Chapter 2 PowerPoint Teacher

advertisement

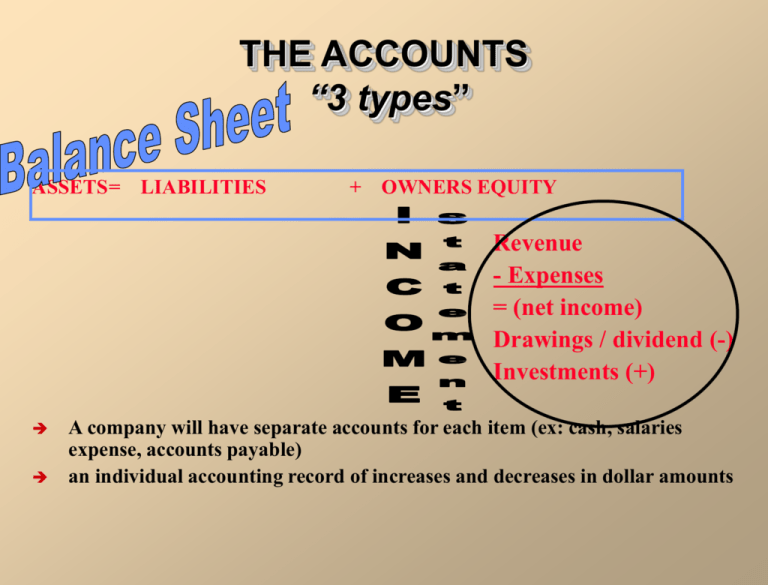

THE ACCOUNTS “3 types” ASSETS= LIABILITIES + OWNERS EQUITY Revenue - Expenses = (net income) Drawings / dividend (-) Investments (+) A company will have separate accounts for each item (ex: cash, salaries expense, accounts payable) an individual accounting record of increases and decreases in dollar amounts DEBITS AND CREDITS Debit = left side Credit = right ASSET ASSET = = L + OE OE L+ INCREASE INCREASE Debit Credit (delightful!) (crappy!) DECREASE Credit Debit (crappy!) (delightful!) DR CR ILLUSTRATION 2-1: BASIC FORM OF ACCOUNT (T-account) In its simplest form, an account consists of 1. the title of the account, 2. a left or debit side 3. a right or credit side. The alignment of these parts resembles the letter T, and therefore the account form is called a T account. Title of Account Left or debit side Right or credit side Debit balance Credit balance ILLUSTRATION 2-2 TABULAR SUMMARY COMPARED TO ACCOUNT FORM Tabular Summary Account Form Cash $15,000 - 7,000 1,200 1,500 - 600 - 900 - 200 - 250 600 - 1,300 Cash $8,050 Debit 15,000 1,200 1,500 600 Balance 8,05 0 Credit 7,000 600 900 200 250 1,300 DEBITING AN ACCOUNT Cash 15,000 Owners Equity 15,000 Example: The owner makes an initial investment of $15,000 to start the business. Cash is debited and the owner’s Capital account is credited. CREDITING AN ACCOUNT Cash 7,000 Rent Exp. 7,000 Example: Monthly rent of $7,000 is paid. Cash is credited and Rent Expense is debited. DEBITING AND CREDITING AN ACCOUNT Cash 15,000 8,000 7,000 Example: Cash is debited for $15,000 and credited for $7,000, leaving a debit balance of $8,000. DOUBLE-ENTRY SYSTEM Value of debit entry the value of the credit entries in every transaction Thus, total debits will always equal the total credits accounting equation will always stay in balance. Assets Liabilities Equity ILLUSTRATION 2-7 DEBIT/CREDIT RULES AND EFFECTS, and Normal act. Balances Assets Assets Dr. + Cr. - = Liabilities = Liabilities Dr. - Owner’s Equity + + Cr. + Owner’s Capital Dr. - + Cr. + Revenues Dr. - - Cr. + Owner’s Drawings Dr. + - Cr. - Expenses Dr. + Cr. - ILLUSTRATION 2-9 THE RECORDING PROCESS JOURNAL JOURNAL LEDGER 1. Analyze each transaction. 2. Enter transaction in a journal. 3. Transfer journal information to ledger accounts. ILLUSTRATION 2-10 TECHNIQUE OF JOURNALIZING What is significant about all of the circled info on the General Journal below? J1 GENERAL JOURNAL Date 2002 Sept. 1 1 Account Titles and Explanation Cash M. Doucet, Capital Invested cash in business. Equipment Cash Purchased equipment for cash. Ref. Debit Credit 15,000 15,000 7,000 7,000 ILLUSTRATION 2-14 POSTING A JOURNAL ENTRY General Journal Account Title and Explanation Date 2002 01-Sep Cash M. Doucet, Capital Invested cash in business. Date 2002 01-Sep Ref 101 301 General Ledger Cash Account Title and Explanation Ref J1 Debit J1 Credit 15,000 Debit 15,000 15,000 Credit 101 Balance 15,000 In the ledger, enter in the appropriate columns of the account(s) debited the date, journal page, and debit amount shown in the journal and the account number to which the journal was posted. THE TRIAL BALANCE A list of accounts and their balances at a given time. Shows that debits and credits are equal after posting. May uncover errors in journalizing and posting. The procedures for preparing a trial balance consist of 1. listing the account titles and their balances, 2. totaling the debit and credit columns, and 3. proving the equality of the two columns. What problems and limitations are there with a trial balance? ILLUSTRATION 2-28 A TRIAL BALANCE PIONEER ADVERTISING AGENCY Trial Balance October 31, 2002 Cash Advertising Supplies Prepaid Insurance Office Equipment Notes Payable Accounts Payable Unearned Revenue C. R. Byrd, Capital C. R. Byrd, Drawings Service Revenue Salaries Expense Rent Expense The total debits must equal the total credits. Notice the order of the accounts BS then IS accounts Debit $ 15,200 2,500 600 5,000 Credit $ 5,000 2,500 1,200 10,000 500 10,000 4,000 900 $ 28,700 $ 28,700