CLF

advertisement

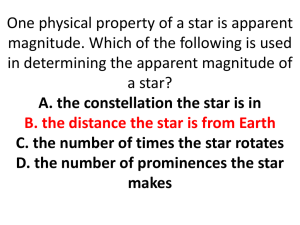

ENERGY STAR in Canada A year in review Anne P.-R. Wilkins Office of Energy Efficiency Natural Resources Canada May 4, 2006 Toronto, May 4 - 5, 2006 Table of Contents A year in review • Looking at ENERGY STAR through 5As – Some highs, some lows – Counting widgets – Program successes and recommendations • Conclusions and recommendations • Next steps 2 Participation in ENERGY STAR Manufacturer 25% Promoter 6% Government 4% Retailer 5% Gas Utility 4% Association 1% Electric Utility 8% Fenestration Retailer/Distributor 19% ESNH 1% Fenestration Manufacturer 27% 269 signed participants We add to the list every day 3 5 As …..Awareness ..........Availability ..............Accessibility ....................Affordability .........................Acceptability 4 AWARENESS 5 Awareness of ENERGY STAR Awareness levels of ENERGY STAR in Canada (%) 100 80 60 40 20 0 80 26 32 40 44 17 13 aided awareness Nov-01 Jan-03 25 29 36 unaided awareness Sep-03 From 2001-2004 question:Now, I would like to read you a description of the ENERGY STAR symbol. ENERGY STAR is either the word 'energy' followed by a large star underneath a curved line in one colour, or the top half of the earth in full colour behind the word 'energy' and a large star. The words 'High Efficiency' may appear underneath. Do you recall seeing this symbol ? In 2005, symbol shown to an Internet panel – aided awareness transitions from phone based question to computer screen. 6 Nov-04 May-05 Unaided question: Have you heard or read or seen anything about ENERGY STAR ? Where most seen Primarily on: • Major kitchen appliances • Laundry appliances And to a lesser extent: • On computer screen • Display in store Very small percentage mentioned: – On the side of a consumer electronics product such as TV, DVD, VCR – In a brochure, a magazine or newspaper 7 Provincial breakdown Unaided awareness by Province Atlantic 28% Que 26% ON 40% Sask/Man 43% Alberta 39% BC 39% 0% 5% 10% 15% 20% 8 25% 30% 35% 40% 45% 50% Survey of Household Energy Use (SHEU) % of households with an appliance less than 4 years old asked if they own an ENERGY STAR qualified unit Clothes washers 69% Dishwashers 65% Freezers 64% Main refrigerator 65% 0% 10% 20% 30% 13% 14% 12% 18% 40% ENERGY STAR QUALIFIED 9 50% 60% 70% 80% DON’T KNOW 90% Survey of Household Energy Use (SHEU) % of households with a heating or cooling system less than 4 years old asked if they own an ENERGY STAR qualified system 65% Furnaces Central air conditioner 21% 59% ENERGY STAR qualified 31% Don't know Main window air conditioner 54% 0% 20% 19% 40% 10 60% 80% 100% Qualitative Interviews with Appliance Sales Managers Telephone interviews were completed with 50 appliance store sales managers: Total Dept. Stores Chains Independents Halifax 10 2 3 5 Montréal 14 2 4 8 Toronto 15 2 4 9 Vancouver 11 - 4 7 50 6 15 29 Total • 50% of Department Store Managers said that 2/3 of their customers asked for energy consumption information; • 40% of Chain Store Managers reported that between 1/3 and 2/3 of their customers asked for energy consumption information; • 59% of Independent Store Managers reported that less than 1/3 of their customers asked about energy consumption information. 11 What the head offices are saying A recent survey of ENERGY STAR Participants reports that: • In three-quarters of cases, respondents train their personnel – The amount of training and the training programs (including sales personnel) has increased by between 50-85% since last year. – % of respondents : o 76% of manufacturers Survey was sent to 125 participants – 68 responded: ~24 manufacturers ~16 retailers ~20 utilities ~15 general participants (NGOs, promoters, others) o 66% of retailers o 70% utilities o 96% fenestration manufactures ~ All said that they trained 80% or more of their personnel 12 Opportunities to enhance visibility of ENERGY STAR on your web site On-line shopping business to Canadian consumers 91.3% of computer owners use their equipment for internet access shopped but did not buy, Number of households that are internet shoppers 4.9M Number of consumers that bought/placed orders 3.2M 43% read news, email, 87% 69% browse, 85% Number of households that use internet to window shop before visiting a store 1.7M 13 ENERGY STAR on the Web Visits to ENERGY STAR Web Site April 04March 05 ENERGY STAR web site Number of visits April 05 March 06 % Change 249,000 388,000 56% 681 1062 56% 13 12 -6% International visits 40% 41% 3% Visits from Canada 60% 59% -1% Average visits per day Duration of average visit in minutes In contrast, Office of Energy Efficiency got 5.1 million visits during 2004-2005. 14 What we found – the survey says: Over 75% of manufacturers and retailers report promoting ENERGY STAR on their web sites (similar to last year) What we found: • On one quarter of respondents’ sites, could not find ESTAR • The ENERGY STAR symbol was displayed prominently on the homepage of only 2 company web sites; on several others, the old symbol is still being used; • On most sites, ENERGY STAR is 2-3 layers deep with product lists or specifications. ENERGY STAR symbol was only found in relevant product lists and specifications, and only if you happen to pick the right product to review detailed specs • ENERGY STAR qualification is not a search tool (like price, colour, brand name, size, etc.) on any retailer site; 15 What we found – the survey says: 59% (16/27) of respondent fenestration manufacturers promote ENERGY STAR on their website (up from 40% last year) • Of these, 1/3 displayed the logo prominently on their homepage, and; 75% include a link to the ENERGY STAR site (up from 50% last year). 16 AVAILABILITY 17 Market penetration/shipments of ENERGY STAR qualified appliances 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2003 2004 2005 Refrigerators 37% 40% 32,0% Clothes washers 24% 35% 30,0% Dishwashers 49% 76% 81,0% Based on data from the Canadian Appliance Manufacturers Association, 2005 18 Shipments of ENERGY STAR qualified gas furnaces* ENERGY STAR qualified : 61% Standard efficiency: 39% • Weighted average efficiency of these shipments are the following: • 2nd half of 2005: 87.09% • 2nd half of 2004: 86.82% Based on shipment data supplied by the Heating Refrigeration and Air Conditioning Institute (HRAI) March 2005 19 Comparing with end-use data Market penetration of ENERGY STAR qualified furnaces*, by year of dwelling construction 70% 60% 50% 40% 62% 30% 20% 37% 35% 33% 10% 28% 29% 1979-1979 1980-1989 0% All Before 1946 1946-1969 households 1990-2003 *Natural gas, propane, oil. Based on weighted data supplied from Survey of Household Energy Use (SHEU) 2003 20 Survey of fenestration manufacturers 54 ENERGY STAR participants asked; only 27 responded. • Almost 2 million windows and over 50,000 sliding glass doors were shipped by respondent participants in 2005 • 58% of all windows shipped in 2005 were ENERGY STAR qualified • 36% of sliding glass doors shipped in 2005 were ENERGY STAR qualified 21 ACCESSIBILITY 22 Access to incentives and information Consumers had unprecedented access to incentive programs in 2005 • ENERGY STAR web site lists 23 (and counting) number of incentives and rebates across Canada – PST rebates in Saskatchewan, British Columbia – Shared incentives on heating equipment with NRCan with 10 utilities; coop programs with manufacturers and dealers – Electric utilities promoting ENERGY STAR qualified appliances, lighting products, heating systems, office and consumer electronics EnerGuide for Houses B audits have resulted in energy efficiency upgrade of 10,261 furnaces and boilers in 13 months 23 Access to policies ENERGY STAR part of Government of Canada’s Green Procurement Policy Many organizations state that they have established a purchasing policy favouring ENERGY STAR Procurement Workshops held across Canada to institutional sector, and development of appropriate tools and publications and ENERGY STAR calculator 24 Appealing to the masses 25 Access to products in stores Growing recognition of the value of stocking ENERGY STAR qualified products, and advertising them in flyers 89% of ENERGY STAR retailers surveyed said they plan to increase the proportion of ENERGY STAR qualified products for sale in their stores in 2006 • 55% increased floor space dedicated to ENERGY STAR qualified products - with increased space estimated at 15-50%; • 44% found that ENERGY STAR promotions increased sales - with increased sales estimated at 8-12% 26 AFFORDABILITY 27 Influencing the affordability factor Driving down the incremental costs: • Furnaces • Compact fluorescent lamps • Exit signs • Major appliances Helping consumers towards some of the up-front costs • Incentives and rebates • Buy down loans / preferential rates 28 ACCEPTABILITY 29 Technology improvements ENERGY STAR becomes the norm • Examples : exit signs, traffic signals, transformers • Increased stringency of ENERGY STAR levels and technical specifications – – Computers, office equipment – Clothes washers, dishwashers Product improvements, form fit and function, and reliability help the cause: • Compact fluorescent lamps • Front Loading Clothes Washers 30 Conclusion, next steps • Leveraging the ENERGY STAR symbol and maintaining its credibility • Maintenance, update and increase stringency of technical specifications and levels • Expand reach and scope of ENERGY STAR qualified products in the market place • Impact of ENERGY STAR evaluation project • Continue to engage Procurement Community to adopt ENERGY STAR 31 Next steps Engage stakeholders in all targetted sectors – for example: • Cross-canada energy efficient lighting strategy: – Goal: By 2015, 95% of lamps installed in Canada will be energy efficient, or controlled incandescents; • National standby strategy – reduce/eliminate standby energy use in products • Encourage and expand ENERGY STAR commercial refrigeration in Canada 32 Contact Information Anne P.-R. Wilkins 613-992-3900 awilkins@nrcan.gc.ca energystar.gc.ca 33