • Nine price increases announced since the beginning of 2004 to offset higher metal prices • Continued increase in metal prices, especially lead, poses a challenge for 2007 • Winchester recently received 2 new military orders: 1. $18 million order from US Army for shotgun shells, and 2. $24 million order under General Dynamics second source small caliber ammunition program 24 Financial Highlights • Q1 cash and short-term investments of $283 million exceed outstanding debt by nearly $30 million • $15 million sale/leaseback, lower tax payments and lower level of working capital growth increased cash balances in Q1 which is normally a cash use period • $80 million voluntary pension contribution in Q3 2006 coupled with higher discount rate and healthy returns on plan assets cut funded status shortfall by $148 million to $234 million • $100 million voluntary contribution this quarter and investment policy change will likely lead to fully funded plan by 2011 without further contributions 25 Financial Highlights (continued) • 2007 pension expense expected to decrease by approximately $21 million as compared to 2006 • Favorably settled all IRS audits through 2002 resulting in a $22 million reduction in tax expense in 2006 • 2007 effective tax rate expected to be in the 34% to 35% range • Capital spending levels, net of January sale leaseback transaction, are expected to be $75 to $80 million in 2007 with 65% allocated to Chlor-Alkali to complete bleach expansion and ongoing maintenance projects 26 Investment Rationale • Continued strong performance based on – Relatively high ECU prices, Pioneer acquisition likely – Cost reductions, better pricing, inventory liquidation gains and restructuring in Metals – Cost reductions, price increases and increased U.S. Military revenue in Winchester • Strong financial discipline • Commitment to investment grade credit rating • At recent price levels, common dividend yield is approximately 4.00% • 322nd consecutive quarterly common dividend (80+ years) paid in June 27 Forward-Looking Statements This presentation contains estimates of future performance, which are forward-looking statements and actual results could differ materially from those anticipated in the forwardlooking statements. Some of the factors that could cause actual results to differ are described in the business and outlook sections of Olin’s Form 10-K for the year ended December 31, 2006 and in Olin’s First Quarter 2007 Earnings Release. These reports are filed with the U.S. Securities and Exchange Commission. 28