Business, Accounting and Financial Studies

advertisement

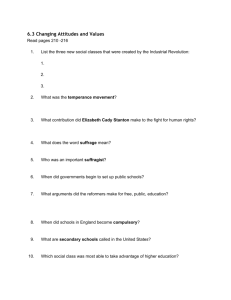

Business, Accounting and Financial Studies Public Assessment & Teaching and Learning 1 Assessment Objectives 1. 2. 3. 4. demonstrate knowledge and understanding of different areas of business; apply such knowledge and understanding to familiar and novel situations; analyse, synthesise and evaluate information in the context of business decisions, taking into account the integrated and dynamic nature of business problems; and communicate facts, opinions, and suggestions in an effective manner 2 Mode of Assessment Component Weighting Duration Public Paper 1: Examination Compulsory Part Paper 2: Elective Part School-based Assessment (Will be implemented in 2016) 34% (8540%) (40%) 51% (8560%) (60%) 1 hr 30 mins 2 hrs 30 mins 15% 3 Public Examination Paper 1 Section A (60%) − multiple choice questions to minimize the language impact Section B (40%) − short questions to make room for tests of high order skills Questions will be set on the compulsory part of the curriculum. All questions are compulsory. 4 Public Examination Paper 2 Paper 2A (accounting module) Paper 2B (business management module) Section A (30%) Section B (50%) short questions short questions application problems case studies Section C (20%) case/theory questions essay questions Remarks All questions are compulsory. Candidates will be required to answer one out of two questions. 5 Public Examination Paper 2A (Accounting Module) Paper 2B (Business Management Module) Section A •basic knowledge and •basic knowledge and understanding understanding (30%) •simple application Section B •application to practical problems (50%) •accounting entries •diverse perspectives in case studies Section C •synthesis and/or evaluation of (20%) information •knowledge integration and in-depth analysis 6 Public Examination Candidates are expected to integrate their knowledge and skills learnt in the compulsory part to demonstrate in-depth knowledge of the module 7 Public Examination Candidates are expected to be aware of the impact of standards issued by the HKICPA upon the accounting definitions and treatments covered by this syllabus: New or revised standards effective for annual periods beginning on or before 1 January 2009 are applicable to the 2012 examination. 8 Teaching Materials Textbooks Publisher Title Subtitle Author(s) Longman Hong Kong Education NSS Business, Accounting and Financial Studies Business Pak Cho Kan, Environment and Lam Pun Lee Introduction to Management (Compulsory Part) Longman Hong Kong Education NSS Business, Accounting and Financial Studies Frank Wood's Eric Lo Chi Introduction to Chung, Accounting Frank Wood (Compulsory Part) Longman Hong Kong Education NSS Business, Accounting and Financial Studies Basics of Personal Louis Cheng Financial Management (Compulsory Part) 9 Teaching Materials Textbooks Publisher Title Subtitle Author(s) Pilot Publishing Company Ltd. BAFS in the New World Vol. 1 (Business & Management) (Compulsory Part) Patrick Kin-wai Ho Pilot Publishing Company Ltd. BAFS in the New World Vol. 2 (Accounting) (Compulsory Part) Patrick Kin-wai Ho Pilot Publishing Company Ltd. BAFS in the New World Vol. 3 (Financial Studies) (Compulsory Part) Patrick Kin-wai Ho 10 教學資源 - 教科書 出版社 書名 副標題 編著者 朗文香 港教育 新高中企業、 會計與財務 概論 新高中企業、 會計與財務 概論 新高中企業、 會計與財務 概論 營商環境與管 理導論 (必修 部分) Frank Wood 會計導論 (必 修部分) 基礎個人理財 (必修部分) 白祖根、 林本利 朗文香 港教育 朗文香 港教育 盧志聰、 Frank Wood 鄭子云 11 教學資源 - 教科書 出版社 書名 副標題 編著者 導師出版社 企業、會計、 第1冊 (企業與管理) 何健偉 有限公司 財務新世界 (必修部分) 導師出版社 企業、會計、 第2冊 (會計) 有限公司 財務新世界 (必修部分) 何健偉 導師出版社 企業、會計、 第3冊 (財務概論) 有限公司 財務新世界 (必修部分) 何健偉 12 教學資源 - 教科書 出版社 書名 副標題 編著者 卓思出版社 有限公司 高中企業、會計 1 (a) 營商 與財務概論 環境 吳子嘉、劉吳 麗梅、萬穎恩 卓思出版社 有限公司 高中企業、會計 1 (b) 管理 與財務概論 導論 吳子嘉、劉吳 麗梅、萬穎恩 卓思出版社 有限公司 高中企業、會計 1 (c) 會計 與財務概論 導論 楊志鴻 卓思出版社 有限公司 高中企業、會計 1 (d) 基礎 與財務概論 個人理財 陳振超 13 Teaching Materials Others EDB Resource Banks – Curriculum Resource: http://www.edb.gov.hk/index.aspx?nodeid=120 &langno=1 HKEAA Subject information: http://www.hkeaa.edu.hk/en/hkdse/Subject_Inf ormation/bafs/ HKAS & HKFRS issued by HKICPA: http://www.hkicpa.org.hk/ebook/HKSA_Memb ers_Handbook_Master/volumeII/contentpage.p df 14 Teaching Materials Others A-level past papers CE past papers LCC&I past exam. papers ACCA / HKIAAT past exam. papers Sample papers 15 END OF THIS PART 16 Business, Accounting and Financial Studies Public Assessment: Paper 2A Accounting Studies 17 Section A Short questions Q.1 – Depreciation application of knowledge 18 Section A Short questions Q.2 – Control accounts application of knowledge 19 Section A Short questions Q.3 – Manufacturing accounts 20 Q.3 – Manufacturing accounts application of knowledge 21 Section A Short questions Q.4 – IT in accounting application of knowledge 22 Section B Application problems Q.5 – Partnership accounts application of accounting principles 23 Q.5 – Partnership accounts 24 Q.5 – Partnership accounts application of knowledge 25 Section B Application problems Q.6 – Correction of errors Aware of new accounting standards 26 Q.6 – Correction of errors Accounting entries 27 Section B Application problems Q.7 – Job costing 28 Q.7 – Job costing 29 Q.7 – Job costing 30 Q.7 – Job costing applying concepts and involving judgment 31 Section C Case/theory questions Q.8 – Ratio analysis involves personal financial management 32 Q.8 – Ratio analysis 33 Q.8 – Ratio analysis 34 Q.8 – Ratio analysis evaluation of information 35 Section C Case/theory questions Q.9 – Marginal costing and CVP analysis 36 Q.9 – Marginal costing and CVP analysis 37 Q.9 – Marginal costing and CVP analysis comparison and analysis of information 38 Q.9 – Marginal costing and CVP analysis topic of entrepreneurship 39 Some Views on Paper 2A Short questions require more application of knowledge instead of mechanical arithmetical work Long questions are generally case-based and integrated rather than a mere combination up of discrete parts No longer purely accounting paper but includes also the topics in the compulsory part 40 Some Views on Paper 2A Questions are constructed in such a way that they assess a representative sample of the learning outcomes Questions have been set on new topics as far as possible to illustrate various item types and depth of treatment The range of questions aims to allow students at different levels of performance to demonstrate their abilities 41 Preparing students for the examination Compulsory part should better be taught alongside with 2A topics Accounting cases should be developed and widely used during the lessons Problem solving and discussion should be used widely during the lessons Factory visits should be arranged 42 END OF THIS PART 43