Bridging Policy and Finance - Atlas of Public Policy and Management

advertisement

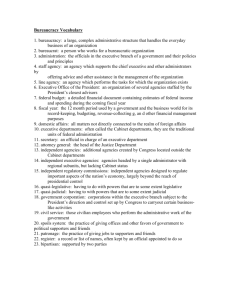

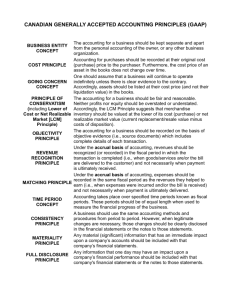

Bridging Policy and Finance: Integrating Financial Consideration into the Policy Life-Cycle Murray Lindo: Director, Financial Management & Control Policy Office of the Provincial Controller Ministry of Finance November 20, 2009 1. Purpose To understanding the key strategic challenges, facing the government is pivotal to designing policy and achieving program value-for-money. Describe five key financial “lenses” that can enable you to identify, assess and mitigate the financial risks and establish risk-based financial measures. Provide a framework to better integrate financial considerations and measures, across the policy life-cycle from design, implementation, maintenance and evaluation. 1 2. Policy and Financial Management Definitions What is Policy? “Policy is the translation of government’s political priorities and principles into programmes and courses of action to deliver desired outcomes.” What is Financial Management? “Financial management is the process by which financial aspects of public sector organizations are directed and controlled in order to achieve the organization's goals.” 2 3. Strategic Financial/Policy Challenges Economic: managing program expenditure and evaluating performance/alternatives during a global economic recession that has constrained revenues. Stewardship of the Long-term: balancing immediate program funding over infrastructure investments, while understanding the long-term financial legacy of current policy/program decisions. Public Expectations: access to information and heighten public expectations will drive greater transparency and the need to demonstrate effectiveness, efficiency and value-formoney. Core Programs: demographics changes will impact the sustainability of large, “open programs” in the health, social services and education sectors. Broader Public Sector (BPS): changing government’s role as a “social-investor” overseeing BPS management and leveraging performance through agreements that codify expectations. Capital and Investments: Increasing complexity of integrating financing, capital investment and operations planning to ensure efficient and effective delivery of services. Public Reporting: Strengthen public accounting and financial disclosure standards will necessitate more rigorous financial analysis and data supported by attestations of its integrity. 3 4. 2009-10 Budget Expense Education Sector 14% $14.2B Health Sector 43% $42.6B Postsecondary Education And Training Sector 6% $6.6B Children’s and Social Services Sector 13% $12.7B Environment 0.37% $0.367B 20th Overall Justice Sector 4% $3.9B Other Programs 20% $19.5B Program expense equals total expense minus interest on debt. 4 5. Key Messages Only by integrating financial analysis into policy and programs proposals can ministries design high-quality, sustainable and cost effective policies. In an constrained economic environment, the strengthen of your policy proposal (and its success) will depend on the ability to demonstrate savings, value-for-money and positive cost/benefit analysis. Evaluating your existing portfolio of policies and programs, using objectives financial analysis, to find efficiencies and effectiveness improvements is going to be essential to maintain services with less resources. 5 Processes Mandate Governance 6. Financial and Policy Decision Process Proposals with Financial Implications Voted Appropriations Legislature Cabinet Treasury Board/ Management Board of Cabinet • Treasury Board authorizes annual and in-year spending plans and ensure compliance. • Reviews policies with financial implications. • It approves the government's overall human resource, information technology plans and also makes decisions about government land and buildings. Ministry of Finance (Treasury Board Office) Eight (Policy) Subcommittee (e.g. Legislation and Regulations Committees) • Policy committees review and make recommendations to Cabinet on the policies and programs government delivers. Cabinet Office • supporting Treasury Board in its fiduciary responsibilities • supports Cabinet and subcommittees • financial long-term stewardship • manages how the government makes decisions • responsible for the development of the fiscal plan (budget), Fall Economic Statement and publishing the Public Accounts. • managing the Results-based Planning process. • developing financial policies • works with ministries to coordinate policy, communications and intergovernmental strategy • monitors government strategies and supports implementation and delivery of results Ministry of Environment • focused on policy development • program delivery and managing service partners • managing within the fiscal envelope • establishing performance expectations and evaluating program outcomes • financial management and results reporting 6 7. Five Financial Lenses for Developing Policy/Programs Economic/ Fiscal Impact •What are the economic and fiscal implications and risks? • How can these risks be mitigated through policy and program design? • What are the financial and fiscal “trade-offs” in supporting the decisions? Fiscal Impacts Value for Money Financial Risks Impairing Future Decisions •Impacts on (future) revenues/ assets/ liabilities (e.g. auto sector pensions) • Impacts on budgets, the multi-year fiscal/capital plans, transfers/ cash flows and appropriations. Efficiency: • Inputs over outputs Effectiveness • Outputs over outcomes Economy: • Cost/benefits against alternatives Transparency/ Public Reporting Financial Accountability Public Reporting (consolidation): • Ensuring appropriate financial accountability and transparency provisions are incorporated into program delivery and design. Financial Transparency Risks • Disclosure of financial information consistent with public accounting and financial reporting standards. • Financial information is completes, reliable, timely, comparable, relevant, clear and verifiable. 7 8. An Integrated Financial-Policy Model Financial & non-financial risks/options Risk-based reviews Policy Decision Financial Analysis Program Implementation Asset Management Asset Implications Effectiveness Forecasts/ fiscal impacts Value-for-money Assurance of controls Consolidated Public Reporting Efficiency Program Evaluation Policy Analysis Financial Performance and Public reporting Integrity of financial data and reporting Sustainability and Value-for-Money 8 9. Integrating Financial Considerations into Policy-Making Integrated Policy should be: Positive benefits: complete and objective cost/benefit analysis that includes immediate and on-going capital, operational and administrative costs; Forward looking: consider the complete and long-term fiscal and financial impacts over the policy’s lifetime; Outward looking: understand the financial “trade-offs” of the recommendation; Innovative and creative: embed the identification and management of financial risks in the policy design and implementation; Evidence based: costing, budgeting and estimates must be build on complete information, solid assumptions and objective analysis Joined up: “horizontal” connect with other policy areas and ministries. Provide opportunity to realize efficiencies or economies of scale; Evaluated: financial and non-financial performance must be measured against objective and weighted leading and lagging indicators; and Demonstrate Value-for-money: the initiative must be able to efficiency (outputs/inputs), effectiveness (outputs/outcomes) and economy (cost effective comparisons). 9 10. Policy and Program Design: Financial Considerations Cost-benefit analysis: all options should be valued against full net benefits and costs calculations. Costs should be expressed in terms of relevant opportunity costs. Categorising costs (fixed, variable and semi-variable) will strengthen sensitivity analysis, including: market interest and demographic fluctuations. Cost-effectiveness analysis: assess the comparative costs and merits of different delivery mechanisms. This should be balanced against an assessment of the relative financial risks. Delivery Options: transfer payments and agency methods of service delivery place increasing (financial) oversight, evaluation and accountability requirements on the ministry. Short and Long-term Financial and Fiscal Impact: understand integrated program, operating and capital costs. Amortized capital costs and “sunk” program commitments will constrain “downstream” ministry fiscal envelopes. Full cost of service delivery: All costs associated with the program should be factored into its cost/benefits analysis. Direct and indirect costs borne by another ministry or central agency (e.g. OSS) come from the same Central Revenue Fund “Peter/Paul scenario”. Investment Proposals: Capital projects (for example: buildings, IT&T and fleet vehicles) require a complete asset life-cycle analysis from the initial investment, post-build and periodic cost/asset evaluations, maintenance, replacement and disposal. Cost utility analysis: accurate forecasting and modeling. Fees and revenues program need to be substantiated by robust sensitivity analysis using different scenarios. 10 11. Policy: Implementation, Maintenance and Evaluation Sustainability: using robust forecasting and modeling to assess the fiscal and financial sustainability and opportunity cost of the program. Should alternatives delivery mechanisms or changes in service offerings be considered? Transfer Payment/ Agency Oversight: review of the recipients or service delivery organization’s service and financial results. Assurance of effective controls, accurate financial reporting and analysis of the organization's financial well-being. Non Tax Revenue: legal constraints on fees (Eurig decisions), the need to demonstrate transparent costing and pricing, and associated accounting structures for Special Purpose Accounts. Are the revenues directly adversely and disproportionately effecting another government revenue stream? Cost Recoveries: what are the full and associated costs of collecting fees, fines and defaults (particularly during an economic recession)? Influence and Control: the concept of “arms-length” is governed by an understanding of the degree of influence and control over a given organization. Provincial “control” defines whether an entity is consolidated into the Public Accounts and is subject to Ministerial responsibility. Oversight, Program and Technology Enhancements: sustainability of a program with a substantial infrastructure “footprint” requires an evaluation of the key enhancement milestones and their associated costs. Assessment of Outcomes: performance measures should be able to indicate whether the intended client are benefiting (and to what extend) from the program/policy and demonstrate its costeffectiveness as a service delivery method. 11 12. Policy Design Questions What are the key financial risks faced by your programs and core policies? How do you mitigated these financial risks? What financial analysis “gaps” do you typically find when developing a policy proposal? What are the key financial drivers impacting the sustainability of your policies and programs? What tools and approaches are you using to evaluate policies and programs’ efficiency, effectiveness and value-for-money? 12 13. Looking Forward Integrating financial risks, analysis and measures are critical to evaluating policy, programs and ensuring sector sustainability. Only by balancing and “weighting” efficiency, effectiveness and value-formoney measures can a full picture of a policy/program’s performance be established. Increasing financial reporting requirements and the complex relationships between capital, financing and operational require an integration of these considerations into policy decisions. Forward looking policy that seeks horizontal sectoral solutions cannot be divorced from robust financial, cost/benefit, business and capital investment decisions. 13