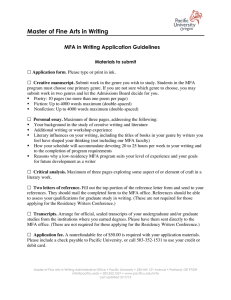

IRCE Presentaion 2013 Sales Tax

advertisement

MARKETPLACE FAIRNESS ACT 2013 AGENDA • What is MFA? Who is pushing it? • Will MFA pass and become law, and if it does when will I have to collect sales tax? • What is Streamlined Sales Tax ? • What will I have to do to comply with the law? • So the software is free? • What other compliance issues will I face? • Will I get audited by 46 states? • What is a sales tax audit like? • Questions??? eMainStreet.org WHAT IS MFA? Marketplace Fairness Act 2013 Remote Sellers with sales outside of home state over $1,000,000 can be required to collect sales tax for any state they do business States must meet Streamlined Sales Tax rules or provide free software to calculate sales tax. Each state must have single tax form and point of contact States include all US Territories and Indian Nations = 50 states +DC, 5 Territories, 566 Indian Tribes WHY – WHO IS PUSHING THIS? Over $50m spent lobbying for MFA ( big box retailers and states hungry for revenue ) States passing laws / budgets – lower taxes if MFA passes ( or house the homeless / end poverty ..) Only $3m spent lobbying against (eBay, ATR.org, catalog companies) Our “friends” are against us ( Amazon, Shop.org are supporting MFA ) OBJECTIVE – weaken and / or eliminate competition ( US!!) WILL IT PASS? AND WHEN? Passed 69 for 27 against Senate May 6th More opposition in Congress including key lawmakers ( e.g. Boehner house speaker) Currently under review by Judiciary Committee Start collecting 180 – 270 days after it passes Our best guess Pass without amendment 20% Pass with amendments in 12 months 40% Killed off or delayed over 12 months 40% Democrat control of Congress in 2014? STREAMLINED SALES TAX Members: Arkansas, DC, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, Wyoming Members = 33% of US population Standard taxability matrix ( = product categories ) Rates and boundaries database ( Zip + 4) NON STREAMLINED STATES The big ones with complex sales tax laws, CA, TX, PA, NY, FL etc. Members = 67% of US population Different Sourcing Rules ( double taxation will occur) Confusing categories ( e.g. in PA - Clothing non taxable, safety clothing taxable, worn safety items non taxable for some industries ) Must provide Rates and boundaries database ( Zip + 4) Taxability matrix ( non standard with different categories ) Free software ( who will write it, will it work?) Single point of contact and tax return COMPLIANCE COSTS Learn Sales Tax laws for 22 + states Review free state software, compare to commercial Implement up to 22 different APIs with all Shopping Carts, Accounting Systems , Back End, ( Amazon, eBay, ….?) Categorize products for 22 States Collect taxes, remit monthly Territories and Indian Tribes – disallow sales if they require collection of sales tax ( cost > profits) Conclusion COMPLIANCE NIGHTMARE SALES TAX COMPLIANCE COST Percentage of Revenue v Sales Revenue 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% Series1 TAX COLLECTED v COMPLIANCE COST $240b in sales, 80% big box = taxes collected $48b sales not taxed = $4b in lost revenue $400m max for CA not $1.1b Cost of compliance first 2 years = $4b estimated eMainStreet $9 to $32 per return, even if tax is $0 Think $1m retailer filing on Vermont States do not care about our compliance costs! FREE SOFTWARE? SST provides free software now ( vendors keep 2% taxes) No requirement SST software to be free when MFA passes ( states will protect their taxpayers – >not free) Non SST states free software quality is unknown May use existing SST CSP Avalara, Taxcloud, Taxware, Exactor, CCH, Accurate Tax Worst case 22 different tools, non API software, no shopping cart support Amazon / eBay will do their own thing! Possible White Knights – Google? SOFTWARE COST CSP per Transaction $0.05 - $0.30 $9 to $32 per form per state per month / quarter API Integration $5,000 per state per cart Integrate Tax Software with Amazon / eBay / CRM Backend phone & manual orders / Accounting System SURVIVE A SALES TAX AUDIT!? Personal Liability for under collected taxes (jail time?) Pay all under collected taxes, over collected does not offset No statute of limitations, go back 20 years Not protected from Misclassification errors Auditors will come back if cost of audit < extra tax Pays to make auditor work Can take 1 month on site State is Judges and Jury Travel to state to defend in court CASE LAW Need special legal software to access Example Official Flags of US are not taxable Historical US Flags 48 stars, Betsy Ross? Marine Corps, Army, Navy? State will always read laws to gain maximum tax Must appeal for relieve -> goes to case law Travel to state for hearing Must respond within time allowed ACTIONS Join eMainStreet.org ( that’s US !) Contact your Representative and Senator Join us for fly in to Washington DC June 25th MarketplaceFairness.org ( aka the enemy ) TrueSimplification.org MORE INFO eMainStreet.org ( that US !) Sales Tax guide Wikipedia ( Sales Tax in United States) StrealinedSalesTax.org MarketplaceFairness.org ( aka the enemy ) TrueSimplification.org