FNBSLW 735 - University of Wisconsin Whitewater

advertisement

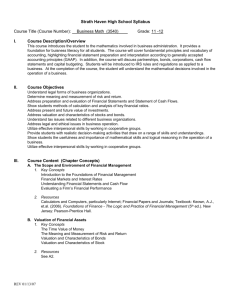

University of Wisconsin-Whitewater Curriculum Proposal Form #3 New Course Effective Term: 2137 (Fall 2013) Subject Area - Course Number: FNBSLW 735 Cross-listing: (See Note #1 below) Course Title: (Limited to 65 characters) Business Valuation using Financial Statements 25-Character Abbreviation: Sponsor(s): Hamid Moini Department(s): Finance & Business Law College(s): Business and Economics Consultation took place: NA Programs Affected: Yes (list departments and attach consultation sheet) Departments: MBA Is paperwork complete for those programs? (Use "Form 2" for Catalog & Academic Report updates) NA Yes Prerequisites: will be at future meeting FNBSLW 718 Grade Basis: Conventional Letter S/NC or Pass/Fail Course will be offered: Part of Load On Campus Above Load Off Campus - Location College: Business and Economics Instructor: Hamid Moini Dept/Area(s): Finance & Business Law Note: If the course is dual-listed, instructor must be a member of Grad Faculty. Check if the Course is to Meet Any of the Following: Technological Literacy Requirement Diversity Writing Requirement General Education Option: Select one: Note: For the Gen Ed option, the proposal should address how this course relates to specific core courses, meets the goals of General Education in providing breadth, and incorporates scholarship in the appropriate field relating to women and gender. Credit/Contact Hours: (per semester) Total lab hours: Number of credits: Total lecture hours: Total contact hours: Can course be taken more than once for credit? (Repeatability) No Yes If "Yes", answer the following questions: No of times in major: No of times in degree: Revised 10/02 0 1 No of credits in major: 0 No of credits in degree: 3 1 of 6 Proposal Information: (Procedures for form #3) Course justification: As the economy and the markets are rebounding, merger and acquisition activities are on the upswing again. There are great interests from students as well as industry for talents in the mergers and acquisitions area. Many leading business programs in the nature offer courses related to mergers and acquisitions. No courses currently offered by the FNBSLW department provide training in this venue. The valuation of a firm depends critically on the understanding and analysis of companies’ financial statements, as well as growth potential. Ability to analyze financial statements is one of the several essential skills for MBA students, as indicated by CoBE Advisory Board. This course is developed in response to both the ever changing financial markets and feedbacks from our Advisory Board. Relationship to program assessment objectives: Students are expected to develop critical thinking skills and able to make sound business decisions. This course introduces firm valuation models and allows students to develop skills which are necessary in valuing projects, divisions, and corporations in a cross-border setting. This course requires students to work on, write up, present, and submit a substantive valuation project based on a recent real-life example involving an acquisition of a ‘target firm’ by an ‘acquiring firm.’ As part of the core MBA curriculum, this course will assess students’ critical thinking skills. Budgetary impact: There is no direct budgetary impact. Once approved, this course will be offered every semester as part of the core curriculum for MBA students. Teaching load will be shifted among existing faculty members to cover graduate level courses. The department will develop a rotation table for course offering – some of the elective courses will offered less frequently. Course description: (50 word limit) The objective of this course is to advance students understanding of how to use financial information in order to value and analyze firms. There is no major corporate investment decision that can be made without first asking and answering the question, ‘what is it worth?'. The goal of this course is to build students skills and confidence in answering that question. The focus of firm valuation is on making investment decisions in real – as opposed to financial – assets. Firm valuation will acquaint students with the widely-used, yet rigorous, ideas that have revolutionized the practice of valuation of projects, divisions, and companies during the past few decades. If dual listed, list graduate level requirements for the following: 1. Content (e.g., What are additional presentation/project requirements?) 2. Intensity (e.g., How are the processes and standards of evaluation different for graduates and undergraduates? ) 3. Self-Directed (e.g., How are research expectations differ for graduates and undergraduates?) Course objectives and tentative course syllabus: Revised 10/02 2 of 6 Bibliography: (Key or essential references only. Normally the bibliography should be no more than one or two pages in length.) The University of Wisconsin-Whitewater is dedicated to a safe, supportive and non-discriminatory learning environment. It is the responsibility of all undergraduate and graduate students to familiarize themselves with University policies regarding Special Accommodations, Academic Misconduct, Religious Beliefs Accommodation, Discrimination and Absence for University Sponsored Events (for details please refer to the Schedule of Classes; the “Rights and Responsibilities” section of the Undergraduate Catalog; the Academic Requirements and Policies and the Facilities and Services sections of the Graduate Catalog; and the “Student Academic Disciplinary Procedures (UWS Chapter 14); and the “Student Nonacademic Disciplinary Procedures" (UWS Chapter 17). Course Objectives and tentative course syllabus with mandatory information (paste syllabus below): Course Proposal Business Valuation using Financial Statements By Hamid Moini Department of Finance and Business Law Course Objectives: The objective of this course is to advance students understanding of how to use financial information in order to value and analyze firms. There is no major corporate investment decision that can be made without first asking and answering the question, ‘what is it worth?'. The goal of this course is to build students skills and confidence in answering that question. The focus of firm valuation is on making investment decisions in real – as opposed to financial – assets. Firm valuation will acquaint students with the widely-used, yet rigorous, ideas that have revolutionized the practice of valuation of projects, divisions, and companies during the past few decades. Firm valuation has three goals. They are: 1. to develop tools which are necessary in valuing projects, divisions, and corporations, including in the cross-border setting; 2. to present the interaction of the firm with financial (including foreign exchange) markets and institutions, and how equilibrium pricing relations in these markets matter for investment decisions; 3. to familiarize students with making corporate valuation, investment, and risk management decisions in the mergers and acquisitions (M&A) context. Simply put, by the end of the course, I expect students in this course to be comfortable with the tools and frameworks to answer the question: What is a real asset worth? Course Synopsis: This course will be divided into five parts. Revised 10/02 3 of 6 Part 1 is a quick recap and reinforcement of the ideas that drive all valuations: free cash flow, cost of equity and weighted average cost of capital, discounted cash flows valuation tools, other valuation tools and calculation of terminal values. Part 2 applies these ideas to typical valuation situations: project/divisional valuation, initial public offering (IPO) valuation, private equity and leverage-by-out (LBO) valuation, valuation in high-growth settings and mature cash flow settings. We also explore the links between valuation tools and the insights these tools offer us to understand “profitable growth.” Part 3 explores real options, focusing on how to identify, conceptualize, and value them. Part 4 gets into cross-border valuation, with particular emphasis on understanding the roles of exchange rates and country risk. We also look at valuation in (and from the point of view of) emerging market settings. Part 5 consists of group report presentations. Required Textbook: Damodaran, Aswath, Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University Edition, 3rd Edition, Wiley Publishing, 2012, ISBN: 978-1-1181-3073-5. Additional Reading: Koller, Goedhart, and Wessels, Valuation: Measuring and Managing the Value of Companies, John Wiley & Sons, 5th Edition, 2010. Requirements: The most important requirement of firm valuation is the preparation for discussion in class, the assigned reading material, problem sets, or cases. It means that students and their group will work on the numbers/spreadsheets. Class may sometimes start with someone being called upon to lead off the discussion (or a study group to present the results of their case analysis, if appropriate). It is strongly recommended that students prepare for every class, whether or not there is a group assignment. Not doing so may constrain student’s ability to follow all of the issues we cover in a typical session. Group Project on Valuation and Accounting Analysis: Students in the class are divided into groups (Group size should not exceed five). The course requires students and their group to work on, write up, present, and submit a substantive valuation project based on a recent real-life example involving an acquisition of a ‘target firm’ (or a portion of it) by an ‘acquiring firm.’ While I would be happy to make suggestions, I encourage students to find one that makes sense for them, given their particular industry or career interests. As the economy and the markets are rebounding, merger and acquisition activities are on the upswing again. Students should have little difficulty in finding an interesting one to work on. Revised 10/02 4 of 6 Guidelines for company picks: I recommend that students avoid analyzing a bank, insurance company, or any other type of financial institution. I suggest students pick a company that has at least 5 years of historical financial statements and stock market information (returns). Foreign companies are welcome, but they are often more challenging to analyze. But, students are welcome to go for it! The main requirement of the project will be a detailed valuation of a target firm or division, but students’ analysis must also contain discussion and evaluation of: 1. the acquiring firm: its business and recent financial performance; 2. the target firm: its business and recent financial performance; 3. the acquiring firm’s stated strategic and business logic for the acquisition; 4. the price paid and medium of exchange used; 5. the impact of any major, additional outcome-determining factors–for example, regulatory issues; contingent payment commitments; caps or floors in pricing; real options; exchange rate effects; country risk effects; potentially interesting corporate governance issues; government-to-government or cross-cultural issues; 6. relevant multiples and premiums paid in precedent transactions; 7. detailed spreadsheet valuation of the target firm, with clearly articulated assumptions on valuation methodology, cash flows, cost of capital; 8. assessment of the acquisition from the standpoint of all the above, most especially the price paid and the medium of exchange used; and 9. specifically, at the end of study of the transaction, the primary question students should answer is: “at the time of the acquisition announcement, given the facts known then, would they have recommended that the acquisition take place at the price offered. Why, or why not?” The final report should not exceed 15 pages long including exhibits. Text should be double-spaced, with font size of at least 12. A hard copy of the report should be submitted for grading. The due date for the report and the date of class presentations will be announced on the first day of the class. Grading: There will be four group write-ups required, and I will inform students of the details sufficiently in advance of the sessions. There will be a take-home exam approximately two-thirds way through the course. If a group write-up assignment is not turned in, that will necessarily count for Revised 10/02 5 of 6 a zero grade. The exam is take-home, open book, open notes, and should reflect solely student’s individual efforts. More details will be given in the class, well in advance of the deadline. The grading system is: Class Participation Written Assignments Exam Group project write-up and presentation 20% 20% 30% 30% Please note that class participation is an earned grade in this course. (Students do get five out of the 20 points for just showing up!). The metric I use to judge the quality of contributions in the classroom is very simple: At the end of every class, I ask, “by dint of his/her contributions to the class that day, did the person, to the best of my judgment, have a positive effect on advancing the learning of the others in the classroom?” Revised 10/02 6 of 6