1-0

WELCOME TO FIN 300!

I’m sure you’re all excited to be here!

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-1

Guest Lecturer:

Alex Wilson, Ph.D.

Prof. Ammermann’s

information follows …

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-2

Peter A. Ammermann, Ph.D.

“Dr. Pete”

CBA 328 Phone: 985-7526

Email = pammerma@csulb.edu

Website =

www.csulb.edu/~pammerma

Office Hours: Immediately after

class and whenever else I happen to

be in (or by appt.)

My background …

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-3

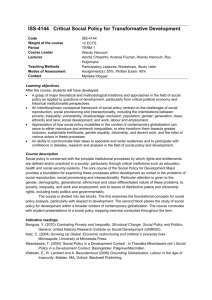

Important Syllabus Info.

Two tests, plus comprehensive

departmental final

Homework projects

stock market game

Weightings:

Tests = total of 50%

• best = 30%

• 2nd best = 20%

Homework and Project = 15%

Final = 35%

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-4

INTRODUCTION

What is finance all about?

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-5

Big Picture: What is Finance??

Ultimately, the gathering and

distribution of cash.

Theoretical basis is Economics - but

we’re more applied.

Our language is Accounting - but

we’re more fun!

Our prey is Strategy & Marketing; our

predator, the Markets

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-6

Fundamentals of Financial

Management

Ninth Edition

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

Requests for permission to make copies of any part of

the work should be mailed to the following address:

Permissions Department, Harcourt, Inc., 6277 Sea

Harbor Drive, Orlando, Florida 32887-6777.

ISBN 0-03-031478-X

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-7

CHAPTER 1

An Overview of Financial Management

Career opportunities

Issues of the new millennium

Forms of business organization

Goals of the corporation

Agency relationships

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-8

Career Opportunities in Finance

Money and capital markets

Investments

Financial management

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1-9

Financial Management

Issues of the new millennium

Use of computers and electronic

transfers of information

The globalization of business

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 10

Percentage of Revenue and Net

Income from Overseas Operations for

10 Well-Known Corporations, 1998

Company

Percentage of

Percentage of

Revenue Originated

Net Income

Overseas

Generated Overseas

3M

Chase Manhattan

Coca-Cola

Exxon

General Electric

General Motors

IBM

McDonald’s

Merck

Walt Disney

Copyright © 2001 by Harcourt, Inc.

51.7

27.8

62.3

80.1

23.9

30.8

56.8

60.8

24.9

16.7

26.9

26.6

64.6

65.1

31.1

68.0

68.9

71.7

27.4

18.9

All rights reserved.

1 - 11

Responsibilities of the Financial Staff

Forecasting and planning

Investment and financing decisions

Coordination and control

Transactions in the financial

markets

Managing risk

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 12

Alternative Forms of Business

Organization

Sole proprietorship

Partnership

Corporation

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 13

Sole Proprietorship

Advantages:

Ease of formation

Subject to few regulations

No corporate income taxes

Disadvantages:

Limited life

Unlimited liability

Difficult to raise capital

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 14

Partnership

A partnership has roughly the same

advantages and disadvantages as a

sole proprietorship.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 15

Corporation

Advantages:

Unlimited life

Easy transfer of ownership

Limited liability

Ease of raising capital

Disadvantages:

Double taxation

Cost of set-up and report filing

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 16

Another Possible Disadvantage of

Corporations:

“Agency” Problems

(We’ll get back to this in a minute ...)

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 17

Goals of the Corporation

The primary goal is shareholder

wealth maximization, which translates

to maximizing stock price.

Do firms have any responsibilities

to society at large?

Is stock price maximization good or

bad for society?

Should firms behave ethically?

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 18

And Now Back to Agency Problems ...

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 19

Agency Relationships

An agency relationship exists

whenever a principal hires an agent

to act on their behalf.

Within a corporation, agency

relationships exist between:

Shareholders and managers

Shareholders and creditors

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 20

What is the problem here?

Many times the groups have different

goals and objectives.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 21

Shareholders versus Managers

Managers are naturally inclined to act in

their own best interests.

e.g., Ross Johnson & RJR-Nabisco

But the following factors affect managerial

behavior:

Managerial compensation plans

Direct intervention by shareholders

The threat of firing

The threat of takeover

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 22

Shareholders versus Creditors

Shareholders (through managers)

could take actions to maximize

stock price that are detrimental to

creditors.

In the long run, such actions will

raise the cost of debt and

ultimately lower stock price.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 23

Factors that Affect Stock Price

Projected cash flows to

shareholders

Timing of the cash flow stream

Riskiness of the cash flows

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

1 - 24

Factors that Affect the Level and

Riskiness of Cash Flows

Decisions made by financial

managers:

Investment decisions

Financing decisions (the relative

use of debt financing)

Dividend policy decisions

The external environment

Copyright © 2001 by Harcourt, Inc.

All rights reserved.