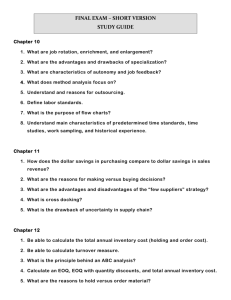

Inventory Management

advertisement

Inventory Management MD707 Operations Management Professor Joy Field Types of Inventory Cycle inventory Safety stock Anticipation inventory Pipeline inventory (WIP, finished goods, goods-in-transit) Replacement parts, tools, and supplies 2 Functions of Inventory To meet anticipated customer demand To smooth seasonal requirements To decouple operations To protect against stockouts To take advantage of order cycles To hedge against price increases As a result of operations cycle and throughput times To take advantage of quantity discounts 3 Managing Independent Demand Inventory Managing independent demand inventory involves answering two questions: How much to order? When to order? When answering these questions, a manager needs to consider costs (holding or carrying costs, ordering costs, shortage costs, unit costs) and the tradeoff between costs and customer service. Inventory management efforts may be allocated based on the relative importance of an item, determined through a classification system such as an A-B-C approach. Customer satisfaction and inventory turnover (i.e., the ratio of annual cost of goods sold to average inventory investment) are two measures of inventory management effectiveness. 4 EOQ Assumptions Item independence Demand is known and constant Lead time does not vary Each order is received in a single delivery There are no quantity discounts Only two relevant costs (holding and ordering costs) 5 EOQ Inventory Cycle Demand is Known and Constant Profile of Inventory Level Over Time Q Usage rate Quantity on hand Reorder point Receive order Place order Receive order Time Place order Receive order Lead time 12-6 Total Annual Cost Annual carrying cost Q (H ) Annual carrying cost = 2 Annual ordering cost D (S ) Annual ordering cost = Q Total annual cost: TC Q D ( H ) (S ) 2 Q 7 Derivation of Economic Order Quantity (EOQ) and Time Between Orders (TBO) Total annual cost: TC = Q D ( H ) (S ) 2 Q Take the first derivative of cost with respect to quantity: dTC H D 2 (S ) dQ 2 Q 2 DS dTC EOQ , Q 0 and solving for Q: Setting o H dQ Time between orders: TBOQ Q D 8 Annual Cost EOQ Cost Curves The Total-Cost Curve is U-Shaped Q D TC H S 2 Q Holding Costs Ordering Costs Q* (optimal order quantity) Order Quantity (Q) 12-9 Overland Motors Example Overland Motors uses 25,000 gear assemblies each year (i.e. 52 weeks) and purchases them at $3.40 per unit. It costs $50 to process and receive each order, and it costs $1.10 to hold one unit in inventory for a whole year. Assume demand is constant. The purchasing agent has been ordering 1,000 gear assemblies at a time, but can adjust his order quantity if it will lower costs. What is the annual cost of the current policy of using a 1,000unit lot size? What is the order quantity that minimizes cost? What is the time between orders for the quantity in part b? If the lead time is two weeks, what is the reorder point? 10 Economic Production Quantity (EPQ) Similar to the EOQ but used for batch production. A complete order is no longer received at once and inventory is replenished gradually (i.e., non-instantaneous replenishment). Maximum Cycle Inventory Q p u I max ( p u ) Q( ) p p Total cost = Annual holding cost + Annual ordering cost I max D Q p u D TC ( H ) (S ) ( )( H ) ( S ) 2 Q 2 p Q Economic Production Quantity (EPQ) 2 DS p Qo H p u 11 EPQ Inventory Cycle Noninstantaneous Replenishment Q Q* Production and usage Usage only Production and usage Usage only Production and usage Cumulative production Imax Amount on hand Time 12-12 EPQ Example A domestic automobile manufacturer schedules 12 two-person teams to assemble 4.6 liter DOHC V-8 engines per work day. Each team can assemble five engines per day. The automobile final assembly line creates an annual demand for the DOHC engine at 10,080 units per year. The engine and automobile assembly plants operate six days per week, 48 weeks per year. The engine assembly line also produces SOHC V-8 engines. The cost to switch the production line from one type of engine to the other is $100,000. It costs $2,000 to store one DOHC V8 for one year. What is the economic production quantity? How long is the production run? What is the average quantity in inventory? What are the total annual costs associated with the EPQ? 13 Quantity Discounts In the case of quantity discounts (price incentives to purchase large quantities), the unit price, P, is relevant to the calculation of total annual cost (since the price is no longer fixed). Total cost = Annual holding cost + Annual ordering cost + Annual cost of materials TC Q D ( H ) ( S ) PD 2 Q 14 Quantity Discounts Two-Step Procedure Step 1 Beginning with lowest price, calculate the EOQ for each price level until a feasible EOQ is found. It is feasible if it lies in the range corresponding to its price. Step 2 If the first feasible EOQ found is for the lowest price level, this quantity is best. Otherwise, calculate the total cost for the first feasible EOQ and for the larger price break quantity at each lower price level. The quantity with the lowest total cost is optimal. 15 Total Cost Curves with Quantity Discounts 12-16 Quantity Discounts Example Order Quantity 1-99 100 or more Price Per Unit $50 $45 If the ordering cost is $16 per order, annual holding cost is 20% of the per unit purchase price, and annual demand is 1,800 items, what is the best order quantity? Step 1 EOQ45.00 = EOQ50.00 = Step 2 TC ___ = TC ___ = 17 Perpetual (Continual) Inventory Review System A perpetual (continual) inventory review system tracks the remaining inventory of an item each time a withdrawal is made, to determine if it is time to reorder. Decision rule: Whenever a withdrawal brings the inventory down to the reorder point (ROP), place an order for Q (fixed) units. 18 Variations of the Perpetual Inventory System Based on the characteristics of the lead time demand and the lead time, the perpetual inventory system is implemented by ordering the EOQ, Qo , at the ROP as follows: Lead time demand (dLT) Known and constant Variable, normally distributed, average lead time demand and dLT known Unknown, but average daily or weekly demand and d known, normally distributed Unknown, but daily or weekly demand known and constant Unknown, but average daily or weekly demand and d known, normally distributed Lead time (LT) Known and constant Variable, normally distributed, dLT known Approach Order Qo when ROP is equal to the lead time demand. Calculate the safety stock for a given service level (= z dLT ) using the table on p.576 or pp.882-3 to determine z.* Known and constant Calculate the expected lead time demand by multiplying the average daily or weekly demand by the lead time. Calculate the safety stock for a given service level (= z LT d ) with z determined as above.* Calculate the expected lead time demand by multiplying the daily or weekly demand by the average lead time. Calculate the safety stock for a given service level (= zd LT ) with z determined as above.* Calculate the expected lead time demand by multiplying the average daily or weekly demand by the average lead time. Calculate the safety stock for a given service level Variable, normally distributed, average lead time and LT known Variable, normally distributed, average lead time and LT known 2 2 (= z LT d2 d LT ) with z determined as above.* *Order Qo when ROP is equal to the expected lead time demand plus safety stock. 19 Reorder Point The ROP based on a normal distribution of lead time demand Risk of stockout Service level Expected demand ROP Quantity Safety stock 0 z z-scale 12-20 Shortages and Service Levels The ROP calculation relates the probability of being able to satisfy demand during the lead time for ordering. In order to determine the expected amount of units to be short during this period, calculate: E (n) E ( z ) dLT where: E(n) = Expected number of units short per order cycle, E(z) = Standardized number of units short (obtained from Table 12.3, p.576), dLT = Standard deviation of lead time demand To calculate the expected number of units short per year: D E ( N ) E ( n) Q where: E(N) = Expected number of units short per year, D = Yearly demand, Q = Order size 21 Perpetual Inventory System Example You are reviewing the company’s current inventory policies for its perpetual inventory system, and began by checking out the current policies for a sample of items. The characteristics of one item are: Average demand = 10 units/wk (assume 52 weeks per year) Ordering cost (S) = $45/order Holding cost (H) = $12/unit/year Mean lead time demand = 30 units Standard deviation of lead time demand = 17 units Service-level = 70% What is the EOQ for this item? What is the desired safety stock? What is the desired reorder point? What is the expected number of units short each cycle and per year? If instead of the above situation, suppose the lead time is known and constant at 2 weeks and the standard deviation of lead time demand is unknown. However, we do know the standard deviation of weekly demand to be 10 units. How do your answers change? 22 The Single-Period Model Used to handle ordering of perishables and items that have a limited useful life Analysis of single-period situations generally focuses on two costs: shortage costs (i.e., unrealized profit per unit) and excess costs (the cost per unit less any salvage cost) Calculate the shortage and excess costs Cshortage = Cs = Revenue per unit – Cost per unit Cexcess = Ce = Original cost per unit – Salvage value per unit Calculate the service level, which is the probability that demand will not exceed the stocking level Cs Service level = C s Ce Determine the optimal stocking level, S o d z d , using the service level and demand distribution information 23 Single-Period Problem The concession manager for the college football stadium must decide how many hot dogs to order for the next game. Each hot dog is sold for $2.25 and makes a profit of $0.75. Hot dogs left over after the game are sold to the student cafeteria for $0.50 each. Based on previous games, the demand is normally distributed with an average of 2000 hot dogs sold per game and a standard deviation of 400. Find the optimal stocking level for hot dogs. 24