Monopoly

Chapter 7

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All Rights Reserved.

Monopoly Structure:

Monopoly

• Market power is the ability to alter the

price of a good or service.

• A monopoly is one firm that produces

the entire market supply of a particular

good or service.

• Since there is only one firm in a

monopoly industry, the firm is the

industry.

LO-1

7-2

Monopoly = Industry

• The firm’s demand curve is identical to

the market demand curve for the

product.

– Market demand is the total quantity of a

good or service people are willing and

able to buy at alternative prices in a given

time period.

LO-1

7-3

Price versus

Marginal Revenue

• Marginal revenue (MR) is the change

in total revenue that results from a oneunit increase in quantity sold.

• Price equals marginal revenue only for

perfectly competitive firms.

• Marginal revenue is always less than

price for a monopolist.

LO-1

7-4

Price versus

Marginal Revenue

• A monopolist can sell additional output

only if it reduces prices.

• The MR curve lies below the demand

curve at every point but the first.

LO-2

7-5

Figure 7.1

7-6

Profit Maximization

• The monopolist uses the profitmaximization rule to determine its rate

of output.

• According to the rule, a monopolist

maximizes profit at the rate of output

where MR = MC.

LO-3

7-7

Profit Maximization

• The profit maximization rule applies to

all firms:

– A perfectly competitive firm produces the

quantity where MC = MR (= p)

– A monopolist produces the quantity

where MC = MR (< p)

LO-3

7-8

Figure 7.2

7-9

The Production

Decision

• Choosing a rate of output is a firm’s

production decision.

• It is the selection of the short-term rate

of output (with existing plant and

equipment).

• A monopolist finds the rate of output

where the marginal revenue and

marginal cost curves intersect.

LO-3

7-10

The Monopoly Price

• The intersection of the marginal

revenue and marginal cost curves

establishes the profit-maximizing rate

of output.

• The demand curve tells us the highest

price consumers are willing to pay for

that specific quantity of output.

• Only one price is compatible with the

profit-maximizing rate of output.

LO-3

7-11

Monopoly Profits

• Total profit equals profit per unit times

the number of units produced.

• Profit per unit = price minus average

total cost

Profit per unit = p – ATC

• Total profit = profit per unit times

quantity

Total profit = (p – ATC) x q

LO-3

7-12

Monopoly Profits

• Profit can also be calculated by

subtracting total cost from total

revenue:

Total profit = TR – TC

LO-3

7-13

Monopoly versus

Competitive Outcomes

• A monopolist produces less and

charges a higher price than would a

competitive industry.

LO-4

7-14

Figure 7.3

7-15

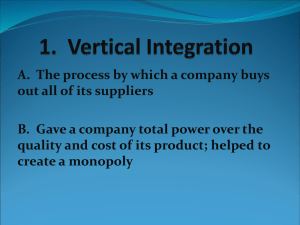

Barriers to Entry

• Obstacles that make it difficult or

impossible for would-be producers to

enter a particular market.

• Examples include patents, legal

harassment, exclusive licensing,

bundled products, and government

franchises.

LO-4

7-16

Patent Protection

• A patent is a government grant of

exclusive ownership of an innovation.

• A patent is a source of monopoly

power.

– Polaroid’s patents forced Kodak out of the

instant-photography business.

LO-4

7-17

Legal Harassment

• Suing potential new entrants can deter

entry into an industry.

• Lengthy legal battles are so expensive

that the threat of legal action may deter

entry into a monopolized market.

LO-4

7-18

Exclusive Licensing

• Lack of a license makes it difficult for

potential competitors to acquire the

factors of production they need.

LO-4

7-19

Bundled Products

• Forcing consumers to purchase

complementary products thwarts

competition.

• Bundling products makes it difficult for

competitors to sell their products

profitably.

– Microsoft bundles software applications

with its Windows operating systems

(although the European Union required

Microsoft to offer alternatives to

consumers).

LO-4

7-20

Government Franchises

• A monopoly granted by a government

license.

– These include local power, telephone, and

cable TV companies.

– Another example is the U.S. Postal

Service, which has a monopoly in

providing first-class mail.

LO-4

7-21

Comparative Outcomes

• A monopoly’s market power allows it to

change the way the market responds

to consumer demands.

LO-4

7-22

Competition versus

Monopoly

• In competition, as well as in monopoly,

high prices and profits signal

consumers’ demand for more output.

• In competition, the high profits attract

new suppliers.

• In monopoly, barriers to entry are

erected to exclude potential

competition.

LO-4

7-23

Competition versus

Monopoly

• In competition, production and supplies

expand, and prices slide down the

market demand curve.

• In monopoly, production and supplies

are constrained, and prices don’t move

down the market demand curve.

LO-4

7-24

Competition versus

Monopoly

• In competition, a new equilibrium is

established, and average costs of

production approach their minimum.

• In monopoly, no new equilibrium is

established, and average costs are not

necessarily at or near a minimum.

LO-4

7-25

Competition versus

Monopoly

• In competition, economic profits

approach zero, and price equals

marginal cost throughout the process.

• In monopoly, economic profits are at a

maximum, and price exceeds marginal

cost at all times.

LO-4

7-26

Competition versus

Monopoly

• In competition, the profit squeeze

pressures firms to reduce costs or

improve product quality.

• In monopoly, there is no profit squeeze

to pressure the firm to reduce costs or

improve product quality.

LO-4

7-27

Competition versus

Monopoly

7-28

Near Monopolies

• Two or more firms may rig the market

to replicate monopoly outcomes and

profits.

LO-4

7-29

Near Monopolies

• In duopoly two firms together produce

the industry output.

• In oligopoly several firms dominate

the market.

• In monopolistic competition many

firms each have a monopoly on their

own brand image but must still contend

with competing brands.

LO-4

7-30

Redeeming Qualities

of Monopolies?

Monopolies could also benefit society.

We must consider:

• Research and Development

• Entrepreneurial Incentives

• Economies of Scale

• Natural Monopolies

• Contestable Markets

• Structure versus behavior

LO-5

7-31

Research and

Development

• In principle, monopolies have a greater

ability to pursue research and

development.

– They have the resources available to

invest in expensive R&D functions.

• However, they have no clear incentive

for invention and innovation, and can

continue to make profits by maintaining

market power.

LO-5

7-32

Entrepreneurial

Incentives

• The promise of even greater profits is a

strong incentive for monopolies to

innovate.

• Innovators in perfect competition also

have the ability to earn large profits.

LO-5

7-33

Economies of Scale

• Economies of scale are present if

average costs fall as the size (scale) of

plant and equipment increases.

• A large firm can produce goods at a

lower unit cost than can a small firm

because of economies of scale.

• Consumers may not benefit from the

lower costs if the monopolist doesn’t

lower its prices.

LO-5

7-34

Natural Monopoly

• A natural monopoly is an industry in

which one firm can achieve economies

of scale over the entire range of market

supply.

– Examples include local telephone, cable,

and utility services.

LO-1

7-35

Contestable Markets

• A contestable market is an

imperfectly competitive industry subject

to potential entry if prices or profits

increase.

• How contestable a market is depends

not so much on its structure as it does

on its barriers to entry.

LO-5

7-36

Structure versus

Behavior

• If potential rivals force a monopolist to

behave like a competitive firm, then

monopoly imposes no cost on

consumers or on society at large.

• The experience with the Model T

suggests that potential competition can

force a monopoly to change its ways.

LO-5

7-37

Flying Monopoly Air

• Market structure explains why it can be

cheap to fly to one place and expensive

to fly somewhere else of equal

distance.

• From a national perspective, the airline

industry looks pretty competitive.

• However, all of these companies do not

fly to the same places.

LO-5

7-38

Industry Behavior

• Air fares from airports dominated by

one or two carriers are 45 – 85%

higher than at more competitive

airports.

LO-5

7-39

Entry Effects

• How fares change when airlines enter

or exit a specific market can be used to

assess the impact of market structure

on prices.

• American Airlines cut its fares when

low-cost carriers entered a market it

dominated—then raised them when the

low-cost carriers left.

LO-5

7-40

Entry Effects

• Predatory pricing – temporary price

reductions designed to drive out

competition.

LO-5

7-41

Barriers to Entry

• One of the most formidable entry

barriers to the airline industry is the

ownership of landing rights and gates.

• At Washington, D.C.’s National Airport,

the six largest carriers owned 97

percent of available takeoff/landing

slots in 2000.

LO-5

7-42

Barriers to Entry

• To offer service from that airport, a new

entrant would have to buy or lease a

slot from one of these firms.

• If existing firms are unwilling to sell or

lease their slots, then competition is

thwarted.

LO-5

7-43

End of

Chapter 7